Wife's non-marital property - Gunderson | Palmer | Nelson | Ashmore

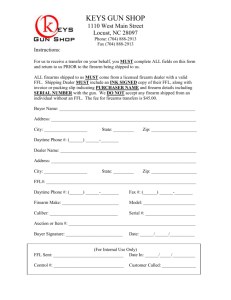

advertisement

BY REBECCA L. MANN the courts may make an equitable division of the property belonging to either or both, whether the title to such property is in the name of the husband or the wife. In making such division of the property, the court shall have regard for equity and the circumstances of the parties. Prenuptial Agreement Set it aside as “Non-marital” Property Have it Awarded to You in the Property Settlement -Husband’s nonmarital property -Wife’s non-marital property -Marital property Inherited and gifted property is not automatically excluded from the marital property Factors To Consider 1. Duration of Marriage 2. Value of the property owned by the parties 3. Ages of the parties 4. Health of the parties 5. Competency of the parties to earn a living 6. Contribution of each party to the accumulation of the property 7. Income producing capacity of the parties’ assets. So the ranch is in the marital property pile. Now what? The Court will make an “equitable” division of the property. Factors To Consider 1. Duration of Marriage 2. Value of the property owned by the parties 3. Ages of the parties 4. Health of the parties 5. Competency of the parties to earn a living 6. Contribution of each party to the accumulation of the property 7. Income producing capacity of the parties’ assets. Courts are very reluctant to Require a lump sum payment that Divide up the Ranch necessitates a sale of the ranch. HOWEVER An equitable property division is paramount to keeping the ranch intact. Usually with a right first refusal Award wife some landofbut require her Solves Have to cash agree flow and problem be ablewith to work buy out together option and/or anitoption tohusband. purchase to lease back to HERS HIS m Rebecca L. Mann Ready, Aim…Trust! Benefits of “Gun Trusts” Target Overview • What’s a “Gun Trust” • How is this applicable to you? – Own a NFA Firearm (Title II or “Class 3” weapons) for Personal use – Family or group use – Collectors – Antiques – Investment – Estate planning – You might already own a NFA Firearm – Know your opposition The National Firearms Act, et al • Special rules for certain “Firearms” – Weapons not illegal to own, just prohibitively-regulated – GCA of 1968; Firearm Owners’ Protection Act of 1986 – Individual states can be more restrictive. All Title II firearms are legal in South Dakota. • Penalties for Violations – Steep penalties for improper possession, transfer, inheritance, use… • Ex: family member, State lines – $250,000 – 10 years What is a NFA “Firearm?” Short Barreled Shotguns (“SBS”) |------- < 18 Inches --------| Not just for robbin’ stagecoaches. Example: protecting the chickens What is a NFA Firearm? Short Barreled Rifles (“SBR”) < 16 inches What is a NFA Firearm? Machinegun What is a NFA Firearm? Silencers What is a NFA Firearm? Any Other Weapon (“AOW”) What is a NFA Firearm? Destructive device Includes the following: Flare Gun + Bean Bag O.K. Explosive devices. Large caliber weapons. What is a NFA Firearm? Unserviceable firearm. An unserviceable firearm is a firearm that is incapable of discharging a shot by the action of an explosive and is incapable of being readily restored to a firing condition. Still a NFA Firearm. Antique Firearm. Firearms defined by the NFA as “antique firearms” are not subject to any controls under the NFA. Must meet both age (1898) and ammunition availability standards of the definition. Curios or relics. Curios or relics are firearms that are of special interest to collectors. Still a NFA Firearm. Owning NFA Weaponry Individually • Basic requirements: – – – – Live in a state where Class III weapons are legal US citizen 21 years old Never been convicted of a Felony or Domestic Violence – Never been dishonorably discharged from the military – Never been adjudicated mentally defective • Plus… Owning NFA Weaponry Individually • Local Requirements – First: “Chief Law Enforcement Officer” (CLEO) sign-off • Federal Requirements – Bureau of Alcohol, Tobacco, Firearms and Explosives – “ATF” – Form 1 or Form 4 – Finger prints – Personal photos – Transfer tax • Only individual can possess firearm – VERY restrictive • Estate Planning Owning NFA Weaponry in a Trust • • • • No Signature of local CLEO needed No fingerprints needed No personal photograph needed In the language of the ATF: – “Although transfers to natural persons (individuals) must include a recent photograph, duplicate fingerprint cards, and a certification from law enforcement, the NFA also defines a person to include a partnership, company, association, trust, estate, or corporation. The requirements for fingerprints, photographs, and the law enforcement certificate specified in § 479.85 are not applicable for transferee who is not an individual.” -NFA Handbook • However, the ATF has the authority to request a NICS background check of the trustee if they wish Bulls-eye Benefits of Gun Trusts • No CLEO signature, no fingerprints, no photos • Multiple people may use the firearm – Ownership can change with no transfer taking place • Advantages of a Trust over a Corporation, LLC, etc – Privacy, Cost • • • • • • Clear terms – Guidance Limit liability of co-trustees Incapacity Death Reducing the risk of changes in the law “DIY” is not a good idea – Quicken or Legal Zoom trusts have been declared invalid by ATF Patrick Goetzinger Presents HOT TOPICS Federal Estate Tax Mess in Congress & Recent Decisions Affecting Farmers & Ranchers DISCLAIMER These materials and this presentation are intended to provide the seminar participants with guidance in these topics of law. The materials and speaker’s comments do not constitute, and should not be treated as legal advice regarding the use of any particular technique or the tax consequences associated with any such technique. Although every effort has been made to assure the accuracy of these materials and comments at the seminar, the speakers and Gunderson, Palmer, Nelson & Ashmore, LLP do not assume responsibility for any individual’s reliance on the written or oral information disseminated during the seminar. Each seminar participant should independently verify all statements made in the materials and at the seminar before applying them to a particular fact situation, and should independently determine all risks and consequences of using any particular technique before recommending that technique. Rawhide Trust The Ultimate Retirement Plan for Farmers & Ranchers • Is it Possible… – To sell livestock & crops tax-free – Build a retirement fund beyond the reach of Death tax – Receive a current charitable deduction to offset other income – Receive an income stream for the life of both spouses – Defer taking income until you need it – Make a substantial gift to charity and; – Do all this without going to jail? • Yes, it is possible… – Form a NIMCRUT – Before going to market transfer a portion of crop or livestock via deed of gift to a NIMCRUT (paper trail is important) – Sales proceeds go directly to NIMCRUT tax free – Donor receives charitable deduction for a portion of cost basis in livestock/crop because it is an ordinary income asset – Let the principal compound because of the NIMCRUT feature DONOR ADVISED FUND The Workhorse of Your Charitable Giving Plan Directs: X% to Donor’s Favorite Charities Subject to CF’s Variance Power $ Donor Advised Fund Agreement Gifts Donor Annual Gifts in Donor’s Name SD Community Foundation $ Favored Charities Thank You for Attending Please fill out the Attendee Contact Card located in your GPNA green folder and place it in the BOX at the back of the room while you are walking to lunch. A drawing will be held for a SPECIAL PRIZE toward the end of the lunch session.