Budget Guidelines

advertisement

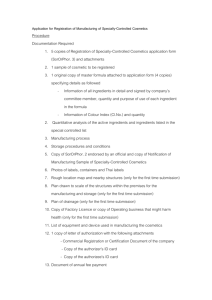

Fiscal Year 2015 - 2016 Budget Guidelines Budget Guidelines 2015-2016 Base Budget Review and Budget Submission Overview These guidelines are for use in preparing the base budget review documents and the final budget submission documents for the FY 2015/16 Operating Fund Budget. These budgeting documents include the following: 1. Base Budget Review– Department Detail, Department Summary, Division Summary 2. Budget Submission Form The FY 2015/16 Operating Fund Budget Allocations by Division schedule (distributed separately) reflects each division’s base budget, any FY 2015/16 budget changes (increases and/or reductions), and carryforward from FY 14/15. The final division 15/16 base budget review and budget submission must reconcile to these target numbers. Salaries The campus continues to follow the consistent methodology that all permanent employees must have a base budget established that is equal to their permanent salary. The Budget Office will be conducting a thorough analysis of the FY 15/16 division budget submissions to ensure that this methodology is being followed. Split Funding Salaries that are funded from various sources that can be distributed by percentages should be set up as a split funded position. The advantage of using this method is that it automatically distributes the salary and can be changed at any time prior to the effective payroll month. Distribution can be made between funds, departments, and program/class/project codes. This requires a PAN/ATF establishing the percentages for each chartfield string in the distribution. Retroactive split funded transactions cannot be done in the Labor Cost Distribution process and must be done by using the salary adjustment form. All personnel documents requiring split funding MUST come to the Budget Office. Salary Savings One-time salary savings is considered a source of funds that is available for other uses. Divisions determine whether savings will be used to offset other needs. University Budget Office Page 2 of 8 Updated June 2015 Budget Guidelines 2015-2016 Benefits Benefits are managed under one of the following: 1. Planning for staff supporting AE&SS initiatives also must include associated benefits according to the operational guidelines. The benefits amounts are transferred to the central benefit pool one-time each year. 2. Departments which receive student fees or user fees, which are considered self-support departments, are required to fund benefit costs for their employees. 3. All other staffing on payroll as of 6/30/15 is included in the 2015/16 Benefit Pool Projections. FY 2014/15 average benefit costs for faculty employees were 46% and average benefit costs for staff employees were 53%. It is recommended that grant proposals seeking replacement costs or stating matching costs use these percentage levels in projecting or reporting costs. Travel To help manage travel funds, specific planned expenditures for travel related costs should be included. The scope of travel costs includes event accommodations, destination travel costs, car rental, local mileage, parking, meals and incidentals. Travel includes in-state and out-of-state destinations and can be budgeted to reflect expected costs for the upcoming year. Travel budgets should use the following accounts: 606001 - Travel-In State 606803 - Travel-In State Student 606802 - Travel-Out of State Faculty 606002 - Travel-Out of State 606801 - Travel-In State Faculty 606804 - Travel-Out of State Student Registration Fees Registration fees should not be charged to 606xxx (in-state travel) or 606xxx (out-of-state travel), as these accounts are reserved for such costs as transportation, lodging and meals. Object codes to be used for registration fees: 660009 – Specialized Training : registration related to training programs 660858 – Other Professional Development: registration for an event without a training aspect (Continued) University Budget Office Page 3 of 8 Updated June 2015 Budget Guidelines 2015-2016 Equipment To help manage equipment funds, specific planned expenditures for equipment should be included. Equipment budgets should use the following accounts: 619001 – Equipment Other $2,500 - $4,999 619002 – Equipment Instructional less than $5,000 619801 – Equip Other greater than $5,000 619804 – Equip Instructional greater than $5,000 619805 – Equipment Other Vehicles 619807 – Equipment Course Instruction less than $5,000 619808 – Equipment Course Instruction greater than $5,000 Equipment Complements Each organizational unit is responsible for buying furniture and equipment for each new employee hired. In preparing your budget for new employees, we recommend you use the following cost estimates to provide funding for the following complements: Telephone equipment $360 includes installation $10.95 voice mail installation Computer equipment (includes software, networking, and support) New refresh contracts on 4-year refresh cycle: Apple Laptop with 27” external monitor, keyboard and mouse - $1,180 per year Apple laptop only - $950 per year Apple Desktop system (iMac 27”) with one monitor - $950 per year. Apple Desktop system with two monitors - $1,200 per year. PC laptop with docking system and one external monitor - $850 per year. Additional monitor +$50 PC Laptop with no docking system - $750 per year PC Desktop system with one monitor - $675 per year. PC Desktop system with two monitors - $725 per year. All faculty complements are a flat rate of $1,180. (Continued) University Budget Office Page 4 of 8 Updated June 2015 Budget Guidelines 2015-2016 Non-Discretionary Revenue (guidelines and template sent out on July 2 – due back on August 1) Non-discretionary refers to resources that are reserved for specific purposes. Revenue dependent programs have direct operating expenditures that are proportionate to the services delivered making service fees non-discretionary. An Executive Order that describes the use and collection of the fee is usually issued by the Chancellor’s Office for all non-discretionary fees. The Budget Office, in collaboration with the divisions, must remain proactive in monitoring the revenue stream to ensure adequate resources exist. Any budget balance available at June 30 of the prior fiscal year is to be restored to the appropriate department in the current fiscal year budget. This balance is designated and cannot be used to fund other activities. Use scenario OBR to identify this balance restoration. The revenue dependent programs accounted for in the Operating Fund are as follows: Non-Discretionary Fee Academic Affairs Student Affairs X X X X Academic Excellence & Student Success Fee Academic Records Fee Commencement Academic Records Fee Registrar Athletics Fee Finance & Admin. Services X X X Augmented Health Services Fees X X Career/Writing/Math Ctr. Fee Chemistry Lab Breakage Fee Childcare Services Fee X Course Fees X Duplicate Diploma Fee X X X Enrollment Fee HS Concurrent Enroll Admin Fee LVN-BSN Skill Assessment Fee X Mental Health Fee X Nursing Program Evaluation Fee X Orientation Fee X Professional Program Fee X Student Health Services Fee X Student Payment Plan Fee X Teacher Credential Application Fee Teacher Performance Assessment Late Fee (TPA) VPA Equipment Late Fee University Budget Office Office of the President Page 5 of 8 X X X Updated June 2015 Budget Guidelines 2015-2016 Budget Scenarios A budget scenario is a PeopleSoft chartfield value that is used to identify various types of budget transactions. The following budget scenarios should be used when developing initial budget allocations for FY 15/16: BBB – Base Budget: This scenario is used in the initial budget submission and represents the base budget that recurs from one year to the next to fund ongoing operations. At the division level, the budget submission for BBB should match the division’s FY 2015/16 Operating Fund base allocation. BBT – Base Budget Transfer: This scenario is used to identify base budget transfers between departments and/or divisions. Overall, BBT entries must net to zero. Be sure to communicate with departments/divisions to ensure that the amount you are transferring corresponds with their submission. OBR – One-time Budget Restoration: This scenario is used in the initial budget upload only. It identifies the budget balance available from the prior year that is being restored. Divisions are encouraged to use this scenario when restoring department carryforward amounts. The Budget Office uses this scenario to restore budgets for purchase orders that roll forward from the prior year, and division balances. OBT – One-time Budget Transfer: This scenario is used to identify one-time budget transfers between departments and/or divisions. Overall, OBT entries must net to zero. Be sure to communicate with departments/divisions to ensure that the amount you are transferring corresponds with their submission. OTB – One-time Budget: This scenario is used in the initial budget submission and represents any initial budgets being allocated one-time. At the division level, the submission for OTB should match the division’s FY 2015/16 Operating Fund one-time allocation. Note: This scenario is also used when identifying other sources of funds that augment a department’s budget. It denotes that funds are expected to be received from other areas or sources. These are entered as a negative amount using the same account number as the expense being reimbursed. OSS – One-time Salary Savings: This scenario identifies base salary that will not be used in the current fiscal year due to a position not being filled, salary being reimbursed from another source, salary increases that aren’t effective for the entire year, etc. These are entered as a negative amount. University Budget Office Page 6 of 8 Updated June 2015 Budget Guidelines 2015-2016 Base Budget Review Instructions The Base Budget Review is a variation of Zero-Based Budgeting. Zero-Based Budgeting assumes that each year department budgets begin at zero, and budget is allocated from the division level based on identified needs to meet service levels. CSUSM uses a variation of this budget approach by continuing to maintain a base budget at the campus, division and salary levels1, applying the needs-based budget at the department/ operating expense level. Base Budget Review – Department Detail Template Section A – Salaries and Wages (and Benefits if AE&SS or Self-Support Department) All positions: permanent, temporary, vacant, new, student assistant Base salary budget reductions Any applicable salary savings entered as a negative number using scenario OSS Pending non-bargaining unit salary increases for permanent employees All salary increases for temporary employees Overtime, shift differential, etc. Vacant positions that have retreat rights for positions that are temporarily reassigned Section B – Operating Expenses Base budget needs for operations Non-recurring one-time expenses that must be funded this year Unique, one-time, special request items Compare prior year expenditures as a guide for historical analysis Section C – Reimbursements These are costs the Operating Fund initially paid and is being reimbursed for by other sources These are one-time funds, and the scenario OTB is used This may represent reimbursements from chargebacks, the Chancellor’s Office, indirect cost recovery, grants, billings to outside agencies, etc. Use the same account code as the expense it reimburses when possible This is denoted by using a negative number 1 Excludes new permanent salaries and augmentations to existing permanent salaries University Budget Office Page 7 of 8 Updated June 2015 Budget Guidelines 2015-2016 Base Budget Review – Department Summary This form summarizes all the department sources and uses of funds. Department totals can be linked to the department detail sheets. Uses of Funds (Needs) Base Salaries and Base FTE – Section A One-time Salaries and One-time FTE – Section A Base and One-time OE&E – Section B One-time Reimbursements – Section C Total Base and One-time budget needs Base Budget Review – Division Summary This final summary looks at the overall base and one-time sources and uses of funds in an easy to follow format. It can be linked to the totals on the Department Summary Form. Totals at the division level should correspond exactly to the target numbers shown on the FY 2015/16 Operating Fund Budget Allocations by Division schedule for base budgets and new base and one-time funds. Budget Submission – Budget Submission Template The budget submission form is the vehicle used to complete and post the initial budget allocation to the PeopleSoft Financial System. This form is completed once the base budget review process has been approved at the division level. It provides the initial budget detail that resides in PeopleSoft for use throughout the fiscal year. Budgets will be posted exactly as they are shown on the form and may or may not mirror the division’s base budget review. As long as division target numbers (as shown on the FY 2015/16 Operating Fund Budget Allocations by Division schedule) remain intact, divisions have the opportunity to make changes from the base budget review to the final budget submission. Division budget submissions are due to the Budget Office by September 4, 2015. The following information is provided on this form: Subdivision Section information as it relates to the base budget review form PeopleSoft chartfield string for the budget submission Line-item description Scenario Budgeted amount While the budget submission form can be populated by linking to the base budget review form(s), it may be rather cumbersome. It is recommended that the information be cut and pasted into this form. Note: Forms may be modified to conform to division and department internal processes and/or preferences. University Budget Office Page 8 of 8 Updated June 2015