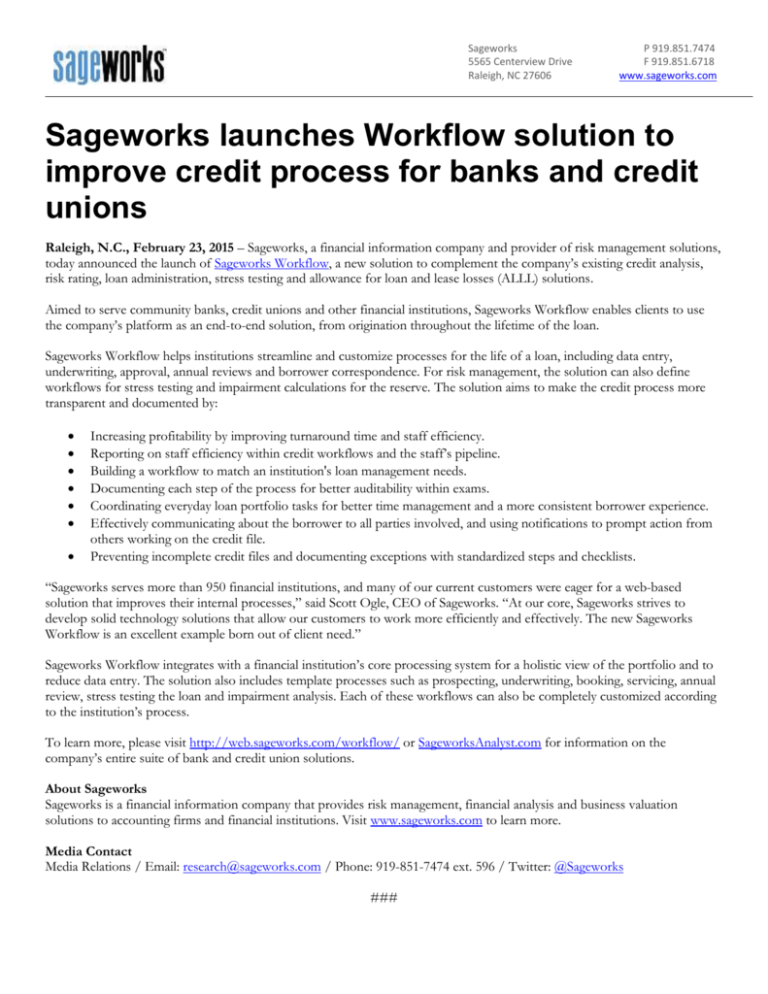

Sageworks launches Workflow solution to improve credit process for

advertisement

Sageworks 5565 Centerview Drive Raleigh, NC 27606 P 919.851.7474 F 919.851.6718 www.sageworks.com Sageworks launches Workflow solution to improve credit process for banks and credit unions Raleigh, N.C., February 23, 2015 – Sageworks, a financial information company and provider of risk management solutions, today announced the launch of Sageworks Workflow, a new solution to complement the company’s existing credit analysis, risk rating, loan administration, stress testing and allowance for loan and lease losses (ALLL) solutions. Aimed to serve community banks, credit unions and other financial institutions, Sageworks Workflow enables clients to use the company’s platform as an end-to-end solution, from origination throughout the lifetime of the loan. Sageworks Workflow helps institutions streamline and customize processes for the life of a loan, including data entry, underwriting, approval, annual reviews and borrower correspondence. For risk management, the solution can also define workflows for stress testing and impairment calculations for the reserve. The solution aims to make the credit process more transparent and documented by: Increasing profitability by improving turnaround time and staff efficiency. Reporting on staff efficiency within credit workflows and the staff’s pipeline. Building a workflow to match an institution's loan management needs. Documenting each step of the process for better auditability within exams. Coordinating everyday loan portfolio tasks for better time management and a more consistent borrower experience. Effectively communicating about the borrower to all parties involved, and using notifications to prompt action from others working on the credit file. Preventing incomplete credit files and documenting exceptions with standardized steps and checklists. “Sageworks serves more than 950 financial institutions, and many of our current customers were eager for a web-based solution that improves their internal processes,” said Scott Ogle, CEO of Sageworks. “At our core, Sageworks strives to develop solid technology solutions that allow our customers to work more efficiently and effectively. The new Sageworks Workflow is an excellent example born out of client need.” Sageworks Workflow integrates with a financial institution’s core processing system for a holistic view of the portfolio and to reduce data entry. The solution also includes template processes such as prospecting, underwriting, booking, servicing, annual review, stress testing the loan and impairment analysis. Each of these workflows can also be completely customized according to the institution’s process. To learn more, please visit http://web.sageworks.com/workflow/ or SageworksAnalyst.com for information on the company’s entire suite of bank and credit union solutions. About Sageworks Sageworks is a financial information company that provides risk management, financial analysis and business valuation solutions to accounting firms and financial institutions. Visit www.sageworks.com to learn more. Media Contact Media Relations / Email: research@sageworks.com / Phone: 919-851-7474 ext. 596 / Twitter: @Sageworks ###