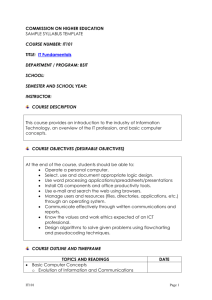

Market Analysis Report

advertisement