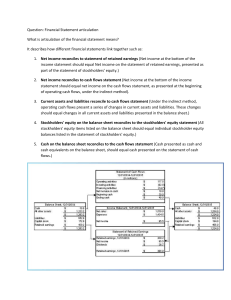

BUS78012Shareholders'Equity

advertisement

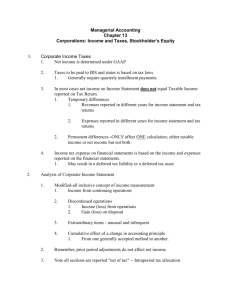

Chapter 12 Shareholders' Equity – Capital Contributions and Distributions BUS780 Objectives of this Chapter I. Basic characteristics of a corporation Characteristics of Common Stock. Characteristics of preferred stock. II. Accounting for common stock and preferred stock: Issuance of common and preferred stock. Stock rights, stock warrants, stock options. Convertible P.S, callable P.S, redeemable P.S. and convertible bonds. Stockholders' Equity 2 Objectives of this Chapter (contd.) III. Accounting for repurchase of common stock VI. Transactions affecting retained earnings : dividends and prior period adjustment. V. Accumulative other comprehensive income. Stockholders' Equity 3 I. Corporation A form of business entity. It is established as a legal entity separated from its owners. It has all rights as a person has (i.e., can sue or be sued, can own property, sign contract) except for voting and marriage. Stockholders' Equity 4 Types of Corporations A. Private corporations. B. Public corporations. Stockholders' Equity 5 A. Private Corporations Types of Corporations Private corporations: privately owned including a. nonstock companies: companies do not issue stock and do not operate for profit (i.e., universities, hospitals churches). b. stock companies: companies issue shares of stock to stockholders and operate for profits. Stockholders' Equity 6 Types of Corporations A. Private Corporations (contd.) Stock companies include: (1)Publicly-traded corporations: stock is available to public on a stock exchange. (2)Privately-held corporations: do not allow sale of stock to the general public and stock is held by a few stockholders. Stockholders' Equity 7 B. Public Corporations Types of Corporations Public corporations: owned by governmental units such as Federal Deposit Insurance Corporation, Pension Benefit Guaranty Corporation. Stockholders' Equity 8 Procedures of Forming a Corporation 1. Apply for a charter by submitting articles of incorporation to the appropriate state officials. 2. If the application is approved, the state will issue a charter. 3. A stockholders' meeting would be held at which the initial issuance of capital stock is made to the incorporators. Stockholders' Equity 9 Procedures of Forming a Corporation (contd.) 4. A board of directors is elected, a set of rules regulating the operation is established, and the board appoints the executive officers. 4. Ready for operations. 5. Issuance of stock to public to raise more capital (IPO). Note: Regardless of the number of states in which a corporation operating, it is incorporated in one state. Stockholders' Equity 10 Organization of a Corporation a. Stockholders (owners). b. Board of Directors (elected by stockholders) Decide major operation principles. Arrange major loans, authorize contract, determine the salaries of executives. Appoint officers. c. Management: Appointed by the board of directors. Responsible for day-to-day operations and the preparations of the financial statements. Stockholders' Equity 11 Advantages of a Corporation 1. Separated legal entity from its owners: it can buy, sell and own properties. 2. Limited liability for stockholders. 3. Continuous existence. 4. Ease of transfer of ownership. 5. Ease of capital generation. 6. Centralized authority and responsibility-- to the President, not to numerous owners. 7. Professional management. Stockholders' Equity 12 Disadvantages of a Corporation 1. Government regulations. 2. Corporation taxes (double taxation). 3. Separation of ownership and management: principal & agent conflicts. Stockholders' Equity 13 Stockholders' Equity Section of a Corporation Balance Sheet State. Microsfot Corporation Balance Sheets (6/30) in millions 1999 Stockholders' equity: Convertible preferred stockshares authorized 12,000; shares issued and outstanding 13 and 0 980 2000 0 Common stock and paid-in capital -shares authorized 12,000; shares issued and outstanding 5,109 and 5,283 13,844 Stockholders' Equity 23,195 14 Stockholders' Equity Section (cont.) Microsfot Corporation Balance Sheets (6/30) (contd.) in millions 1999 2000 Stockholders' equity(contd.) : Retained earnings, including other comprehensive income of $1,787 and $1,527 13,614 18,713 Total stockholders' equity 28,438 41,368 Stockholders' Equity 15 Stockholders' Equity Statements Microsfot Corporation Stockholders' Equity Statements (year ended 6/30) in millions 1999 2000 Convertible preferred stock Balance, beginning of year 980 980 Conversion of pref.to com. (980) Balance, end of year 980 0 Stockholders' Equity 16 Stockholders' Equity Statements (contd.) Microsfot Corporation Stockholders' Equity Statements (year ended 6/30) in millions 1999 2000 Com. stock and paid-in capital Balance, beginning of year 8,025 Common stock issued 2,338 Common stock repurchased (64) Structured repurch. price differ. (328) Proceeds from sale of put warrants 766 Stock option income tax benefits 3,107 Balance, end of year 13,844 Stockholders' Equity 13,844 3,554 (210) 472 5,535 23,195 17 Stockholders' Equity Statements(contd.) Microsfot Corporation Stockholders' Equity Statements (year ended 6/30) in millions 1999 2000 Retained earnings Balance, beginning of years Net income Other comprehensive income: Net unrealized invest. gains/losses Translation adjustment Comprehensive income 7,622 7,785 13,614 9,421 1,052 69 8,906 (283) 23 9,161 Stockholders' Equity 18 Stockholders' Equity Statements(contd.) Microsfot Corporation Stockholders' Equity Statements (year ended 6/30) in millions 1999 2000 Retained earnings (contd.) Comprehensive income Preferred stock dividends Immaterial pooling of interests Common stock repurchased Balance, end of year Total stockholders' equity 8,906 (28) (2,631) 13,614 $28,438 Stockholders' Equity 9,161 (13) 97 (4,686) 18,173 $41,368 19 Terminologies Related to Stockholders' Equity (contd.) 1. Common Stock: a class of stock with the rights of: (a)To share proportionately in profits and losses; (b)To share proportionately in management; (c) To share proportionately in corporate assets in liquidation; (d) To share proportionately in any new issuance of stock of the same class (the preemptive right). Stockholders' Equity 20 Terminologies Related to Stockholders' Equity (contd.) 2. Preferred Stock: a class of stock with rights of (a) Dividends (with a higher priority than that of common stock); (b) Sharing assets in liquidation (with a higher priority than that of common stock). Stockholders' Equity 21 Terminologies Related to Stockholders' Equity (contd.) 3. Par Value Stock: capital stock with a nominal dollar amount printed on the stock certificate. Some states designate the par value of issued stock as the legal capital. 4. No-Par Stock: capital stock without a Par Value. Some states require the entire proceeds received for issuing no-par stock be designated as legal capital. Many states allow the board of directors to establish a stated value, in general, is the legal capital. Stockholders' Equity 22 Terminologies Related to Stockholders' Equity (contd.) 5.Additional Paid-in Capital (or Paid-in Capital in Excess of Par Value): The excess of the issuance price over the par (or stated) value. 6. Contributed Capital: the portion of stockholders' equity contributed by shareholders (i.e., par value and the paid-in capital of common and preferred stock). 7. Legal Capital: the amount of contributed capital not available for dividends (usually equal to the par or stated value of outstanding stock). Stockholders' Equity 23 Terminologies Related to Stockholders' Equity This concept of par value and legal capital has been eliminated entirely by Model Business Corporation Act which is adopted by many states. Reasons: companies have assigned very low par value to common stock to avoid the watered share liabilities and dividend distribution restrictions. However, companies have issued par value stock prior to the changes in the state law and continued to issue previous authorized par value shares. Stockholders' Equity 24 Terminologies Related to Stockholders' Equity (contd.) 8. Outstanding Stock: issued stock held by investors (not being repurchased back). 9. Treasury Stock: issued stock repurchased by the corporation and held by the corporation, not retired. 10. Authorized Capital: the number of shares of stock that the corporation can issue as stated in its corporate Charter. Stockholders' Equity 25 Issuance for Cash II. Accounting for the Issuance of Stock Stock issued for cash Example 1: (Common Stock with Par) Issued 1,000 shares of $10 par common stock for $50 per share. Journal Entry Cash Common Stock Paid-in Capital in Excess of Par--Common Stock 50,000 Stockholders' Equity 10,000 40,000 26 Issuance for Cash Example 2: (Preferred Stock with Par) Issued 1,000 shares of $10 par preferred stock for $30 per share. Journal Entry Cash 30,000 Preferred Stock 10,000 Paid-in Capital in Excess of par -- Preferred Stock 20,000 Stockholders' Equity 27 Issuance for Cash Example 3 (Common Stock with Stated Value Set by the Board of Directors) Issued 1,000 shares of no-par common stock with a stated value $1 per share. Shares are issued at $5 per share. Journal Entry Cash 5,000 Common Stock Paid-in Capital in Excess of Stated Value Stockholders' Equity 1,000 4,000 28 Issuance for Cash Example 4 (No-par Common Stock without Stated Value) Issued 1,000 shares of no-par and no stated value common stock for $5 per share. Journal Entry Cash Common Stock 5,000 5,000 Stockholders' Equity 29 Stock Issued for Noncash Assets Principle: Stock issued for service or property should be recorded either at the fair value of the stock or the fair value of the property, whichever is more clearly determinable (reliable). In most cases, if stock is traded frequently, the fair value of stock is used. Otherwise, use the market value of the property. Stockholders' Equity 30 Example- Stock Issued for Noncash Assets Issued 10,000 shares of $5 par C.S. for building. The market value of the stock is $15 per share and the stock is traded frequently. Journal Entry: Building C.S. Additional paid-in 150,000 Stockholders' Equity 50,000 100,000 31 Stock Splits Reasons (1) To increase the marketability of stock by decreasing the market value and par value per share. (2) To increase the numbers of shares outstanding. Stockholders' Equity 32 Example: 2 for 1 split Before Split After Split Shares Outstanding Par value Market Price 1,000 $50 $120 a b c Stockholders' Equity 33 Accounting for Stock Splits No entry. A memo is required. a. 2,000 b.$25 c.$60(likely) Proportionate Stock Split: the memo indicates the increase in shares outstanding and the reduction of par value. Stockholders' Equity 34 Stock Rights Issued to Current Shareholders Accounting Treatment: no entry is required. A memo listing the number of additional shares that maybe acquired through the exercise of the stock rights is made. If the right expires, another memo is made. Stockholders' Equity 35 Stock Warrants Issued to General Public for Cash Example: ABC issues 1,000 warrants for $10,000 cash to the public to purchase 1,000 share of its common stock for $30 each: J.E. Cash 10,000 Common Stock Warrants 10,000 Warrants holders exercise the rights to purchase 900 shares of $5 par at $30 each: Stockholders' Equity 36 Stock Warrants Issued to General Public for Cash J.E. Common STK Warrants 9,000 Cash 27,000 Common Stock -$5 par 4,500 Additional Paid-in Capital 31,500 The remaining 100 warrants expire: J.E. Common STK Warrants 1,000 Additional Paid-in Capital Stockholders' Equity 1,000 37 Convertible Bonds (contd.) Possible reasons of issuing convertible bonds: 1. As an indirect way to issue stock when facing resistance from current stockholders to issue additional stock.; 2. To issue bonds at a higher price (thus, lower effective interest rate); Stockholders' Equity 38 Accounting Treatment for Convertible Bonds APB Opinion 14 requires that the issuance of convertible debt is recorded in the same manner as the issuance of nonconvertible debts without allocating a value (from the proceeds received) to the conversion feature. (Reason?) Stockholders' Equity 39 Recording for the Conversion Two acceptable methods: A. Book Value Method: the stockholders’ equity is recorded at the book value of the convertible bonds on the date of conversion. No gain or loss is recorded upon conversion. If the par value of the common stock is greater than the book value of the bonds, the difference is recorded as a reduction of retained earnings. Stockholders' Equity 40 Recording for the Conversion (contd.) B. Market Value Method: The stockholders’ equity is recorded at the market value of the shares issued on the date of conversion, and a gain or loss is recorded (treated as an ordinary income or loss). Stockholders' Equity 41 Example Shannon Company has outstanding convertible bonds with a face value of $10,000, interest has been paid on these bonds, and the bonds have a book value of $10,500. Each $1,000 bond is convertible into 40 shares of common stock (par value $20 per share). Stockholders' Equity 42 Example (contd.) If all the bonds were converted into common stock when the market value of Shannon’s common stock is $26.5 per share, the following alternative entries may be made: Stockholders' Equity 43 Example (contd.) A. Book Value Method: (BV of the bonds= $10,500) (more commonly used by companies) Bonds payable 10,000 Premium on Bonds Payable 500 Common Stock 1 8,000 Paid-in Capital from Bond Conversion 2 2,500 1. $20 x 40 x 10 2. 10,500 - 8,000 Stockholders' Equity 44 Example (contd.) B. Market Value Method : (MV of converted Stock = 26.5 x (40x 10) = 10,600) Bonds payable 10,000 Premium on B/P 500 Loss on Conversion 100 Common Stock 8,000 Paid-in Capital from Bond Conversion 2,600 1 1. 10,600 - 8,000 Stockholders' Equity 45 Preferred Stock Characteristics Preference as to dividends: holders have a preference to dividends. The annual dividends are expressed as percentage of the par value. If nopar preferred stock is issued, the dividend is expressed as a dollar amount per share. Stockholders' Equity 46 Convertible Preferred Stock Convertible preferred stock allows stockholders, at their option, to convert the shares of preferred stock into another security of the corporation under specified conditions. Both the preferred features and the potential for common stock equity are valuable to investors in convertible preferred stock. Stockholders' Equity 47 Convertible Preferred Stock Therefore, conceptually, the proceeds received upon issuance should be separated into preferred and common stock equity. However, APB Opinion No. 14 requires that when convertible preferred stock is issued, no value is assigned to the the conversion feature. Any difference between the par and market values is recorded as the paid-in capital. Stockholders' Equity 48 Accounting for the Conversion of Preferred to Common Stock Book value method is used. Example: A corporation issued 500 shares of $100 par convertible preferred stock at $120 per share. Each preferred share was converted into 4 shares of $20 par common stock. The following entry will be recorded for this conversion: Stockholders' Equity 49 Example (contd.) Preferred Stock Additional Paid-in Capital on P.S 50,000 10,000 Common Stock Additional Paid-in capital on Common Stock Stockholders' Equity 40,000 20,000 50 Callable Preferred Stock Callable Preferred Stock: preferred stock may be retrieved (recalled) under specified conditions by the corporation. The call price is usually several points (dollars) higher than the issuance price. Also, the specified conditions and call price are specified in the stock contract. Payments of dividends in arrears before the execution of call option is in general required in the stock contract. Stockholders' Equity 51 Callable Preferred Stock (contd.) When callable preferred stock is issued, no value is assigned to the call feature. Upon recall, the difference between the call price and the original issuance price is NOT treated as a gain or loss, but treated as a reduction of retained earnings (when call price > issuance price) or as an increase of additional paid-in (when call price < issuance price). Stockholders' Equity 52 Callable Preferred Stock (contd.) This treatment is to avoid a company from manipulating its earnings by recognizing a gain (or a loss) in transaction involving its own equity securities. Stockholders' Equity 53 Example Koden Corporation has outstanding 1,000 shares of $100 par callable preferred stock that was issued at $110 per share and no dividends are in arrears. If the call price is $112, the following entry is made to record the recall of these shares: Preferred Stock Additional Paid-in on P.S. Retained Earnings Cash 100,000 10,000 2,000 Stockholders' Equity 112,000 54 Redeemable Preferred Stock Redeemable at the option of the holders for a specified price or mandatory at a specified future maturity date for a specified price. Thus, redeemable preferred stock has some of the characteristics of a liability. Stockholders' Equity 55 Redeemable Preferred Stock (cont.) SEC requires this stock to be reported as a separate component of the balance sheet (i .e., before the stockholders’ equity) and requires the disclosure of the redemption features, shares issued and redeemed. FASB does not require a separate reporting but requires a similar disclosure. Stockholders' Equity 56 III. Treasury Stock Treasury stock: issued stock that has been purchased back (reacquired) by the issuing corporation. Treasury stock carries no voting or preemptive rights, no right to dividends, and no right at liquidation. However, it does participate in stock split. Stockholders' Equity 57 Reasons of Acquiring Treasury Stock 1. To use for stock option plans, bonus and employee purchase plans; 2. To use in the conversion of convertible preferred stock or bonds; 3. To use excess cash and help maintain the market price of its stock; to increase EPS; Stockholders' Equity 58 Reasons of Acquiring Treasury Stock (contd.) 4. To use in the acquisition of other companies; 5. To use for stock dividend; 6. To reduce the number of shares held by outside shareholders and thereby reduce the likelihood of being acquired by another company. Stockholders' Equity 59 Accounting Methods for Treasury Stock A. Cost method B. Par value method (rarely used) Stockholders' Equity 60 Cost Method T.S. is recorded at cost paid for transactions: 1. Issuance of 6,000 shares of $10 par common stock for $12 per share Cash 72,000 C.S., $10 par Additional Paid-in Capital on C.S. Stockholders' Equity 60,000 12,000 61 Cost Method (contd.) 2. Reacquisition of 1,000 shares of C.S. at $13 per share: Treasury Stock 13,000 Cash 13,000 3. Reissuance of 600 shares of T.S. at $15 per share Cash 9,000 T.S. 7,800 Additional Paid-in Capital from T.S. 1,200 Stockholders' Equity 62 Cost Method (contd.) 4. Reissuance of another 200 shares of T.S. at $8 per share: Cash 1,600 Additional Paid-in Capital from T.S. 1,000 Treasury Stock 2,600 Stockholders' Equity 63 Cost Method (contd.) 5. Reissuance of another 100 shares of T.S. at $6 per share Cash 600 Additional Paid-in Capital from T.S. 200 Retained Earnings 500 Treasury Stock 1,300 Stockholders' Equity 64 Cost Method (contd.) 6. Retirement of the last 100 shares of T.S. Common Stock, $10 par 1,000 *Additional Paid-in on Common Stock 200 Retained Earnings 100 Treasury Stock 1,300 * [12,000 (100/6,000)] = $200 Original additional Paid-in Capital on common stock for 6,000 shares. Stockholders' Equity 65 Retirement of Stock Repurchased stock can be retired immediately. Example: 100 shares of stock were repurchase at $14 per share and retired immediately: Common Stock, $10 par 1,000 Additional Paid-in on Common Stock 200 Retained Earningsa 200 Cash 1,400 a. If there is a credit balance in the paid-in capital-repurchase of stock account, this paid-in capital account needs to be debited first before debiting R/E. Stockholders' Equity 66 Balance Sheet Presentation of Treasury Stock Before the last 100 shares of treasury stock were retired, the stockholders' equity section is prepared after transactions 1-5 as follows: (The Retained earnings has a credit balance of $40,000 prior to record any treasury stock transaction.) Stockholders' Equity 67 Cost Method Contributed Capital: Common stock, $10 par (20,000 shares authorized, 6,000 shares issued, of which 100 are being held as Treasury Stock) Additional paid-in capital on C.S. Total Contributed Capital Retained Earnings (see Note) Total Contributed Capital and Retained Earnings Less: Treasury Stock (100 shares at cost) Total Stockholders' Equity $ 60,000 12,000 72,000 39,500 111,500 (1,300) $110,200 Note: Retained Earnings are restricted regarding dividends in the amount of $1,300, the cost of treasury stock. Stockholders' Equity 68 Overview of Treasury Stock Cost method is widely used due to its simplicity but par value method is theoretically preferable. Treasury stock is not an asset; it is treated as a reduction of stockholders' equity. Treasury stock does not have voting rights, no preemptive right; does not participate in dividends; does not participate in assets at liquidation, but participate in stock split. Stockholders' Equity 69 Overview of Treasury Stock(contd.) Treasury stock transactions do not result in gains or losses. Treasury stock transactions may reduce retained earnings but may never increase retained earnings. Retained earnings may be restricted regarding dividends in the amount of the treasury stock on hand. Stockholders' Equity 70 IV. Retained Earnings Stockholders’ equity consists of primarily stockholders’ investments (i.e., contributed capital), retained earnings and accumulated other comprehensive income. The primary factors that affect retained earnings besides net income (or net loss) include (1) dividends and(2) prior period adjustments. Stockholders' Equity 71 Dividends While the net income increases the retained earnings, the distribution of dividends reduces the retained earnings. In order to declare dividends, a company must meet both legal and contractual requirements and have assets available for distribution. Stockholders' Equity 72 Dividends (contd.) Most states require a positive retained earnings before dividends may be declared. In this case, the amount of dividends declared cannot exceed the balance of the retained earnings. Stockholders' Equity 73 Dividends:(contd.) Contractual agreements (such as long-term bond provisions) may restrict a Corp. from declaring dividends. The board of directors is responsible for the establishment of dividend policy and the determination of the amount, timing and types of dividends to be declared. Stockholders' Equity 74 Dividends:(contd.) A few types of dividends may be considered: (1) cash, and (2) stock. Cash dividends decrease retained earnings (R/E) and the stockholders’ equity. Stock dividend decreases R/E but increases contributed capital in the same amount. So, there is no change in the total stockholders’ equity Stockholders' Equity 75 Cash Dividends A cash dividend is the most common type of dividend. Four days are relevant to the cash dividend: 1) the date of declaration, 2) the ex-dividend date, 3) the date of record, and 4) the date of payment. Stockholders' Equity 76 Cash Dividends:(contd.) Example: on Nov. 3, 20x5, the board of directors declares preferred dividends totaled $10,000 and common dividends totaled $20,000. These dividends are payable on 12/15/x5 to stockholders of record on 11/24/x5. In addition, the ex-dividend date is 11/20/x5. The journal entries for the declaration and other related events are: Stockholders' Equity 77 Cash Dividends:(contd.) 11/3/x5 the date of declaration Retained Earnings 30,000 Dividends Payable: CS 20,000 Dividends Payable: PS 10,000 Shares are traded with dividends attached after this date. Companies are legally liable for declared dividends on this date. Stockholders' Equity 78 Cash Dividends:(contd.) 11/24/x5 The date of record Memo: the company will pay dividends on 12/15/x5 to preferred and common stockholders of record as of today, the date of record. Stockholders on the record will be paid of dividend even if they sell those shares prior to 12/15/x5, the payment date. Stockholders' Equity 79 Cash Dividends:(contd.) 12/15/x5 Dividend payment date Div. Payable: Com. stk 20,000 Div. Payable: Prefer.stk 10,000 Cash 30,000 Stockholders' Equity 80 Preferred Stock Characteristics Preferred stockholders have a preference to dividends. A preference to dividends does not guarantee a dividend distribution. Because a dividend declaration is at the discretion of the board of directors. Stockholders' Equity 81 Preferred Stock Characteristics (contd.) If a corporation fails to declare a dividend, or declares a dividend which is less than the stated rate of the preferred stock, the "passed" dividend of non-cumulative preferred stock will never be paid. Stockholders' Equity 82 Cumulative Preferred Stock For cumulative preferred stock, the amount of passed dividend becomes "dividend in arrears”. The “dividend in arrears” has the highest priority to be paid in the following periods. Common stockholders cannot be paid any dividend until the preferred dividend in arrears has been paid. Stockholders' Equity 83 Cumulative Preferred Stock Dividend in arrears accumulate from period to period. The “dividend in arrears” is not a liability because no liability exists until the dividend declaration. Stockholders' Equity 84 Stock Dividends A stock dividend is a proportional distribution of additional shares of a corporations own stock to its shareholders. When a stock dividend is distributed, no corporate assets are distributed. Each stockholder maintain the same percentage of ownership as before. Stock dividend is similar to a stock split. Stockholders' Equity 85 Stock Dividends (contd.) Accounting treatment: a. Small stock dividend (less than 25% of previous outstanding shares): the stock dividends are accounted for by transferring from retained earnings to contributed capital an amount equals to the fair market value of the additional shares issued. Stockholders' Equity 86 Stock Dividends :(contd.) Example 1: Small Stock Dividend A Corporation with 20,000 shares outstanding declares and issues a 10% stock dividend. On the date of declaration, the stock is selling for $23 per share with a par value of $10 per share. The journal entry to recorded the stock dividend is : Stockholders' Equity 87 Stock Dividends :(contd.) Date of Declaration (no change on par value): Retained Earnings 46,000 C.S. To be Distributed ** Additional Paid-in Capital from Stock Dividend Date of Issuance: C.S. To be Distributed C.S. $10 par 20,000 20,000 26,000 20,000 ** reported as a component of contributed capital. Stockholders' Equity 88 Stock Dividends :(contd.) Example 2: Large Stock Dividend Similar to example 1 except that the stock dividend increases from 10 % to 40% of the shares outstanding: Date Declaration:** $10 x(40% x 20,000 shares) Additional paid in Capital* 80,000** C.S to be Distributed 80,000 *Reason of debiting paid-in capital rather than R/E for large stock dividends: to prevent transferring earned capital to contributed capital. Stockholders' Equity 89 Stock Dividends :(contd.) * (contd.) An alternative account is retained earnings. If R/E is used, the accounting standard does not prevent the capitalization of a larger amount per share. The impact of stock dividend and stock splits on total firm value, the ownership % of existing shareholders are the same. A 100% stock dividend is equivalent to a twofor-one stock split (par value will be changed proportionately) in substance. Stockholders' Equity 90 Prior Period Adjustments Items reported as prior period adjustments of retained earnings include: a. changes in accounting method (when a retrospective approach is used), b. corrections of errors of prior periods. Stockholders' Equity 91 Prior Period Adjustments (error correction) Example: In 20x5, Fox Company discovered that it did not accrue $10,000 of interest expense for 20x4. The income tax effect is $3,000, the correct entries are: 1. Retained Earnings 10,000 Interest Payable 10,000 2. Income Tax Refund Rece. 3,000 Retained Earnings 3,000 Stockholders' Equity 92 Prior Period Adjustments (contd.) Presentation on the Retained Earnings Statement: R/E, as previous reported Jan 1, 20x5 $102,400 Less: Correction of overstatement in 20x4 N/I due to interest expense understatement (Net of $3,000 I/T) (7,000) Adjusted Retained Earnings, Jan 1, 20x5 $95,400 Stockholders' Equity 93 V. Other Component of Stockholder's Equity Accumulative Other Comprehensive Incomea: Other Comprehensive income accumulated over the current (reported on the combined income statement) and prior periods. a. Comprehensive income: changes in equity other than from owner related transactions (i.e., additional investment and dividends distribution). Stockholders' Equity 94 Other Component of Stockholder's Equity (contd.) Comprehensive income includes: a. Net income b. Other Comprehensive Income (all net of tax): Unrealized gain (loss) from SAS Foreign currency translation adjustments Minimum Pension liability adjustment Deferred gain (loss) from derivatives Stockholders' Equity 95 Example of Stockholders’ Equity and Statement of Changes in Stockholders’ Equity KARDWELL CORPORATION Stockholders’ Equity December 31, 20x5 Contributed capital: Common stock , $5 par (30,000 shares authorized, 11,400 shares issued, of which 100 shares are being held treasury stock) Additional paid-in capital on common stock Additional paid-in capital from treasury stock Paid-in Capital - stock options Total Contributed capital Accumulative Other Comprehensive Income Unrealized gain from valuation of SAS Retained earnings (see note) Total contributed capital, unrealized capital, and retained earnings Less: Treasury stock (at cost) Total stockholders' equity 57,000 197,400 5,000 3,600 263,000 40,000 386,200 689,200 (3,000) 686,200 Note: R/E are restricted regarding dividends in the amount of $3,000, the cost of the treasuryStockholders' stock. Equity 96 Example of Stockholders’ Equity and Statement of Changes in Stockholders’ Equity: (Contd.) Statement of Changes in Stockholders’ Equity for Year Ended December 31, 20x5 Common Stock Explanation Balances, 1/1/95 Issued for cash Reissued treaury stock Issued for exercise of stock options Compensation expense for stock options Compensation cost for new stock options Shares Issued 10,000 1,100 Par Value 50,000 5,500 Additional Paid-in Capital Paid-In Accum. Capital- Other Common Treasury Stock Stock 170,000 22,000 2,300 Stock Options Compre. Income Retained Earnings 2,000 10,000 322,000 2700 300 1,500 Stock (Cost) (7,500) 4,500 5,400 1,600 Unrealized gain from valuation of SAS Net income Cash dividends Balances, 12/31/95 Treasury 30,000 97,000 (32,800) 11,400 57,000 197,400 5,000 3,600 40,000 386,200 Stockholders' Equity (3,000) 97 Stock Option Plans Corporations have programs that enable employees to acquire shares of stock, often at a price less than the current market price (at the time of exercising the right). These programs involve the issuance of options to the employees and are referred to as stock option plans. A compensatory stock option plan is to provide additional compensation to selected employees. Stockholders' Equity 98 Compensatory Stock Option Plans The additional compensation is the difference between the amount of proceeds the corporation will receive from the issuance of the shares related to the stock option plan and the amount of the proceeds that it could receive if the stock were issued on the open market. Stockholders' Equity 99 Compensatory Stock Option Plans – the Intrinsic Value Method (Eliminated by SFAS 123 ( R )) Based on APB 25, the compensation cost related to a stock option plan is the excess of the market price over the option price on the measurement date (no consideration of time value of options). The measurement date is usually the grant date. Stockholders' Equity 100 Compensatory Stock Option Plans (Contd.) – the intrinsic Value Method The total compensation cost is recognized as an expense over the service period (the years in which company receives the benefit of the employee’s service). Stockholders' Equity 101 Compensatory Stock Option Plans – the Intrinsic Value Method Example Assume that on 12/31/x2, a corporation grants A. Paul the nontransferable right to acquire 1,000 shares of $10 par common stock for $27 per share. The market price on the date (12/31/x2) is $29 per share, and the service period is 4 years. The stock option may not be exercised until the service period expired and the rights terminate at the end of 7 years or if Paul leaves the corporation. Stockholders' Equity 102 Compensatory Stock Option Plans – Example: the Intrinsic Value Method (cont.) J.E. 12/31/x3 Compensation expense 500 a Paid-in capital-stock options 500 a. ($29-27) * 1,000 = $2,000; $2,000/4 = $500 The compensation expense is also recognized for x4,x5 and x6 service years: J.E. for 12/31/x4,x5 and x6: Compensation Expense 500 Paid-in capital –stock options 500 Stockholders' Equity 103 Compensatory Stock Option Plans – Example: the Intrinsic Value Method (cont.) When the options are exercised on 3/6/x8, the following J.E is recorded: Cash ($27 * 1,000) 27,000 Paid-in capital-stock options 2,000 Common Stock ($10*1,000) 10,000 Additional Paid-in Capital 19,000 Disclosure on the Balance Sheet (x3): Contributed Capital: paid-in Capital-stock options 500 Stockholders' Equity 104 Compensatory Stock Option Plans – Example: the Intrinsic Value Method (cont.) If 500 shares of vested stock options were expired (due to market price fall below the exercise price) on 1/1/x9, the following entry will be recorded: Paid-in capital-stock options 1,000 Paid-in capital from expired options 1,000 Note: when stock options expired, the previously recognized compensation expense is not adjusted. Stockholders' Equity 105 The Fair Value Method (SFAS No. 123): Effective for fiscal year beg. after 12/15/1995 Under the intrinsic value method, when setting the option price equals the market price of the stock on the grant date, the intrinsic value of the option would be zero. Thus, companies can avoid the recognition of compensation expense by setting the option price equals the market price. Stockholders' Equity 106 The Fair Value Method (SFAS 123) Based on available stock option pricing models, the fair value of employee stock options (ESO) can be estimated on the grant date based on the following factors: exercise price, expected term of the option (the time value), current market price of the stock, expected dividends, expected risk-free rate of return and expected volatility of the stock. Stockholders' Equity 107 The Fair Value Method (SFAS 123) (contd.) Using the fair value method, the estimated fair value of ESO based on an option pricing model would be allocated over the service (vested) period. The journal entries are similar to those of the intrinsic value method as follows: Compensation Expense xxx Paid in capital – stock options Stockholders' Equity xxxx 108 The Fair Value Method (SFAS 123) Using the fair value method, the estimated compensation cost is not calculated as the difference between the option price and the market price on the grant date. Rather, it is based on an option pricing model. Thus, the option value may not be zero even setting the option price equals the market value on the grant date. Stockholders' Equity 109 The Emergence of the Fair Value Method in the Early 1990s The public began to be more aware of the executive compensation in the form of stock options at the begining of the1990s. It is apparent that under the intrinsic value method, the ESO compensation expense is undervalued and therefore, under-expensed. Stockholders' Equity 110 The Emergence of the Fair Value Method (cont.) With the encouragement from both the SEC and the Congress, the FASB moved forward with its stock option project and issued the Exposure Draft requiring the fair value method for the ESO accounting in 1993. Stockholders' Equity 111 The Emergence of the Fair Value Method (cont.) The FASB encountered strong opposition toward the fair value method accounting from many sectors of the society (i.e., the corp. executives, the auditors, members of the Congress, the SEC, etc.). The objection reasons provided by the critics: Stockholders' Equity 112 The Emergence of the Fair Value Method (cont.) 1. ESO with no intrinsic value should have no fair value; 2. It is impossible to estimate the fair value of ESO; 3. The fair value method would have unacceptable economic consequences. Note: The fair value method does not have any cash flow impact. Stockholders' Equity 113 The Emergence of the Fair Value Method (cont.) As a result of the strong opposition, the FASB modified its position on the fair value method to allow companies to choose between the intrinsic value method (APB 25) and the fair value method to account for the ESO compensation expense. Stockholders' Equity 114 The Fair Value Method (SFAS 123) Under SFAS No. 123, a company can choose either the intrinsic value method (i.e., method prescribed in APB No. 25) or the fair value method to account for the stock based compensation cost. Stockholders' Equity 115 The Fair Value Method (SFAS 123) However, companies that choose the intrinsic value method are required to disclose the pro-forma net income and EPS, as if the fair value method were used. Stockholders' Equity 116 The Fair Value Method : SFAS 123 ( R ) (issued 2004, effective for fiscal year beg. after 6/15/2005 SFAS 123 (Revised 2004) requires companies to use the fair value method (NOT the intrinsic value method) to account for ESO expense. The estimated fair value of ESO will be allocated over the vested period as compensation expense. Stockholders' Equity 117 The Emergence of the SFAS 123 ( R ) Prior to 2002, only two companies volunteered expensed employee stock option compensation at the fair value method. The accounting scandals (i.e., fraudulent reports) of the high-profile companies lead to some degree of public consensus that the greed of the executives is a contributing factor to those misleading reports. Stockholders' Equity 118 The Emergence of the SFAS 123 ( R ) With the proliferation of stock options granted to executives, the executives have more incentive to produce fraudulent reports to increase their stock price. When stock price is increased, the executives’ compensation would also be increased from exercising their stock options. Stockholders' Equity 119 The Emergence of the SFAS 123 ( R ) Thus, not expensing the ESO cost based on the fair value may have contributed to these accounting scandals. Stockholders' Equity 120 The Emergence of the SFAS 123 ( R ) With this renewed interest in expensing the employee stock option at the fair value from the public, the FASB proposed and issued SFAS 123 (R) in 2004 to require the expense of employee stock option at the fair value, eliminating the intrinsic value method. Note: By the end of 2004, hundreds of firms have volunteering expensed ESO at fair value. Stockholders' Equity 121