Sustainable Economic Development Strategy

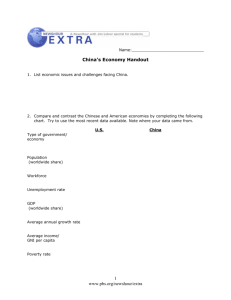

advertisement

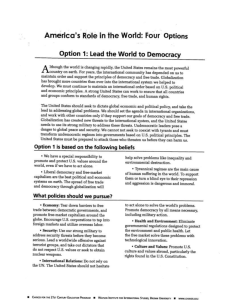

Economic Development Three core components of Economic Development 1) Business Attraction i. ii. iii. iv. Marketing & Promotion Trade Shows Sector specific initiatives Statistical information 2) Business Retention i. ii. Labour force recruitment Local, Regional, Provincial & Federal Regulations 3) Business Expansion i. ii. iii. Export markets Network connections Land and building search Why Business Retention and Expansion? • Existing businesses in a community are responsible for approximately 80% of future employment growth • Happy existing businesses help attract new businesses • Identify problems and new opportunities • Gain a better understanding of the status of the local economy • Strengthen linkage between local government and business community • Retention visits lead to business expansion initiatives • Identify companies at risk of closing/relocating • Identify barriers to growth Background • Economic Development Strategy identified the need for a BR+E Program • Project supported by City of Vernon, Community Futures and the Province of BC • Initial target sectors included Manufacturing & Technology • Hired consultant to complete 100 Surveys • Executive Pulse – largest BR+E database provider in North America • Phase 2 – Downtown retail & professional services • Phase 3 – Agricultural Sector Where did we interview/ Source of Interviews 1 6 5 Vernon 6 Rural Areas 9 Spallumcheen 57 17 Coldstream Enderby Armstrong Lumby BR+E FINDINGS Years in Business Years In Business Percentage < One Year 3% 2-4 Years 7% 5-9 Years 12% 10-14 Years 12% 15> 66% Life Cycle Life cycle stage of firm's primary product/service: Declining Maturing Growing Emerging 0 10 20 30 40 50 60 Succession Plan Succession Plan Yes 43% No 57% Labour Over the past three years • 43 percent of businesses have maintained a stable workforce • 36 percent of businesses increased their workforce • 69% plan on increasing amount of full time employees over next 3 years. Total number of employees at the businesses surveyed breakdown as follows: • Full-time employees - 2,482 • Part-time employees - 169 • Temporary employees - 156 • Total employees - 2,807 Availability of Workers 35 30 25 20 15 10 5 0 High Average Low • 51% ranked availability of workers from Average to Low Quality of Labour Force 40 35 30 25 20 15 10 5 0 High Average Low • 52% ranked quality between Average and Low Stability of Labour Force 40 35 30 25 20 15 10 5 0 High Average Low • Stability is ranked High • 86% stated that the number of unfilled positions today was stable Skill Levels and Wages Skill Level and Wages Skill Level (%) Skilled/Professional Wages (PH) 53% $29 Semi-skilled 24% $19 Entry Level 20% $14 • 48% of companies believe that the level they pay is greater than others locally • 20% of companies have problems retaining employees Unfilled Positions • 55% are having difficulties in finding employees Job Type (difficulty on finding) Business Administration Clerical Computer technology/programming Machinery operators Marketing Plant operators Sales Skilled trade Unskilled labour Other (%) 11 4 11 4 4 6 15 43 15 36 Other Key Labour Findings • 85% of companies find employees locally (note: different than three years ago) • 51% of companies have a training budget for employees • 58% of companies do not have a formal workplace training program in place • 87% of companies are non-unionized. Of those that are, 100% rank relations as good or excellent. • 74% of company employees are middle aged Sales Market Share Increasing Stable Decreasing 24% 52% 24% Sales Historical Sales Trend Facility (%) Within Industry (%) Increasing 56 21 Staying the same 20 40 Declining 24 36 0 3 Not applicable • North Okanagan companies indicate that they are doing better than the industry average Sales Source of Sales International 15% National 19% Local (within 50 miles) 41% Provincial (balance) 25% • 59% of company sales are located outside of geographic area Export • 48% have Export Sales Status • Export Markets include USA, China, Mexico & Europe Export Sales Export Sales (%) Increasing 29 Staying the same 37 Declining 13 Not applicable 21 Facility and Equipment • 58% own their facility (42% lease) • 83% indicate that the condition of the current facility is good or excellent • Usage of facility • 43% use more than 90% of facility • 24% use 76-90% • 20% use 51-75% and balance use less than 50% • 87% rank equipment as good or excellent • Usage of Equipment • 33% use more than 90% of equipment capacity • 25% use 76-90% • 29% use 51-75% and balance use less than 50% Facilities (expansion) • 46% of companies have expansion plans within the next 12-18 months • 68% indicate they have room for expansion at current site • 74% of those planning expansion indicate that it will occur within the North Okanagan. • 53% of those planning expansion indicate that they will expand at current site – balance will need to find new land or facilities • Estimated total investment of those planning expansion is $58,000,000 • 215,000 sq.ft. of new space will be required to accommodate the expansions • 209 New Jobs will be created through Expansion Facilities (expansion) Expansion Restrictions Broadband access Finance Identifying and accessing new markets Lack of skilled staff Lack of suitable premises Local regulations e.g. zoning Problems with DAs Roads Transport/freight Warehousing Other (please specify): % 6 47 14 19 36 47 14 3 3 3 28 • Other includes – water restrictions, parking and global economy Services and Costs Municipal and Regional Services • Inspections and Licensing – 52% rank as average to poor • Development Approval Process – 70% rank as average to poor • Availability of Land – 73% rank as average to poor Cost of Doing Business • Permit Fees – 74% rank average to poor • Land Costs – 83% rank average to poor • Building Costs – 84% rank average to poor • Leasing Space – 76% rank average to poor • Taxes – 74% rank average to poor Business Climate Local and Regional Government Excellent Local/Regional Government (%) 4 Taxation (%) 1 Good 18 18 Fair 50 46 Poor 26 29 2 6 100 100 No opinion Totals • Some concerns raised regarding both local & regional government Business Climate • dd Better today No change Worse today No opinion Totals Business Climate today vs 5 Year ago (%) Business Climate 5 years from today (%) 20 69 16 22 61 6 3 100 3 100 • 71% overall had a positive attitude toward the community despite some concerns Strengths as a Place to do Business • Location • Quality of Life • Support from other businesses • New focused economic development program • Support services (Community Futures, Chambers of Commerce, Vernon EDC) • Large Customer base • Workforce – dedicated employees • Lifestyle can attract labour • Support amongst businesses Weaknesses as a Place to do Business • Location • Lifestyle • Workforce • Local and Regional Governments (bureaucracy) • Lack of Land and Facilities • Non-supportive attitude to entrepreneurism and small business community • Expensive *most of these were identified also as a barrier to growth Other Findings • 93% of companies were rated as having little to no risk of closing or downsizing • 29% of Manufacturing companies spend more than 3% of annual sales on R&D Recommendations 1) Review Local and Regional Government approval processes 2) Develop labour force recruitment Packages 3) Assist companies in recruitment process 4) Consider developing an HR website for use by companies seeking employees 5) Complete a Land and Facility Inventory 6) Complete a BR+E Program for other sectors 7) Introduce companies to BC Trade & Investment representatives in USA, Asia, and Europe 8) Create a Sector Alliance for Manufacturing Questions Kevin Poole Economic Development Officer City of Vernon Tel: 250-550-3249 kpoole@vernon.ca www.investvernon.ca