Cross-Border Resolution Conflicts

advertisement

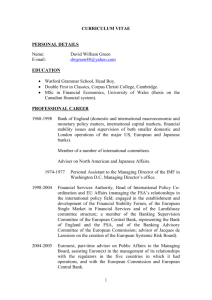

Appropriate structure for handling crisis management by Rosa María Lastra Professor of International Financial and Monetary Law Queen Mary University of London Joint FMG – CCLS Conference London, 30 January 2008 Introduction – A tale of greed and fear The trigger of the current financial crisis was the US Sub-prime mortgage market crisis. The major casualty so far in the UK has been Northern Rock, a classic banking crisis triggered by liquidity problems. The banking industry is inherently fragile and vulnerable to crises. The resolution of banking crises is always problematic, since often ‘gains are privatised and losses are socialised (Martin Wolf). Who is to blame for the current troubles in the financial World? Some would say that the mis-pricing of risk (Greenspan put) is the causa remota. Others would point to macro-economic imbalances. The focus of this conference is not to discuss how and why the crisis came about, but rather to analyse the regulatory response to the crisis. My presentation deals with the appropriate structure for handling crisis management. To this end I will discuss: The scope of bank crisis management Structure in the UK - The tripartite arrangement Role of the Bank of England (central banking role) Role of the FSA (role of regulators and supervisors) Role of HMT (fiscal authority & role of politicians) Cross-border considerations at the European level and internationally. 2 Lastra Scope of bank crisis management Bank crisis management at the national level comprises an array of official and private responses. Any structural review ought to take into account this multi-faceted reality: it is not possible to reform one part of the structure without considering the others. As regards the official responses, when confronted with failed or failing banks, public authorities have at their disposal: (1) The lender of last resort role of the central bank (2) Deposit insurance schemes (3) Government policies of implicit protection of depositors, banks (the ‘too-big-to-fail doctrine’) or the payment system (4) Insolvency laws (lex specialis vs lex generalis) (5) Prompt corrective action and preventive mesasures (PCA formal rules and other forms of prompt corrective action). 3 Lastra The UK structure – the Tripartite Arrangement 4 The Tripartite arrangement does not deal with all the aspects of bank crises management. It deals with (1) ELA and (3). The Tripartite arrangement is a good structure to respond to the problems of transferring supervision from the central bank (Bank of England) to a separate supervisory agency (FSA), while keeping the Treasury involved. However, the wisdom of separating the monetary and supervisory responsibility of the central bank remains a matter of controversy. This is a key ‘structural issue’. Given that supervision is a key instrument in the maintenance of financial stability, depriving the central bank of this instrument, makes the pursuit of the goal of financial stability more difficult. Why did the Tripartite arrangement fail in Northern Rock? Lack of effective and timely communication, apparent lack of a clear leadership structure, uncertainties surrounding the resolution procedures (questions of EU law, timing etc), an ill-designed deposit insurance system.... It needs reform. Lastra UK reform proposals It is anticipated that the FSA will be given new powers and that the tripartite arrangement will be reformed (FT Interview with the Chancellor, 3 January 2008). The UK Government is also ‘looking at insolvency law’ and considering improvements in the compensation scheme. The Government plans to introduce new legislation in May. However, the HC Treasury Select Committee in its recently published report (26 January 2008) “The Run on the Rock” suggests that the Bank of England should be given new powers. It recommends that a single authority – akin to the US FDIC - be created (the Deputy Governor of the Bank of England and Head of Financial Stability and a corresponding Office) with powers for handling failing banks (ch. 5) and the Deposit Insurance Fund (Ch.6). 5 Lastra Resolution procedures and deposit insurance in the UK DEPOSIT INSURANCE - Northern Rock exposed the deficiencies in the structure of deposit insurance in the UK. A credible deposit insurance system requires inter alia prompt payment of depositors and a reasonable amount of coverage (neither too meagre to be non-credible nor too generous to incur into moral hazard incentives). The Financial Services Compensation Scheme was set up under the Financial Services and Markets Act 2000 (FSMA) as the UK’s compensation fund of last resort for customers of financial services according to the Directives on Deposit Guarantee Schemes and Investor Compensation Schemes. FSCS has no real ‘powers’ as opposed to FDIC in the US insurer, supervisor and receiver of failed or failing institutions. 6 RESOLUTION PROCEDURES - Northern Rock exposed the deficiencies of the UK regime to deal with banks in distress. With regard to bank resolution procedures, prevalence should be given to prompt resolution and market solutions, while maintaining access to critical banking functions in a crisis. Shareholders should bear losses. The Treasury Select Committee (January 2008 Report) recommends a special resolution regime. PRE-INSOLVENCY PHASE - The efficiency of bank insolvency law and procedures would be greatly enhanced - in terms of minimising cost to taxpayers by the adoption of a system of a formal system of prompt corrective action (akin to FDICIA), linking the intensity of supervision to the level of capitalization. The Treasury Select Committee sees great merit in the adoption of PCA Lastra Cross-border considerations – the European dimension The appropriate structure to handle crisis management cannot ignore cross-border issues. Though regulation and supervision remain nationally based, financial markets have grown international, and hence the structure at the EU and international level must be reformed, too. Though the ECB has so far successfully provided liquidity to the market (in recent months) to alleviate the ‘credit squeeze’, the structure for managing and resolving a cross-border financial crisis in the EU is, in my opinion, inappropriate. Cross-border crisis management in Europe presents additional challenges for policy-makers and regulators, because of: European Monetary Union. The ECB has no European fiscal counterpart, which means that the relevant fiscal authorities are by definition at the national level. 7 Supervision remains at the national level - process of financial integration, the single market in financial services - the ‘trilemma’ The ‘patchy’ and scattered legal framework The complex ‘European Financial architecture’ Lastra European financial architecture Lamfalussy framework ECOFIN European Parliament LEVEL 1 European and Financial Committee EFC Framework directives (co-decision) EUROPEAN COMMISSION ECB Financial Services Committee 8 Level 2 European Securities Committee (ESC) Banking Securities & UCITS Level 3 Committee Of European Banking Supervisors (CEBS) London Level 3 Committee of European Securities Regulators (CESR) Paris Level 2 European Insurance & Operational Pensions Committee (EIOPC) Insurance & pensions Level 2 European Financial Conglomerates Committee •Comitology Financial conglomeratesss Level 3 Committee of European Insurance and OccupationalPensi on Supervisors (CEIOPS) Frankfurt Lastra LEVEL 3 Banking Supervision Committee Level 2 European Banking Committee (EBC) LEVEL 2 Secondary legislation The trilemma of financial supervision (Thygesen & Schoenmaker) Stable financial system National financial supervision Integrated financial market 9 Lastra A patchy and scattered legal framework 10 Primary Law: article 105 EC Treaty and Articles 18 and 25 ESCB Statute LOLR & rules on state aid - Articles 87-89 EC Treaty. Secondary law (pursuant to Art 47 (2) EC Treaty): Directive 2006/48/EC of the European Parliament and of the Council relating to the taking up and pursuit of the business of credit institutions (‘Recast Banking Directive’). Dir 2006/49/EC, ‘Capital Requirements Directive’ Directive 2003/6/EC, ‘Market Abuse Directive’. Dir 2002/87/EC, ‘Financial Conglomerates Directive’ Directive 2001/24/EC on the reorganisation and winding up of credit institutions. Directive 2004/39/EC on markets in financial instruments (‘MiFID’) Dir 94/19/EC,‘Deposit-Guarantee Schemes Directive’. Dir 97/9/EC, ‘Investor Compensation Schemes Dir.” MoUs (non-legally binding arrangements) – 2001, 2003, 2005 Lastra Reform in the EU – recent proposals 11 ECOFIN conclusions October 2007 calling for an enhancement of the arrangements for financial stability in the EU (co-operation (?) and review of the tools for crisis prevention, management and resolution 2007-9) To revise the Winding Up Directive - Public consultation on the reorganization and winding up of credit institutions by the EU Commission (http://ec.europa.eu/internal_market/bank/windingup/i ndex_en.htm <http://ec.europa.eu/internal_market/bank/windingup/i ndex_en.htm To clarify the Deposit Guarantee Directive ECOFIN conclusions December 2007 calling for a review of the Lamfalussy framework (half-baked solution?) Towards a single regulator???? Lastra Cross-border considerations – the international dimension The IMF surveillance function (akin to supervision at the national level) ought to be strengthened to detect incipient financial tensions and vulnerabilities in international capital markets. New rules (regulation) are needed to deal with crossborder bank insolvency. The Basel Committee has established a working group (December 2007) to study the resolution of cross-border banks. The cross-border dimension was echoed in an article (Ways to Fix the World’s Financial System) by Gordon Brown published in FT 25 Jan 2008: “As financial markets become increasingly interlinked, countries must ensure they have robust and effective cross-border crisis management arrangements…The IMF should be at the heart of this reform…[with clearer responsibilities for financial stability]”. 12 Lastra Concluding observations Protection justifies regulation (preventive regulation) and supervision. The financial system has become very complicated. Complexity frustrates accountability Time is of the essence in any rescue operation. Central bank lending over an extended period of time is typically an indication of insolvency not of illiquidity. As the Chancellor stated with regard to the handling of the NR crisis (p. 80 of 2008 Jan report, “The run on the Rock”) in his appearance in front of the Treasury Select Committee: What you need is a legal framework… This framework – providing clarity, predictability and certainty – has a national dimension, but also a European and an international dimension 13 Lastra