The Structure of Retirement Income

advertisement

The Structure of Retirement

Income

Advanced Workshop

CAIFA Vancouver

November 1, 2001

Daryl Diamond CFP CLU CHFC

Diamond Retirement Planning Ltd.

www.personalfinanceseries.com

Login:

advisors

Password:

primeapproach

Today’s Presentation

1.

2.

3.

4.

What is different from six years ago?

The structure of retirement income

Developing a process to attract clients

Touch on today’s investment climate

Things you can use with clients

Above all else…

to accomplish the above without putting

you into a coma

Today’s Business Realities

GIC harvest is over

Banks /C.U.’s have

planners

Fund industry sales

Difficult markets

DSC out of favor

More demanding

clients?

Retirements

Termination/severance

Inheritance

Life insurance proceeds

Attracting existing

portfolios

Five Stages of Retirement Planning

1

2

3

4

5

Accumulation

Positioning

Income Structure

Disposition

Distribution

Three Significant Timing Points

1 Point of independence

2 Point of realization

3 Point of consolidation

The Point of Independence

That juncture where an individual’s assets

and benefits can create an ongoing income

stream that would allow them to discontinue

employment.

It is at this point that an individual can make

an election to “Trade money for time”

The Point of Realization

That juncture when an individual (couple)

realizes the following;

We should get some help with this and really

see how it is going to look when we retire.

We need to find someone who can pull all of

this together for us.

Point of Consolidation

Where action is taken after the point

of realization has been reached

Becoming “The Consolidator”

• You must be the one they trust

• Help them define what it is they want

• Be aware of the issues that are significant

to and unique to this market

• Provide advice on other income sources

Becoming “The Consolidator”

•

•

•

•

Be technically competent

Be able to integrate all sources of income

Illustrate and communicate your plan

Understand that income structure is only

one facet of income planning

The Planning Process

Initial meeting and assessment

1.

2.

3.

4.

5.

6.

Gathering data

Establishing client objectives & priorities

Identification of issues and opportunities

Preparation of alternatives and recommendations

Implementation of chosen alternatives

Monitor and review

The Four Planning Channels

1.

2.

3.

4.

Income Structure

Investment Portfolios

Health Risk Management

Wealth Transfer

Structural

Plan

Investment

Portfolio

Health Risk

Management

Wealth

Transfer

The Two Factors

… From Two Perspectives

Accumulation

Risk

Return

Retirement

Income

Risk

Return

In the retirement market, there is an incredible opportunity

in risk analysis / risk management

Managing Risk

Protecting income producing assets

Capital Loss

Investment Loss

Purchasing Power Loss

Health Related Loss

Tax Loss

Changing Factors

Male Age 65

Year

Life Expectancy Income Factors

1965

7.5 Yrs

1975

10 Yrs

1985

14 Yrs

Today

17.5 Yrs

2010

20 + Yrs

Only a few retirement years to fund

CPP commences

Appreciating real estate values

High nominal interest rates

Excessive taxation

Excessive Government borrowing

None of the above apply in the

same manner

Issues and Assets

Issue

Retirement Age

Life Expectancy

Lifestyle Expectations

Taxation

Inflation

Family Complications

Wealth Transfer

Forecast

earlier

_______

longer

_______

better

_______

greater

_______

present

_______

possible

_______

important

_______

Impact

more

_______

more

_______

_______

more

more

_______

more

_______

_______

_______

more

Potential Clients

•

•

•

•

Parents of existing clients

Educational seminars

Mining group accounts

Referrals

Retirement Income Planning

Defined

Creating and implementing a plan that will

deliver what clients want by making the

most efficient use of their assets and

benefits.

Retirement Income Planning

Defined

Creating and implementing a plan that will

deliver what clients want by making the

most efficient use of their assets and

benefits.

Income Basics

•

•

•

•

•

What are my priorities

How much income do I want / need?

How long will I require this?

From where should I draw my income?

General issues and considerations

INITIAL CONSIDERATIONS

It’s Net Income That Counts

Emp.

4,000

Gross Income

Deductions

Combined Fed.&

Prov. Taxes

962

CPP

110

E.I.

78

Group Benefits

72

Pension @ 4.5%

180

Parking

125

Group RRSP

200

Net Income

2,273

Ret.

@ 65

2,500

494

0

0

0

0

0

0

2,006

Difference

1,500 (-37.5%)

267 (-11.7%)

1. How Do Income Needs Change?

1. You now have 100% leisure time expenses

2. Business/work expenses disappear

3. Group benefits disappear (health, dental, life insurance)

4. From payroll to ‘drawing upon assets’

5. No longer in ‘savings mode’

2. Our Retirement Expectations

1. More fulfilling

2. Longer life expectancy

3. Stay healthier longer

4. Question stability of government programs

5. View retirement as the start of a new phase v/s ‘The

End’

3. General Issues

Defining “retirement”

Working after you retire

Where are you going to live?

What is the state of health?

4. Determining Your Income

Level

• Percentage of pre-retirement income

• Budget approach

– After-tax

– Household

• Reduction at some point

• Survivor income needs

Additional Considerations

• Will there be any debt / mortgage to service

at the time of retirement?

• Is there a desire / need for additional

income in the early years?

• Are there any major purchases to be made

at the time of retirement?

• Do we need cash flow for risk management

premiums?

Varying Income Needs

Different

objectives

Do more things earlier

Don’t need same income all the way through

Difference between life expectancy and years

of good health

The Prime Approach To

Your Retirement Years

That period of time between

when you commence “retirement”

and

the moment that one of you

needs care or passes away

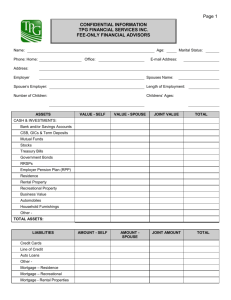

Information Gathering

Formal “Data Gathering” process

Investor profile

Details of investments, RRSP’s pensions,

Government Benefits

Most recent income tax return

Revenue Canada Notice Of Assessment

Life, disability, C.I. or health plan contracts

Copy of will, POA, trust agreements etc.

Advisor’s checklist

Establishing Your Priorities

Rank the following in terms of their importance to you

• Income security

The Older You Become,

The Longer You Will Live

Current

Age

55

60

65

70

75

Average Life Expectancy

Men

Women

81

86

82

87

83

88

84

88

86

89

Establishing Your Priorities

Rank the following in terms of their importance to you

•

•

•

•

•

Income security

Highest possible income today

Coping with inflation

Estate transfer

Using capital assets

Asset Usage

A) No Income

Grow assets instead

Income

producing

assets

B) Some Income

Keep asset values

constant

C) Max Income

Age

Life

expectancy

Deplete assets

Establishing Your Priorities

Rank the following in terms of their importance to you

•

•

•

•

•

Income security

Highest possible income today

Coping with inflation

Estate transfer

Using capital assets

• Health risk management

Years Of Good Health At Age 65

Life

Expectancy

Good

Health

Male

15

8

Female

19

9

Establishing Your Priorities

Rank the following in terms of their importance to you

•

•

•

•

•

•

•

Income security

Highest possible income today

Coping with inflation

Estate transfer

Using capital assets

Health risk management

Tax Reduction

Taxation Of Income

Taxable Income

Federal Tax

Combined

Marginal*

$0 - $30,754

0 + 16%

25.7%

$30,755 - $61,509

$ 4,920 + 22%

36.8%

$61,510 -$100,000

$11,685 + 26%

42.5%

$100,000 and over

$21,692 + 29 %

46.8%

* Average provincial rate

What You Keep On Your Investments

For each $1,000 taxable

Taxable Income

<$30,755

>$30,754

Interest

$743

$632

Dividends

$846

$707

Capital Gains

$871

$816

Marginal rates using average provincial rate

The “Age Credit”

• To qualify you must be age 65 or over by

the end of the calendar year

• Serves as a credit against Federal tax

• In 2000, net income greater than $26,284

reduces credit by 15% and is eliminated by

net income of $49,284

• Is transferable

The Pension Income Credit

• $160 Federal credit applies to the first $1,000 of

eligible periodic income

– Pension income at any age or after age 65

• LIF / LRIF payments

• RRIF or registered annuity payments

• Taxable portion of a non-registered annuity including

deferred annuities

or where you are the surviving spouse of someone who was

claiming the credit

• Is transferable

A Tax Checklist

•

•

•

•

Withholding tax amounts

Form of investment income

Making use of lower tax brackets

Splitting income where possible

Income

{

Personal

savings

Sources

Income

from other

investments

RRSP Income

(RRIF’s, Annuities

{

Employer pension

{

Canada Pension Plan (CPP)

Employee

benefits

Government

benefits

Old Age Security (OAS)

Early Receipt of CPP

Age

60

61

62

63

64

Months

Early

60 mos

48 mos

36 mos

24 mos

12 mos

Present

decrease

@ 1/2% per

month

70%

76%

82%

88%

94%

Monthly

payments

$70.00

$76.00

$82.00

$88.00

$94.00

Monthly

decrease

$30.00

$24.00

$18.00

$12.00

$6.00

Payments

prior to 65

$4,200

$3,648

$2,952

$2,112

Make up

time in

months

140

152

164

176

188

Make up

time in

years

11.66

12.67

13.67

14.67

15.67

79

80

81

Breakeven

point at

age

77

78

$1,128

Income

{

Personal

savings

Sources

Income

from other

investments

RRSP Income

(RRIF’s, Annuities

{

Employer pension

{

Canada Pension Plan (CPP)

Employee

benefits

Government

benefits

Old Age Security (OAS)

Reading Your Pension Statement

• Shows amount of monthly income earned to

date of statement …

• Payable at age 65 - NRD

• Normal form of income - single life guar 5

• Expect a basic reduction of 10% - 15%

• D.B. restrictions at age 55

Shopping For Your Annuity

Male 65 Female 62 Joint G15, $100,000

1.

2.

3.

5.

10.

15.

Sun Life

Equitable Life

Empire Life

Royal & Sun Alliance

Imperial Life

Great West Life

678.15

677.96

677.95

674.35

666.28

607.14

Source: Cannex Financial Exchange Limited

Pension / LIF

Income

$100,000 Male Age 65 - Female Age 62

Age

S G15

JL

65

765

678

615

70

765

678

653

75

765

678

696

79

765

678

734

G15

LIF*

* assumes 7% return

Pension / LIF

Estate Value

$100,000 Male Age 65 - Female Age 62

Age

S G15

JL

G15

LIF*

65

89,283

80,267

100,000

70

67,566

59,882

93,909

75

38,869

34,272

83,345

79

0

0

69,641

* assumes 7% return

Converting Locked-In Money

• Convert LIRA to LIF or LRIF

• Commence income on minimum w/d basis

• Difference between min & max can be

transferred to RRSP (CCRA T2030)

• Deduction offsets receipt (except for min)

• Direct transfer under 60 (I) (v) does not

affect RRSP contribution room

Income

{

Personal

savings

Sources

Income

from other

investments

RRSP Income

(RRIF’s, Annuities

{

Employer pension

{

Canada Pension Plan (CPP)

Employee

benefits

Government

benefits

Old Age Security (OAS)

RRSP / RRIF Income

•

•

•

•

•

•

Defer or commence

Taxation and control

RRIF or RRSP lump sums

Spousal RRSP considerations

Use of spouse’s age for min w/d

Stopping income streams

Capital Encroachment

Male 65 $100,000 5%

Interest only withdrawal

Age

65

72

75

80

85

90

Income

$5,000

$7,348

$7,075

$6,645

$6,219

$5,791

Balance

$100,000

$ 97,003

$ 89,085

$ 74,972

$ 59,380

$ 41,899

Income

{

Personal

savings

Sources

Income

from other

investments

RRSP Income

(RRIF’s, Annuities

{

Employer pension

{

Canada Pension Plan (CPP)

Employee

benefits

Government

benefits

Old Age Security (OAS)

Non-Registered Assets

•

•

•

•

GIC’s

Distributions from investment funds

Use of capital

Deferring taxation

Why SWP’s Work

C.I. Global

Year End Unit Price

1989

1990

1991

1992

1993

1994

1995

5.70

5.01

6.47

7.16

9.48

8.69

9.04

1996

1997

1998

1999

2000

YTD

9.38

10.38

12.02

16.48

15.84

10.78

LIF Investment Fund Selection

THE MONEY WEDGE

Fund A

Fund B

$40,159

$40,000

Fund G

$40,000

Money Market

$18,000

Fund C

Fund F

$30,000

Initial Value $228,159

$15,000

Fund E

$30,000

Fund D

$15,000

History Lesson

Don’t Miss The Recovery

Market

Top

Bear

Duration

May 46

Aug 56

Dec 61

Feb 66

Nov 68

Jan 73

Nov 80

Oct 87

Jul 90

Mar 00

38

14

6

8

18

21

21

4

3

Sep 21

Bear

Decline

30%

22%

28%

22%

36%

48%

28%

35%

20%

36%

Bull

Increase

267%

86%

80%

48%

73%

226%

233%

67%

427%

??

Non-registered capital

$3,000

per

month

RRIF

$1,800

$1,260

Non-registered

distrib. $200

Non-registered

distrib. $200

Non-registered

distrib. $200

OAS $515

CPP $540

Pension

$1,000

Age

58

Age

60

Age

65

$645

Order Of Income Structure

1 Government Benefits

2 Pension / Locked-In Assets

3 Taxable Non-RRSP Distributions

4 RRSP / RRIF Income

5 Non - Registered Capital

Income Allocation

Non-Reg

15%

Pension

45%

RRIF

20%

CPP / OAS

20%

The Investment Decision Process

Written financial plan

Objectives, risk

tolerance of investors

Risk/return characteristics

of asset classes

Long term

asset mix

Selection of Funds

Bonds/GICs/Annuities

Investment Policy Statement

Monitoring / Rebalance

Take profits

Steps In The Process

•

•

•

•

•

•

Determine priorities

Establish net income objective

Address survivor issues

Create fully taxable income as base

Use tax-efficient income at higher levels

Use least flexible assets first

Remember the “Golden Rule”

The person who advises on

“The Gold” ...

also advises on the insurance

needs

and solutions

Why We Are Worth 1% / Year

•

•

•

•

•

Increase investment returns by 1%

Save people 1% from mistakes

Save them time, stress, worry

Save them $_______ / yr in income taxes

Preserve 10’s - 100’s of thousands of $ in

estate value through conservation

• Provide continuity to spouse / heirs

Opportunity Knocks

Demonstrate your value as an advisor

People DO want to hear from you

Pick up existing accounts by having

a process

A great time to ask for referrals

Get more money into the market

While everyone else is hiding, get going

Positioning For The Future

•

•

•

•

Take on the role of a consultant

Have a written process for your clients

Use comprehensive planning

Become adept at Risk Analysis and

Management

• Specialize and develop strategic alliances

• Evolve your money practice in the direction

of asset-based compensation

www.personalfinanceseries.com