Quiz Question for Module 11

advertisement

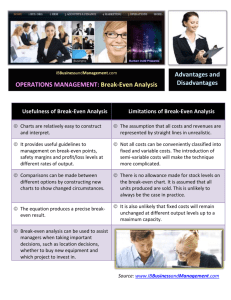

QUIZ MODULE 11 1. On a break-even chart, the fixed cost line is: a. b. c. d. 2. A break-even chart has been set up to show the current break-even point. Due to an increase in the price of raw materials, the variable cost per unit has increased. Assume all other costs and the selling price per unit remains constant. How does this change in the variable cost per unit affect the break-even chart? a. b. c. d. 3. parallel to the x-axis @ Correct.(See Chapter 6, Section 6.1B, Break-even charts) parallel to the y-axis @ Incorrect.(See Chapter 6, Section 6.1B, Break-even charts) has a positive slope @ Incorrect.(See Chapter 6, Section 6.1B, Break-even charts) has a negative slope @ Incorrect.(See Chapter 6, Section 6.1B, Break-even charts) The y-intercept of the total cost line increases @ Incorrect.(See Chapter 6, Section 6.1B, Break-even charts) The slope of the total cost line increases. @ Correct.(See Chapter 6, Section 6.1B, Break-even charts) The break-even point in units decreases. @ Incorrect.(See Chapter 6, Section 6.1B, Break-even charts) The y-intercept of the total cost line decreases. @ Incorrect.(See Chapter 6, Section 6.1B, Break-even charts) The contribution rate is a. b. c. d. The unit selling price as a fraction of the contribution margin @ Incorrect. (See Chapter 6, Section 6.2B, Contribution Margin and Rate) The fixed costs as a fraction of the unit contribution margin @ Incorrect. (See Chapter 6, Section 6.2B, Contribution Margin and Rate) The fixed costs as a fraction of the contribution rate @ Incorrect. (See Chapter 6, Section 6.2B, Contribution Margin and Rate) The contribution margin as a fraction of the unit selling price @ Correct. (See Chapter 6, Section 6.2B, Contribution Margin and Rate) 4. Consider the following data related to the production of an electronic gadget. The sales price is $20 per unit. The variable cost per unit is $15, and fixed costs are $85 000. Find the break-even point in units. a. 4250 @ Incorrect. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) b. 5667 @ Incorrect. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) c. 17 000 @ Correct. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) d. 15 567 @ Incorrect. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) 5. J.B. Lincoln, Ltd. produces a DVD player. Fixed costs are $360 000. The variable cost per unit is $58, and the selling price per unit is $84. Find the contribution rate per unit. a. 31% @ Correct. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) b. 69% @ Incorrect. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) c. 15% @ Incorrect. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) d. 85% @ Incorrect. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) 1 6. Johnson, Ltd. produces a desk lamp. Fixed costs are $280 000. The variable cost per unit is $17, and the selling price per unit is $35. Find the break-even point in terms of sales dollars. a. $15 556 @ Incorrect. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) b. $544 444 @ Correct. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) c. $264 452 @ Incorrect. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) d. $279 982 @ Incorrect. (See Chapter 6, Section 6.1C, Computing Break-even using formulas) 7. A plant produces small TV sets. The plant has a capacity of 24 000 units. Fixed costs are $320 000. The selling price is $128 per unit, and the variable cost is $88 per unit. Find the break-even point as a percent of plant capacity. a. 15.15% @ Incorrect. (See Chapter 6, Section 6.1D, Calculating Break-even when the unit prices and unit costs are unknown.) b. 10.42% @ Incorrect. (See Chapter 6, Section 6.1D, Calculating Break-even when the unit prices and unit costs are unknown.) c. 21.33% @ Incorrect. (See Chapter 6, Section 6.1D, Calculating Break-even when the unit prices and unit costs are unknown.) d. 33.33% @ Correct. (See Chapter 6, Section 6.1D, Calculating Break-even when the unit prices and unit costs are unknown.) 8. The variable costs on a new product will be $40 per unit and the fixed costs are estimated to be $4800. The selling price of the product is to be $75 per unit. What is the contribution margin? a. $15 @ Incorrect. (See Chapter 6, Section 6.2A, Contribution Margin) b. $75 @ Incorrect. (See Chapter 6, Section 6.2A, Contribution Margin) c. $60 @ Incorrect. (See Chapter 6, Section 6.2A, Contribution Margin) d. $35 @ Correct. (See Chapter 6, Section 6.2A, Contribution Margin) 9. Merit, Ltd. manufactures a remote control device. The device sells for $25 per unit. The current fixed costs are $75 000 and the current variable cost per unit is $10. Find the new break-even point in units if fixed costs increase by 20%. The other values stay the same. a. 6000 @ Correct. (See Chapter 6, Section 6.3, Effects of changes to Cost-Volume-Profit) b. 5000 @ Incorrect. (See Chapter 6, Section 6.3, Effects of changes to Cost-Volume-Profit) c. 5770 @ Incorrect. (See Chapter 6, Section 6.3, Effects of changes to Cost-Volume-Profit) d. 9000 @ Incorrect. (See Chapter 6, Section 6.3, Effects of changes to Cost-Volume-Profit) 10. Total variable costs are $58 750 when total sales revenue is $124 396. Find the break-even point in sales dollars if fixed costs are $424 000. a) $803 460 @ Correct. (See Chapter 6, Section 6.1D, Calculating Break-even when the unit prices and unit costs are unknown.) b) $902 128 @ Incorrect. (See Chapter 6, Section 6.1D, Calculating Break-even when the unit prices and unit costs are unknown.) c) $656 460 @ Incorrect. (See Chapter 6, Section 6.1D, Calculating Break-even when the unit prices and unit costs are unknown.) d) $362 250 @ Incorrect. (See Chapter 6, Section 6.1D, Calculating Break-even when the unit prices and unit costs are unknown.) 2