Auto Insurance Lesson Plan

advertisement

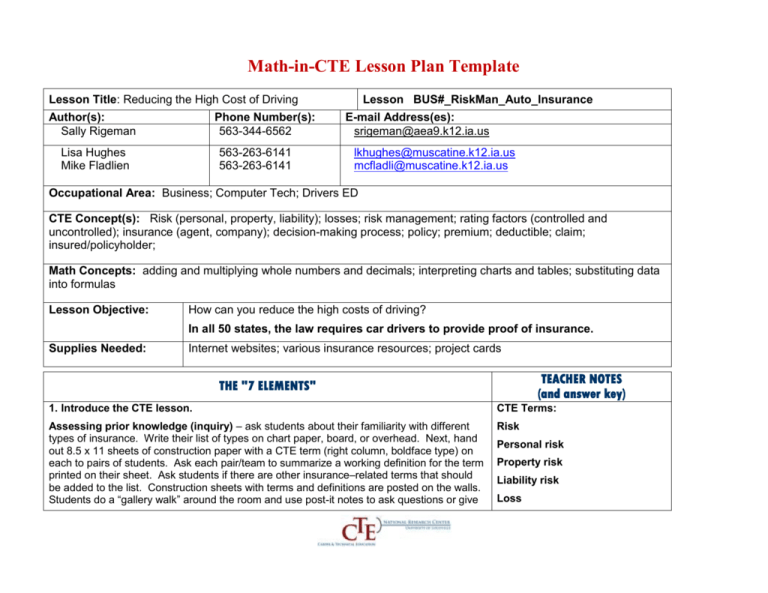

Math-in-CTE Lesson Plan Template Lesson Title: Reducing the High Cost of Driving Author(s): Sally Rigeman Phone Number(s): 563-344-6562 Lisa Hughes Mike Fladlien 563-263-6141 563-263-6141 Lesson BUS#_RiskMan_Auto_Insurance E-mail Address(es): srigeman@aea9.k12.ia.us lkhughes@muscatine.k12.ia.us mcfladli@muscatine.k12.ia.us Occupational Area: Business; Computer Tech; Drivers ED CTE Concept(s): Risk (personal, property, liability); losses; risk management; rating factors (controlled and uncontrolled); insurance (agent, company); decision-making process; policy; premium; deductible; claim; insured/policyholder; Math Concepts: adding and multiplying whole numbers and decimals; interpreting charts and tables; substituting data into formulas Lesson Objective: How can you reduce the high costs of driving? In all 50 states, the law requires car drivers to provide proof of insurance. Supplies Needed: Internet websites; various insurance resources; project cards TEACHER NOTES (and answer key) THE "7 ELEMENTS" 1. Introduce the CTE lesson. CTE Terms: Assessing prior knowledge (inquiry) – ask students about their familiarity with different types of insurance. Write their list of types on chart paper, board, or overhead. Next, hand out 8.5 x 11 sheets of construction paper with a CTE term (right column, boldface type) on each to pairs of students. Ask each pair/team to summarize a working definition for the term printed on their sheet. Ask students if there are other insurance–related terms that should be added to the list. Construction sheets with terms and definitions are posted on the walls. Students do a “gallery walk” around the room and use post-it notes to ask questions or give Risk Personal risk Property risk Liability risk Loss feedback. Vocabulary terms remain on the walls during the lesson so that students can modify definitions. www.visuwords.com Risk management Insurance Insurance agent Decision-making process Policy Premium Deductible Claim Liability insurance Bodily injury insurance Property damage insurance Collision insurance Comprehensive insurance Annual Premium Base Premium Driver Rating Factors 2. Assess students’ math awareness as it relates to the CTE lesson. Multiple Choice Scenario (Launch): 1. TBD 1. Jack is a 17 year old Quad City high school student with a “C” average. He drives a Ford Explorer. Since getting his license a year ago, Jack has received 2 speeding tickets and been involved in 2 “fender benders”. If Jack were paying his own insurance premium, it would be: 2. TBD A. B. C. D. About $600 every six months About $900 every six months About $1,200 every six months About $1,500 every six months 2. Because his parents carry Jack as a second driver on their auto insurance policy, how 3. Age, driving record, 2 claims, academic standing 4. Kind, model, and value of car; type of coverage and deductible, distance driven to work and yearly; city of residence; marital status. 5. Insurance costs can change when any of the factors associated much has their premium increased every six months since he began driving a year ago? A. B. C. D. About $300 About $600 About $900 About $1,200 3. What factors does Jack have that make insuring him a high risk for an insurance company? 4. Are there other factors that insurance companies consider when determining the cost of an auto insurance policy? 5. What could Jack do to lower his insurance costs? Worksheet for CTE math (adding money) and practice using a calculator. Students use online resources to find Bluebook value for family-owned own vehicles. with the initial insurance application change. For young drivers, insurance quotes are based on the following factors: Age and driving record Accident record Academic standing Type & value (age) of car Marital status Type of coverage Deductible coverage Purpose for driving Zip code you live in Number of miles driven per year Internet access 3. Work through the math example embedded in the CTE lesson. New terms: Insurance companies use tables to determine base premiums. Annual base premium Base Premium for a Private Passenger Automobile Annual premium Bodily Injury Limits Property Damage Limits 25/50 $ 206.40 $ 212.40 $ 220.80 $25,000 $50,000 $100,000 25/100 $ 218.80 $ 224.80 $ 233.20 50/100 $ 213.20 $ 237.20 $ 245.60 100/200 $ 252.00 $ 258.00 $ 266.40 100/300 300/300 $ 258.00 $ 286.80 $ 264.00 $ 293.20 $ 272.40 $ 301.20 Physical Damage Premium Age Group A B Comprehensive $50 Deductible C D A B Collision $50 Deductible C D Coverage 10 $76.80 $65.20 $62.00 $59.20 $225.60 $214.00 $204.00 $194.40 11 $81.60 $77.60 $74.00 $70.40 $246.00 $233.20 $222.80 $212.00 Insurance Rating group 12 13 14 $95.20 $108.00 $122.00 $90.40 $102.40 $115.60 $86.00 $98.00 $110.40 $82.00 $93.20 $105.20 $266.80 $287.20 $307.60 $253.20 $272.40 $291.60 $241.60 $260.00 $278.40 $230.00 $247.60 $265.20 15 $135.60 $128.40 $122.80 $116.80 $328.00 $311.20 $296.80 $282.80 (Chart in Mathematics With Business Applications, 4th edition, Glencoe, p.246) Annual Base Premium = Annual Premium = Liability + Premium Comprehensive Premium Annual Base Premium X + Collision Premium Driver-Rating Premium John wants to purchase auto insurance for his car. He contacts Secure Insurance and asks for a quote. His car age group is D and his insurance rating group is 10. He has a driver- rating factor of 1.20. The coverage he wants is $50,000 property damage; 50/100 bodily injury; $50-deductible comprehensive; and $50-deductible collision. 1. What will his annual base premium be? 2. What will his annual premium be? 1. $237.20 $ 59.20 $194.40 $490.80 annual base premium 2. $490.80 X 1.20 = $588.96 annual premium 4. Work through related, contextual math-in-CTE examples. Sandy’s driver-rating factor is 3.90 and her car age group is B and insurance rating group is 14. If she wants the same insurance coverage as John, what will her annual base premium and annual premium be? $237.20 $115.60 $291.60 $644.40 $644.40 X 3.90 = $2,513.16 How much more will she have to pay for the same coverage as John? 5. Work through traditional math examples. Using the chart above, if a car is in age group C and the principal driver has an insurance rating of 10 and a driver-rating factor of 1.50, what is the annual base premium and the annual premium for an insurance policy with 25/100 bodily injury and $100,000 property damage, and $50-deductible comprehensive and $50-deductible collision? $2,513.16 - $588.96 = $1,924.20 $233.20 $ 62.00 $204.00 $499.20 annual base premium $499.20 X 1.50 = $748.80 annual premium 6. Students demonstrate their understanding. Mike Fladlien uses his car mainly to drive to and from work. His car is age group B and his insurance rating group is 12. Currently, his driver-rating factor is now 2.65. However, he learns that his driver-rating factor will drop to 2.15 after he is married in October. If he has $25,000 property damage, 50/100 bodily injury, $50-deductible comprehensive and $50- $213.20 $90.40 $253.20 $556.80 deductible collision, how much less will his annual premium be when he gets married? $556.80 X 2.65 = $1,475.52 $556.80 X 2.15 = $1,197.12 $ 278.40 7. Formal assessment. $556.80; $640.32 Debra Pfab uses her car to drive to and from work. Her insurance coverage includes 50/100 bodily injury and $25,000 property damage. Her driver-rating factor is 1.15. She has $50deductible comprehensive and $50-deductible collision insurance coverage on her car. Her car is in age group B, and rating group 12. What are her annual base premium and her annual premium? Base Premium for a Private Passenger Automobile Property Damage Limits $25,000 $50,000 $100,000 Bodily Injury Limits 25/50 25/100 50/100 $ 206.40 $ 212.40 $ 220.80 $ 218.80 $ 224.80 $ 233.20 $ 213.20 $ 237.20 $ 245.60 Physical Damage Premium Coverage Comprehensive $50 Deductible Collision $50 Deductible Age Group A B A B Insurance Rating group 12 13 14 $95.20 $108.00 $122.00 $90.40 $102.40 $115.60 $266.80 $287.20 $307.60 $253.20 $272.40 $291.60 NOTES: Suggestions for student engagement and group work: In teams, select a “standard auto insurance coverage” plan. Then ask all students to choose a car they’d like to own after college and have them contact an insurance agent to find out how much it would cost to insure their vehicle. Pool the results on a class chart. Have students contact their family insurance agent to find out how much difference there is between $100, $250 and $500-deductible coverage. Have students use the Internet to determine which cars are the most and least expensive to insure. Create an auto insurance game. Have each student draw a card describing 8 driver characteristics and have each student contact an insurance agent for an auto insurance quote or see if there are insurance calculators online. Tabulate the class data.