ppt

advertisement

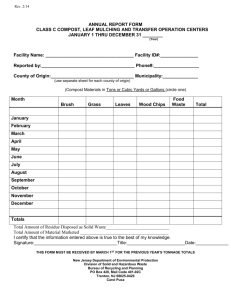

MAXIDIGM INVESTMENT CLUB STOCK ANALYSIS Learning SECTOR Pure E-Learning Traditional Education – Higher Learning Others What is E-Learning Vs. Traditional training By third-party vendor on training department Time-consuming Costly (travel, accommodation – 2/3 of total costs) Computer based training (CBT) Web-based Deployed to mass users Cost advantage Anywhere, anytime, anything! Industry Outlook Corporate Training Total corporate training market $66 billion Traditional training still account for about 80-90% $3.5 billion spent in 2000, growing to $25 billion in 2003 Constantly evolving Highly competitive and fragmented Competition from publisher, software vendor Acceptance and effectiveness of training Traditional Education – higher Learning U.S. Dept of Education estimated $200 billion Growth in enrollment to continue 25 years and older, part-timers, female Demand from changing Technology Stock Selection Age > 6 mths? (> 4 mths) P/E Ratio y y y y y y N/A 2000 N/A N/A N/A N/A N/A N/A 1.66 b 585.6 m 573.8 m 214 m 165.1 m 33.1 m 11.5 m 529 k 447.8 k 336.1 k 49 k 68.9 k 351.8 k 54.8 k Rising sales/ falling Earnings Rising sales Rose significantly in 2000 Rising Rising slowly Slowed in 1999 2000 fell from 1999 Traditional Education - higher learning APOL Apollo Group DV DeVry ltre Learning Tree edmc Education Mgt Corp coco Corinthian Colleges ceco Career Education Corp esi ITT Education Services y y y Y y y y 45.37 50.58 27.12 38.51 43.75 35.106 24.345 3.728 b 2.51 b 980 m 860 m 679 m 670 m 499.7 m 1.01 m 243.7 k 235.5 k 285.8 k 145.6 k 169.3 k 126.5 k Rising Rising Rose significantly in 2000 Rising Rose significantly in 2000 Rising Rising Traditional Education - K to 12 edsn Edison Schools y N/A 1.46 b 250.8 k Rising Publisher/Schools schl Scholastic Corp y 21.567 1.55 b 155.6 k Rising Pure E-Learnings SMTF Smartforce DTHK DigitalThink SABA Saba Software SKIL SkillSoft Corp CLKS Click2learn.com LTWO Learn2.com VCMP Vcampus asis ASI Solution Canadian Companies cty-tse or ctynf itk-tse Mkt Cap Avg Trading 3-mth Volume Sales/Earnings Trend (> $100 m?) (> 10,000 shares/day?) (Falling or Rising?) Impact of slowdown… Reduction in training budget? Higher demand for skills improvement? SmartForce PLC - SMTF Incorporated in Ireland 1989 Largest and only profitable company Comprehensive offerings – more than 1300 courses IT, business skills, project management, core competencies Customers Fortune 3000 and major international companies Alcatel, Lucent, MCI, British Airways, Chase Manhattan … (2500) Revenue Stream Prior to 2000, license software 2000 – internet rental model (ASP) ; hence income has been deferred No single customer account for 5 % SMTF GROWTH RATES 1 Year Sales % SMTF 3 Years 5 Years -14.95 7.07 24.87 EPS % NM NM NM Dividend % NM NM NM REVENUE Quarters 1997 1998 1999 2000 MAR 26,727 39,929 40,197 28,534 JUN 29,755 44,852 47,247 36,393 SEP 35,136 35,182 50,188 45,572 DEC 45,429 42,269 60,122 57,699 137,047 162,232 197,754 168,198 Totals Note: Units in Thousands of U.S. Dollars EARNINGS P ER SHARE Quarters 1997 1998 1999 2000 MAR 0.04 0.16 0.03 -0.23 JUN 0.05 0.09 -0.01 -0.19 SEP 0.11 0.06 0.11 -0.1 DEC 0.22 0.05 0.15 -0.03 0.42 0.36 0.28 -0.55 Totals Saba Software - SABA Founded in 1997 Tool to ‘manage’ learning Launched B2B SABA Learning exchange in 1999 Leading provider of “human capital development” & mgt solutions Customers Large businesses, governments and Learning providers Cisco, 3Com, Continental Airlines, Lucent, P & G Revenue Stream Mostly from license fees, implementation and consulting Transaction-based revenue from B2B marketplace still insignificant No single customer account for 10 % Profitability 2002? SABA GROWTH RATES 1 Year SABA 3 Years 5 Years Sales % 827.9 NA NM EPS % NM NA NM Dividend % NM NA NM REVENUE Quarters 1999 2000 2001 AUG 156 1,707 10,048 NOV 327 3,497 13,023 FEB 554 5,202 MAY 902 7,586 1,939 17,992 Totals 23,071 Note: Units in Thousands of U.S. Dollars EARNINGS P ER SHARE Quarters 1999 2000 2001 AUG -0.04 -0.63 -0.46 NOV -0.16 -0.63 -0.43 FEB -0.19 -0.46 MAY -0.45 -0.53 -0.84 -2.25 Totals -0.89 Note: Units in U.S. Dollars Digital Think - DTHK Founded in 1996, revenue 1999 Focus is custom-tailored courses (62%) More than 350 courses Partnership with EDS Customers 260 Adobe, Siebel, Deutsche Bank, KPMG, Schwab Revenue Stream Software licenses, development fees Profit sharing with customers from “Extended Enterprise” 50% of 2000 revenue from 6 customers! Profitability 2002? DTHK GROWTH RATES 1 Year Sales % DTHK 3 Years 5 Years 485.54 656.3 NM EPS % NM NM NM Dividend % NM NM NM REVENUE Quarters 1999 2000 2001 JUN 283 1,174 6,262 SEP 406 2,136 8,760 DEC 468 3,178 MAR 690 4,327 1,847 10,815 Totals 15,022 Note: Units in Thousands of U.S. Dollars EARNINGS P ER SHARE Quarters 1999 2000 2001 JUN -0.28 -0.57 -0.23 SEP -0.31 -0.92 -0.68 DEC -0.87 -2.86 -2.26 -4.94 Totals -0.91 SkillSoft Corp - SKIL Leading provider of critical business skills (professional development) 380 courses World’s largest e-learning library for Project Management First company to be certified by PMI (PM Institute) Reseller arrangements with other learning agencies Main customer is GTE (25% of revenue) SKIL GROWTH RATES 1 Year SKIL 3 Years 5 Years Sales % -100 NA NM EPS % NM NA NM Dividend % NM NA NM REVENUE Quarters 1999 2000 2001 APR 0 198 2,114 JUL 0 890 3,639 OCT 0 1,283 5,511 JAN 0 1,820 Totals 0 4,191 11,264 Note: Units in Thousands of U.S. Dollars EARNINGS P ER SHARE Quarters 1999 2000 2001 APR 0 -2.4 -0.57 JUL 0 -1.9 -0.47 OCT -3.33 -4.23 -0.4 JAN -2.35 -3.22 -5.68 -11.75 Totals -1.44 Apollo Group - APOL Largest private institution for higher learning, around for 25 years University of Phoenix, Western International University, Institute of Professional Development, Financial Planning Inst. Launched online Learning via U. of Phoenix More than 50 campuses and 100 learning centres 100,000 enrollments 90 % job placement rate 55% rentention rate 6% student-loan default rate 40% revenue from Europe – exposed to currency exchange risk APOL GROWTH RATES 1 Year APOL 3 Years 5 Years Sales % 22.28 29.76 30.53 EPS % 24.03 29.38 38.39 NM NM NM Dividend % REVENUE Quarters 1998 1999 2000 2001 NOV 87,875 115,698 143,418 FEB 85,078 109,356 133,980 MAY 105,201 138,107 167,591 AUG 106,723 135,685 165,008 384,877 498,846 609,997 Totals 177,073 177,073 Note: Units in Thousands of U.S. Dollars EARNINGS P ER SHARE Quarters 1998 1999 2000 2001 NOV 0.13 0.17 0.22 FEB 0.1 0.13 0.16 MAY 0.2 0.24 0.28 AUG 0.16 0.21 0.28 0.59 0.75 0.94 Totals 0.32 0.32 DeVry - DV One of the largest publicly held higher education institute Founded 70 years ago DeVry University, Denver Technical College, Keller Institute of Management, Becker Conviser Review (CPA, CMA, CFA) 300 locations 80,000 enrollments Recently partnered with eCollege to develop e-learning Fiscal 2001 is 10th consecutive year of annual earnings growth >= 20% DV GROWTH RATES 1 Year DV 3 Years 5 Years Sales % 20.49 18.02 17.26 EPS % 23.23 24.13 24.94 NM NM NM Dividend % REVENUE Quarters 1998 1999 2000 2001 SEP 80,421 93,858 118,282 135,419 DEC 90,342 107,813 133,248 150,365* MAR 92,854 110,234 130,132 JUN 89,854 108,730 125,162 353,471 420,635 506,824 Totals 285,784* Note: Units in Thousands of U.S. Dollars EARNINGS P ER SHARE Quarters 1998 1999 2000 2001 SEP 0.09 0.11 0.14 0.17 DEC 0.12 0.15 0.18 0.220* MAR 0.12 0.15 0.19 JUN 0.11 0.14 0.17 0.44 0.55 0.68 Totals 0.390* Learning Tree - LTRE Worldwide provider of training for IT professionals Corporate clients and governments Broad base of instructor-led courses Custom-designed courses for larger clients CBT offerings on CD-Rom up until 1999 (wrote off $1.2 mil in 1999) Shifting to e-learning in 2000 LTRE GROWTH RATES 1 Year LTRE 3 Years 5 Years Sales % 18.32 10.85 23.23 EPS % 190.65 51.39 34.1 NM NM NM Dividend % REVENUE Quarters 1997 1998 1999 2000 DEC 36,010 45,179 45,152 49,399 MAR 35,759 45,005 46,520 52,997 JUN 43,881 47,946 49,129 63,024 SEP 48,833 49,044 48,520 58,588 164,483 187,174 189,321 224,008 Totals Note: Units in Thousands of U.S. Dollars EARNINGS P ER SHARE Quarters 1997 1998 1999 2000 DEC 0.19 0.06 0.12 0.35 MAR 0.1 0.1 0.13 0.36 JUN 0.14 0.15 0.06 0.54 SEP 0.06 0.18 0.26 0.4 0.49 0.49 0.57 1.65 Totals Edison Schools - EDSN Largest private operator of public schools for K – 12 in U.S. Contract with school boards; fund by pupil count Assume operational and educational responsibilities First 4 schools in 1995; now 113 in 21 states Private schools principle – dramatic results Risks Private, for-profit public school – new area Acceptance Success depends on academic achievements Lengthy sales cycle Profitability 2004? EDSN GROWTH RATES 1 Year EDSN 3 Years 5 Years Sales % 69.16 79.92 108.99 EPS % NM NM NM Dividend % NM NM NM REVENUE Quarters 1999 2000 2001 SEP 24,004 41,151 DEC 35,576 61,596 MAR 36,391 61,531 JUN 36,791 60,300 132,762 224,578 Totals 64,791 64,791 Note: Units in Thousands of U.S. Dollars EARNINGS P ER SHARE Quarters 1999 2000 2001 SEP -1.37 -0.46 DEC -0.99 -0.16 MAR -1.02 -0.14 JUN -4.75 -0.2 -8.13 -0.96 Totals -0.43 -0.43 Scholastic Corp – SCHL Global children’s publishing and media company Children Books & magazines publishing (biggest chunk) Educational publishing Multimedia licensing and advertising Website is most visited by teachers and schools American rights to Pokemon, Harry Potter series Risks Changes in publishing industry Changes in purchasing patterns Competition from media, entertainment and publisher SCHL GROWTH RATES 1 Year SCHL 3 Years 5 Years Sales % 20.34 13.22 13.34 EPS % 33.94 397.32 4.38 NM NM NM Dividend % REVENUE Quarters 1998 1999 2000 2001 AUG 166,600 150,200 182,500 362,100 NOV 354,800 403,200 511,300 668,300 FEB 239,000 267,300 312,800 MAY 298,000 334,000 395,900 1,058,400 1,154,700 1,402,500 Totals 1,030,400 Note: Units in Thousands of U.S. Dollars EARNINGS P ER SHARE Quarters 1998 1999 2000 2001 AUG -0.405 -0.535 -0.715 -0.31 NOV 0.755 0.905 1.15 1.47 FEB -0.095 0.005 0.055 0.41 0.635 0.775 0.665 1.01 1.265 MAY Totals 1.16 ASI Solution - ASIS Provide HR outsourcing for large corporations (Fortune 500) Performance improvement Employment Process outsourcing Compensation & Market Share studies Founded in 1978, public in 1997 1996 to 2000: revenue growth at a compounded rate of 55% from 10.6 mil to 79.1 mil ASIS GROWTH RATES 1 Year ASIS 3 Years 5 Years Sales % 20.53 56.33 55.05 EPS % -11.81 9.4 32.8 NM NM NM Dividend % REVENUE Quarters 1998 1999 2000 2001 JUN 6,700 12,013 15,899 23,087 SEP 5,905 14,844 15,239 17,901 DEC 9,385 18,058 20,252 MAR 12,876 14,738 20,512 34,866 59,653 71,902 Totals 40,988 Note: Units in Thousands of U.S. Dollars EARNINGS P ER SHARE Quarters 1998 1999 2000 2001 JUN 0.07 0.13 0.15 0.32 SEP 0.03 0.14 0.03 0.15 DEC 0.1 0.17 0.11 MAR 0.13 0.14 0.22 0.33 0.58 0.51 Totals 0.47 Quantitative Analysis What the numbers say… Technical Analysis What the charts say… Technical Analysis Ind:E-Learning BUY ? MAYBE ? Current Price Sym bol 6-m th Return 1-Yr Return Support Level 1 Support Level 2 Sentim ent Current P/E Buy, Sell, vs. 52 w k Hold range Signal Pure E-Learning 1 SMTF SmartForce PLC $43.88 -8.59% 29.04% 43.00 37.00 Recovering N/A in 2000 2 SABA Saba Software $16.38 -22.02% -42.54% 21.00 13.00 Recovering N/A Sell 3 DTHK Digital Think $15.00 -58.33% -62.50% 29.00 15.00 Bearish N/A Hold $16.38 17.00% 18.00 15.00 Bearish N/A Hold 4 SKIL SkillSoft Traditional Education - Higher Learning -9.00% Sell 1 APOL Apollo Group $51.50 90.74% 134.09% 35.00 25.00 Bullish High End Hold 2 DV DeVry $33.44 28.61% 85.76% 28.00 24.00 Wait & See Nrear High Hold 3 LTRE Learning Tree $46.25 -24.18% 92.71% 44.00 30.00 Recovery Near Low Hold 1 EDSN Edison Schools $33.94 47.55% 182.81% 31.00 22.00 Bullish N/A Sell 2 SCHL Scholastic Corp $43.44 40.12% 35.74% 30.00 24.00 Bullish Near Low Hold 3 ASIS ASI Solution $17.25 115.63% 245.00% 20.00 13.00 Bullish Near High Buy Others