Personal Finance Project 1 - Middletown Public Schools

advertisement

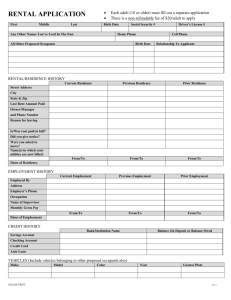

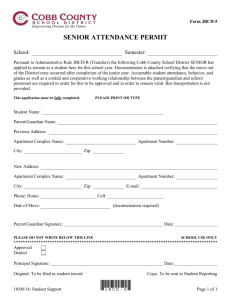

Retailing Financial Literacy Project As part of your graduation requirement, you must either take Personal Finance or both Retailing and Marketing where you are exposed to financial concepts. To that end, this is a project that you are to have completed prior to your FINAL EXAM. You will add all your answers to this electronic document (do not print and hand in a physical copy) and save it on your personal student drive on the Middletown High School network. 1. 2. 3. 4. 5. Go to the Student Data folder Find your Class Find your name Find the SSP folder Save this document as SSP-PersonalFinance This project has two main sections, to be done in order: 1. Budgeting and Goals 2. Financial Vehicles and Investments This is a mandatory assignment and will result in a 20 point deduction from the final exam if not completed, in full and with quality, prior to your final exam date. Budgeting and Goals Soon you will be on your own. You will need food, shelter, transportation, employment, Hot Pockets, etc. How much will this all cost and how much do you need to earn to actually afford the lifestyle you want? In this unit you will learn the answers to these questions and more. Please, go in order of assignments! Assignment 1 Future Narrative Assignment 2 First Draft of Budget Assignment 3 Renting an apartment Assignment 4 Purchasing a car Assignment 5 Purchasing groceries Assignment 6 Final Draft of Budget Assignment 1 Future Narrative In this section, type a narrative of what your life is going to be like at age 25. Where will you be working? Living? Doing for fun? What will you be driving? Be specific. Length should be no more than one page double-spaced. Assignment 2 First Draft of your Budget On my website under Personal Finance, click on the file titled “Monthly Expenses Spreadsheet Personal Finance.” This will open an Excel spreadsheet that you will use to create your first budget. It automatically calculates many aspects of the budget for you, so all you need to enter is the budget item and your ESTIMATE of what it would cost. Don’t do any research, this is a rough draft and it’s purpose is to get your assumptions based on what budget items cost. You must include 20 items that you will purchase on a monthly basis. For items that you don’t purchase monthly, spread the cost out over 12 months. For example, one expense might be a trip to Zimbabwe each year that costs $2400. Therefore, place in your budget “Trip to Zimbabwe” and put the cost as $200 which is $2400 divided by 12 months. Only type in the YELLOW boxes please. You will notice that the spreadsheet calculates three points of data for you: Monthly Net Income This is the amount you need to earn each month, AFTER taxes and insurance, to afford your budget. Yearly Net Income This is the amount you need to earn each year, AFTER taxes and insurance, to afford your budget. Yearly Gross Income This is the amount you need to earn each year, BEFORE taxes and insurance, to afford your budget. This is an important figure because when you research a job, the typically salary figure is noted in gross income. For example, if you research that the average salary of an Accountant is $58,000, that is in gross salary. Once your budget is completed, delete the below example and replace it with your budget: (total from column 1, don't type here) Monthly Expense Gas Cost Monthly Expense 100 11 12 13 14 15 16 17 18 19 20 Name: Eileen Over Period: E 100 Cost TOTAL/Mo 100 TOTAL/Yr 1200 1620 Assignment 3 Renting an Apartment Typically, the first time you live on your own, you will rent an apartment. As we learn about living on our own, we need to get real about what is involved and how much it will cost. Before we create an accurate list of average expenses to live on your own, let’s do some research on how much it actually costs to rent an apartment in Connecticut. Using the internet, complete the following form. In a nutshell, you will research THREE apartments within a 30 minute drive of Middletown. You need to use 2 different websites and each apartment must be in a different town. Be realistic. No homeless shelters and no Diddy penthouses please. (See reverse side as well). Apartment 1 (copy and paste a picture of the INTERIOR) Website used: City/Town: Monthly Rent: What is included? (heat, pets, parking, washer/dryer, bedrooms, square feet, pool, etc) Give a short opinion on this apartment. Would you rent it? Why or why not. Apartment 2 (copy and paste a picture of the INTERIOR) Website used: City/Town: Monthly Rent: What is included? (heat, pets, parking, washer/dryer, bedrooms, square feet, pool, etc) Give a short opinion on this apartment. Would you rent it? Why or why not. Apartment 3 (copy and paste a picture of the INTERIOR) Website used: City/Town: Monthly Rent: What is included? (heat, pets, parking, washer/dryer, bedrooms, square feet, pool, etc) Give a short opinion on this apartment. Would you rent it? Why or why not. Now that you have your 3 apartments, complete the following math equation: 1. MONTHLY RENT OF APARTMENT #1 _______ 2. MONTHLY RENT OF APARTMENT #2 _______ 3. MONTHLY RENT OF APARTMENT #3 _______ 4. TOTAL OF ALL 3 APARTMENTS _______ Find the AVERAGE rent of your 3 apartments. Take your total from above and divide by 3. TOTAL FROM LINE 4 DIVIDED BY 3 = _______ This is the average rent of an apartment you want in the state of CT. You will use this figure for your FINAL budget later in the unit. Assignment 4 Purchasing a Car One of life’s major joys and expenses is that of a car. For purposes of this assignment, you are going to research three cars that you may drive at age 25. You are to assume that your car loan will be for six years. Complete the data below and then put the final average car price in your final budget. Car #1 Car Manufacturer (ie Ford) Car Model (ie Mustang) Car Year (ie 2012) Details of the Vehicle Picture of the Vehicle Purchase price of the Vehicle (ie $15,000) Car #2 Car Manufacturer (ie Ford) Car Model (ie Mustang) Car Year (ie 2012) Details of the Vehicle Picture of the Vehicle Purchase price of the Vehicle (ie $15,000) Car #3 Car Manufacturer (ie Ford) Car Model (ie Mustang) Car Year (ie 2012) Details of the Vehicle Picture of the Vehicle Purchase price of the Vehicle (ie $15,000) Average Cost of Your Car (Car 1+ Car 2+ Car 3)/3 _______________________________________ Monthly Cost of Your Car (see below for the formula) (This cost is to go onto your Final budget) _______________________________________ The average cost of a car, over six years, is $160 per month for every $10,000 cost of the car. Therefore, use this formula: Cost of the car divided by 10,000 = X. Multiply X by 160 for the monthly cost. Example: Cost of the car, $15,000 divided by 10,000 = 1.5 1.5 x 160 = $240 monthly cost. Assignment 5 Purchasing Groceries You are going to purchase groceries for an entire month. Use the Stop n Shop “Peapod” webpage to shop for groceries. www.peapod.com You do not need to create an account to shop. Create your shopping list (talk to parents if you need guidance) for an entire month. Once complete, delete my example below, hit the PRINT SCREEN button and copy and paste your total grocery list below. I estimate that the cost will be $500-$600. You will use this total in your FINAL budget. Assignment 6 Final Draft of the Budget In Assignment 2, you created a rough draft of your budget without knowing much or researching. After Assignments 3, 4 and 5 you have a better idea about the main costs of your budget. You will now create your Final Budget. Go back to Assignment 2 for directions and now create your Final Budget. Do not save over your first budget, you are going to cut and paste your final budget below. Example: Monthly Expenses Monthly Expense 1 Gas 2 Apartment 3 Car 4 Groceries 5 Hair and Nails 6 7 8 9 10 (total from column 1, don't type here) Cost 100 2000 480 550 45 Name: Period: Monthly Expense 11 12 13 14 15 16 17 18 19 20 3175 Cost TOTAL/Mo 3175 TOTAL/Yr 38100 51435 Eileen Over E What is the total gross income you need to afford your budget? ________________________________ What career do you want to be doing when you’re 25? ________________________________ What is the average gross salary of this occupation? ________________________________ Can you afford your lifestyle based on your chosen application? Yes or No What are your thoughts after completing this budget? Are you comfortable with it? Does it surprise you? What surprised you the most? Does this make you rethink your college and career choices? Financial Vehicles When you earn money and don’t spend it, you put it to work for you. In this unit, you will discover ways to put your money to work for you. Please, go in order of assignments! Assignment 1 Retirement Assignment 2 Types of Investments Assignment 1 Retirement It is said the best way to attain a goal is to begin with the end in mind. Therefore, we begin with Retirement Planning. There will come a time in your life when you are ready to retire from working full-time. When will that be? Why is it that some people are retired at 40 and live the summers in Miami while others work until they are 70 and can only afford to watch reruns of Buckwild? The reason is that some people fail to plan and others take their financial futures in their hands and plan for their retirement. But why must you think about retirement now, you ask? You are only a teenager. It's very simple, the earlier you start saving for retirement (or any financial goal for that matter) the easier and cheaper it is to reach your goal. For example (according to Allstate.com 2006): If you put $20,000 away today, in 30 years it might be worth $350,000. If you wait 5 years and put that same $20,000 away, it would only be worth $216,000. Waiting a short 5 years just cost you $134,000!. If you waited 10 years then invested the $20,000, your money would only be worth $135,000. Waiting 10 years just cost you $215,000! A second reason is that chances are, by the time you retire, social security may not be around or your portion may be a lot smaller than it is now. Define: Time Value of Money STEP 1: List the age you want to retire and then, in a paragraph, describe what a year in your retirement life would be like. STEP 2: How much would this retirement lifestyle cost you on a yearly basis? STEP 3: To achieve your goal of affording steps 2 and 3, how much money will you need to have in one lump sum? STEP 4: Explain how you will reach your goal for step 4 in detail. STEP 5: Chances are by this point, you have forgotten all about inflation. Remember that over time, money becomes LESS valuable. In 1950 you might get 4 Hershey Bars for $1.00 but today you may only get 1. Therefore, if you need 200,000 in today’s money to retire, you will need millions by the time you are 65! Use the Future Value Calculator below to understand the impact of inflation on the numbers above. Remember, by the time you retire you will need a lot more money than you would need if you retired today because of inflation. http://www.easysurf.cc/vfpt2.htm#fvm STEP 6: Give a few final thoughts on retirement. Does this assignment open your eyes? Scare you? Spur you to action? Assignment 2 Types of Investments To reach your retirement goals or other financial goals, you need to put your money to work for you. In the following section, answer the below questions: 1. 2. 3. 4. 5. Identify and define five types of investments Identify and define three types of bank services (Savings, Checking, etc) Define Rate of Return Define Rule of 72 For each of the eight you identified in steps 1 and 2, identify the average Rate of Return and the time it would take you to double your money using the Rule of 72. 6. What are the two economic factors that devalue your money and “eat” into your Rate of Return? 7. You put $10,000 under your mattress today. In one year you remove the $10,000. Did you lose money, gain money or break even? 8. You put $10,000 in a savings account today at 3% Rate of Return. Inflation is 3% and you pay taxes on the 3% gain, did you gain money, lose money or break even?