Proposed Federal Budget FY2012

advertisement

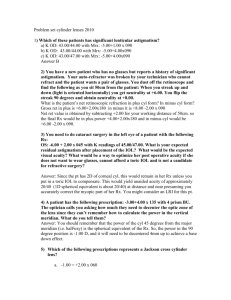

U.S. Treasury Original system based on brackets from 1035%. Proposed changes include modifying the existing bracket distribution along with tax rates. Also introducing a entirely new tax bracket. Existing Marginal Income Tax Proposed Marginal Income Tax Tax rate Bracket Tax rate Bracket 10% 0 - $8,375 10% 0 - $8,375 15% $8376 - $34,000 15% $8376 - $34,000 25% $34,001 - $82,400 25% $34,001 - $99,999 28% $82,401 - $171,850 30% $100,000- $199,999 33% $171,851 - $373,650 35% $200,000 - $499,999 35% $373651+ 40% $500,000 - $999,999 - - 45% $1,000,000+ Original system divided investments between short and long term designations. Long term: 1 year+ Propose to reclassify all investments as normal income that will be taxed through the Marginal Income Tax Existing Capital Gains Tax Short Term Long Term Tax rate Tax Rate 10% Proposed Capital Gains Tax Bracket Tax rate Bracket 0% 0 - $8,375 10% 0 - $8,375 15% 0% $8376 - $34,000 15% $8376 - $34,000 25% 15% $34,001 - $82,400 25% $34,001 - $99,999 28% 15% $82,401 - $171,850 30% $100,000- $199,999 33% 15% $171,851 - $373,650 35% $200,000 - $499,999 35% 15% $373651+ 40% $500,000 - $999,999 - - - 45% $1,000,000+ CURRENT SYSTEM Tax rate is based off brackets of income. Current tax rates are some of the highest in the world, however revenue is not realized due to loop holes in the deductions, credits, and write-offs. Interest from debts can be deducted from income tax. Overseas profit is taxed at a much lower rate. Special Preferences in Industry's causes an unequal economic playing field. PROPOSED SYSTEM Remove current bias towards debt based financing by removing the ability to deduct Interest paid on loans from taxes. All profit, whether made domestically or overseas, is taxed at the same rate. Removal of all special preferences to let the free market decide economic value. As an added incentive to promote small business, for FY2013 we suggest lowering the tax rate for all new businesses who make under $50,000 to 0% Current system sets a cut off at $5,000,000 and under. All fortunes over this amount are taxed at the flat rate of 35%. Propose to change to a bracket based system with increasing tax rates. Existing Estate Tax Proposed Estate Tax Tax rate Bracket Tax rate Bracket 35% $5,000,000+ 30% $5,000,000 - $9,999,999 - - 35% $10,000,000 - $19,999,999 - - 40% $20,000,000+ No national sales tax currently exists Fair tax bill proposed in 1999, since then has had many revisions that make it more and more appealing. All proponents suggest that this bill be introduced IN PLACE of the Marginal Income Tax. Tax rate necessary to match current income revenue would be ~23% Families could be given a consumption allowance based on their size so low income families would not be so disproportionately affected. Current system taxes less fuel efficient cars more heavily. Tax is determined through a formula with the vehicles city and highway mileage as inputs Propose modifying the constants of this function to raise the percentage taxed to a steeper rate. Current Formula: 𝐹(𝐹𝑐 , 𝐹ℎ )= 1 ( .495 .351 + ) 𝐹𝑐 𝐹ℎ + .15 Proposed Formula: 𝐹(𝐹𝑐 , 𝐹ℎ )= 1 .450 .325 (𝐹 +𝐹 ) 𝑐 ℎ + .15 Existing Marginal Income Revenue Proposed Marginal Income Revenue Bracket Population Mean Income Total Income Revenue Bracket Population Mean Income Total Income Revenue 0 - $8,375 60,902,000 $1,588.59 $96,748,319,000 $9,674,831,900 0 - $8,375 60,902,000 $1,588.59 $96,748,319,000 $9,674,831,900 $8376 - $34,000 99,936,000 $19,300.64 $1,928,829,019 $247,476,152,850 $8376 - $34,000 99,936,000 $19,300.64 $1,928,829,019,000 $247,476,152,850 $34,001 - $82,400 62,127,000 $52,147.91 $3,239,793,082,000 $572,700,789,250 $34,001 - $99,999 68,061,000 $55,459.41 $3,774,623,150,000 $683,747,843,750 $100,000 - $199,999 10,741,000 $127,528.36 $1,369,782,158,000 $316,212,990,700 $200,000 - $499,999 6,752,523 $379,847.00 $2,564,925,603,981 $770,650,594,439 $82,401 - $171,850 14,608,000 $125,988.08 $1,840,433,844,000 $423,426,200,320 $171,851 - $373,650 8,736,353 $312,934.70 $2,733,908,005,149 $764,349,648,153 $373651+ 6,379,538 $1,023,054.00 $6,526,611,869,052 $2,135,985,111,014 $500,000 - $999,999 3,874,688 $722,983.30 $2,801,334,716,710 $1,008,870,803,087 Totals 252,688,891 $4,153,612,733,488 $1,000,000+ 2,421,680 $1,401,343.00 $3,393,604,316,240 $1,293,869,236,144 Totals 252,688,891 $4,330,502,452,870 Brackets 0 - $8,375 $8376 - $34,000 $34,001 - $99,999 $100,000 - $199,999 $200,000 - $499,999 $500,000 - $999,999 $1,000,000+ Total Net Change in Revenue $0.00 $0.00 $111,047,054,500.00 -$107,213,209,620.00 $6,300,946,285.95 -$1,127,114,307,927.34 $1,293,869,236,144.00 $176,889,719,382.61 Existing Capital Gains Tax Brackets 0 - $8,375 $8376 - $34,000 $34,001 - $82,400 $82,401 - $171,850 $171,851 - $373,650 $373651+ Brackets 0 - $8,375 $8376 - $34,000 $34,001 - $82,400 $82,401 - $171,850 $171,851 - $373,650 $373651+ Totals Distribution 13,958,000.00 Mean Income Long Term Revenue OLD $4,031.00 $0.00 56,512,000.00 $22,642.00 $0.00 48,611,000.00 $64,385.00 $469,472,885,250.00 13,431,000.00 $139,632.00 $281,309,608,800.00 3,606,000.00 $306,231.00 $165,640,347,900.00 3,109,000.00 $1,326,589.00 $618,654,780,150.00 Distribution 6,042,000.00 Mean Income Short Term Revenue OLD $4,031.00 $2,435,530,200.00 1,434,000.00 $22,642.00 $4,860,812,862.50 10,810,800.00 $65,402.00 $176,512,231,512.50 3,890,200.00 $137,950.00 $149,395,056,237.50 1,760,000.00 $304,600.00 $172,378,242,050.00 625,000.00 $1,302,650.00 $255,832,318,437.50 24,562,000.00 $761,414,191,300.00 Brackets 0 - $8,375 $8376 - $34,000 $34,001 - Proposed Capital Gains Tax Distribution Mean Income Total $4,031.00 $8,062,000,000.00 20,000,000 $22,642.00 $172,537,112,300.00 57,946,000 Brackets $53,215.00 $576,830,275,000.00 60,815,000 $99,999 $100,000 - $150,000.00 $662,913,778,600.00 $321,364.00 $502,572,852,500.00 $708,650.00 $230,959,749,800.00 $1,164,200.00 $192,715,937,850.00 18,322,000 $199,999 $200,000 - 5,366,000 $499,999 $500,000 - 907,000 $999,999 $1,000,000+ 433,000 Totals $2,346,591,706,050.00 163,789,000 0-8375 8376-34000 34001-99999 100000-199999 200000-499999 500000-999999 1000000+ Total Net Change in Revenue $5,626,469,800.00 $167,676,299,437.50 -$69,154,841,762.50 $232,209,113,562.50 $164,554,262,550.00 -$643,527,348,787.50 $192,715,937,850.00 $50,099,892,650.00 Proposal Revenue Effect Remove bias towards debt based financing. $32,500,000,000 Reclassification of all profits under the $53,200,000,000 same tax rate as opposed to separate domestic and overseas rates. Removal of special preferences towards industry's and allow the free market to determine value. $120,000,000,000 Introduce a one year tax deduction for -$7,000,000,000 new businesses who make under $50,000 for FY 2013 (Effective rate: 0%) Total $201,400,000,000 Existing Estate Tax Bracket Distribution Mean Income 5,000,000+ 8,600 $14,623,000.00 $44,015,230,000.00 Proposed Estate Tax Bracket Distribution Mean Income 5,000,000-9,999,999 5,870 $6,649,000.00 $13,660,370,500.00 10,000,00019,999,999 1,650 $13,542,000.00 $8,112,720,082.50 20,000,000+ 1,090 $59,342,000.00 $36,737,250,182.50 Totals 8,600 Net Change $58,510,340,765.00 $14,495,110,765.00 Existing & Proposed Gas Guzzler Tax Bracket Gas Guzzler C/H/Com Price Old Tax New Tax MPG Less than 12.5 MPG 2010 Bugatti Veyron 8,14,10 $1,990,064.00 $235,207.61 $253,420.12 2010 Lamborghini Murcielago Coupe 9,14,11 $450,000.00 $57,665.65 $62,138.41 12.5-13.5 2007 Lamborghini Gallardo Spyder M6, 10 cyl, 5L 11,17,13 $299,990.00 $46,789.10 $50,426.05 2008 Lamborghini Gallardo Coupe M6, 10 cyl, 5L 10,17,13 $190,600.00 $27,850.34 $30,012.51 2011 Bentley Mulsanne 2011 ROLLS ROYCE Phantom EWB 2009 DODGE CHARGER Auto(L5), 8 cyl, 6.1 L 11,18,13 11,18,14 13,19,15 $300,000.00 $450,000.00 $30,000.00 $47,626.55 $71,439.83 $5,423.14 $51,327.94 $76,991.92 $5,845.39 12,20,15 $121,250.00 $21,099.07 $22,740.01 16.5-17.5 2011 MASERATI QUATTROPORTE A6, 8 cyl, 4.2 L, 2WD Rear 2009 DODGE CHALLENGER M6, 8cyl, 6.1 L 2009 FORD MUSTANG M6, 8 cyl, 5.4L 2009 CHEVROLET IMPALA Auto(L4), 6 cylinders, 3.5 liter, 14,22,16 14,20,16 14,22,17 $21,995.00 $25,000.00 $26,000.00 $4,380.05 $4,827.43 $5,177.60 $4,721.20 $5,203.55 $5,580.87 17.5-18.5 2011 AUDI S5 M6, 8 cyl, 4.2 L, AWD, 2011 PORSCHE Panamera Turbo A7, 8 cyl, 4.8 L, AWD, 14,22,17 15,23,18 $55,000.00 $127,500.00 $10,952.62 $26,980.23 $11,805.68 $29,082.88 2009 INFINITI M45 Auto(S5), 8 cylinders, 4.5 liter, 16,21,18 $31,684.00 $6,784.96 $7,314.30 2011 BMW Z4 sDrive35i S7, 6 cyl, 3L, 2WD,RearWD 17,24,19 $60,000.00 $13,993.56 $15,085.41 2011 HYUNDAI EQUUS A6, 8 cyl, 4.6L, 2WD,Rear WD 16,24,19 $58,000.00 $12,993.82 $14,007.00 2011 SUBARU LEGACY AWD S5, 6 cyl, 3.6 L, AWD 18,25,20 $25,000.00 $6,137.38 $6,616.45 2011 MERCEDES-BENZ SLK 350 M6,6 cyl,3.5 L, 2WD,Rear 18,26,20 $53,300.00 $13,258.52 $14,293.28 20.5-21.5 2011 MAZDA MAZDASPEED3 M6, 4 cyl, 2.3 L, 2WD Front 18,25,21 $23,700.00 $5,527.46 $6,272.39 21.5-22.5 2007 INFINITI M35 S5, 6 cyl, 3.5 L 2011 NISSAN MAXIMA AV-S6, 6 cyl, 3.5 L, 2WD Front 18,25,21 19,26,22 $22,561.00 $31,000.00 $5,538.61 $7,989.86 $5,970.95 $8,613.77 2011 TOYOTA MATRIX A4, 4 cyl, 2.4 L, AWD 20,26,22 $18,845.00 $5,020.32 $5,412.55 $642,663.71 $692,882.63 13.5-14.5 14.5-15.5 15.5-16.5 18.5-19.5 19.5-20.5 Totals Sample set cars Old Revenue $642,663.71 New Revenue $692,882.63 Net Change ($) $50,218 Net Change (%) 7.81% Total cars Existing Revenue from Gas Guzzler $9,392,075,000.00 Proposed rate increase 7.81% Net Increase $170,372,240.50