Appropriation Units & Appropriation Transactions * Non

advertisement

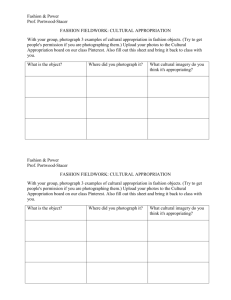

Appropriation Units & Appropriation Transactions – Non-Sponsored Accounts Appropriation Unit Coding Appropriation units are used to budget and account for revenue and expenses within an agency/org. Appropriation units are tied to a group of revenue and expenditure codes. Local accounts include all non-state accounts. Following is a table of all appropriation units: APPROPRIAITON UNIT CODE APPROPRIATION UNIT CODE NAME A All Other Operating Direct Cost of Sales Employee Related Expenses Student Support Personal Services Transfers-Out Deficit Carryforward Balance Forward Gifts and Grants D E F P O Z B G H I M T Interest Income Transfers-In Miscellaneous Revenue Tuition and Student Fees TRIF REVENUE/EXPENDITURE CODE TYPE OF AGENCY/ORG 73XX, 74XX, 75XX, 78XX, 79XX, 82XX 7010 Local Budgeted and State 7200 Local Budgeted and State 77XX 71XX Local Budgeted Local Budgeted and State 8001, 8002 8900 Local Budgeted Local Budgeted 5000 Local Budgeted 5310, 5320, 5330,5340, 5390 6212, 6215 6001, 6002 59XX Local Budgeted 52XX Local Budgeted Local Budgeted Local Budgeted Local Budgeted X State Appropriations 5100 State Revenue Accounts and Local Budgeted State Revenue Accounts and Local Budgeted State Revenue Accounts S Sales and Services Cash Basis 54XX, 55XX Local Budgeted All revenue & expense codes Cash Basis Local J C Revised 2/11/2013 5400 Page 1 Appropriation Units & Appropriation Transactions – Non-Sponsored Accounts Local budgeted and state agency/orgs are budgeted at the appropriation unit level and spending is controlled at the appropriation unit level. Cash basis accounts are not budgeted and spending is controlled based on the account ending balance. Appropriation Transactions Appropriation transactions are used to establish a budget for a new account or to modify a budget on an existing account. Annual Budget Process The Office of Planning and Budget coordinates the annual budget load process for non-sponsored accounts. Instructions for the budgeting process are available on the Office of Planning and Budget website. Budget changes may not be processed in Advantage until the original budget load in Advantage has been processed. Appropriation Transactions on Budgeted Local Accounts All local accounts with expenditures greater than $100,000 should be set up as budgeted accounts. In addition, all General Purpose Accounts, except for Research Incentive Distribution (RID) accounts are set up as budgeted regardless of the expenditure level. RID accounts are budgeted at the discretion of the department. Local budgeted agency/org appropriation changes may be transferred from one appropriation unit to another within the same agency/org. Local budgeted agency/orgs may also modify appropriations within the same agency/org to reflect a more accurate projection of forecasted revenues and expenses. Appropriation changes that result in an overall change in funding sources or uses require approval by the appropriate provost/vice provost/vice president. Academic units are also required to obtain dean’s office approval before routing to the provost/vice provost. Local agency/org appropriation changes resulting in an increase in the overall current year expenditure authority on agency/orgs receiving funding from general university sources require approval from the appropriate provost/vice provost/vice president as well as approval from the Office of Planning and Budget. Departments may utilize the Budget Change Worksheet to assist with budget change review and analysis. Departments setting up new budgeted local agency/orgs should submit a budget with the New Agency/Org Application to their Financial Services accountant. Appropriation Transactions on State Accounts Revised 2/11/2013 Page 2 Appropriation Units & Appropriation Transactions – Non-Sponsored Accounts State accounts are budgeted for Personal Services (P appropriation unit), Employee Related Expenses (E appropriation unit) and All Other Operating (A appropriation unit). Budgeted appropriations may be transferred from one stage agency/org to another state agency/org within the same campus. The following table illustrates appropriation transfers between appropriations units that are allowable and not allowable on state agency/orgs: STATE AGENCY/ORG APPROPRIATION TRANSFERS FROM TO Allowable/Not Allowable and Special Approvals Personal Services (P) Personal Services (P) Allowable Personal Services (P) All Other Operating (A) Allowable Personal Services (P) Employee Related Expenses (E) Not Allowable All Other Operating (A) Personal Services (P) Requires approval from the Office of Planning and Budget All Other Operating (A) All Other Operating (A) Allowable All Other Operating (A) Employee Related Expenses (E) Not Allowable Employee Related Expenses (E) Personal Services (P) Not Allowable Employee Related Expenses (E) All Other Operating (A) Not Allowable Employee Related Expenses (E) Employee Related Expenses (E) Allowable Instructions for Entering Appropriation Transfer Documents in Advantage Instructions for entering Appropriation Transfer Documents may be found in the Advantage Appropriation Transfer Instruction Booklet on the Advantage Help & Training website Cross Reference – For additional information see FIN 102-01 Appropriation Budget Changes For additional questions, contact your accountant in Financial Services. Revised 2/11/2013 Page 3