more information

advertisement

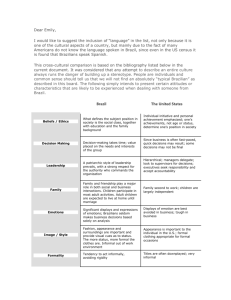

Market Analysis for Textile and Apparel in Brazil Over the last three years, there was a new outbreak of growth of the imports and stagnation of the Brazilian exports of textile products and apparel. In 2012, imports of textile and apparel were estimated to be $6.4 billion and major sourcing countries are India, Indonesia, Argentina, the United States, and China. Imports of textiles and apparels by Brazil grew by 25.4 % year-onyear in value and 17.3 % year-on-year in volume, amounting to 104,800 tons in April 2013. In the clothing sub-sector, the imports increased by 51.1 % year-on-year in value and 45.5 % yearon-year in volume during the month. From January to April 2013, Brazil’s textile and clothing imports totaled US$ 2.4 billion, showing an increase of 9% year-on-year. Clothing sector imports grew at a faster pace of 12.7 % year-on-year to US$ 957 million. The Brazilian textile and apparel industry, which is among the top five in the world is reeling under the impact of two challenges, large-scale of imports and high costs of production (labour & energy). These have created a cascading effect in the form of closures or factories relocating to low cost countries. The cost of textile and apparel production is particularly high. It is important to note that the industry’s output is exported and export numbers have decreased from $74 million in 2006 to $39 million in 2011. With a fast developing market, Brazil holds a prominent position, in the retail apparel index. Country Region Rank China Asia 1 UAE Mena 2 Kuwait Mena 3 Russia Eastern Europe 4 Saudi Arabia Mena 5 India Brazil Asia Latin Amerca 6 7 Turkey Mena 8 Vietnam Asia 9 Chile Latin America 10 Source: Euromonitor, A.T. Kearney Research The Brazilian clothing industry is growing by 7% annually. The estimated expenditure of Brazilian families on textiles and clothing in 2012 was approximately US $102 billion, which represents 3.7 % of total consumption expenditure on households. Source: Euromonitor, A.T. Kearney Research Furthermore, the market benefited from the growing disposable income, which enabled consumers to seek sophisticated value-added products. As a result, large apparel specialist retailers have invested in partnerships with renowned fashion designers and marketing campaigns endorsed by celebrities in order to associate their products with the latest fashion trends and good quality. This strategy was also adopted to distinguish from low- and mid-end brands, mainly imported from China. According to key players met, premium and luxury apparel players have also been luring the market, targeting upper middle-class and wealthier consumers in the high end malls. Cities strong on Fashion Consumption in Brazil Approximately 42.2 million people of the Brazilian population are classified in segments A and B, (an income of above USD 2.800 a month). Most of these people live in the major cities, mainly São Paulo, Rio de Janeiro, Brasília and Curitiba. These areas should therefore be the target market of companies wishing to enter the Brazilian market, with core focus on São Paulo and Rio de Janeiro. In addition, upper-price and luxury goods are primarily sold in upscale shopping centres in Brazil. The best known upscale shopping centres in São Paulo are Cidade Jardim, Daslu Mall and Shopping Iguatemi. Furthermore, a survey has shown that when it comes to the buying patterns of the Brazilian high-end consumer, customers spend on average USD 1,700 on every visit to shopping mall Cidade Jardim; an amount equivalent to more than three times the minimum wage in Brazil. Consumer Trends Several trends across Brazil are driving the growth of apparel retail: Trends in the Brazil apparel retail market Growing Middle Class -Brazil middle class went from 38% of the the population in 2003 to be 51% in 2009 . It is projected to be over 60% by 2014. -Around 57% of apparel consumers fall under the social category of A and B while 31% belongs to the group C -Consumers between 30-40 years old spend most on apparel Rising Fashion Awareness -Growing sales of sophisticated value added products -Brazilians are extremely fashion-conscious, displaying a typical shopping trait swayed by clothing lines endorsed by local celebrities -Brazilians, especially women, like to pay attention to fashion trends by reading fashion magazines and watching trendy television programmes. Rapid modern retail increase -The prevalence of Shopping centers everywhere accentuates demand in Brazil Increasing access to credit -A key growth driver has been easier access to consumer credit -In Brazil , retailer offer payments in installments with "no interests" as a means of making purchases more affordable Consumer Behaviour Due to the fact that the A and B population segments are increasing in Brazil, the market for luxury goods is also expanding rapidly and is becoming a strong source of profits. As Brazilians are experiencing more stability, prosperity and general changes in social classes, they are now capable of buying products that were previously too expensive, which is partly why the demand for trendy and sophisticated high-end fashion is increasing. A. Where are they Shopping? According to the Global Lifestyle Monitor, consumers prefer to shop for apparel at different retail channels, particularly with respect to department, specialty, and chain stores. In Brazil, 53% consumers prefer to buy most of their clothes at chain stores. Source:Global Lifestyle Monitor Survey, 2012 B. What are they buying? When the consumers were asked what apparel they had purchased in the past three months, the top two responses were cotton-centric items — T-shirts (78%) and Jeans (75%). This preference for casual dress reflects the young demographics of Brazil, where over 60% of the population are under the age of 35, compared to 47% of the U.S. population. Beyond the popular pairing of jeans with T-shirts, Brazilians consumers also view cotton as a comfortable and fashionable wardrobe component — 80% identified cotton as the fiber best suited for today’s fashions and 84% preferred cotton for the clothing they wore the most. C. Purchasing Patterns According to the “Global Lifestyle Monitor Survey, 2012” 94% of the Brazilian consumers said that price was one of the main characteristics which they took into consideration before purchasing clothing. Brazilians want the best quality clothing for their money, as 70% said they tend to shop for clothing on sale. Significantly, women are much more likely to be impulsive buyers than men (40% versus 24%), and younger consumers (ages 15–34) are more impulsive when buying clothes than older consumers (ages 35–55), 37% versus 27%. Over the past several years, consumers checking labels for fibre content has increased to 73% in 2012, up from 56% in 2008. This change in purchasing behavior could suggest that having more disposable income is encouraging consumers to seek out better-quality clothing. The majority of consumers (61%) think better-quality clothes are made from 100% natural fibers, and cotton and cotton-rich clothing is the preferred choice, with nearly 9 out of 10 consumers (88%) preferring that their clothes be made of cotton and cotton blend. Purchase Drivers – Top Factors that influence Brazilian consumers’ clothing purchases Source: Global Lifestyle Monitor, 2012 Shifting Shoppers Chain stores, such as C&A, Renner, Riachuelo, and Marisa, continue to rank at the top of the list of places where consumers purchase most of their clothing (53% in 2012, up from 34% in 2001). Additionally, more than one-fifth of Brazilians shop at independent stores, with older consumers being more likely than their younger counterparts to shop at these retailers (25% versus 18%). Brazilians say they prefer to shop at chain and independent retailers because of the selection of clothing, bargains and low prices. Import Duties It is evident that there are numerous possibilities for Mauritian companies to enter the Brazilian upscale fashion industry due to the above macroeconomic and demographic factors. Barriers to entry: The main barrier to entry for Mauritian companies to enter Brazil is the import duty of 35% on all kind of textiles and apparels. Brazil has a state tax (STT) which is levied at a rate of 18% of the duty paid value in most of the states, e.g. in São Paulo. The rates, however, may vary for specific products and usually amount between 7% and 25%. In addition, Brazil has a national tax (NAT) which is levied at a rate of 5% of the duty paid value. However, the tax varies from product to product and ranges from 0% to 20%. Furthermore, the tax of contribution to funding of social security (COF) is levied at a rate of 7.6% of the duty paid value; and The tax of contribution to social integration programmes is levied at a rate of 1.65% of the duty paid value. Landing Costs of Selected Mauritian Textile and Apparel Products The following tax structure applies for the textile and apparel sector. For the sake of analysis we can estimate that CIF will be around 30% of the FoB price. The table below gives the various tax structure applied to textile products. Price CIF Customs Duties 30% 35% PIS (Contribution to the Social Integration Program Tax) 2% COFINS (Contribution to the Financing of Social Security Tax) 9% ICMS (Merchandise Tax) 18% Based on the various interviews carried out with potential importers about the various costs involved in importing textile and apparels, we have been able to calculate the landing costs and the retail selling price of selected products as given in the table below: Product HS Code Fob Price Price CIF (+20%) Customs Duties PIS (Contribution to the Social Integration Program Tax) COFINS (Contribution to the Financing of Social Security Tax) ICMS (Merch andise Tax) Profit and Operatin g costs 50% Selling Price 30% 35% 2% 9% 18% 50% R$ USD USD USD USD USD USD R$ Shirts 620520 15 20 26 27 29 34 51 113 T-Shirts 610910 4.74 6 8 8 9 11 16 36 20 26 27 29 34 51 113 Denim Trousers 15 Shorts 610462 5.8 8 10 10 11 13 20 44 Ladies top 620630 7.52 10 13 13 15 17 26 57 Polo Shirt 610910 6.58 9 12 12 13 15 23 50 Suits (Men/Wo men) 620,319,62 0,312,620,0 00,000,000 195 263 268 291 343 514 1,131 Lingerie 610,821,62 1,210,610,0 00 621112 12 16 17 18 21 32 70 150 Swimwear Cardigans Kidswear 611,030,61 1,019 620920 9.27 13 18 18 19 23 34 75 10 15 20 26 27 29 34 51 113 4 5 7 7 8 9 14 30 Tapping the kidswear market The Brazilian Institute of Geography and Statistics (IBGE) reports that around five babies are born per minute in Brazil. Taking into consideration this Brazilian market research, a middleclass family spends approximately US$3,000 for baby clothing alone for the first year of the child's life. In Brazil, the market for maternity, babies and children's products and services is developing rapidly. Hence, Brazilian suppliers are aware of this opportunity and they want to grasp and take hold of this niche market. They are now increasingly focused on launching specialized stores, offering innovative products and brands to sell exclusively in Brazil. In 2012, imports of kidswear amounted to USD 17.6 million, predominately from China, India, Bangladesh and Paraguay. China is the leading market for kidswear with a share of 77.2% in Brazil Babies imports. Brazil’s import of kidswear from China has increased over the 2008-2012 period by 33%. With around 9.7% share of Brazil’s total imports, India is the second most important market for Brazil’s imports of kidswear after China. Table showing the landing costs and selling price of Mauritian Kidswear. Product Kidswear HS Code 620920 Fob Price 4 Price CIF (+20%) Customs Duties COFINS (Contribution to the Financing of Social Security Tax) 9% ICMS (Merch andise Tax) 35% PIS (Contribution to the Social Integration Program Tax) 2% 18% Profit and Operatin g costs 50% 50% 30% USD USD USD USD USD USD 5 7 7 8 9 14 Selling Price R$ 30 Mauritian kidswear selling at R$ 30 will definitely be competitive among the middle to up market stores. Knitwear The South concentrates the largest number of companies that manufacture knitwear in the country. The region’s states are responsible for 50.2% of total knitwear production in Brazil and there is huge investment in automation and technology, subsequently Brazilian knitwear is very competitive. Apart from normal retail channels there are a very large number of people in the informal economy selling knitted garments into smaller retail stores at very low prices In addition major local designers brands such as Doiselles sells though high end Boutiques throughout Brazil at prices around R$400. Renner woollen garments retail for R$19-R$100+ We have identified 3 importers of woollen garments: Kraus, Malise Malhas and St Clare. Table showing the landing costs and selling price of Mauritian Cardigan. Product Cardigans HS Code 611,030,61 1,019 Fob Price 15 Price CIF (+20%) Customs Duties COFINS (Contribution to the Financing of Social Security Tax) 9% ICMS (Merch andise Tax) 35% PIS (Contribution to the Social Integration Program Tax) 2% 18% Profit and Operatin g costs 50% 50% 30% Selling Price USD USD USD USD USD USD R$ 20 26 27 29 34 51 113 R$ Mauritian cardigans selling at R$ 113 will be competitive among the mid and up-market retails stores. Women’s Blouses Marisa shows a huge selection of ladies tops (700) ranging from R$9 to R$60 spanning beachwear, daywear and evening wear in dozens of styles and fabrics. The highest priced item is R$69 which defines the C category to a large extent. The largest single categories are manga curta – shortsleeved and regatta (beachwear) Apart from own label products C and A also sells specially commissioned designs from outside designers such as Adrianna Barra with prices ranging from R$80-R$260. C and A utilises several outside designers in this way. Renner Jackets and Tops in various materials range from R$80-R$260. Women’s Skirts / Dresses Marisa prices for Women’s skirts vary from R$13 the cheapest to R$80 the most expensive, in a huge variety of styles, fabrics, colours and jeans from Sawaray in a variety of styles all around R$100 Renner skirts in a variety of materials range from R$30-R$180 designs – mostly lightweight, By contrast C and A prices range from R$40-$299. Marisa also commissions. Menswear The menswear market includes men’s activewear, casualwear, essentials, formalwear, suits and trousers, formalwear-occasion and outerwear. The market is valued at retail prices. All currency conversions were carried out using constant average 2010 exchange rates. The Brazilian menswear market is expected to generate total revenues of $15.1 billion in 2011, representing a compound annual growth rate (CAGR) of 7.3% between 2007 and 2011. Sales through Clothing, Footwear, Sportswear and Accessories Retailers accounted for 66.1% of the market while sales through Department Stores accounted for 21.7%. The performance of the market is forecast to decelerate, with an anticipated CAGR of 6.9% for the five-year period 2011 - 2016, which is expected to drive the market to a value of $21.1 billion by the end of 2016. Jeans Mauritian Jeans were found to be of good quality and the price is competitive. For example, a denim trouser costing Fob USD 15 will easily be competitive among in Ellus stores since its retail selling price of similar jeans is USD 100.