2016_Travelers_Actuarial_Contest_-_Prompt

advertisement

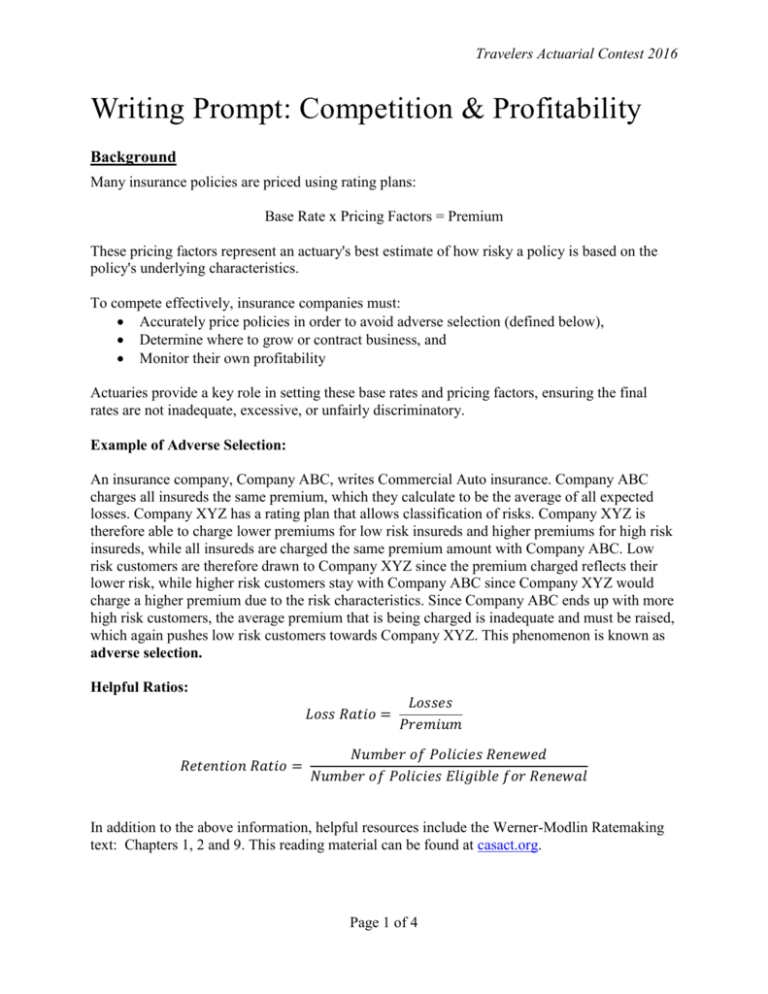

Travelers Actuarial Contest 2016 Writing Prompt: Competition & Profitability Background Many insurance policies are priced using rating plans: Base Rate x Pricing Factors = Premium These pricing factors represent an actuary's best estimate of how risky a policy is based on the policy's underlying characteristics. To compete effectively, insurance companies must: Accurately price policies in order to avoid adverse selection (defined below), Determine where to grow or contract business, and Monitor their own profitability Actuaries provide a key role in setting these base rates and pricing factors, ensuring the final rates are not inadequate, excessive, or unfairly discriminatory. Example of Adverse Selection: An insurance company, Company ABC, writes Commercial Auto insurance. Company ABC charges all insureds the same premium, which they calculate to be the average of all expected losses. Company XYZ has a rating plan that allows classification of risks. Company XYZ is therefore able to charge lower premiums for low risk insureds and higher premiums for high risk insureds, while all insureds are charged the same premium amount with Company ABC. Low risk customers are therefore drawn to Company XYZ since the premium charged reflects their lower risk, while higher risk customers stay with Company ABC since Company XYZ would charge a higher premium due to the risk characteristics. Since Company ABC ends up with more high risk customers, the average premium that is being charged is inadequate and must be raised, which again pushes low risk customers towards Company XYZ. This phenomenon is known as adverse selection. Helpful Ratios: 𝐿𝑜𝑠𝑠 𝑅𝑎𝑡𝑖𝑜 = 𝑅𝑒𝑡𝑒𝑛𝑡𝑖𝑜𝑛 𝑅𝑎𝑡𝑖𝑜 = 𝐿𝑜𝑠𝑠𝑒𝑠 𝑃𝑟𝑒𝑚𝑖𝑢𝑚 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑃𝑜𝑙𝑖𝑐𝑖𝑒𝑠 𝑅𝑒𝑛𝑒𝑤𝑒𝑑 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑃𝑜𝑙𝑖𝑐𝑖𝑒𝑠 𝐸𝑙𝑖𝑔𝑖𝑏𝑙𝑒 𝑓𝑜𝑟 𝑅𝑒𝑛𝑒𝑤𝑎𝑙 In addition to the above information, helpful resources include the Werner-Modlin Ratemaking text: Chapters 1, 2 and 9. This reading material can be found at casact.org. Page 1 of 4 Travelers Actuarial Contest 2016 Business Problem Overview A.) Rating Plan: Given a rating plan (base rate and pricing factors for the levels of 4 variables), along with data regarding premiums and losses, you are asked to determine which pricing factors to change in the rating plan, and by how much. As you determine which factors to adjust, think about what your goal is. Is it to turn an unprofitable segment into a profitable one? Grow in a certain area? Capture overall market share? Consider how your adjustments will accomplish this goal. Additional data concerning policy retention and new business is provided to help you think about where you may be more/less competitive in keeping policies you have or in attracting new ones. B.) Additional Consideration: Because you know that decisions around changing rating plans are rarely as straightforward as they appear here, you’re going to use this opportunity to also explore ONE additional facet of insurance as it relates to your task (choices are on page 3). Objectives Management has asked you to do an analysis on the rating plan and develop a strategy for the business going forward (detailed in the writing prompt above). They have requested an executive summary (between 2-6 pages) that highlights your findings and recommendations and includes appropriate support. Please see below for the specific information they would like you to address. A. Rating Plan 1. Describe, using the data, how your company has been performing in commercial auto along the different dimensions given, and identify areas for improvement. 2. Develop a goal for your company and explain your strategy to achieve that goal. 3. Update your company's rating plan factors. You are limited to changing 8 values within the ranges specified in the data summary below. These changes, along with the goal they support, should be documented and submitted along with your written response using the form in Appendix A. 4. Describe the changes you proposed and, using the data given, explain the reasons behind those changes and how you expect those changes to impact your company in the future. B. Additional Consideration 1. Fully research only ONE of the actuarial/insurance topics listed on page 3 and convey your findings. Be sure and tie this topic to your strategy and rating factor changes. ** It may be beneficial to approach your written response as a memo to senior management about your recommended course of action, instead of a standard written essay. You should provide background and support for your proposal, but avoid unnecessary items that may distract readers from your main points. ** Page 2 of 4 Travelers Actuarial Contest 2016 Additional Considerations (Choose ONE and integrate it into your response) Regulation: Discuss insurance regulation and the role of state insurance regulators in the process of changing your rating plan. Reinsurance: What’s the risk of growing unprofitably or entering a new line of business? Discuss reinsurance and how it could be implemented. Investment Income: Discuss investment income and how it contributes to insurer profitability, with specific attention to how it’s generated and how it relates to different lines of business. Components of Premium: You did not consider expenses or profit in this case, but how do they factor into insurance pricing? What are some additional components of premium? Evaluation Your response will be evaluated based on your performance in the following areas: Category Quantitative: Data Analysis Qualitative: Strategy and Research Written Response Description Correct interpretation of the data and reasonable recommendations/decisions based on that interpretation Knowledge of issues affecting insurance profitability, company strategy, competition in the marketplace and insurance in general, including response to the additional consideration Effectiveness of written response, including clarity of communication and exhibits, proper use and citation of sources and overall organization/layout Data Summary (provided in separate Excel file) A rating workbook with a sample premium calculation (Tab: “Appendix B – Current Class Plan”) Summaries of premium, loss, retention and new business by variable/level (Tab: “Appendix C – Data Summaries”) Notes on the Data: Data provided is simulated. The data does not reflect the actual experience of The Travelers Companies. For the purpose of this auto data, assume a loss ratio under 0.65 implies profitability. The remaining percentage of premium pays fixed and variable expenses that your company incurs. Your numeric changes may take on any value you wish, but may not be less than half or more than double the original value. Page 3 of 4 Travelers Actuarial Contest 2016 Appendix A Name: ____________________________ School: __________________________ Enter proposed factors in the spaces below: Maximum of 8 factors/base rate changes New factor must not be less than half or more than twice the original All factors should be rounded to two decimal places Goal (Briefly describe your goal in making your selections): ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ Additional Consideration chosen (title): __________________ Variable Factor Current Proposed 710.00 Name Base Rate Level All Financial Health Financial Health Financial Health Financial Health Financial Health Very_Bad Bad Average Good Excellent 1.23 1.08 1.03 0.98 0.74 Company Size Company Size Company Size Small Medium Large 1.04 1.00 0.90 Industry Industry Industry Industry Contractor Restaurant Office Store 1.14 1.14 0.95 0.86 Vehicle Type Vehicle Type Vehicle Type Vehicle Type Vehicle Type Vehicle Type Vehicle Type Sedan Coupe Wagon Truck Van Hatchback SUV 0.93 0.93 0.93 1.03 0.98 0.93 1.09 Page 4 of 4