CH.3 Double Entry Accounting

advertisement

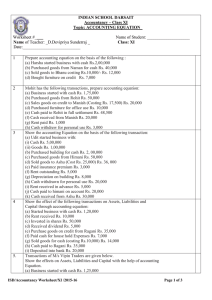

EVERY BUSINESS TRANSACTION INVOLVES RECEIVING ASPECT AND GIVING ASPECT. EVERY DEBIT HAS AN EQUIVALENT CREDIT. In cash system, transactions are recorded only if cash is received or paid. E.g. Government accounting. In mercantile system, cash and credit transactions are recorded. E.g. Credit sales or purchases, salary payable, rent receivable, interest accrued but not received, depreciation provided, etc. Personal accounts : Accounts of debtor & creditors, natural & artificial persons like bank, club a/c, salary payable, outside rent account etc. Real accounts : Tangible & Intangible real accounts ( All assets accounts) Nominal accounts : Impersonal accounts (All expense & income accounts) e.g. salary account Classification of Accounts Personal Real Natural personal Tangible real Artificial personal Intangible real Representative personal Nominal In respect to personal accounts : - Debit the receiver & credit the giver In respect to real accounts : - Debit what comes in & credit what goes out In respect to nominal accounts : - Debit all expenses & losses and credit all incomes & gains. Rules of debit & credit Types of accounts Debit Credit Personal account The receiver The giver Real account What comes in What goes out Nominal account All expenses & losses All incomes & gains Suchitra started her business with cash Borrowed from Mahesh Purchased furniture Purchased furniture from Mohan on credit Purchased goods for cash Purchased goods from Ram on credit Sold goods for cash Sold goods to Shyam on credit Received cash from Shyam Paid cash to Ram Deposited into bank Withdrew cash for personal use Withdrew from bank for office use Withdrew from bank for personal use Paid Ram by cheque Paid salary Paid rent by cheque Goods withdrawn for personal use Paid an advance to suppliers of goods Received an advance from customers Paid interest on loan Paid installment of loan Interest allowed by bank Sources of Funds = Application of funds Or Owner’s equity = Asset Or Owner’s equity + outside liabilities = Assets Or Liabilities + proprietor’ equity = Assets where, L = liabilities P = proprietor’s equity A = assets hence, OR OR OR L+P=A P=A–L L=A–P A – L- P = ZERO 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. MADAN COMMENCED BUSINESS WITH CASH OF RS. 70000. PURCHASED GOODS ON CREDIT RS. 14000 WITHDREW FOR PRIVATE USE RS. 3000 GOODS PURCHASED FOR CASH RS.12000 PAID WAGES RS. 5000 PAID TO CREDITORS RS. 10000 SOLD GOODS ON CREDIT( CP 18000) RS. 22000 SOLD GOODS ON CASH( CP 3000) RS. 6000 PURCHASED FURNITURE FOR CASH RS. 5000 RECEIVED FROM DEBTORS RS. 11000 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Ganesh started business with a capital of Rs. 40000. He purchased stock of goods Rs. 30000. He sold goods on cash Rs. 40000 cost of which is Rs. 25000. Bought goods on credit Rs. 10000. Sold goods on credit for Rs. 18000 (c.p. Rs. 10000) Paid sales commission Rs. 5000. Received cash discount Rs. 3000. Purchased furniture Rs. 10000. Received cash from debtors Rs. 15000. Paid cash to creditors Rs. 6000.