here - Grafton Elliott

advertisement

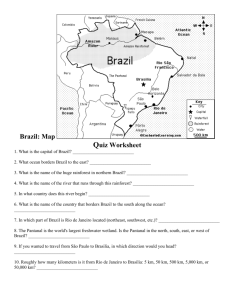

Executive Summary This report is an analysis of Brita, Inc.’s position within the marketplace and the potential growth opportunities if the company were to introduce products into the Brazilian market. Contaminated drinking water can cause several bacterial diseases for those living in Brazil. This has become a serious health problem that people of Brazil face. Due to an increase in population and internal migration, many water sources have become overexploited, making Brazil a great market for water purification and filtration products. Brita is one of the leading companies in household water filtration products and has yet to reach the market in Brazil. In an attempt to gain market share from competitors, Brita intends to launch the sale of products in the Brazilian market. Over the years Brita has been able to offer great tasting water without the cost or waste of bottled water. The company offers a wide range of products using disposable filters as their primary filtering mechanism. Brita’s most popular products including their pitchers and dispensers, filtering bottles, and faucet filtration products. This product line offers convenience to consumers whether filtering the water in your own kitchen or water on-the-go. Not only will these products benefit the consumer but aid in reducing the community's carbon footprint as well. “One Brita pitcher or bottle filter can save 300 standard 16.9 oz. plastic bottles from reaching landfills” (Brita, 2014). Brita’s products will help Brazil become a part of their growing community making better choices for the environment and consumer health by reducing water bottle waste and giving citizens a greater chance of escaping various harmful diseases. In an attempt to test the effectiveness of the product our team decided to introduce Brita Pitchers and Brita Filtration bottles to the new market. Brazil - General Facts Geographical setting Brazil is located on the eastern coast of South America. It borders ten other countries – French Guiana, Suriname, Guyana, Venezuela, Colombia, Peru, Bolivia, Paraguay, Argentina, and Uruguay – as well as the Atlantic Ocean. It is the largest country in South America and fifth largest country in the world in both land area and population (Central Intelligence Agency, 2014). The northern part of Brazil is made up of the Amazon River and its basin. Ridges and mountain ranges span the southeastern region, making it much more rugged. There are hills, plains, and highlands in the rest of the country, as well as a narrow coastal belt. The climate is mostly tropical, except in the south where it is temperate (Central Intelligence Agency, 2014). History Brazil gained independence from Portugal in 1822, after nearly 3 centuries of being under their rule. A monarchical government was maintained for 66 years, after which the military was in control. In 1985, civilian rulers peacefully gained control of the country. There has been immense industrial and agricultural growth in recent decades (Central Intelligence Agency, 2014). Language Portuguese is the most widely spoken and official language of Brazil. Spanish is spoken in border areas as well as in some schools. English, German, Italian, and Japanese are spoken in certain areas, and there are many Amerindian languages still spoken as well (Central Intelligence Agency, 2014). Economic Analysis The Federative Republic of Brazil’s current total population is roughly 201 million ranking it as the fifth most populated country in the world just behind Indonesia. The population density of Brazil is about 23 people per square kilometer or 61 people per square mile. The population distribution in Brazil is very uneven with the vast majority of citizens living along the coast and the Amazon Basin to the west is sparsely populated. Sao Paulo and Rio de Janeiro are by far the largest cities in Brazil with Sao Paulo being home to 11 million and Rio de Janeiro with 6 million. In recent years, the Gross Domestic Product per capita has risen to $12,528 from just over $11,000 in 2010 and the economy is expected to grow in years to come due to increased industrialization and the implementation of more jobs and also due to the upcoming hosting of the FIFA World Cup which will be held in June 2014. Employment rates in Brazil are fairly stable with about 51 percent of people aged 1524 are employed. The vast majority of people aged 25-54 are employed with a rate of 76 percent in 2011. The unemployment rate, however, is slightly lower than that of the United States at about 5 percent in 2012. The inflation rate was at 5 percent in 2012. Brazil has numerous mineral reserves harboring iron ore, tin, quartz, granite, manganese, gold and bauxite, most of which are found in Minas Gerais and Para. There is a large amount of the mineral kaolin found in the Amazon Basin as well. Off the southeast coast, Brazil has many petroleum reserved and natural gas making it a big competitor in the oil industry. Coffee is a major industry in Brazil, it is the world’s primary source of coffee, oranges, and cassava and also produces large quantities of sugar, soy, and beef. Brazil has traditionally been an agrarian culture but the importance of it has declined in recent years due to increased industrialization and exploitation of mineral, industrial, and hydroelectric power. Brazil has one of the most expansive highway systems in the world but is infamously inadequate with only 1.5 percent of the country’s GDP allocated to maintaining the infrastructure. To accommodate for the upcoming FIFA World Cup and 2016 Olympic Games the roadways will undergo an extreme overhaul. Market Audit and Competitive Market Analysis Analysis of relevant trends Cultural A cultural trend can be defined as an action or belief that is widespread throughout a culture as a tendency to follow along with others in one’s own culture. Something that can be considered a cultural trend in Brazil is that in cities such as Rio de Janeiro and Sao Paulo, there are many universities resulting in a more educated population overall. A more educated population in turn can cause a variety of other cultural trends. One trend that is relevant to the all industries, is that this influence of education has caused many Brazilians to strive for higher living standards. OCED Better Life (2014) explains that “Brazil has made tremendous progress over the last decade in terms of improving the quality of life of its citizens. In recent years, the country has seen a track record of inclusive growth and poverty reduction.” This ultimately opens Brazil’s market and invites different brands and products in because with this rise in quality of life, many citizens have a more disposable income to buy products that would continue to improve their quality of life. Another cultural trend is that the education of its citizens has lead middle class Brazilians to be more aware of different diseases caused by water contamination. Ribeiro (2011) states “the consumption of filtered and/or bottled mineral water is widespread in Brazil.” This means that many Brazilians are either purchasing water bottles or using inhome water filtration systems in order to access clean water. This leaves the market and cultural demands of Brazil open to a product like ours. Demographic Brazil is currently the sixth most populated country in the world with a population of 201, 009, 622 people. The growth rate has been slowing due to a decline in the fertility rate since the 1960s. Currently the majority of people are of working age, but the labor force will shrink with the aging population (Central Intelligence Agency, 2014). Eighty seven percent of Brazil’s population is urban. The two most populated cities are Sao Paulo with 19.96 million people and Rio de Janeiro with 11.836 million people. Ninety nine and a half percent of this urban population has access to a slightly improved drinking water source such as piped water or public tap (Central Intelligence Agency, 2014). Of the rural population, eighty five percent of them have access to improved water sources, which is an increase of 2% since 2009 (The World Bank, 2013). Economic The economic trends in Brazil reflect a concern for inflation rates, debt, and investor confidence, but still expect gross domestic product to rise and no cuts to the country’s budget. This could create a few concerns in entering this country for business, but the prospects for the market still look good for our product. As Latin America’s largest economy, Brazil shows no room for budget cuts and cuts to governmental spending (Trevisani, 2014). As a result, The Wall street Journal has found that a “rigid budget structure means the government has little room to cut costs, so it needs lots of taxes to be able to pay its bills” (Trevisani, 2014). This can be reflected in possible increases to the taxes placed on the citizens of Brazil. This could be a possible influence on entering the market of Brazil because if citizens are paying higher taxes they will be less likely to spend money on products like ours or they will have a smaller disposable income. Also, with rises in taxes to its citizens, the Brazilian government “struggles to rebuild confidence amid slow growth, high inflation and concerns about the fast pace of government spending” (Trevisani, 2014). This is seen through the lack of confidence that foreign investors have in the Brazilian market. Despite the challenges that Brazil faces, the economy has remained “stable” since 2011 (Trevisani, 2014) and the government has been working hard to re-instill the confidence of Brazilian citizens in the economic decisions of that the government has made. Since Brazil is also fraught with rising inflation, the Finance Minister, Guido Mantega, released economic data to show that in “2013 [the government] had saved around 75 billion Brazilian reais ($31.57 billion) of its tax revenues to pay debt” (Trevisani, 2014). This information was released to show that despite these difficulties, Brazil is using its tax revenue to repay its debt while it’s economy is still growing. In a report by Trading Economics (Taborda, 2014), as the second largest economy in the world, Brazil’s GDP expanded by .70 percent in the fourth quarter of 2013 alone. This growth despite the nation’s rising inflation and debt is because of “trade is driven by its extensive natural resources and diverse agricultural and manufacturing production” (Taborda, 2014). The growth of Brazil’s economy despite it’s economic struggles shows a good outlook in most sectors including the category in which our product would fall. Electricity, water, and gas supply rose by 1.4 percent during the year (Taborda, 2014). This proves that the industry our product is entering has been growing in an economy that is facing rising inflation and high taxes to come back from national debt. However, despite these challenges and economic trends that Brazil is facing, we are confident that Brita will do well in Brazil. This is because Brazil’s quality of life is rising causing a larger educated and middle class population that has a disposable income to spend on various products. Our product is congruent with many needs and beliefs of Brazilians and is set to flourish in their market for foreign products. Psychographic As previously mentioned, the education level of many Brazilians, especially in the middle class in urban areas, is rising. This has lead to an improved quality of life that many Brazilians strive for. That ultimate goal has left Brazilians with a few underlying goals and lifestyles. The first psychographic that is important to our product’s success is that consumers are more environmentally and personal health conscious. This means that our consumers have often times are beginning to make purchasing decisions based on these factors. They are looking for products that either help to promote their own well-being or the well-being of the planet. An example of this is the popularity of bottled water to avoid contaminated water sources for the health of the consumer and this trend’s move into the popularity of in-home water filters in order to provide the same health benefits with a reduced risk of harming the environment. Technological While Brazil has a rapidly fast growing economy and industrialization rate, it is still considered to be a developing country. This often times means that a country is growing and expanding, but the markets and technology available is still trying to meet the needs of consumers. Technology Trends in Latin America (2014) explains “With the restrictive laws on importation of hardware in Brazil, the prices of computers are about twice the price in the U.S. Surprisingly however, there is a technology boom going on in Sao Paulo.” As one of our target markets, our product will be reaching a part of Brazil that is more technologically advanced. Despite the inflated cost of computers, Technology Trends in Latin America (2014) also states that Brazil has the 5 largest number of mobile phone and Internet users in the th world. Not only does this go to show that Brazil is advancing as far as the technology they have available and their ability to use it, but the Brazilian government is also putting a heavy influence on the availability to technology centers and various equipment (Technology Trends in Latin America, 2014). The technological trends in Brazil are also accompanied by trends such as social media usage. According to Global Intelligence Alliance (2010), “ecommerce in Brazil has been growing at a little over 30 percent per year since 2000” and that “Brazilians spend more time web surfing than their peers in the US.” Most of this web surfing is attributed to social media websites, both ones that are popular in the US, such as Facebook, and ones that are more popular internationally, like Orkut. Consumer As previously mentioned with other aspects of relevant trends, consumers are increasingly becoming more educated and striving for a better quality of life. This often times leaves consumers with a more disposable income as there is growth in Brazil’s middle class. This disposable income leaves the consumer with the ability to pick and choose the products they want. The consumers in Brazil and choosing to spend their money on products that ultimately will improve the quality of their life and the quality of their family’s lives (GIA, 2010). Products such as water filtration devices fit this category and are exactly what consumers in Brazil are looking for. Another beneficial trend that affects consumers includes the recent movement on being eco- friendly. The use of Brita filters could greatly decrease the amount of plastic bottles wasted in Brazil every year. According to the GIA, most Brazilian Supermarkets “have started selling eco-friendly products, diminishing the use of plastic bags and providing recycling collection centers (GIA, 2010). This “green” movement could be extremely beneficial when it comes to marketing our new eco- friendly product. Social The social trends in Brazil focus heavily around what is next for Brazil and its people. Future global sporting events such as the 2014 World Cup and 2016 Summer Olympic Games make Brazil an extremely viable future market. These events are predicted to boost the Brazilian economy greatly and generate millions of new jobs. According to the Global Intelligence Alliance it is expected to generate 2 to 3 million jobs over the next six years and boost the infrastructure, telecommunications, retail, and services sectors in the Brazilian economy (GIA, 2010). This ultimately has caused and is set to continue to cause a rise in the quality of living and social classes of Brazil. Another recent trend that is worth recognizing is new social media expansion. ECommerce in Brazil has grown 30 percent every year since 2000 and the number of Internet users in Brazil exceeds 35 percent of the world’s population (GIA,2010). Today Brazil is the number 2 Facebook and Twitter users in the world and the market is continually expanding. This social trend will enable our company to reach a huge portion of the Brazilian population at a rather inexpensive marketing investment. SWOT Analysis STRENGTHS Established, successful brand in other countries Need for clean water in Brazil Cheap cost of producing water filter WEAKNESSES No established brand recognition in Brazil OPPORTUNITIES Growing interest in saving the environment – recycling THREATS and producing less waste Size of the target market – 34.6 million people Slowed economic growth in recent years Online distributors are available for consumers Growth of the bottled water industry Target Market: Characteristics and estimated size The target market - those ages 25-40 - is about 40 million people out of the total population of Brazil. This is the age where people start building families and having children and start to become their own independent unit. This age group is more educated than any other age group and is more likely to be interested in healthy alternatives to things that they now know are not good for them. They are also more tech savvy than any other age group making it very easy to reach them for promotion. With increased industrialization and a growing job market, the middle class has expanded allowing for families to have a higher income and make basic health services available to them. With more access to healthcare, people are now living longer and the life expectancy in Brazil has risen to 77 for women and 70 for men. Industrialization has also made an impact on the birth rate. Now that there are more people, particularly women, in the workforce, they are waiting longer to have children and or may be having fewer children. The birth rate in 1970 was 4 births per woman, and in 2012 the birth rate was 1.81 births per woman. Industries will continue to grow and the population will grow along with it. With fewer children being born the population will not increase at the steady rate that it has before but it will continue to increase. The Product Consumer needs it addresses Contaminated drinking water is a serious health problem that causes several bacterial diseases for Brazilians. The water in Brazil and many areas in South America coming from lakes, streams, rivers, and shallow wells contain harmful chemicals. The World Bank states that, “Despite having almost 20 percent of the world’s freshwater, Brazil suffers from very unequal access and increasing natural disasters linked to extreme weather, either flooding or drought, with growing social and economic impacts” (2011). Other challenges include the lack of access to clean water due to rural areas that do not have piped water and the high number of poor Brazilians living in slums. Another challenge faced is water scarcity in the northern parts of Brazil. Due to the increase in population and internal migration, many water sources have become overexploited making Brazil a great market for water purification and filtration products. Features and benefits The way Brita filters work differs among the pitcher filters and faucet filters. Brita pitcher filters use activated carbon and ion exchange resin to filter out several impurities leaving the user with healthier drinking water. “The Carbon reduces Chlorine, and the Ion Exchange Resin reduces metals: Copper, Cadmium, Mercury (health contaminants) & Zinc (metallic taste)” (Brita, 2014). Brita faucet filters, on the other hand, use a two-step process. “ When you turn on your tap, water first passes through a non-woven screen around the filter to trap sediment. The water then flows through a compressed block of carbon and zeolite, reducing chlorine (for taste and odor) and lead” (Brita, 2014). The products that we will be providing include Brita water pitchers and Brita water bottles. Brita has a large line of products that could be offered, but during the introduction to the Brazilian market, we have chosen to these two top selling products. This then provides consumers the benefit of having clean drinking water. Since many Brazilians, rural or urban, do not freely have access to uncontaminated drinking water, our product is a cost efficient way of improving upon this situation. With a Brita pitcher or water bottle, consumers are able to fill it up with water from the tap and allow it to be filtered into clean drinking water for consumption. Competition More and more companies are manufacturing water filters and competing with Brita. Some popular competitors include Pur, Whirlpool, and Aquasana. The prices of whirlpool products are a bit higher ($30-$130) due to their refrigerator filtering systems. Aquasana has prices similar to Whirlpool; however they don’t have a very large product line. Aquasana has a couple of water drinking filters, but they focus more of their efforts on their wholehouse water filters which cost as much as $1399.99 (Aquasana, 2014). Pur water filters have somewhat lower prices, much like these of Brita; however Brita’s got the competition beat with some filters costing as little as $20 (Brita, 2014). The Price The cost of manufacturing Brita products is low compared to the possible selling cost. Brita products are made using 2 main components, which allow the manufacturing process to remain inexpensive. Brita’s pitchers, filtration bottles and the outsides of each filter are made of polypropylene plastic (Sheryl, 2009). Polypropylene is the most common plastic used to manufacture products and it costs an average of 5 cents a pound to produce (Plastic News, 2014). The second component is the carbon/ charcoal used in the products’ filter. Carbon is priced at $2.40 per 100 grams making it extremely inexpensive. According to Brita.com, each filter used in a pitcher contains 25 grams of Charcoal. The cost of materials is then combined with the cost of the mold and the cost of labor. Total cost to produce one Brita filter comes to about $5. In the United States, the selling price for a basic Brita pitcher ranges from $25 to $36 dollars and the average price of a personal filtration bottle is $14. The replaceable filters for these products cost $7.99 for pitchers and $3.99 for filtration bottles. Based on the current selling price and the inexpensive manufacturing cost, selling Brita filters in Brazil is likely to remain extremely profitable. We will be selling Brita filter in Brazil for the following prices: Water filter pitchers - $21.99 Personal water filter bottles - $9.99 Distribution Brazil has many locations that are industrial and can host a factory where our product can be produced. Minas Gerais has the nation’s second largest industrial plant with expansion on the horizon (Brazilian Regions for Foreign Investors, 2014). This would be a good place to produce our product because it is not too far from both Sao Paulo and Rio de Janeiro. According to The Real Cost of Trucking (2013), a semi-truck that is used to transport goods costs about $0.54 per mile to operate. With Minas Gerais being 475 miles from Sao Paulo and 393 miles from Rio de Janeiro, this makes the cost per truckload to transport the products to this location $256.50 and $213.84, respectively (this does not factor trucker salary). We will be selling our product in Walmart stores in Sao Paulo and Rio de Janeiro. Walmart is the third largest retailer in Brazil, with a total of 556 total retail units in the country (Walmart, 2014). Promotion and its cost Due to the technological trends in Brazil, we will take advantage of social media as a way of promoting our product. It is cheap to advertise on sites such as Facebook, Twitter, Google+ and Orkut. If we hire a consulting company to manage our sites, it would cost anywhere from $500-$2000 per month (Collier, 2012). This cost would be reduced by having an in-house social media manager. Projections Sales volume. The target demographic of 25-40 year olds accounts for 40 million people in Brazil (Brazil Auto Reports, 2011). However, the focus of our marketing plan will be on Sao Paulo and Rio de Janeiro, which according to Brazil Auto Reports (2011) make up 86.6% of Brazil’s population. Since 86.6% of the Brazilian population is located in Sao Paulo and Rio de Janiero, our target market is roughly comprised of 34.6 million people. It was reported that from 2007 to 2010, the presence of water filters in Brazilian homes rose from 51.1% to 51.6% (Ribereiro, 2011). The increased consumption of bottled water and other products used for clean drinking water was expected to rise 15% in 2011(Ribereiro). Ribereiro (2011) also remarks that 5.694% of this increase is directly attributed to the sale of bottled water. That being said, if the consumption rate of products related to ours raises 15% and 5.694% of that is directly attributed to rival products (bottled water), sales in our product category should see a .38% raise each year. In the year 2011 from a basis of water filtration products being present in 51.6% of homes (Ribereiro, 2011), the rate in which consumption rises should be 67.36% by the year 2014. Revenue Our filter pitchers will be introduced to the market at a price of $21.99, and our filter water bottles will be introduced at a price of $9.99. These prices are a bit cheaper than what they are being sold for in the United States because we are introducing our products into a new market, geared towards the 25-40 year olds in the urban areas around Rio de Janeiro and Sao Paulo. These individuals will be able to afford our products and identify them as a necessity due to the poor water conditions in the area. The penetration rate for filtration products in Brazil is fairly low, but anticipates a steady increase each year. Therefore we arrived at a penetration rate, or the amount of sales and adoption of our product, of about 7% of our target market by the year 2014 due to current market trends. Our target market is around 34.6 million people, so we can multiply this population first by the penetration rate, and again by the price of our product to calculate our expected revenue. Our expected revenue for the year 2014 will therefore be around $53,259,780 from the pitchers and $24,195,780 from the water bottles. Rev= (Penetration rate)(Target market)($) Pitchers: (7%)(34.6million)($21.99)=$53,259,780 Water Bottles: (7%)(34.6million)($9.99)=$24,195,780 Profit The estimated cost to produce a Brita filter in Brazil is around $5, based on the cost of the polypropylene plastic for the bottle, the carbon/ charcoal component used in the filter, and the cost of labor per pitcher. For a target market of 34.6 million people and a penetration rate of 7%, the estimated cost to produce filters for the year is $12,110,000. Finally to figure out our ending profit for the year 2014, we subtract the estimated cost of production from our expected revenue. Therefore, we will end with a profit of $41,149,780 from our pitchers, and $12,085,780 from our water bottles. Estimated cost of production = (Target market)(Penetration rate)(Cost of production) (34.6million)(7%)($5)= $12,110,000 Profit = Revenue - Cost of Production Water Bottles: (24,195,780) - ($12,110,000) = $12,085,780 Pitchers: ($53,259,780) - ($12,110,000) = $41,149,780 Conclusion After conducting an extensive marketing analysis, it seems that the introduction of Brita products into the Brazilian market is a profitable venture to pursue. High product demand and high profit projects all work in the favor of this conclusion. Using social media advertising and the need for environmentally friendly products Brita will be able to penetrate and succeed in this market. Low levels of competition will allow Brita to remain at the top of its perspective industry and remain profitable for years to come. Being an already established and well known global company, Brita will once again gain a sustainable advantage over its competition in the new Brazilian market. References (2013, October). OCED Ecomonic Surveys: Brazil 2013. Retrieved from http://www.keepeek.com/Digital-Asset-Management/oecd/economics/oecd-economicsurveys-brazil-2013_eco_surveys-bra-2013-en#page3 (2014, March). Cost of living in Rio de Janeiro, Brazil. Numbeo. Retrieved from http://www.numbeo.com/cost-of-living/city_result.jsp?country=Brazil&city=Rio+De+Janeiro Aquasana, Inc. (2014). Our products: Whole house water filters. Retrieved from http://www.aquasana.com/category.php?category_id=4 ASD Report (2013). Brazil Water Purifier Market Set to Cross 1.1 Billion. Retrieved from https://www.asdreports.com/news.asp?pr_id=1388 Brazil Auto Report (2011). Country Snapshot: Brazil Demographic Data. Brazil Autos Report. Retrieved from http://www.businessmonitor.com/ Brazil: Manufacturing Base. (2014). Retrieved March 31, 2014, from http://www.brazilsourcing.com/manufbase.php Brazilian Regions for Foreign Investors. (2014). Retrieved March 30, 2014, from http://thebrazilbusiness.com/article/brazilian-regions-for-foreign-investors Brita, LP. (2014). Why Brita: Solutions For Better Water. Retrieved from https://www.brita.com/why-brita/ Brita, LP. (2014). Why Brita: Solutions For Better Water. Retrieved from https://www.brita.com/why-brita/ Central Intelligence Agency. (2014, February 26). The world factbook: Brazil. Retrieved from https://www.cia.gov/library/publications/the-world-factbook/geos/br.html Collier, Mack. (2012). How much does social media cost companies in 2012? Retrieved from http://www.mackcollier.com/cost-of-social-media-in-2012/ Dold, J. (2009). Brazil’s Bottled Water Boom. Latin Business Chronicle. Retrieved from http://www.latinbusinesschronicle.com/app/frontpage.aspx Global Intelligence Alliance, (2010). Six Trends that will Shape Brazil’s Consumer and Retail Market. Retrieved from http://www.globalintelligence.com/insights/all/six-trends-that-will-shape-brazil-s-consumerand-retail-market “International Shipping- ‘water filter.’” (2014). Amazon.com. Retrieved from http://www.amazon.com/s/ref=nb_sb_noss?url=search-alias%3Dus-worldwide-shippingaps&field-keywords=water+filter&rh=i%3Aus-worldwide-shipping-aps%2Ck%3Awater+filter OCED Better Life. (2014). Brazil. OCED Better Life Index. Retrieved from http://www.oecdbetterlifeindex.org/countries/brazil/ Plastic News (2014, January 30). Prices Jump for polypropylene and suspension PVC. Retrieved from: http://www.plasticsnews.com/article/20140130/NEWS/140139990/pricesjump-for-polypropylene-and-suspension-pvc# “Postage Price Calculator.” (2014). United States Postal Service. Retrieved from http://ircalc.usps.com/MailServices.aspx?country=10043&m=13&p=0&o=1&mt=24&Mailing Date=4/1/2014&MailingTime=8:00%20AM&dv=35 Sheryl (2009, Octorber 31). Are Brita And Pur Water Pitchers BPA Free? This Green Blog. Retrieved from: http://thisgreenblog.com/2009/10/are-brita-and-pur-water-pitchers-bpa.html “Shipping Rates to Latin America.” (2014). Amazon.com. Retrieved from https://www.amazon.com/gp/help/customer/display.html?nodeId=596202 “Shipping Times to Latin America.” (2014). Amazon.com. Retrieved from http://www.amazon.com/gp/help/customer/display.html/ref=hp_left_sib?ie=UTF8&nodeId=2 01118470 The Real Cost of Trucking. (2013). Retrieved March 31, 2014, from http://www.thetruckersreport.com/infographics/cost-of-trucking/ Walmart. (January, 2014). Our Locations. Retrieved from http://corporate.walmart.com/our-story/our-business/locations/#/brazil Taborda, J. (2014). Brazil gdp growth rate. Trading Economomics. Retrieved from http://www.tradingeconomics.com/brazil/gdp-growth Technology Trends in Latin America (2014). Brazil. Technology Trends in Latin America and their social and economic impact. Retrieved from http://cs.stanford.edu/people/eroberts/cs181/projects/201011/TechnologyTrendsLatinAmerica/brazil.html Trevisani, P. (2014). Moody’s concerned with economic trends in Brazil. The Wallstreet Journal Online. Retrieved from http://online.wsj.com/news/articles/SB10001424052702304887104579304743926117198 Ribeiro, P. (2011). Drinking water safety in Brazil. About.com. Retrieved from http://gobrazil.about.com/od/healthsafety/a/Drinking-Water-Safety-in-Brazil.htm World Population Review (2014). Retrieved from http://worldpopulationreview.com/countries/brazil-population/