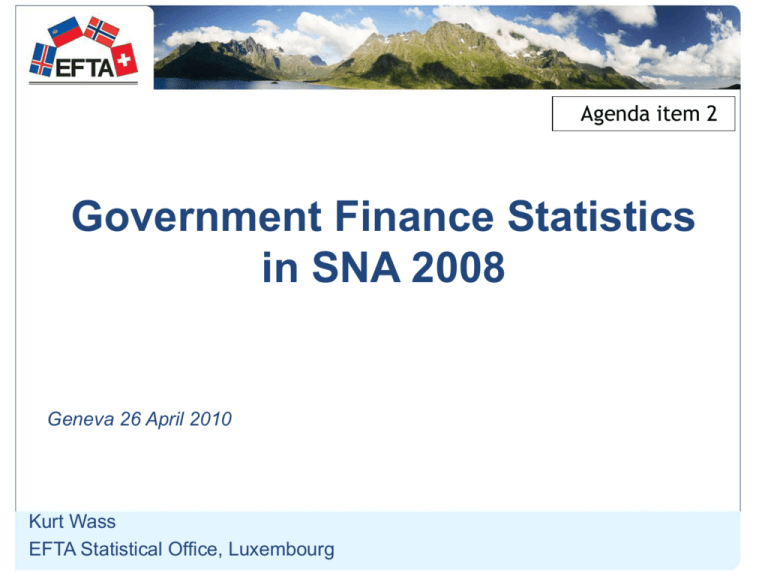

Financial presentation of the General Government

advertisement

Agenda item 2 Government Finance Statistics in SNA 2008 Geneva 26 April 2010 Kurt Wass EFTA Statistical Office, Luxembourg Outline 1. Why dedicate a chapter to the General Government? 2. The General Government sector 3. Financial presentation of the General Government 4. Some accounting issues 1/1 • • • • • • Why dedicate a chapter to the General Government? 1/1 Policy Sector – directly instrumental for economic policy Different powers, motivation and functions Affects behaviour of other economic units The Public Sector Revision of SNA recognized the need to provide a presentation of government more suitable for finance analysts and policymakers 2. The General Government sector Entities Controlled by Public or Private Sector? Private Sector Public Sector Institutional Unit? No Yes Controlling Unit Market Producer? Yes Public corporation No General Government 1/4 2. The General Government sector • What is a market producer? – Economically significant prices • To what extent sales cover production costs • No clear quantitative threshold • “Market situation” 2/4 2. The General Government sector • The subsectors of the General Government Sector: – Central government (IMF: Budgetary and Extrabudgetary) – State government – Local government – Social Security (can be assigned to the other three subsectors) 3/4 2. The General Government sector • Borderline/difficult cases – – – – – Quasi-corporations Restructuring agencies Special purpose entities Joint Ventures Supranational authorities 4/4 3. Financial presentation of the General 1/3 Government Fundamental equations: (1) Transactions: Revenue Expense = Net operating Balance (impact on net wealth) Net acquisitions of non-financial assets = Net lending/net borrowing Outlays: Expense + Net acquisitions of non-financial assets 3. Financial presentation of the General 2/3 Government Fundamental equations: (2) Change in net wealth: Net wealth (t) + Transactions affecting net wealth (t+1) + Other economic flows (t+1) = Net wealth (t+1) - Financial presentation: combine (1) and (2) to establish an integrated (and consolidated) financial presentation Transactions Revenue Opening balance Net Worth Other economic flows Expense Closing balance = Net operating balance = Non Financial Assets Financial presentation of the General Government Net acq NFA Holding gains/ losses Other changes in volume = = NFA NFA = Net Worth = NFA = Δ Net Δ Net f.worth volume ch. Net financial worth = = = FA FA FA FA L L L L Net financial worth Net lending/ borrowing = = Financial Assets Liabilities f.worth hold.g/l 3/3 Some accounting issues • Taxes – clarification of recording • Interactions with non-resident governmenttype authorities • Debt issues • Interactions with the corporations sectors 1/1 Summary 1/1 • The new chapter 22 in SNA 2008: – clarifies sectorisation issues – brings a new integrated and consolidated financial presentation framework of the general government (and the public sector) – clarifies some specific accounting issues • The philosophy of national accounts remains: – the aim is to reflect economic realities rather than legal or administrative arrangements.