Les industries automobiles et électriques/électronique apparaissent

advertisement

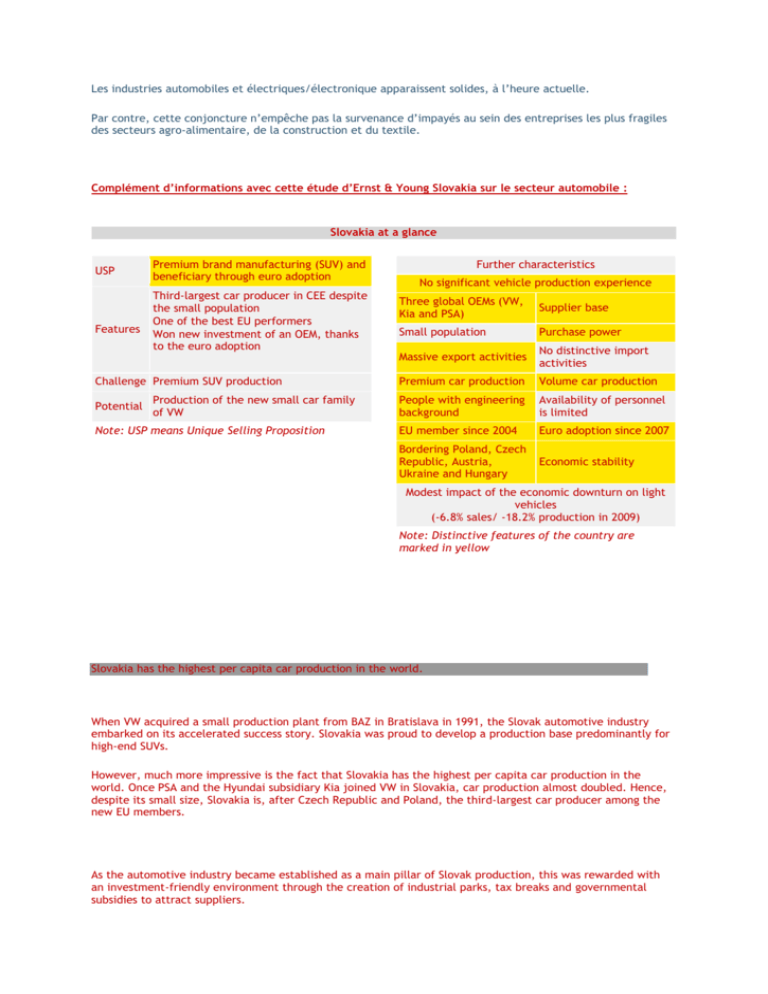

Les industries automobiles et électriques/électronique apparaissent solides, à l’heure actuelle. Par contre, cette conjoncture n’empêche pas la survenance d’impayés au sein des entreprises les plus fragiles des secteurs agro-alimentaire, de la construction et du textile. Complément d’informations avec cette étude d’Ernst & Young Slovakia sur le secteur automobile : Slovakia at a glance Premium brand manufacturing (SUV) and beneficiary through euro adoption USP Features Third-largest car producer in CEE despite the small population One of the best EU performers Won new investment of an OEM, thanks to the euro adoption Challenge Premium SUV production Potential Production of the new small car family of VW Note: USP means Unique Selling Proposition Further characteristics No significant vehicle production experience Three global OEMs (VW, Kia and PSA) Supplier base Small population Purchase power Massive export activities No distinctive import activities Premium car production Volume car production People with engineering background Availability of personnel is limited EU member since 2004 Euro adoption since 2007 Bordering Poland, Czech Republic, Austria, Ukraine and Hungary Economic stability Modest impact of the economic downturn on light vehicles (-6.8% sales/ -18.2% production in 2009) Note: Distinctive features of the country are marked in yellow Slovakia has the highest per capita car production in the world. When VW acquired a small production plant from BAZ in Bratislava in 1991, the Slovak automotive industry embarked on its accelerated success story. Slovakia was proud to develop a production base predominantly for high-end SUVs. However, much more impressive is the fact that Slovakia has the highest per capita car production in the world. Once PSA and the Hyundai subsidiary Kia joined VW in Slovakia, car production almost doubled. Hence, despite its small size, Slovakia is, after Czech Republic and Poland, the third-largest car producer among the new EU members. As the automotive industry became established as a main pillar of Slovak production, this was rewarded with an investment-friendly environment through the creation of industrial parks, tax breaks and governmental subsidies to attract suppliers. Market demand Slovakia, with a population of 5.4 million, is one of the two smallest Central European new EU members but is one of the best performers. Following reforms, the economy and consumption have experienced prosperous growth in the past five years. However, Slovak car ownership is relatively low compared to the rest of Europe and, as in the other new EU countries, used car imports are a significant factor. Imports account for one out of every two car purchases, and the average vehicle age, while decreasing, is 13 years. Imports of vehicles more than 10 years old are not permitted, and a certificate of compliance with EU norms is a requirement. In 2008, new car sales reached a peak of 97,000, an increase of 16.4%, thanks to the strong development of the Slovak economy in recent years and the adoption of the euro. In 2009, new car sales dropped to 90,400. The Czech brand Škoda, long familiar to Slovakians, is the leader in terms of new car sales. Figure 35: Sales and production (in units) compared between 2008 and 2012 Figure 36: Light vehicle sales and production compared (in units), 2006–09 Automotive player Overall, 488,021 passenger cars were produced in Slovak plants in 2008, up from 178,000 in 2005, as a result of increasing establishment of foreign production capacities. Domestic light vehicle production declined by 19% in 2009. In 2011, VW will begin production of the new small family car “Up!” near Bratislava, perpetuating the current trend toward small and efficient cars. The production site builds the Škoda Octavia and the VW Touareg, Audi Q7 and Porsche Cayenne. Both Kia and PSA began their investments in Slovakia in 2006. Kia builds vehicles near Žilina, 200 kilometers from Bratislava. Its facility produces the compact SUV Sportage and the compact family car Cee’d. PSA has set up an assembly line in the western Slovak town of Trnava, where it builds the Peugeot 207, one of the most popular small cars in Europe, and the efficiency oriented compact van Citroen C3 Picasso. If required, Slovakia could increase car production to a maximum annual capacity of approximately 900,000 units. The circle of passenger car manufacturers may be enlarged as the Chinese Jianghuai Automobile Company is in negotiations with the Slovakian Government about the establishment of a manufacturing facility there. In the downturn Before the slowdown, Slovakia was one of the most rapidly growing of all European economies. The country enjoyed prosperous economic development with a nominal GDP increase in 2008 of 36% on 2005 levels. Figure 37: Light vehicle sales by brand (in units), 2007 and 2009 Figure 38: Light vehicle production by brand (in units), 2007 and 2009 Like other European countries, Slovakia has had to deal with layoffs in the current crisis, but it has not, been as severely affected as some other markets. Nevertheless, GDP fell substantially in 2009. The Slovak automotive sector has been known for producing large gas-guzzling vehicles. But Slovakia’s adoption of the euro has led to new investment in the production of economy cars, starting with the VW “Up!” The gains in economy car production might offset the losses associated with the downturn in the premium SUV segment. Confronted with the slowdown, the Government reacted quickly by implementing different measures, as the automotive industry accounts for approximately 33% of GDP. Slovakia was one of the first Eastern European economies to follow the example of Germany and France in offering subsidies to citizens who wanted to trade in their old cars and buy new ones. Accordingly, sales of private cars grew, and Škoda retained its leading position. However, the subsidy did little to support the domestic, largely high-end, production. On the production side, the Government guaranteed the possibility of short-time work and was prepared to subsidize every workplace until 2010. An overview of investment activities reveals that no plans have been canceled to date, because investors still regard Slovakia as a favorable location. But some implementation dates have been postponed, given the current economic situation. Nevertheless, PSA has even increased its output of the Citroen C3 Picasso in Trnava due to strong demand. And Kia Motors has expanded capacity in its engine production plant in order to supply its affiliate, Hyundai, which has a plant in the neighboring Czech Republic. Further investment initiatives were also announced by, Getrag and Continental, at the end of 2008. Risks and opportunities Risks Activity in the sector is largely concentrated in the Bratislava and Trnava areas; hiring and retaining skilled labor is becoming increasingly challenging in this region VW’s entry into the Bratislava region was followed by that of a number of suppliers, which boosted the capital’s regional economy. VW employs about 10,000 people at this facility. High demand for workers to staff the manufacturing operations at the plant and the supplier parks has created a daily workforce migration from up to 100 kilometers away. The operations of PSA in Trnava (50 kilometers north of Bratislava) and Kia in Zilina (200 kilometers northeast of Bratislava) are likely to exert further pressure on labor availability, resulting in higher wages and more difficult conditions for smaller component manufacturers establishing new operations. Opportunities Favorable environment for automotive manufacturing and investment The Slovak Government has been proactive in its dealings with large investors such as VW, PSA and Kia, offering tailored infrastructure solutions and attractive incentives. This approach, linked with persuasive reforms such as a flat tax and a user-friendly corporate tax system, has helped to secure these prestigious projects. The country’s economy demonstrates a clear focus on developing industrial manufacturing activities. The country’s dependence on the manufacturing sector, and the automotive industry in particular, affords a reasonable basis for assuming that operations in Slovakia will enjoy a favorable environment for many years to come. But the Government may start to promote service- and R&D-oriented projects in the future in order to reduce dependence on manufacturing. Economic stability Slovakia adopted the euro in January 2009, after meeting the economic criteria. This will bring stability to the high-grade export activities and preclude losses triggered by currency fluctuations. The euro adoption was one of the main reasons that VW chose Slovakia as a production site for its new “Up!” family model. Slovakia’s debt ratio is below the EU average, which makes its financial system quite robust in comparison with other EU members in Eastern Europe SOURCE: ERNST&YOUNG SLOVAKIA