Marginal Income Tax Revenue

advertisement

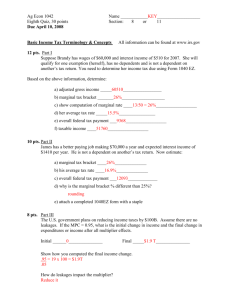

2012 Federal Budget The U.S. Treasury Adam Dorwart Denny Routson DeJaneau Garay Zakaria Ezzeddine As the federal deficit continues to grow with our budget, the Treasury Department feels it is necessary to reflect on a few of our current tax policy’s, and take more careful examination of them. It's always important for us to constantly critique our tax law and keep their definitions and content relevant. This becomes even more imperative when we observe our economy’s requirement for growth. Certain tax codes rely heavily on brackets that are dependent of the economic conditions of that bill's time. As our economy takes a drastic shift from when some of these bills were written it becomes pressing to update these tax laws to better reflect our current economic condition. The taxes that would be most apparent to critique over time would be ones with revenue based on static bracket values or defined limits. This would include the Marginal income tax, Capital Gains tax, and Corporate Income Tax. The Corporate Income Tax also requires special attention as its system of deductions, credits, and write offs has completely hindered its ability to collect revenue. The Estate tax is also another careful consideration given its defined line of what is and isn't taxed. A less apparent tax to keep updated would be ones dependent on technological progress such as the Gas Guzzler tax and its dependency on increasing average gas mileage of new vehicles. It may even make sense to look at alternate sources of income to see if they appear to be a good substitution for existing taxes. One tax that has been proposed countless times has been a National Sales tax, which would replace the current Marginal Income tax system. We have been called upon to seek up to $200 billion in additional revenue added to the budget, a large feat in itself. This will possibly include drastic changes in how we consider taxes in an attempt to increase revenue, improve and maintain economic stability, and create a fair and balanced system that takes into consideration current conditions. In addition to these necessary changes, we feel that in our current economic predicament it becomes more apparent of possible issues to address. One that we feel is of great importance to American tax payers is equal and fair taxation of the different economic classes. As we listen to more and more Americans asking to end the Bush era tax cuts for the rich we feel it becomes necessary to perform our duties as delegates of the people and begin reorganizing our tax law. Introduction, Background, & Problem Statement Over the last decade our tax laws have become outdated and it is becoming more and more apparent that the economic conditions of when they were created are not a good representation of now. As time goes by our economy continues to reshape itself every year while our tax laws remain static. As we face one of the worst economic downturns since the Great Depression, more and more citizens are looking towards the government for help. It is our duty to take careful examination of our system and come up with beneficial changes for society. One issue that American tax payers are growing upset with, are the Bush era tax cuts for the rich. These tax cuts were originally designed with ‘trickledown’ economics in mind. Trickledown economics is the idea that in giving the rich more money to spend they will create more jobs and in turn economic prosperity will ensue. After 8 years and very little increase in the job market, it is becoming more apparent that the theory of trickledown economics is not as prevalent as we might have thought. Although we are facing one of the worst recessions of our time, we continue to keep taxes low for the wealthy. In times of great hardship for the masses we feel it is the duty of every American to contribute their fair share to helping solve the problem. Policy Options In order to accomplish our goal of $200 Billion added to the budget, we the Treasury Department present six policy options for consideration. These include the Marginal Income Tax, Capital Gains Tax, Corporate Income Tax, Estate tax, National Sales Tax, and the Gas Guzzler Tax. The Marginal Income Tax is a tax revenue based off of one's income. The tax rate is determined by a bracket system based on how much income you make as a single filer. The income that each individual is taxed on is based on total gross income, minus allowed deductions. Each bracket has its own increasing tax rate and the amount of your income that is taxed is based on the amount of money allocated to that bracket. Currently, the Marginal Income tax system has 6 brackets with the top bracket around $373,000 at 35%. We propose to introduce an additional bracket with an increasing income range and tax rate along with modifying some of the existing bracket tax rates. The proposed changes include modifying the 3rd bracket from $34,000-$82,400, to $34,000-$99,999. The 4th bracket tax rate to 30% and the bracket amounts from $82,401-$171,850, to $100,000-$199,999. The 5th bracket to 35% and the bracket amounts from $171,851-$373,650, to $200,000-$499,999. The 6th bracket will be changed to 40%. Additionally the 6th bracket range shall be changed from $373,651+ to $500,000-$999,999. The new 7th bracket shall have a tax range of $500,000-$999,999 and be taxed at a rate of 45%. These changes allow us to tax a recently untouched level of wealth and will increase revenue by grand amounts. As individuals report larger and larger personal incomes, these new tax brackets become necessary to tax wealth proportionately. Existing Marginal Income Tax Proposed Marginal Income Tax Tax rate Bracket Tax rate Bracket 10% 0 - $8,375 10% 0 - $8,375 15% $8376 - $34,000 15% $8376 - $34,000 25% $34,001 - $82,400 25% $34,001 - $99,999 28% $82,401 - $171,850 30% $100,000- $199,999 33% $171,851 - $373,650 35% $200,000 - $499,999 35% $373651+ 40% $500,000 - $999,999 - - 45% $1,000,000+ The Capital gains tax is the tax on revenue made from investments. The current system taxes short term investments, or investments that are made and withdrawn within 1 year, at the same rates as personal income that is defined in the marginal income tax. Long term investments that are held for over a year are taxed at a lower rate of 10% per bracket. We propose to change the classification of investment income to be reconsidered as normal income handled by the marginal income tax, as proposed by the Obama administration. We believe it is unfair to favor some forms of income over others. These changes will make more revenue off of large profits from both short and long term investments and create a more fair tax system for all. Existing Capital Gains Tax Proposed Capital Gains Tax Short Term Long Term Bracket Tax Bracket Tax rate Tax Rate 10% 0% 0 - $8,375 10% 0 - $8,375 15% 0% $8376 - $34,000 15% $8376 - $34,000 25% 15% $34,001 - $82,400 25% $34,001 - $99,999 28% 15% $82,401 - $171,850 30% $100,000- $199,999 33% 15% $171,851 - $373,650 35% $200,000 - $499,999 rate 35% 15% $373651+ 40% $500,000 - $999,999 - - - 45% $1,000,000+ The Corporate income tax is the tax on profit made by a corporation. Current implementation taxes profit based on a bracket system starting at 15% for 50,000 of taxable income and caps off at $18,333,333 at 35%. While the statutory rate of our tax code is 35%, among one of the highest rates in the world, the average rate paid is one of the lowest. This is because of the numerous tax deductions that are available to corporations. Over time tax law for corporate income has become so convoluted and full of loopholes that our estimated revenue from corporations has consistently decreased over time. We propose to fix these loopholes through modifying the deductions, credits, and write offs available to corporations. Our first main concern is addressing the tax codes bias towards debt based financing. Current corporate tax code encourages corporations to finance their investments with debt rather than equity. This creates risks for the financial institution along with the broader economy, as can be seen by the recent economic crisis. We propose to make debt financing and equity financing on equal level with each other as to not promote riskier decisions. Additionally, current tax law defines a much lower tax rate for oversea investments compared to domestic investments. This creates an incentive for corporations to shift economic activity overseas and opens up a means of escaping taxation by shuffling profits and favoring oversea investments. It is our recommendation that the tax paid on profit is based on global profit and not separated between domestic and overseas profit. Finally, special preferences have created an unequal economic playing field. As opposed to a free economy where corporations determine investments based on true economic value, special preferences in tax code force corporations to also take into consideration their tax value and create an unequal playing field for those that choose to pay attention to the other areas of the economy. These 3 major changes to corporate income tax policy will allow us raise revenue significantly to what the tax intended for the rates to be. Also at the request of various budget committee members to look into helping small businesses in the short term we have decided to propose one more policy change. We feel more emphasis on small businesses is the answer to our recent economic downturn. We propose for the FY2013 that corporate income taxes for the first bracket up to $50,000 shall not be taxed for new business so it may be used to help new business creation and promote competition within the economy. The Estate tax is the tax on the transfer of capital of a deceased person by means of a will. Currently, the system sets a cut off at $5,000,000 for when inheritance is taxed. All fortunes over this value shall be taxed at a rate of 35%. We propose to create a marginal bracket system to further keep tax law consistent and tax larger proportionally to their size. The 1rst bracket shall be set at the rate of 0% for fortunes from 0-$1,000,000. The 2nd bracket shall be set at the rate of 25% for fortunes from $1,000,000-$5,000,000. The 3rd bracket shall be set at the rate of 35% for fortunes from $5,000,000-$10,000,000. The 4th bracket shall be set at the rate of 45% for fortunes from $10,000,000-$20,000,000. The 5th and final bracket shall be set at the rate of 49% for fortunes $20,000,000+. This further allows us to increase revenue and create a more fair tax system on large fortunes. Existing Estate Tax Proposed Estate Tax Tax rate Bracket Tax rate Bracket 35% $5,000,000+ 30% $5,000,000 - $9,999,999 - - 35% $10,000,000 - $19,999,999 - - 40% $20,000,000+ The National Sales tax will be a new tax introduced on the sale of all goods. The most long running proposition for National Sales Tax is the Fair Tax bill that was introduced in 1999. This bill has been on and off the floor of Congress ever since and has seen many changes over time. Currently the best proposed tax rate to match current revenue made from income taxes is 23%. Family households would also be eligible to receive a Family consumption allowance based on the family’s size. This is a tax rebate rebate that’s paid in monthly installments and is adjusted for inflation. The Gas Guzzler Tax was created in 1978 to persuade people to buy more environmentally friendly cars. The tax only applies to cars that have a lower than 22.5 combined mpg. This tax does not affect the Sport Utility Vehicles or trucks. The Gas Guzzler Tax modification will increase some of the numbers in the formula from the current gas guzzler tax. The current formula is F1= 1/((.495/Fc)+(.351/Fh)) + .15. We propose to increase revenue by changing the .495 to .450 and changing .351 to .325, which will increase the percentage of the car's price that they additionally pay. Criteria In order to carefully examine and critique our proposed changes to tax law, we must come up with key criteria to analyze and grade them upon. For the goals that we feel are important to achieve Revenue and Economic stability are the criteria that we will judge our policies on. Revenue is the government's income from which public expenses are met. Revenue is made through various means but mostly by taxes. Without enough revenue to pay for government programs and expenses we leave debt for future generations that has devastating long term effects on our economy which puts us at risk of defaulting on our loans and ruining our credit rating later down the line. With the national debt growing everyday constant revenue will be necessary with future plans to try and start paying off that debt. The most accurate way to measure our nations revenue is by using data about citizen income distribution to best determine which taxes will affect what people and how much will be made from those taxes. We will grade each of our policy options revenue effect by determining how much their current implementations make (Not necessary if it's a new policy) and then determining how much our proposed changes will make and then presenting the difference between the values to see how much additional revenue can be made by enacting that policy change. The revenue gained will be graded on a percentage scale from 0-100. The score received will be decided by the amount of revenue earned/200,000,000,000. The number $200 billion was chosen because we need to save $200 billion and this will tell us the percentage of the goal that is completed by each policy. For example, if a policy earns $48 billion, it will be scored as $48,000,000,000/$200,000,000,000. This would come out to about 24% which tells us that 24% of the goal is completed using this policy option. Economic stability is an important aspect of any economy and ensures long term health of all citizens. Stability in terms of economics is the lessening of extreme fluctuations in the economy, usually through market control. Stability can be measured by comparing GDP, to the rate of inflation. Currently, the health of our economy can be viewed as unstable due to the recent recession and large disparity between economic classes of wealthy and middle classes. As the distribution of wealth continues to become more and more uneven it becomes necessary to introduce legislation to re-balance the economy. In the analysis of our policy we shall grade their economic stability as a value in reference to the current systems stability. This value will be calculated by measuring a policy’s effect on inflation along with its share of GDP. Its final score can be represented by the following formula. Grade = Revenue/(GDP*Rate of Inflation) The inflation can be measured by the amount of money created annually, 1,700,000,000,000, divided by the total money in circulation, 188,000,000,000,000. This would give you an inflation percentage of 0.9% annually. When the U.S. needs more money they can sell bonds from the Treasury to create money, but if they have money from increased revenue they do not need to create this money, which will keep inflation low. Additionally, the revenue that the government does have can be considered guaranteed contributions to national GDP as the government will use that money to pay for programs or other transaction within the economy. Application of Criteria to Policy Options Marginal Income Tax Revenue The marginal income tax was originally separated into 6 brackets ranging from $0373,651+. We have adjusted the current brackets and also created a new bracket. The first bracket, $0-8,750, on the both systems remained the same and raised $9,674,831,900.00 in revenue. The second bracket, $8,751-34,000, on both systems also remained the same, raised $247,476,152,850.00 in revenue. The third bracket on the old system raised $572,700,789,250.00, the new system raised $683,747,843,750.00, which is a $111,047,054,500.00 increase. The fourth bracket made $423,426,200,320.00 in the old system and $316,212,990,700.00 in the new system, which is a $107,213,209,620.00 decrease. The fifth bracket raised $764,349,648,153.45 in the old system and $770,650,594,439.40 in the new system, which is an increase of $6,300,946,285.95. The sixth bracket raised $2,135,985,111,014.70 in the old system and $1,008,870,803,087.36 in the new system, which is a $1,127,114,307,927.34 decrease. This decrease was expected because the income from the sixth bracket in the old system, was moved to the seventh bracket in the new system. The seventh bracket was the created bracket, which made a revenue of $1,293,869,236,144.00. The total revenue earned by the old system was $4,153,612,733,488.15. The new system raised a total of $4,330,502,452,870.76. This means that the marginal income tax increase raised $176,889,719,382.61 of revenue. When we apply the grading system to the marginal income tax increase we get an equation of $176,889,719,382.61/$200,000,000,000 which equals 88.4% of the goal of raising $200 billion. Existing Marginal Income Revenue Bracket Population Mean Income Total Income Revenue 0 - $8,375 60,902,000 $1,588.59 $96,748,319,000 $9,674,831,900 $8376 - $34,000 99,936,000 $19,300.64 $1,928,829,019 $247,476,152,850 $34,001 - $82,400 62,127,000 $52,147.91 $3,239,793,082,000 $572,700,789,250 $82,401 - $171,850 14,608,000 $125,988.08 $1,840,433,844,000 $423,426,200,320 $171,851 - $373,650 8,736,353 $312,934.70 $2,733,908,005,149 $764,349,648,153 $373651+ 6,379,538 $1,023,054.00 $6,526,611,869,052 $2,135,985,111,014 Totals 252,688,891 $4,153,612,733,488 Proposed Marginal Income Revenue Bracket Population Mean Income Total Income Revenue 0 - $8,375 60,902,000 $1,588.59 $96,748,319,000 $9,674,831,900 $8376 - $34,000 99,936,000 $19,300.64 $1,928,829,019,000 $247,476,152,850 $34,001 - $99,999 68,061,000 $55,459.41 $3,774,623,150,000 $683,747,843,750 $100,000 - $199,999 10,741,000 $127,528.36 $1,369,782,158,000 $316,212,990,700 $200,000 - $499,999 6,752,523 $379,847.00 $2,564,925,603,981 $770,650,594,439 $500,000 - $999,999 3,874,688 $722,983.30 $2,801,334,716,710 $1,008,870,803,087 $1,000,000+ 2,421,680 $1,401,343.00 $3,393,604,316,240 $1,293,869,236,144 Totals 252,688,891 $4,330,502,452,870 Brackets Net Change in Revenue 0 - $8,375 $0.00 $8376 - $34,000 $0.00 $34,001 - $99,999 $111,047,054,500.00 $100,000 - $199,999 -$107,213,209,620.00 $200,000 - $499,999 $6,300,946,285.95 $500,000 - $999,999 -$1,127,114,307,927.34 $1,000,000+ Total $1,293,869,236,144.00 $176,889,719,382.61 Economic Stability The effect on economic stability that our proposed marginal income tax system will have can be shown by firstly finding its effect on inflation and GDP. To do this we will need to look at revenue previously made from the old system and acknowledge that revenue made is currency that does not need to be created in the form of bonds and will not contribute to inflation. Furthermore that is money that can be guaranteed to be contributed to GDP as the government will include it in its fiscal yearly budget. So if the current system makes about $4,153,600,000,000 than that is the amount of money that does not need to be created. Old Inflation Rate= 1,700,000,000,000/188,000,000,000,000 = 0.9% New Inflation Rate= (1,700,000,000,000-176889719382.61)/188,000,000,000,000 = 0.81% Old Grade= $4,153,612,733,488.15/(14,200,000,000,000*.009) = 32.50 New Grade=$4,330,502,452,870.76/(14,200,000,000,000*.0081) = 37.65 Capital Gains Tax Revenue The capital gains tax was separated into 2 sub-divisions, short-term and long-term. We combined these two categories into one category and also adjusted some of the brackets. We decided to get rid of the old capital gains tax and just add it to the marginal income tax. So, if you made any money from any investments, you would add that into your annual income, instead of filing it separately. The first bracket on the old system raised $2,435,530,200 in shortterm investments and $0 in long-term investments. The new system raised $8,062,000,000 in revenue, which made for a $5,626,469,800 increase in that bracket. The second bracket in the old system raised $4,860,812,862.50 for the Short-term investments and again $0 for the long-term investments. The second bracket in the new system raised $172,537,112,300, which led to a $167,676,299,437.50 revenue increase, this was due to the long-term investments not being taxed. The third bracket raised $176,512,231,512 revenue from short-term and made $469,472,885,250 from long-term investments. In the new system it raised $576,830,275,000, which means it decreased the total revenue by $69,154,841,762.50. The fourth bracket raised by $149,395,056,237.50 from short-term and $281,309,608,800 from long-term investments. The new system generated $662,913,778,600 revenue, which created a $232,209,113,562.50 increase. The fifth bracket raised $172,378,242,050 in short-term investments and $165,640,347,900 from long-term investments. The new system raised $502,572,852,500 in revenue, which means a $164,554,262,550 total increase for that bracket. The sixth bracket on the old system raised $255,832,318,437.50 from short-term investments and $618,654,780,150 from long-term investments. The new system raised $230,959,749,800 in revenue, which made a $643,527,348,787.50 decrease in that bracket. The seventh bracket only exists in the new system and raised $192,715,937,850 in revenue, which is all increase. With all of the increases and decreases, it comes out to a total $50,099,892,650 increase. With the grading scale, this would receive $50,099,892,650/$200,000,000,000 which equals about 25% of the entire goal. Brackets 0 - $8,375 $8376 - $34,000 $34,001 - $82,400 $82,401 - $171,850 $171,851 - $373,650 $373651+ Brackets 0 - $8,375 Existing Capital Gains Tax Distribution Mean Income Long Term Revenue OLD $4,031.00 $0.00 13,958,000.00 $22,642.00 $0.00 56,512,000.00 $64,385.00 $469,472,885,250.00 48,611,000.00 $139,632.00 $281,309,608,800.00 13,431,000.00 $306,231.00 $165,640,347,900.00 3,606,000.00 $1,326,589.00 $618,654,780,150.00 3,109,000.00 Distribution Mean Income Short Term Revenue OLD $4,031.00 $2,435,530,200.00 6,042,000.00 $8376 - $34,000 $22,642.00 $4,860,812,862.50 $65,402.00 $176,512,231,512.50 $137,950.00 $149,395,056,237.50 $304,600.00 $172,378,242,050.00 $1,302,650.00 $255,832,318,437.50 1,434,000.00 $34,001 - $82,400 10,810,800.00 $82,401 - $171,850 3,890,200.00 $171,851 - $373,650 1,760,000.00 $373651+ 625,000.00 Totals $761,414,191,300.00 24,562,000.00 Brackets 0 - $8,375 $8376 - $34,000 $34,001 - $99,999 $100,000 - $199,999 $200,000 - $499,999 $500,000 - $999,999 $1,000,000+ Proposed Capital Gains Tax Distribution Mean Income Total $4,031.00 20,000,000.00 $22,642.00 57,946,000.00 $53,215.00 60,815,000.00 $150,000.00 18,322,000.00 $321,364.00 5,366,000.00 $708,650.00 907,000.00 $1,164,200.00 433,000.00 Totals $8,062,000,000.00 $172,537,112,300.00 $576,830,275,000.00 $662,913,778,600.00 $502,572,852,500.00 $230,959,749,800.00 $192,715,937,850.00 $2,346,591,706,050.00 163,789,000.00 Brackets 0-8375 8376-34000 34001-99999 100000-199999 200000-499999 500000-999999 1000000+ Total Net Change in Revenue $5,626,469,800.00 $167,676,299,437.50 -$69,154,841,762.50 $232,209,113,562.50 $164,554,262,550.00 $643,527,348,787.50 $192,715,937,850.00 $50,099,892,650.00 Economic Stability We can see the effect of the economic stability from the revenue from the capital gains tax. The more money that is earned has an effect on the rate of inflation. The money earned by capital gains tax will help lower the rate of inflation because the less money that will need to be created. The Economic stability from capital gains is graded by the following equation. Old Inflation Rate= 1,700,000,000,000/188,000,000,000,000 = 0.9% New Inflation Rate= (1,700,000,000,000-50,099,892,650)/188,000,000,000,000 = 0.877% Old Grade=$2,296,491,813,400.00/(14,200,000,000,000*.009) = 17.97 New Grade= $2,346,591,706,050.00/(14,200,000,000,000*.00877) = 18.84 Corporate Income Tax Revenue The Corporate income taxes largest demise is its convoluted and loophole ridden deduction and credit system. By fixing these loopholes and restructuring the tax code we hope to reclaim more of the envisioned revenue for this tax. The first deduction to address is the current laws bias towards debt financing compared to equity financing. Current law allows corporations to deduct interest from loans out of taxes as business expenses when they should be considered an avoidable cost of business. By making equity and debt financing equal we can realize up to .23% of GDP in increased revenue according to the IMF. With GDP currently reaching $14.12 Trillion, this gives a proposed increase of $32.5 Billion. Secondly, differing tax rates between overseas profit and domestic profit presents the next biggest area for improvement. Current tax law does include a tax on foreign income but only once it is repatriated. This allows for company’s to evade paying taxes by shifting their income into "tax havens", countries with little to no corporate income tax, through nefarious but legal means and keeping them their permanently. It has been estimated by the Office of Management and Budget that by creating a system that ensures the corporations are taxed at their actual rate, but allowing certain deductions to avoid getting double taxed, we can gain up to $53.2 Billion in additional revenue. Thirdly, the various special preferences that exist within our tax law truly are the biggest problem that we face. Be preferring certain industry’s we create a very uneven playing field and interfere with the dynamics of an open market where supply is based purely on demand and not on tax incentives. In 2007, our department performed an analysis on corporate tax expenditures and determined that over the course of a decade, special preferences added up to $1.2 Trillion in lost revenue. This equates to about $120 Billion a year if we return to a equal market that allows the economy to determine the value of products. Also taking into consideration our proposition to remove income tax from new businesses that fall within the first bracket for FY2013, if we were to deduct their tax liability this would only mean a loss of $7 Billion, a very generous estimate that in actuality will be much lower. This equates to a net change of $35.2 + $53.2 + $120 - $7 = +$201.4 in new revenue. Using our grading scale, $201,400,000,000/$200,000,000,000 gives us a score of 100.7%. Economic Stability The effect that closing these loopholes will have on economic stability can be determined by realizing the increased revenue it will make and how it will affect inflation. Also closing these loopholes will help prevent too big to fail multinational corporations from taking advantage of our tax law and paying almost no taxes. This creates a more stable economy by ensuring that multibillion dollar company’s don't have the advantage of getting even larger through tax loopholes. Additionally the tax break on new businesses will help begin to reshape our economy into where it needs to be, that being a larger focus on small business. By introducing more competition into the market this will help to drive down any over inflated prices and create safety nets if other multinationals fail and risk bringing the economy down with them. This propositions effect on inflation will be that it will introduce $201.4 billion into the federal budget. That's $201.4 billion that does not have to be created through debt and will help drive inflation down. Old Inflation Rate= 1,700,000,000,000/188,000,000,000,000 = 0.9% New Inflation Rate= (1,700,000,000,000-201,400,000,000)/188,000,000,000,000 =0.797% Old Grade=$983,439,902,441.00/(14,200,000,000,000*.009) = 7.69 New Grade=$1,184,839,902,441.00/(14,200,000,000,000*.00797) = 10.47 Estate Tax Revenue The Estate tax used to be a flat tax at anything over $5,000,000, but we changed it to a marginal tax. The new system is separated into 3 brackets, ranging from $5,000,000$20,000,000+. The old system had a revenue of $44,015,230,000. The new system separated its revenue into three brackets, the first one making $13,660,370,500,the second one making $8,112,720,082.50, and the third one making $36,737,250,182.50, which comes to a total of $58,510,340,765. This is an overall increase of $14,495,110,765. The grading on the estate tax would be $14,495,110,765/$200,000,000,000, which is 7.25% of the entire goal. Bracket 5,000,000+ Bracket 5,000,000-9,999,999 10,000,000-19,999,999 20,000,000+ Totals Existing Estate Tax Distribution Mean Income 8600.00 $14,623,000.00 $44,015,230,000.00 Proposed Estate Tax Distribution Mean Income 5870.00 $6,649,000.00 $13,660,370,500.00 1650.00 $13,542,000.00 $8,112,720,082.50 1090.00 $59,342,000.00 $36,737,250,182.50 8600.00 $58,510,340,765.00 Economic Stability We can find out the economic stability for estate tax from the revenue earned. The economic stability for estate tax can be seen by the following formula. Old Inflation Rate= 1,700,000,000,000/188,000,000,000,000 = 0.9% New Inflation Rate= (1,700,000,000,000-14,495,110,765)/188,000,000,000,000=0.89 Old Grade= $44,015,230,000.00/(14,200,000,000,000*.009) = .344 New Grade=$58,510,340,765.00/(14,200,000,000,000*.0089) = .463 National Sales Tax Revenue The effects of removing our existing income taxes and putting in place an all encompassing sales tax would be to initially create a system that is equal to existing revenue. This is the initial goal of the Fair Tax bill. So the bill will create the same amount of revenue as our income taxes, however a part of the bill is abolishing all income tax law which will reduce the budget by its revenue. Therefore this bills grade for revenue effect is (Revenue created by National Sales Tax) - (Revenue made by Income Taxes) = 0. Finally 0/200 gives a 0% score for this criteria. Economic Stability The effects on economic stability that a National Sales tax would have would be very minimal. Considering their is no net change in revenue from Income Taxes this should mean that Stability would not fluctuate at all. Thus the grade for economic stability for the national sales tax would be considered fair as it is no improvement from our current system in this regard. Gas Guzzler Revenue The Gas Guzzler tax is found by the formula (1/((.495/x)+(.351/y)))+.15)=z. Where x is the city mpg, y is the highway mpg, and z is a percentage of the price of the car that will be taxed. Our new system modified the formula by changing .495 to .450 and changing .351 to .325. This raised the percentage f the price that the buyers would have to pay. We applied this formula to 22 cars varying from 8 city mpg to 20 city mpg. This formula taxed the more expensive and less environmentally friendly cars more heavily. On the 2010 Lamborghini Murcielago Coupe, a $450,000, the tax only increased about $4,500, which is not that expensive. For the $21,000 Dodge Challenger, with a 16 combined mpg, the tax increased the price by less than $400. With the more economic friendly but still gas guzzling 2011 Toyota Matrix, a sub $19,000 car, the increase was only $400 as well. The combined total of all the cars we examined for the old tax was $642,663.71. The new tax raised the revenue $50,218, with $692,882.63 revenue. This increase was only from the sampled cars. The percent that this taxed raised is $50,218/$642,663.71 which comes to a 7.81% increase. The revenue earned from the old gas guzzler tax was $9,392,075,000.00. So if we apply the percentage increase to the original revenue tax, we get a total of $170,372,240.50. The grading process for the new gas guzzling tax would be a $170,372,240.50/200,000,000,000, which is 0.08% of the total goal. Economic Stability The Gas Guzzler Tax would have a small increase, but it would still stabilize the economy a little. The formula to stabilize the economy is shown below. Old Inflation Rate= 1,700,000,000,000/188,000,000,000,000 = 0.9% New Inflation Rate= (1,700,000,000,000-170,372,240.50)/188,000,000,000,000 =0.9% Old Grade=9,392,075,000/(14,200,000,000,000*.009)= 0.07314 New Grade=9,562,447,240.5/(14,200,000,000,000*.009)=0.07447 Policy Recommendation The first policy option that strikes us as interesting is the Corporate Income Tax. It has been known for some time that our Corporate Income Tax requires an overhaul due to some blatant abuse by corporations within US. Compared to our other policy changes, we didn't feel it was necessary to change the bracket distribution considering that at first glance US Corporate Income Tax is one of the most excessive in the world. However, as we have seen this high tax rate is for nothing due to a large amount of loopholes in the deductions, credits, and write offs. By acknowledging and fixing these loopholes we have shown that their is a large amount of revenue that isn't being realized, up to $200 Billion, along with an opportunity to jolt the US economy back to life through a temporary 1 year tax deduction on new businesses. As more citizens feel that the Bush era tax cuts did little to help the recession, along with a faith in 'trickle down' economics, it becomes necessary to explore new options to create jobs. We the US treasury believe that creation of small businesses will create lots of new jobs and give our economy just what it needs to come out on top yet again. These conclusions are compelling and we feel this should be the budget committees first source of new income. The second best policy option is marginal income tax. The Marginal Income Tax was adjusted in many different ways. We increased some of the tax rates, we also increased the income rates in the brackets and added a bracket. When combined with the revenue criteria, income tax performed very well. This tax received a 88.4%, which means it raised 88.4% of the entire budget goal. This tax was almost good enough to raise enough money on its own. The income tax earned a lot of its money from the creation of the new tax bracket. It also earned most of it from the increase in tax percentage for each bracket. When merged with the second criteria, economic stability, it performed very well. Because of its large revenue, it decreased the rate of inflation heavily. It had a 9% increase from its original grade compared to the new grade. Marginal Income Tax was able to perform very well because of the increased tax rates in the brackets, the increased income rates in the brackets and also the addition of the $1,000,000+ bracket. The third most successful policy option is the Capital Gains Tax. This tax was successful because we got rid of the original bracket system and added the investments that were made onto the Marginal Income Tax. It also was successful because of the merging of the two former divisions, short-term and long-term investments. With the merging, the long term investments would be taxed at a higher rate and this would increase the revenue earned even more. The grade that this policy received was about 25%. This is a pretty good grade because it raised a quarter of the budget goal. When combined with the economic stability criteria, it performed well. Because of its revenue generated, Capital Gains Tax lowered the rate of inflation. It also received a higher grade than the previous Capital Gains Tax. Overall, this policy performed well, due to its combining of the short-term and long-term investment brackets and also tax rate increases. Existing & Proposed Gas Guzzler Tax Bracket Gas Guzzler Less than 12.5 MPG 2010 Bugatti Veyron C/H/Com MPG 8,14,10 2010 Lamborghini Murcielago Coupe 9,14,11 Price Old Tax New Tax $1,990,06 4.00 $450,000. 00 $235,20 7.61 $57,665. 65 $253,42 0.12 $62,138. 41 12.5-13.5 13.5-14.5 14.5-15.5 15.5-16.5 16.5-17.5 17.5-18.5 18.5-19.5 19.5-20.5 20.5-21.5 21.5-22.5 2007 Lamborghini Gallardo Spyder M6, 10 cyl, 5L 11,17,13 2008 Lamborghini Gallardo Coupe M6, 10 cyl, 5L 10,17,13 2011 Bentley Mulsanne 11,18,13 2011 ROLLS ROYCE Phantom EWB 11,18,14 2009 DODGE CHARGER Auto(L5), 8 cyl, 6.1 L 2011 MASERATI QUATTROPORTE A6, 8 cyl, 4.2 L, 2WD Rear 2009 DODGE CHALLENGER M6, 8cyl, 6.1 L 13,19,15 2009 FORD MUSTANG M6, 8 cyl, 5.4L 14,20,16 2009 CHEVROLET IMPALA Auto(L4), 6 cylinders, 3.5 liter, 2011 AUDI S5 M6, 8 cyl, 4.2 L, AWD, 14,22,17 2011 PORSCHE Panamera Turbo A7, 8 cyl, 4.8 L, AWD, 2009 INFINITI M45 Auto(S5), 8 cylinders, 4.5 liter, 2011 BMW Z4 sDrive35i S7, 6 cyl, 3L, 2WD,RearWD 2011 HYUNDAI EQUUS A6, 8 cyl, 4.6L, 2WD,Rear WD 2011 SUBARU LEGACY AWD S5, 6 cyl, 3.6 L, AWD 2011 MERCEDES-BENZ SLK 350 M6,6 cyl,3.5 L, 2WD,Rear 2011 MAZDA MAZDASPEED3 M6, 4 cyl, 2.3 L, 2WD Front 2007 INFINITI M35 S5, 6 cyl, 3.5 L 15,23,18 2011 NISSAN MAXIMA AV-S6, 6 cyl, 3.5 L, 2WD Front 2011 TOYOTA MATRIX A4, 4 cyl, 2.4 L, AWD 19,26,22 Works Citied 12,20,15 14,22,16 14,22,17 16,21,18 17,24,19 16,24,19 18,25,20 18,26,20 18,25,21 18,25,21 20,26,22 $299,990. 00 $190,600. 00 $300,000. 00 $450,000. 00 $30,000.0 0 $121,250. 00 $21,995.0 0 $25,000.0 0 $26,000.0 0 $55,000.0 0 $127,500. 00 $31,684.0 0 $60,000.0 0 $58,000.0 0 $25,000.0 0 $53,300.0 0 $23,700.0 0 $22,561.0 0 $31,000.0 0 $18,845.0 0 $46,789. 10 $27,850. 34 $47,626. 55 $71,439. 83 $5,423.1 4 $21,099. 07 $4,380.0 5 $4,827.4 3 $5,177.6 0 $10,952. 62 $26,980. 23 $6,784.9 6 $13,993. 56 $12,993. 82 $6,137.3 8 $13,258. 52 $5,527.4 6 $5,538.6 1 $7,989.8 6 $5,020.3 2 $642,66 3.71 $50,426. 05 $30,012. 51 $51,327. 94 $76,991. 92 $5,845.3 9 $22,740. 01 $4,721.2 0 $5,203.5 5 $5,580.8 7 $11,805. 68 $29,082. 88 $7,314.3 0 $15,085. 41 $14,007. 00 $6,616.4 5 $14,293. 28 $6,272.3 9 $5,970.9 5 $8,613.7 7 $5,412.5 5 $692,88 2.63 Tax Policy Center. Tax Policy Center. Ed. Donald Marron. Tax Policy Center, 2010. Web. 19 July 2011. <http://www.taxpolicycenter.org/index.cfm>. Internal Revenue Service. IRS.gov. Ed. Douglas H. Shulman. United States Treasury, July 2011. Web. 20 July 2011. <http://www.irs.gov/>. Center on Budget and Policy Priorites. Six Tests for Corporate Tax Reform . Ed. Chuck Marr and Brian Highsmith. United States Treasury, 28 Feb. 2011. Web. 20 July 2011. <http://www.cbpp.org/cms/index.cfm?fa=view&id=3411>. US Treasury Department. US Department of the Treasury. Ed. Timothy F. Geithner. Executive branch of the United States of America, July 2011. Web. 20 July 2011. <http://www.treasury.gov/Pages/default.aspx>. IMF. IMF.org. Ed. Ruud A. de Mooij. International Monetary Fund, 3 May 2011. Web. 20 July 2011. <http://www.imf.org/external/index.htm>.