Optimizing Scrip Systems:

advertisement

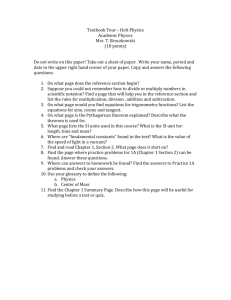

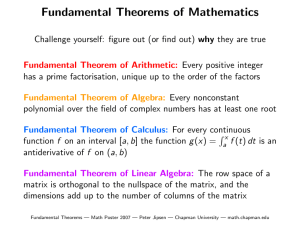

Optimizing Scrip Systems: Efficiency, Crashes, Hoarders, and Altruists By Ian A. Kash, Eric J. Friedman, Joseph Y. Halpern Presentation by Avner May 12/10/08 Overview 1) 2) 3) 4) 5) 6) 7) Introduction Review of Earlier Model Basic Results about Equilibrium in System Examining Distribution of Money in System Optimizing System Performance Through Money Supply Effects of Altruists and Hoarders on System Conclusion Intro: Brief History NGO’s issue their own currency Examples These are known as “scrip” In company towns where government currency was scarce To prevent robbery in DC buses Online Systems: Everquest, Second Life Creates market for exchange of goods/services that would be impractical or undesirable with real currency Introduction Motivating Example: Capital Hill Baby Sitting Coop Effects of too much or too little money on effectiveness of system Optimal Money Supply? Note: fixed price Homogeneous vs. Heterogeneous Population Altruists and Hoarders Gnutella: 1% users satisfy 50% of requests Effect on System? Model Very similar to previous model Agent Types: Tuple: t = (αt, βt, γt, δt, ρt) in T (finite set) αt: Cost of satisfying request βt: Probability that agent can satisfy request γt: Utility an agent gains for having a request satisfied δt: Rate at which agent discounts utility ρt: Represents an agent’s relative request rate Agent population entirely determined by (T,f,n) T: finite set of types f: vector of ft, fraction of agents of type t n: # of agents Model (cont.) Infinite number of rounds Each round: An agent is picked to request service (prob. proportional to ρt) If chosen agent has money, every other agent is able to satisfy request with certain probability (βt: independent of round). Else round ends If at least one agent is willing and able to satisfy request, transaction occurs Requester (type t) gets γt utils, pays $1 (normalized scrip cost) Volunteer (type t’) pays cost of αt’ utils, receives $ n rounds per unit time (time b/w rounds is 1/n) Model (cont.) Payoff Heterogeneity The results in this paper only explicitly apply to “payoff heterogeneous” populations Population of types T that differ only in α, γ, δ (utility variables) Don’t differ in probability of being able to satisfy request (β), or in frequency of requests (ρ) Authors don’t believe it would fundamentally change results to extend it to an arbitrary heterogeneous population Recap: This paper extends the results from previous paper to payoff heterogeneous populations Discussion: Model Any thoughts? Are the assumptions too strong? Payoff-Heterogeneity Assumption? Agent types remain constant over time? Choice of volunteer is independent over time? Threshold Strategies? Theoretical Results Many of the results in this paper are direct analogs of the theorems we saw in the previous paper Theorem 3.1 General idea: Given a payoff-heterogeneous system, it will approach the max-entropy monetary distribution More specifically, if there are enough agents in the system, after sufficient time, it will be arbitrarily close to the max-entropy distributions with arbitrarily high probability Note: This is assuming a given distribution of strategies, and the final monetary distribution maximizes entropy subject to the constraints of the strategy distribution Theoretical Results (cont) Theorem 3.2 Given a payoff-heterogeneous system, if each agent of type t plays a threshold strategy, then every agent has a best-response which is a threshold strategy Lemma 3.2 The best-response function for agents of type t is nondecreasing Note: input to best-response function is vector k of threshold values for agents of each type Intuition: If all agents increase their threshold value, an agent will earn money less often while wanting to spend money at least as often. Thus, they will increase their threshold value. Theoretical Results (cont) Theorem 3.3 Given a payoff-heterogeneous system, their exists a non-trivial Nash equilibrium where all agents of type t play the same threshold strategy Sk. Sketch of proof By Lemma 3.2, for each type, BRt(k) is non-decreasing (k is vector) Thus, BR(k) is non-decreasing function So, Tarski’s fixed point theorem guarantees the existence of a greatest and least fixed point Least fixed point: trivial equilibrium (all types play S0) Greatest fixed point: Non-trivial equilibrium Tarski’s Fixed Point Theorem Given any monotone increasing function on a complete lattice L (f: LL) , their exist a greatest and a least fixed point. Theoretical Results (cont) What is a fixed point? Vector k s.t. BR(k) = k This means that given k, the best-response strategy profile is precisely k Thus, this is an equilibrium Computing the fixed point efficiently Best-reply dynamics Begin with strategy profile (∞, ∞, …, ∞) Iteratively compute best-reply strategy profile BR(BR(….(BR((∞, ∞, …, ∞)) This process converges to greatest fixed point Note: The greatest fixed point might not be the one which maximizes social welfare Theoretical Results (cont) EXAMPLE Using Best-Reply Dynamics Identifying User Strategies In section 3 of paper, used max-entropy to get explicit formula for monetary distribution given strategies of agents (fraction of agents playing each strategy) πM Now, we would like to try to determine the strategies of the agents given a certain monetary distribution πM Identifying User Strategies (cont) Given a monetary distribution M, an “explanation” of M to be a distribution π over strategies such that the maximum entropy distribution which results from π is M. (i.e., π “explains” M if π M) Lemma 4.1 If M is a fully supported distribution of money with finite support, then there exist an infinite number of explanations of M The paper explains an algorithm for finding the “minimal explanation,” that in which fewest # of strategies are played. From minimal explanation, can further make inferences about fraction of population of each type, and strategy they are playing Discussion At this point, the authors motivate why the minimal explanation is useful They think that there will be clusters of agents of similar types, and within a cluster agents will play similar strategies. Does this make sense? What if small differences in type make large differences in strategy? Can people be expected to compute their best response functions accurately? What if there are not clusters, but rather a uniform distribution of agents of different types? Optimizing the Money Supply In sections 3 & 4, we assumed money supply was fixed, and considered how money is distributed among agents of different types We will now examine what happens to the distribution of money when the money supply is altered We want to determine the money supply which will optimize the performance of the system (maximize social welfare) Optimizing the Money Supply Result: Increasing the amount of money improves performance up to the point where the system crashes. Thus, optimizing the system is simply a matter of finding the point at which the system would experience monetary crash Optimizing Money Supply But how do we find this optimal point? Observation: We would like to find money supply which minimizes fraction M0 of people without any money Why? Expected utility gain in each round (1-M0)(γt-αt) * PROB(at least one agent volunteers) Expected total utility (assuming homogeneous populations) (1-M0)(γt-αt)/(1-δt) Analysis is very similar for heterogeneous population Optimizing Money Supply Theorem 5.1 Increasing average money decreases fraction of people with no money (assuming there is no monetary crash) Thus, as long as non-trivial equilibria exist, the more money the better Corollary 5.1 There exists a finite threshold m*, such that: If average money/person < m*, then non-trivial equilibria exist If average money/person > m*, then system crashes (no nontrivial equilibrium exists) Optimizing Money Supply But how do we find m*??? Given that you know T and f, you can use techniques from section 3 (best-reply dynamics) to see if non-trivial equilibria exists Binary search: Given T,f. Vary m But how do we know T,f? m: average money/person You can use results from section 4 to solve for T,f. Reasonable? Altruists and Hoarders Altruists: Provide services at no cost Hoarders: Always volunteer to satisfy requests, but never make requests Presumably gain some utility by satisfying a request Can be modeled as playing S∞ Intuition Having altruists is like increasing money supply Having hoarders is like decreasing money supply Altruists and Hoarders Theorem 6.1 Increasing fraction of agents which are altruists increases social welfare up to the point where the system crashes Theorem 6.2 Increasing fraction of agents which are hoarders decreases social welfare System designer can see actions of these agents and modify money supply accordingly to prevent sub-optimal outcomes Additional property: Hoarders stabilize system by helping to prevent monetary crash Theoretically, they are always willing to work for $1, regardless of how depreciated the dollar is Discussion Floating prices? Auctions with scrips? Other types of irrational behavior? Would these theoretical results hold-up well in real-world scrip systems? What next? Any other thoughts