Replacement Cost - Insurance Community University

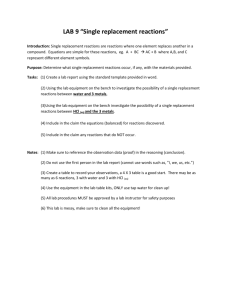

Property Valuation

The webinar will begin shortly.

100% Participation in

Polling Questions is required to receive credit for this class. Even if you do not intend to receive credit, please participate in the polls.

There is no audio at this time.

This presentation is being recorded for your viewing pleasure at a future date.

The attendance and proctor forms are available under ‘Materials’ in the Webinar’s

Console to the right.

The PowerPoint presentation is also available under ‘Materials’.

You will receive the course number for your state near the end of class.

Use the ‘chat’ window for questions on the content.

Insurance Community University www.InsuranceCommunityUniversity.com

Welcome to your Insurance Community

University

Audio

• All of you are currently on mute

– Un-mute your own system

– Telephone Option

• Select Telephone on your screen

• Dial in the PIN number so that your number becomes active

– Microphone and/or Speaker Option

• You can use this option if you have a headset that you use with your computer

Insurance Community University www.InsuranceCommunityUniversity.com

2

Participation & Chat Window

• You will receive information from the monitor via the

‘Chat’ window.

– Please locate window in the control panel

• Q & A is welcomed during the presentation and at the end of the presentation

• You will find the question box on your control panel

– Write your question in that box and send it to the presenter/organizer

• The presenter will take those

• questions in the order submitted

Insurance Community University www.InsuranceCommunityUniversity.com

3

DOI Requirements

• When you see a slide with the hand up symbol, touch the “hand” icon on your control panel

– Click ONCE only

• If you do not raise your hand, the monitor will be in contact with you in the chat box

• If you are in a group, the designated proctor is responsible to make certain you are all in attendance at all times

= Hand is down

Insurance Community University www.InsuranceCommunityUniversity.com

4

Polling

• Throughout the class we will be conducting periodic polls

• We need 100% participation on the polls

• The polls are intended to check participation but also to create discussion topics throughout the presentation

Insurance Community University www.InsuranceCommunityUniversity.com

5

Forms To Complete for CE

• After class ends

– Return attendance form

– Proctors – return your form to email address

• Email address is in chat window or in email sent to you today

Insurance Community University www.InsuranceCommunityUniversity.com

6

DOI Requirements

• We will file your hours with the DOI after the completion of this webinar and we have received the attendance form.

• You have 48 hours to return the form

• You will be sent a Certificate of

Attendance/Completion by email. Please retain this for your records for five years.

Insurance Community University www.InsuranceCommunityUniversity.com

7

Internet Disruption

• If the presenter looses internet connection STAY ON THE LINE

• The administrators will communicate with you

Insurance Community University www.InsuranceCommunityUniversity.com

Internet Failure

• If the internet fails and all participants are kicked off line by Go To Training or other source then the seminar will be terminated

• You will receive instructions by email as to how we will proceed

• This is a precautionary notice, only

Insurance Community University www.InsuranceCommunityUniversity.com

9

This class is being recorded

• Available in the University

• Does NOT qualify for CE if not taken during a scheduled class

Insurance Community University www.InsuranceCommunityUniversity.com

Your Instructor Today

Laurie Infantino, CIC, AFIS, CISC, ACSR, CISC, CRIS

President and Co-Founder of

The Insurance Community Center

Insurance Community University www.InsuranceCommunityUniversity.com

California Department of Insurance

New Regulation on Valuation

Insurance Community University www.InsuranceCommunityUniversity.com

The Regulation is Long Overdue

• The discussions began as far back as

2005 when SB 2 was added to Section

1749.85 to the California Insurance

Code (CIC).

• The regulation is in response to the

“chronic” problem of underinsurance most notably in the area of residential properties.

Insurance Community University www.InsuranceCommunityUniversity.com

13

The Regulation is Long Overdue

• The State Insurance Commissioner,

Steve Poizner, initially proposed these regulations as a result of major wildfires most notably in the San Diego area that destroyed 1600 homes and a reported

35,000 claims according to the L. A.

Times.

Insurance Community University www.InsuranceCommunityUniversity.com

14

The Regulation is Long Overdue

• A major issue following the loss was underinsurance and who should be held responsible. Many homeowners publically complained that they felt they had been mislead by their insurers.

• United Policyholders, an insurance consumer group, called on the commissioner to take action.

Insurance Community University www.InsuranceCommunityUniversity.com

15

The Regulation is Long Overdue

• California courts have ruled that homeowners have the primary responsibility for ensuring that they have enough insurance on their property.

• Insurers are brought into the actions because they are supplying the valuation tools that they require be completed for acceptance

Insurance Community University www.InsuranceCommunityUniversity.com

16

The Regulation is Long Overdue

• The agent certainly has been held responsible but errors, omissions, negligence are not that easy to prove

• The regulation is a heightened responsibility on the agent/broker

Insurance Community University www.InsuranceCommunityUniversity.com

17

An Agent is the Eyes and Ears of the

Company they represent

AND

Insurance Community University www.InsuranceCommunityUniversity.com

18

Polling Question #1

Insurance Community University www.InsuranceCommunityUniversity.com

19

Polling Question #2

Insurance Community University www.InsuranceCommunityUniversity.com

20

Overview (2188.65 and 1749.85)

• (b) On or after June 27, 2011, every California resident fire and casualty broker-agent and personal lines broker-agent who has not already taken a homeowners' insurance valuation training course must satisfactorily complete one three-hour training course on homeowners' insurance valuation meeting the requirements of this section prior to estimating the replacement value of structures in connection with, or explaining the various levels of coverage under, a homeowners' insurance policy.

Insurance Community University www.InsuranceCommunityUniversity.com

21

Overview (2188.65 and 1749.85)

• For resident broker-agents, this requirement shall be part of, and not in addition to, the continuing education requirements of

Insurance Code section 1749.3. The homeowners' insurance valuation training course needs to be taken only once in order to satisfy the requirements of this subdivision

• http://www20.insurance.ca.gov/epubacc/REG

/151771.htm

Insurance Community University www.InsuranceCommunityUniversity.com

22

Overview (2188.65 and 1749.85)

• This class must only be taken once and does qualify for three hours of CE

• An individual who no longer has to take

CE in California due to their age still

MUST take this class if they are involved in residential insurance

• The regulation is for California resident fire and casualty broker-agent and personal lines broker-agents ONLY

Insurance Community University www.InsuranceCommunityUniversity.com

23

Overview (2188.65 and 1749.85)

• If individuals who primarily write commercial lines also offer advice and provide any information on estimations on residential insurance then they should attend this class, as well to avoid any future problems

Insurance Community University www.InsuranceCommunityUniversity.com

24

Section 2695.182. Documentation of

Person Making Estimate

• This section is VERY important and discusses the new requirements for documenting estimations. The section should be read in its totality, communicated to the entire office staff and procedures should be put in place for compliance and monitoring of the systems. We will discuss some of the key requirements later in the course.

Insurance Community University www.InsuranceCommunityUniversity.com

25

Polling Question #3

Do you have an area in your agency management system where you store the underwriting questions you asked about the home before you wrote the coverage?

Insurance Community University www.InsuranceCommunityUniversity.com

26

Polling Question #4

Insurance Community University www.InsuranceCommunityUniversity.com

27

Course Objective

• Be able to differentiate between a homeowners policy and a dwelling property form

• Be able to estimate the value of an insured’s property by having basic knowledge of its value

• Know the valuation principles and methods

• Know the value of the components of a dwelling to access its replacements cost or value

Insurance Community University www.InsuranceCommunityUniversity.com

28

Course Objective

• Have the ability to recognize other factors influencing the replacement cost

• Have knowledge of endorsements used in relation to the insuring of replacement costs of homeowners’/dwelling policy; and,

• Understand the process used in determining the value of an insured’s property

Insurance Community University www.InsuranceCommunityUniversity.com

29

No Two Homes Are Exactly Alike

Insurance Community University www.InsuranceCommunityUniversity.com

30

No Two Homes Are Exactly Alike For

Sure

Insurance Community University www.InsuranceCommunityUniversity.com

31

Property Valuation

• “Value is a matter of opinion”, according to a New Jersey court. “Not only in the eyes of the courts is value indeterminate, but appraisers differ in their opinions and contractors bidding on the same job vary widely in their cost estimates”.

» Practical Risk Management

Insurance Community University www.InsuranceCommunityUniversity.com

32

Property Valuation

Practical Risk Management

• “Further, values for insurance purposes differ significantly from values for other purposes”.

Insurance Community University www.InsuranceCommunityUniversity.com

33

Differences between Homeowners and Dwelling Property Policies

Insurance Community University www.InsuranceCommunityUniversity.com

34

Insurance Policies

• A dwelling is considered a residential property of up to four units, whether occupied by the insured or not

• There are several forms of insurance for residential properties

• The type of policy that should be written on a residence depends on the underwriting considerations discussed in this course

Insurance Community University www.InsuranceCommunityUniversity.com

35

Insurance Policies

• A Homeowner’s policy is for a dwelling that is owner occupied

• In general the major considerations that determine the type of policy to be issued include:

– Type of Residence

– Ownership

– Occupancy

– Age, Condition and Protection

– Values

• Insurance Companies all have different eligibility requirements for different insurance forms

Insurance Community University www.InsuranceCommunityUniversity.com

36

Insurance Policies

Difference in property coverage forms

Insurance Community University www.InsuranceCommunityUniversity.com

37

DP Forms Available

Insurance Community University www.InsuranceCommunityUniversity.com

38

Reasons to Write the

Dwelling Fire Program

• Home does not qualify for a Homeowners

Policy

• Residence is NOT owner-occupied

• Residence is in a designated brush hazard area

• Residence is under construction

• Home is vacant

• Differences in property coverages available on the DP series necessitates different coverage levels and valuation triggers

Insurance Community University www.InsuranceCommunityUniversity.com

39

Reasons to Write the

Dwelling Fire Program

• Residence value is less then the minimum or maximum allowable by the company

• Residence is a “seasonal” or secondary

• Residence is not up to the “physical” standards

• Residence may be owned in a name different from the “home owners” such as a partnership, joint venture or corporation

Insurance Community University www.InsuranceCommunityUniversity.com

40

Reasons to Write the

Dwelling Fire Program

• The insured may prefer having their home issued on a Dwelling Program because:

– The insured might not want or need the full range of homeowners coverages

– The Homeowners Program might be more expensive than the insured chooses to pay

Insurance Community University www.InsuranceCommunityUniversity.com

41

California FAIR Plan

• The California FAIR plan policy is written on a DP 1 basis

• The policy is written on an ACV basis and Replacement Cost is optional on the

Dwelling

Insurance Community University www.InsuranceCommunityUniversity.com

42

CEA

(

www.earthquakeauthority.com

)

• Dwelling coverage - The coverage limit is the insured value of your home stated on your companion homeowner policy.

• Additional Coverages

Limited Building Code Upgrade

In most California communities, repairing or rebuilding a home after an earthquake must be done according to current building codes.

Insurance Community University www.InsuranceCommunityUniversity.com

43

CEA

(

www.earthquakeauthority.com

)

• In addition to providing funds for repairing or replacing your home, the CEA base policy includes an additional $10,000 in Building

Code Upgrade coverage. Option to Increase

Building Code Upgrade Coverage

For policies that renew or become effective on or after July 1, 2006, homeowners can choose to increase Building Code Upgrade coverage by an additional $10,000, for a total Building

Code Upgrade coverage limit of $20,000.

Insurance Community University www.InsuranceCommunityUniversity.com

44

CEA

(

www.earthquakeauthority.com

)

• Your CEA policy excludes some items from dwelling coverage. A partial list of items that are not covered includes:

• Detached garages and most other structures that are not part of the dwelling

• Land damage (other than $10,000 in coverage for land stabilization)

• Swimming pools and spas

• Awnings and patio coverings

Insurance Community University www.InsuranceCommunityUniversity.com

45

CEA

(

www.earthquakeauthority.com

)

• Fences, landscaping, and irrigation systems

• Antennas and satellite dishes

• Patios and decks

• Walkways and driveways not needed for pedestrian or disabled access to your home

• Certain decorative or artistic items such as mirrors, chandeliers, stained glass, or mosaics

Insurance Community University www.InsuranceCommunityUniversity.com

46

California Earthquake Authority

(CEA) Section 10081

• That coverage may be provided in the policy of residential property insurance itself, either by specific policy provision or endorsement, or in a separate policy or certificate of insurance which specifically provides coverage for loss or damage caused by the peril of earthquake alone or in combination with other perils.

• http://www.leginfo.ca.gov/cgibin/displaycode?section=ins&group=10001-

11000&file=10081-10089.4

Insurance Community University www.InsuranceCommunityUniversity.com

47

Homeowners

• Homeowners Policies are the premier policy for the owner of a home who occupies it as their residence.

• It is a package policy of Property and

Liability and includes a lot of enhanced coverages and numerous endorsements.

Insurance Community University www.InsuranceCommunityUniversity.com

48

Homeowners

• Every company has their own eligibility and their own form and endorsements

• ISO provides a guideline for homeowners coverages

Insurance Community University www.InsuranceCommunityUniversity.com

49

Homeowners Forms Available

Homeowners

Basic Form

Homeowners

Broad Form

Homeowners

Special Form

HO 0001

HO 0002

HO 0003

Not widely used

Not widely used

Coverage

A, B, C, D

Insurance Community University www.InsuranceCommunityUniversity.com

50

Homeowners Forms Available

Contents Broad

Form

Homeowners

Comprehensive

Form

Homeowners

Unit Owners

HO 0004

HO 0005

HO 0006

Coverage

C,D

Coverage

A, B, C, D

Coverage

A, C, D

Insurance Community University www.InsuranceCommunityUniversity.com

51

Homeowners Forms Available

Homeowners

Modified

Form

HO 0008

Coverage

A, B, C,D

HO 04 81 05 96 Actual Cash Value

Changes the valuation on all building losses to ACV.

Endorsement used for homeowners who do not want to carry enough insurance to comply with valuation provision

Insurance Community University www.InsuranceCommunityUniversity.com

52

What Types of Properties Are Insured On A

Homeowner’s Policy

• A Single Family Dwelling

• A Multiple Family Dwelling (1-4 units)

• A Townhouse Unit

Insurance Community University www.InsuranceCommunityUniversity.com

53

Basic Concepts of Property

Valuations

Insurance Community University www.InsuranceCommunityUniversity.com

54

Loss Settlement Provisions

• Loss Settlement Provisions are contained in each type of property policy

• Loss Settlement Provisions in terms of how it applies indicates how a loss will be settled and on what basis:

– Valuation trigger

– What will happen if there is underinsurance

– What will happen if the insured does not repair or replace

Insurance Community University www.InsuranceCommunityUniversity.com

55

What effect does underinsurance have on a settlement

• Insurance companies require that a home be insured to replacement cost in order for them to qualify for a homeowners policy

• Estimators are required as minimum indicators of coverage

• In the event of underinsurance the insured will NOT receive the total loss that they claim

Insurance Community University www.InsuranceCommunityUniversity.com

56

What effect does underinsurance have on a settlement

• There is no “coinsurance” requirement on a Homeowners Policy but there is an

“Insurance to Value Clause”

Insurance Community University www.InsuranceCommunityUniversity.com

57

Insurance To Value Clause on a

Homeowners Policy

Buildings covered under Coverage A or B at replacement cost without deduction for depreciation, subject to the following: a.

If, at the time of loss, the amount of insurance in this policy on the damaged building is 80% or more of the full replacement cost of the building immediately before the loss, we will pay the cost to repair or replace, after application of any deductible and without deduction for depreciation, but not more than the least of the following amounts:

Insurance Community University www.InsuranceCommunityUniversity.com

58

Insurance To Value Clause on a

Homeowners Policy

(1) The limit of liability under this policy that applies to the building;

(2) The replacement cost of that part of the building damaged with material of like kind and quality and for like use; or

(3) The necessary amount actually spent to repair or replace the damaged building.

If the building is rebuilt at a new premises, the cost described in (2) above is limited to the cost which would have been incurred if the building had been built at the original premises.

Insurance Community University www.InsuranceCommunityUniversity.com

59

Polling Question #5

Insurance Community University www.InsuranceCommunityUniversity.com

60

Loss Settlement Provisions

– Market Value—Fair Market Value

– Jefferson Decision

– ACV

– Replacement Cost

• Under normal situations

• Under catastrophic situations

– Reproduction Cost

• Historical buildings

– Inflation Guard

– Functional

Insurance Community University www.InsuranceCommunityUniversity.com

61

Market Value/Fair Market Value

• A term used in the Real Estate industry to represent the price a property can be sold at based on what the market will pay at any given time.

• The price at which the property is being sold normally includes the land value and area consideration.

• This is NOT appropriate to determine the amount of insurance to be carried.

Insurance Community University www.InsuranceCommunityUniversity.com

62

Bank Requirement Changed

2009 California Civil Code Section 2947-2955.5:

Article 2. Mortgage of Real Property http://law.justia.com/codes/california/2009/civ/29

47-2955.5.html

• 2955.5. (a) No lender shall require a borrower, as a condition of receiving or maintaining a loan secured by real property, to provide hazard insurance coverage against risks to the improvements on that real property in an amount exceeding the replacement value of the improvements on the property.

Insurance Community University www.InsuranceCommunityUniversity.com

63

Actual Cash Value (ACV)

• There is NO specific definition of this word in the insurance policies

• It is broadly interpreted to mean the cost to repair or replace the property with material of like, kind and quality minus depreciation.

• The insured need not repair or replace the damaged property to be indemnified on the contract-it is a cash settlement and a “holdback” in terms of allowing for the full Replacement

Cost.

Insurance Community University www.InsuranceCommunityUniversity.com

64

Actual Cash Value (ACV)

– Physical deterioration

– Functional obsolescence

– Economic obsolescence due to causes independent of the property

– Effective age as compared with other properties considering renovations and reconstruction

– Future life expectancy

Insurance Community University www.InsuranceCommunityUniversity.com

65

Replacement Cost less Depreciation of age, wear and tear

• Factors that enter into depreciation

– Age

– Usage

– Wear and Tear

– Obsolescence

• Depreciation guides are available through some insurance companies AND there are sites that have important information such as: www.claimspages.com

Insurance Community University www.InsuranceCommunityUniversity.com

66

Depreciation (Holdback)

• There is a requirement under the

Replacement Cost provision of a

Homeowners Policy to actually repair or replace or they will HOLDBACK the additional dollars available under the Loss

Settlement Provision.

• The policy reads as follows:

Insurance Community University www.InsuranceCommunityUniversity.com

67

Depreciation (Holdback)

We will pay no more than the actual cash value of the damage until actual repair or replacement is complete. Once actual repair or replacement is complete, we will settle the loss as noted in 2.a. and b. above.

However, if the cost to repair or replace the damage is both:

(1) Less than 5% of the amount of insurance in this policy on the building; and

(2) Less than $2,500; we will settle the loss as noted in 2.a. and b. above whether or not actual repair or replacement is complete.

Insurance Community University www.InsuranceCommunityUniversity.com

68

Depreciation (Holdback)

• You may disregard the replacement cost loss settlement provisions and make claim under this policy for loss to buildings on an actual cash value basis. You may then make claim for any additional liability according to the provisions of this

Condition D. Loss Settlement, provided you notify us, within 180 days after the date of loss, of your intent to repair or replace the damaged building.

Insurance Community University www.InsuranceCommunityUniversity.com

69

Jefferson Decision vs. ACV

• Since 1970 California has been referred to as a “Fair Market Value” State or a

Jefferson Decision State.

• The case is Cheeks v. California Fair

Plan.61 Cal.APP.4th423 (1998)

• In the case, Cheeks’ home was severely damaged in the Northridge Earthquake of l994

Insurance Community University www.InsuranceCommunityUniversity.com

70

Jefferson Decision vs. ACV

• It was insured on a policy with the California

Fair Plan that promised: “Covered property losses are settled at Actual Cash Value at the time of loss, but not more than the amount required to repair or replace the damaged property.”

• Cheeks sued, contended that the ACV of his home, based on its market value, was more then the insurer’s estimate

Insurance Community University www.InsuranceCommunityUniversity.com

71

Jefferson Decision vs. ACV

• The basic test is what would a willing buyer pay for a property irrespective of land consideration

Insurance Community University www.InsuranceCommunityUniversity.com

72

Replacement Cost

• This is the cost to repair or replace the property with materials of "like, kind and quality" without depreciation.

• Replacement cost is based on what it would cost to replace the structure on the same premises and for the same purpose without the requirement to do so.

• Replacement cost would be different based on different types of structures; construction; square footage; upgrades

Insurance Community University www.InsuranceCommunityUniversity.com

73

Replacement Cost

• Replacement Cost applies to different types of structures including

– Dwelling

– Detached Garage

– Detached buildings other than garages

– Structures such as swimming pools, cabanas, etc

• CIC Code 10102 has language precluding the use of Guaranteed

Replacement Cost

Insurance Community University www.InsuranceCommunityUniversity.com

74

Replacement Cost CIC Section 2051 and 2051.5

• 2051.5. (a) Under an open policy that requires payment of the replacement cost for a loss, the measure of indemnity is the amount that it would cost the insured to repair, rebuild, or replace the thing lost or injured, without a deduction for physical depreciation, or the policy limit, whichever is less

Insurance Community University www.InsuranceCommunityUniversity.com

75

Replacement Cost CIC Section 2051 and 2051.5

• If the policy requires the insured to repair, rebuild, or replace the damaged property in order to collect the full replacement cost, the insurer shall pay the actual cash value of the damaged property, as defined in Section 2051, until the damaged property is repaired, rebuilt, or replaced.

Insurance Community University www.InsuranceCommunityUniversity.com

76

Replacement Cost CIC Section 2051 and 2051.5

• Once the property is repaired, rebuilt, or replaced, the insurer shall pay the difference between the actual cash value payment made and the full replacement cost reasonably paid to replace the damaged property, up to the limits stated in the policy.

Insurance Community University www.InsuranceCommunityUniversity.com

77

Replacement Cost CIC Section 2051 and 2051.5

• (c) In the event of a total loss of the insured structure, no policy issued or delivered in this state may contain a provision that limits or denies payment of the replacement cost in the event the insured decides to rebuild or replace the property at a location other than the insured premises.

However, the measure of indemnity shall be based upon the replacement cost of the insured property and shall not be based upon the cost to repair, rebuild, or replace at a location other than the insured premises.

Insurance Community University www.InsuranceCommunityUniversity.com

78

Replacement Cost

• There is, however, the requirement to actually rebuild, repair, or replace in order to be indemnified on the contract.

• Is the insured required to build at the same site?

• Is the insured required to build the same home/building?

Insurance Community University www.InsuranceCommunityUniversity.com

79

Replacement Cost and Different

Types of Structures

• Dwelling

• Attached Garage

• Detached Garage

• Carport

• Fence

• Patios

• Greenhouse

• Swimming Pools

• Jacuzzis

• Gazebos

• Guest Houses

• Barns

• Fire pits

• Docks

• Tennis Courts

Insurance Community University www.InsuranceCommunityUniversity.com

80

Additional costs associated with single or custom home

• Estimators only provide basic information and “estimates” of value

• Broker/Agents should always inspect a home, take pictures and do an on site evaluation for any costs associated with customization

Insurance Community University www.InsuranceCommunityUniversity.com

81

Is that a house or a Garage?

Insurance Community University www.InsuranceCommunityUniversity.com

82

Size and Type of Attached Garage

• Garages vary in type, size, usage and construction (specialty finishes)

• Often times the garage is overlooked in the overall valuation and must be considered as a separate line item

Insurance Community University www.InsuranceCommunityUniversity.com

83

Replacement Cost and Different

Types of Structures

• Homeowners Estimators are only as good as the questions we ask your insured

• We must identify ALL structures that they have to include in the value and insure properly

Insurance Community University www.InsuranceCommunityUniversity.com

84

Other Costs relating to evaluating

Replacement Cost

• Cost of demolition and debris removal

– The policy is silent on Demolition and would be construed to be covered under “Replacement Cost”

– Debris Removal is included in a

Homeowners Policy but the limit of insurance MUST include the costs associated with the coverage

Insurance Community University www.InsuranceCommunityUniversity.com

85

Debris Removal

• This expense is included in the limit of liability that applies to the damaged property. If the amount to be paid for the actual damage to the property plus the debris removal expense is more than the limit of liability for the damaged property, an additional 5% of that limit is available for such expense

Insurance Community University www.InsuranceCommunityUniversity.com

86

Debris Removal

And if there are any Pollutants??

And there probably are!

Insurance Community University www.InsuranceCommunityUniversity.com

87

Other Costs relating to evaluating

Replacement Cost

We will also pay your reasonable expense, up to $1,000, for the removal from the

"residence premises" of:

(1) Your trees felled by the peril of

Windstorm or Hail or Weight of Ice, Snow or Sleet; or

(2) A neighbor's trees felled by a Peril

Insured Against under Coverage C;

Insurance Community University www.InsuranceCommunityUniversity.com

88

Other Costs relating to evaluating

Replacement Cost

• Other costs that must be included when considering the amount for Replacement

Cost would be:

– Architect’s Plans

– Engineering Studies

– Building Permits

Insurance Community University www.InsuranceCommunityUniversity.com

89

Replacement Cost and Additional

Living (CIC 2051.5)

• (2) In the event of a covered loss relating to a state of emergency, as defined in Section 8558 of the Government Code, coverage for additional living expenses shall be for a period of 24 months, but shall be subject to other policy provisions, provided that any extension of time required by this paragraph beyond the period provided in the policy shall not act to increase the additional living expense policy limit in force at the time of the loss. This paragraph shall become operative on January 1, 2007.

Insurance Community University www.InsuranceCommunityUniversity.com

90

Functional Replacement Cost Loss

Settlement - HO 05 30 10 00

• Allows for functionally equivalent building to replace the original structure.

• Buildings under Coverages A or B are eligible.

– Must be insured at least 80% to functional value.

• Must contract to rebuild within 180 days of loss.

Insurance Community University www.InsuranceCommunityUniversity.com

91

Polling Question #6

Insurance Community University www.InsuranceCommunityUniversity.com

92

Reproduction Cost

• This is the cost to reproduce with identical types of materials rather than a functional equivalent.

• It is used for special types of construction where reproducing the structure identically is necessary based on its value, function, or aesthetic quality.

Insurance Community University www.InsuranceCommunityUniversity.com

93

Reproduction Cost

• If you own an historic building, whether it is a stately home or an ancient cottage, a standard policy from a general insurance provider could fall well short of expectations if you need to make a claim. If your building is also listed, it is protected by law, limiting repair options and making some higher costs unavoidable: it is the responsibility of the owner to insure it properly.

www.buildingconservation.com

Insurance Community University www.InsuranceCommunityUniversity.com

94

Polling Question #7

Insurance Community University www.InsuranceCommunityUniversity.com

95

California Residential Property

Insurance Disclosure Statement

California Insurance Code (CIC) 10102 http://www.leginfo.ca.gov/cgibin/displaycode?section=ins&group=1000

1-11000&file=10101-10107

Insurance Community University www.InsuranceCommunityUniversity.com

96

California Residential Property

Insurance Disclosure Statement

• This is a disclosure required by California

Law under section 10102 of the Insurance

Code

• For policies issued on or after July 1,

1993, the agent or insurer shall obtain the applicant's signature acknowledging receipt of the disclosure form within 60 days of the date of the application

Insurance Community University www.InsuranceCommunityUniversity.com

97

California Residential Property

Insurance Disclosure Statement

• There is a checkmark required on the

Disclosure Form indicating the following valuation triggers

– Actual Cash Value

– Replacement Cost Value

– Extended Replacement Cost

– Guaranteed Replacement Cost

• With limited building code upgrade

• With unlimited/full building code upgrade

– Building Code Upgrade

Insurance Community University www.InsuranceCommunityUniversity.com

98

Components of a Structure

Necessary to Estimate Replacement

Cost

Including a discussion on how the various components contribute to Fire Hazard

Identification

Insurance Community University www.InsuranceCommunityUniversity.com

99

One of the Best Lessons in

Construction

Laguna Fires October 1993 http://www.finehomebuilding.com/howto/articles/fire-resistant-details.aspx

Insurance Community University www.InsuranceCommunityUniversity.com

100

Insurance Community University www.InsuranceCommunityUniversity.com

101

Laguna Fires

• That was the scene in October 1993 after a fire storm destroyed nearly 400 homes in Laguna Beach, California. The fires started several miles inland and swept to the sea at a brisk 2 mph to 4 mph, consuming increasingly thick vegetation along the way.

Insurance Community University www.InsuranceCommunityUniversity.com

102

Laguna Fires

• Frequently, the flames boiled 50 ft. or 60 ft. into the air, and they reached temperatures of 2,000°F or greater

• The most obvious question homeowners, builders, architects and code officials asked as they combed the rubble for clues was how did a precious few structures survive such an inferno while houses on all sides vanished in the fire? What they learned was a number of lessons that likely will work their way into local building codes and should help to reduce the damage of future fires.

Insurance Community University www.InsuranceCommunityUniversity.com

103

Laguna Fires

• The home of To Bui and Doris Bender was called a "miracle house" by the Los

Angeles Times because of its dramatic survival in a neighborhood almost totally devastated by the fire. Why did this trilevel structure and a few others like it survive while neighbors' homes on all sides, sometimes no more than 10 ft. or 15 ft. away, burned to the ground?

Insurance Community University www.InsuranceCommunityUniversity.com

104

Laguna Fires

• "It's in the details," Bui insists. He knows about such details. Originally from

Vietnam, he lived and worked as a structural engineer in Germany for more than 10 years. There, the predominant building materials are concrete, stone, brick and steel. "In Germany, structures are designed to last hundreds of years," he said. "I built my house to last."

Insurance Community University www.InsuranceCommunityUniversity.com

105

Types of Basic Building Construction

Insurance Community University www.InsuranceCommunityUniversity.com

106

Types of Construction

• Tilt Up

• Cinderblock

• Wood Frame

• Brick & Masonry

• Metal Frame

• Superior Construction

– Non Combustible

– Masonry Non

Combustible

– Fire Resistive

Insurance Community University www.InsuranceCommunityUniversity.com

107

Types of Foundations

• Determining the types of foundations is very important for purposes of loss settlement and determination of value

• If a foundation is cracked due to excessive heat, for example in a fire, then the loss is considered a constructive total loss and the foundation must be replaced

• Often times the foundation may not be up to code such as in the example of the

Oakland Fires

Insurance Community University www.InsuranceCommunityUniversity.com

108

Types of Foundations

• Type of Foundation

– Depending on when and where a house was built, the foundation may be made of stone, brick, preservative-treated lumber, concrete block, or poured concrete. By far the most common material for foundations is concrete

– There are three types of conventional concrete foundations: poured concrete, concrete block, and post-and-pier. Size and acceptable types are regulated by building codes

Insurance Community University www.InsuranceCommunityUniversity.com

109

Foundations and the Homeowners

To determine the amount of insurance required to equal 80% of the full replacement cost of the building immediately before the loss, do not include the value of:

(1) Excavations, footings, foundations, piers, or any other structures or devices that support all or part of the building, which are below the undersurface of the lowest basement floor;

(2) Those supports described in (1) above which are below the surface of the ground inside the foundation walls, if there is no basement; and

(3) Underground flues, pipes, wiring and drains.

Insurance Community University www.InsuranceCommunityUniversity.com

110

Roofing Materials

• Roofing Materials are very important in terms of fire hazard

• Many older types of roofs are no longer acceptable, such as wood shake, due to their susceptibility to fire.

• Example is the Laguna Fires where the roofs caught on fire and created explosions that was a major cause in spreading the loss to other homes.

Insurance Community University www.InsuranceCommunityUniversity.com

111

Roofing Materials

• Roofing materials can be a significant cost factor in replacement of homes

– Shingles—Asphalt, Shingles Architectural

– Wood Shake, Wood Victorian Scallop

– Tile—Clay Concrete

– Tar & Gravel

– Slate

– Tin

– Copper

– Foam

Insurance Community University www.InsuranceCommunityUniversity.com

112

That’s a roof?

Insurance Community University www.InsuranceCommunityUniversity.com

113

That’s a roof?

Insurance Community University www.InsuranceCommunityUniversity.com

114

Siding Materials

• Stucco

• Stone Veneer

• Cement Fiber

• Wood Clapboard

• Brick Veneer

• Cedar Shingle Siding

• Engineered Wood Siding

Insurance Community University www.InsuranceCommunityUniversity.com

115

Hazards

There are checklists that are useful to help identify hazards and mitigate them such as:

www.befiresmart.com/protect

Insurance Community University www.InsuranceCommunityUniversity.com

116

Slope

• The Slope on which a home is built enters into the per square footage replacement cost.

• As relates slope, various schemes for rating fire hazard have been developed

• Five elements chosen by many agencies are: vegetation, canopy cover, slope, aspect, and elevation

• Slope and Other Fire Hazard Considerations http://grayback.com/applegate-valley/fireplan/how-freq.htm

Insurance Community University www.InsuranceCommunityUniversity.com

117

Slope and Other Fire Hazard

Considerations

• Vegetation directly influences rate of spread,

• Canopy cover and ladder fuels are closely related when it comes to hazard rating. A greater percentage of ladder fuels means a greater likelihood of a surface fire moving into the crown canopy, increasing the difficulty of suppressing the fire.

Insurance Community University www.InsuranceCommunityUniversity.com

118

Slope and Other Fire Hazard

Considerations

• Gravity dictates that many if not most things travel downhill faster than uphill. As the slope becomes steeper, fire increases in speed. On flat terrain, the spread of fire relies more on wind.

Insurance Community University www.InsuranceCommunityUniversity.com

119

Slope

• Slope is graded in the following broad categories

– Flat to Slight

– Moderate

– Steep

Insurance Community University www.InsuranceCommunityUniversity.com

120

Age of the structure or the year it was built

• The age of the structure is important for valuation from a couple of aspects

– Building could be substantially out of code

– Building may be able to be built as it was prior to the loss

– The building my be “historical” or have unique building items that must be included in Replacement Cost

Insurance Community University www.InsuranceCommunityUniversity.com

121

CAT Losses make a big difference

San Diego Fires 2007

Oakland Fires

Laguna Beach Fires

Insurance Community University www.InsuranceCommunityUniversity.com

122

Oakland Fires 1991

The destructive Oakland fires were an eye-opener when it came to rebuilding costs in the Bay Area.

With the steep slopes in the Oakland hills, the bill came in at $400 per square foot rather than the

$100 national average. www.paloaltoonline.com

Insurance Community University www.InsuranceCommunityUniversity.com

123

Effects of Catastrophes on

Replacement Cost

• Under Normal Situations Repair and Replace

• Following a CAT loss the costs of construction can sky rocket

– Cost of permits

– Change in building codes

– Supply and demand (Building Supplies)

– Fuel Charges

– Inability to replace at the same site— especially a consider in flood prone areas

– Construction Labor Sources

Insurance Community University www.InsuranceCommunityUniversity.com

124

Review of Significant Endorsements

• Guaranteed Replacement Cost

• Extended Replacement Cost

• Inflation Guard

• Building Ordinance

Insurance Community University www.InsuranceCommunityUniversity.com

125

Polling Question #8

Insurance Community University www.InsuranceCommunityUniversity.com

126

Guaranteed Replacement Cost

• The limit of insurance is suspended on the described property.

• In the event of a total loss, the recovery is the actual amount of the loss.

• In the event of a partial loss, the policy pays replacement cost or ACV if the property is not replaced.

Insurance Community University www.InsuranceCommunityUniversity.com

127

Guaranteed Replacement Cost

• Many homeowner policies prior to 1991 provided this enhanced coverage.

• In the aftermath of a catastrophic fire in the Berkeley Hills above Oakland, most homeowner policies revised this provision.

Insurance Community University www.InsuranceCommunityUniversity.com

128

CIC Code as relates Guaranteed

Replacement Cost 10102

• Significant misuse of the “Guaranteed

Replacement Cost Endorsement” and

Extended Replacement Costs have resulted in law suits following losses.

• Specifically the term Guaranteed was misused leading the insured to believe that the full cost of replacement was

“guaranteed” without restriction.

According the code makes specific reference to this.

Insurance Community University www.InsuranceCommunityUniversity.com

129

Guaranteed Replacement Cost

Section 10102 of CIC

• e) No policy of residential property insurance may be initially issued on and after January 1, 1993, as guaranteed replacement cost coverage if it contains any maximum limitation of coverage based on any set dollar limits, percentage amounts, construction cost limits, indexing, or any other preset maximum limitation for covered damage to the insured dwelling. The limitations referred to in this section are solely applicable to dwelling structure coverages. Endorsements covering additional risks to the insurer's dwelling structure coverage may have internal limits as long as those endorsements are not called guaranteed replacement cost coverage.

Insurance Community University www.InsuranceCommunityUniversity.com

130

Polling Question #9

Insurance Community University www.InsuranceCommunityUniversity.com

131

Extended and Guaranteed

• Misuse of Extended Replacement Cost

AND Guaranteed Replacement Cost does

NOT remove the obligation to insure to value and it is inappropriate and harmful to an insured to underinsure their property and rely on either of these endorsements as remedies.

Insurance Community University www.InsuranceCommunityUniversity.com

132

Extended Replacement Cost

• Most homeowner policies today provide coverage for the dwelling at an increased percentage of the specified amount on the policy.

• This provision has in the past been misused in setting value

Insurance Community University www.InsuranceCommunityUniversity.com

133

Extended Replacement Cost

• Commonly at 125% of the specified amount.

• Requires the home to be insured to 100% of the insurance company’s replacement value.

• Must report any remodeling or additions that increase the reconstruction cost above $5,000 or 5%, whichever is less.

• What does it really mean anyway?????

Insurance Community University www.InsuranceCommunityUniversity.com

134

Catastrophe Coverages and Types of

Replacement Cost

• Following a Catastrophe loss there will be increased costs of construction due to such issues as: construction labor, building supplies, fuel, transportation issues and permit restriction.

• All of these can contribute to demand surge and the cost of rebuilding

• Replacement Cost estimators do not take into account these increased costs

• This is the purpose of the Extended

Replacement Cost Endorsement

Insurance Community University www.InsuranceCommunityUniversity.com

135

Inflation Guard

• An Inflation Guard is usually a built in feature on a Homeowners and Commercial Property

Form.

• The Inflation Guard may appear as a percentage on the Declarations Page

• The intent of the Inflation Guard is to provide coverage during the policy period to increase by a percentage for inflation of building costs.

Insurance Community University www.InsuranceCommunityUniversity.com

136

Inflation Guard HO 04 46

• For an additional premium, the limits of liability for Coverages A, B, C and D will be increased annually by %*, applied pro rata during the policy period.

• *Entries may be left blank if shown elsewhere in this policy for this coverage.

Insurance Community University www.InsuranceCommunityUniversity.com

137

Building Ordinance

Insurance Community University www.InsuranceCommunityUniversity.com

Polling Question #10

Insurance Community University www.InsuranceCommunityUniversity.com

139

Regulate Everything About “How” A

Building Is To Be Constructed

• Plumbing

• Electrical

• Structural support

• Grading

• Sloping

• Roofing

• Parking Spaces

• Set Backs

• Flooring

• Insulation

• Landscaping

• Signs - placement, size and type

• Materials used vs.

Occupancy

• ADA

• Miscellaneous

Insurance Community University www.InsuranceCommunityUniversity.com

140

Sprinkler Code

• California State Fire Marshal Information

Bulletin

• http://osfm.fire.c.gov

• http://osfm.fire.ca.gov/pdf/firemarshal/ taskforcefinalrepord.pdf

• Section R313 and R313.3

Insurance Community University www.InsuranceCommunityUniversity.com

141

Building Code Upgrades

• Building Code upgrades deal with the size and construction of the entire structures and separately for the square footage of the living space. Valuation must be done to determine the amount necessary under the Building Ordinance Endorsements

• This is not only important for older homes but is part of insurance company’s eligibility.

Insurance Community University www.InsuranceCommunityUniversity.com

142

Building Code Upgrades

• If a home is over a certain age then it must have required upgrades which would include such items as electrical, plumbing, and roofing.

The company is specifically asking these questions to mitigate the fire exposure and exposure to other types of losses.

Insurance Community University www.InsuranceCommunityUniversity.com

143

Building Code Upgrades

www.bsc.ca.gov

Building codes regulate how a building has to be reconstructed following a loss.

• Types of construction and costs attached thereto can vary based on many factors:

• Size of the building and at what point it must be sprinklered.

• Number of stories and nonstandard interior wall heights is a factor.

Insurance Community University www.InsuranceCommunityUniversity.com

144

Building Code Upgrades

www.bsc.ca.gov

• There is a point with damage, when the building must be ripped down and replaced in its entirety rather than simply repairing damage.

• There are always additional costs associated with building a custom home.

Insurance Community University www.InsuranceCommunityUniversity.com

145

Building Code Upgrades

www.bsc.ca.gov

• Geographic location in terms of set backs, brush hazard and proximity to other hazards

• Construction costs differ tremendously based on where the home is being built.

This differs state by state and city by city .

• Cost of demolition and debris removal are often written for a separate limit from the increased cost of construction.

Insurance Community University www.InsuranceCommunityUniversity.com

146

Homeowners Policy

• Section I – Exclusions

• We do not insure for loss caused directly or indirectly by any of the following. Such loss is excluded regardless of any other cause or event contributing concurrently or in any sequence to the loss.

• Ordinance or Law, meaning enforcement of any ordinance or law regulating the construction, repair, or demolition of a building or other structure, unless specifically provided under this policy.

Insurance Community University www.InsuranceCommunityUniversity.com

147

Building Ordinance Issues

• Tearing down undamaged dwelling

• Removing Debris

• Building the home as to updated building codes

Insurance Community University www.InsuranceCommunityUniversity.com

148

Ordinance or Law

• You may use up to 10% of the limit of liability that applies to Coverage A for the increased costs you incur due to the enforcement of any ordinance or law which requires or regulates

– This is new to the 2000 series.

– This can be increased with the HO 04

77 Ordinance or Law Increased

Amount of Coverage.

Insurance Community University www.InsuranceCommunityUniversity.com

149

CIC Section #10103

• (5) Whether the policy provides coverage for the increased costs of repairing or replacing damage to the insured dwelling caused by a covered loss because of building ordinances or laws regulating the repair. In the event that no coverage is provided for repairs that result from new building ordinances or laws, the insurer shall include in no less than 10-point typeface the following statement: "THIS POLICY DOES NOT

INCLUDE BUILDING CODE UPGRADE

COVERAGE."

Insurance Community University www.InsuranceCommunityUniversity.com

150

CIC Section #10103

• In the event that the policy does include code upgrade coverage, it shall either: (1)

State this on the declaration page, and denote any applicable limits. (2) State this on a separate disclosure form attached to the declarations page, if the separate disclosure form meets the following standards:

Insurance Community University www.InsuranceCommunityUniversity.com

151

Methodology of Determining Values

Insurance Community University www.InsuranceCommunityUniversity.com

152

Proprietary Valuation Tools

• Valuation tools provide a mere indicator of minimum values. Agent/Brokers should pay particular attention to individual home components and values

• Insurance Company Evaluations On Line

• Marshall Swift

• www.marshallswift.com

• Data Quick

• www.dataquick.com

Insurance Community University www.InsuranceCommunityUniversity.com

153

Proprietary Valuation Tools

• Zillow

• Real Quest

• Netroline

• Google Maps

Insurance Community University www.InsuranceCommunityUniversity.com

154

Why Values Are So Important

• Accurate values avoid

– Over insuring

– Under insuring

– Ultimately used to establish a fair premium for the property at risk

Insurance Community University www.InsuranceCommunityUniversity.com

155

Responsibility

• Whose responsibility is it to establish property values for the personal lines client.

– The responsibility is the property owner’s not the insurance agent or insurance company

– IF the insurance client asks to be “fully” insured then a heightened responsibility exists.

– The insurance agent has guidelines such as estimators but these are only minimum limits that should be carried

Insurance Community University www.InsuranceCommunityUniversity.com

156

How Are Values Established??

• Purchase Price of the home

– Insureds often want to insure for what they purchased the property for

• Bank’s requirements

– Banks often want the insurance to equal the amount of the loan

Insurance Community University www.InsuranceCommunityUniversity.com

157

Methodology of Determining

Value

• Prior Policies

– New buyers may assume the coverage of the prior homeowner

• Property Owner

– Property owners typically only know what they paid for the property or the comps

– The property owner typically does not understand how the policy will pay in the event of a loss.

Insurance Community University www.InsuranceCommunityUniversity.com

158

Methodology of Determining Value

• Real Estate Appraisals

– Real estate appraisals are sometimes done by insurance agents utilizing independent companies. These appraisals, while they cost money, are a very good indicator of value

• Insurance Company’s Valuation Software

– Almost all insurance carriers provide estimators through their portal

Insurance Community University www.InsuranceCommunityUniversity.com

159

Methodology of Determining Value

• Contractor’s and Expert’s estimates or opinions

– The same comment applies here as with independent appraisals

• Cost per square footage Estimates

– This is a beginning mark for determining value

Insurance Community University www.InsuranceCommunityUniversity.com

160

Polling Question #11

Insurance Community University www.InsuranceCommunityUniversity.com

161

Documentation of Person Making

Estimate

• There are specific requirements in the DOI

Regulations relating to the requirements of an individual who is making an estimate on Residential Properties.

• All of this documentation must be in a retrievable format

• The website should be consulted

• The regulations provide as follows

Insurance Community University www.InsuranceCommunityUniversity.com

162

Documentation of Person Making

Estimate (2695.182)

a) In the event an estimate of replacement cost is provided or communicated by a licensee to an applicant or insured in connection with an application for or renewal of a homeowners' insurance policy that provides coverage on a replacement cost basis, the licensee shall document and maintain in the applicant's or insured's file the following information:

Insurance Community University www.InsuranceCommunityUniversity.com

163

Documentation of Person Making

Estimate (2695.182)

1. Status of person preparing estimate

2. Name, job title, address, telephone number, license number of person preparing estimate

3. Source of estimate

4. Copy of any reports, inspection reports, contractor’s estimates

Insurance Community University www.InsuranceCommunityUniversity.com

164

Documentation of Person Making

Estimate

(b) In the event the estimate of replacement cost is provided by a licensee to an applicant or insured in connection with an application for or renewal of a homeowners' insurance policy that provides coverage on a replacement cost basis, the licensee shall maintain in the insured's file the records specified in subdivision

Insurance Community University www.InsuranceCommunityUniversity.com

165

Documentation of Person Making

Estimate

(g)(1) If a licensee communicates an estimate of replacement cost to an applicant or insured in connection with an application for or renewal of a homeowners' insurance policy that provides coverage on a replacement cost basis, the licensee must provide a copy of the estimate of replacement cost to the applicant or insured at the time the estimate is communicated.

Insurance Community University www.InsuranceCommunityUniversity.com

166

Section 2695.183. Standards for

Estimates of Replacement Value

• However, in the event the estimate of replacement cost is communicated by a licensee to an applicant to whom the licensee determines an insurance policy shall not be issued, then the licensee is not required pursuant to the preceding sentence to provide a copy of the estimate of replacement cost.

Insurance Community University www.InsuranceCommunityUniversity.com

167

Section 2695.183. Standards for

Estimates of Replacement Value

• In the event the estimate of replacement cost is communicated by telephone to an insured, the copy of the estimate shall be mailed to the insured no later than three business days after the time of the telephone conversation. In the event the estimate of replacement cost is communicated by telephone to an applicant, the copy of the estimate shall be mailed to the applicant no later than three business days after the applicant agrees to purchase the coverage.

Insurance Community University www.InsuranceCommunityUniversity.com

168

Documentation of Person Making

Estimate

(c) Notwithstanding any other provision of this Section 2695.182, this section shall impose no duty upon a broker-agent to obtain from the insurer and maintain any information or document that in the absence of this section would not come into the possession of the broker-agent in the ordinary course of business.

Insurance Community University www.InsuranceCommunityUniversity.com

169

Section 2695.183 Standards to be used when a licensee estimates Replacement

Cost

• This section of the regulations is also found at: http://www20.insurance.ca.gov/epubacc/REG/1

51771.htm

• The regulations deal with the requirements and standards of communication of what must be included in the estimation submitted to the insured

• Follows is the regulation language

Insurance Community University www.InsuranceCommunityUniversity.com

170

Section 2695.183 Standards to be used when a licensee estimates Replacement Cost

• No licensee shall communicate an estimate of replacement cost to an applicant or insured in connection with an application for or renewal of a homeowners' insurance policy that provides coverage on a replacement cost basis, unless the requirements and standards set forth in subdivisions (a) through (e) below are met:

(a) The estimate of replacement cost shall include the expenses that would reasonably be incurred to rebuild the insured structure(s) in its entirety, including at least the following:

Insurance Community University www.InsuranceCommunityUniversity.com

171

Section 2695.183 Standards to be used when a licensee estimates Replacement Cost

• (1) Cost of labor, building materials and supplies;

(2) Overhead and profit;

(3) Cost of demolition and debris removal;

(4) Cost of permits and architect's plans; and

(5) Consideration of components and features of the insured structure, including at least the following:

Insurance Community University www.InsuranceCommunityUniversity.com

172

Section 2695.183 Standards to be used when a licensee estimates Replacement Cost

(b) The estimate of replacement cost shall be based on an estimate of the cost to rebuild or replace the structure taking into account the cost to reconstruct the single property being evaluated, as compared to the cost to build multiple, or tract, dwellings.

(c) The estimate of replacement cost shall not be based upon the resale value of the land, or upon the amount or outstanding balance of any loan.

(d) The estimate of replacement cost shall not include a deduction for physical depreciation.

Insurance Community University www.InsuranceCommunityUniversity.com

173

Section 2695.183 Standards to be used when a licensee estimates Replacement Cost

• (e) The licensee shall no less frequently than annually take reasonable steps to verify that the sources and methods used to generate the estimate of replacement cost are kept current to reflect changes in the costs of reconstruction and rebuilding, including changes in labor, building materials, and supplies, based upon the geographic location of the insured structure. The estimate of replacement cost shall be created using such reasonably current sources and methods.

Insurance Community University www.InsuranceCommunityUniversity.com

174

Summary of Retention

• Prospects, applicants and renewals

– Name, position, license number , address, telephone number

– Source of estimate and additional reports

– Copy to customer immediately

• If by phone – within three days

• If prospect, but not customer – no need to send copy

• Five years retention

Insurance Community University www.InsuranceCommunityUniversity.com

175

Upcoming Classes

Upcoming

University/Paid CE

Classes

12/10

12/17

12/19 & 20 th

2014 1/9

FREE to University Members

$50.00/charge for non university members

Crop

Equine

Insight on Errors and Omissions

Best Practices of Customer Service

THE 2014 CLASS SCHEDULE IS NOW PUBLISHED

Sign Up Early!!!

Join the University TODAY. www.insurancecommunitycenter.com

Click Join University at the top of the bar

Insurance Community University www.InsuranceCommunityUniversity.com

176