Financial Management: Goals, Governance, and Organization

advertisement

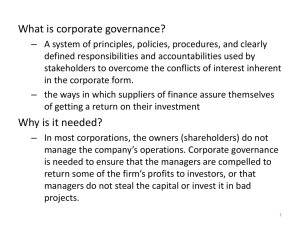

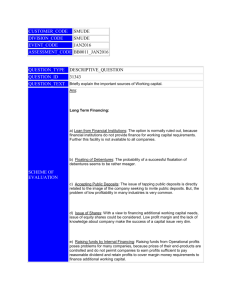

Arzu AKŞAHİN 201442810 1. 2. 3. 4. What is Financial Management? The Goal of the Firm Corporate Governance Organization of the Financial Management Function 1.1. Important Notions Finance is the money, funds or capital that individual or corporate can benefit. Financing is the act or the process of providing these money, funds or capital. Financial Management is the process which includes the determination of the capital needed by the firm, the providing of this capital and the effective use of this capital. 1.2. Historical of Financial Management Financial management has emerged as an independent discipline in the early 20th century. Until this date, financial management was accepted as a field of economics. During these years, it was expected that financial management mainly provides source of funds. 1.2. Historical of Financial Management But, with the Great Depression in 1929, bankruptcies happened and all this chaos gave a new perspective to economic and especially to financial management. From this date, what is expected from financial management was not simple as the former. Bankruptcies showed that providing assets were not sufficient if the firms wanted to be able to continue their existence. Besides financing policy, investment and dividend policy should also be heeded. 1.3. Financial Management and Decisions Definition of financial management today accepted: Financial management deals with “the acquisition, financing and management of assets with some overall goal in mind” (Van Horne). This definition refers to the managerial finance functions: Investment Decision Financing Decision Asset Management Decision 1.3. Financial Management and Decisions Investment Decision is the process in which the firm chooses the most appropriate area of investment with scarce resources. It concerns how distribute the assets between short and long-term assets. Long-term proposal brings some uncertainties and so some risks. Investment decision must evaluate the balance between the risks and the returns. Financing Decision is also known as capital structure decision. It allows to determine the sources of funds. The sources of long-term funds include equity capital and debt capital. A particular combination of debt and equity may be more beneficial and financial management decides about the optimal proportions. Asset Management Decision is about the efficient management of the assets, once they have been acquired and appropriate financing provided. Varying degrees of operating responsibility is the charge of the financial manager. The financial manager should be more concerned with the management of current assets than fixed assets. Financial management is a goal-oriented activity. Concerning the nature of the goal, there are two different approaches: Profit Maximization Shareholders’ Wealth Maximization 2.1. Profit Maximization It has long been the traditional and narrow approach. It consists on maximizing a firm’s earning after taxes. But, it fails for a number of reasons: It is vague, profit is not defined precisely or correctly. It ignores the timing or duration of expected returns. It does not consider the risk. Sometimes earning per share maximization is cited as a version of profit maximization. It deals with earning after taxes divided by the number of common shares outstanding. 2.2. Shareholders' Wealth Maximization With latest innovations and improvements, it is one of the modern approaches accepted today. Here, the goal is to maximize the wealth of the shareholders for whom the firm is managed; In another words, to increase the current net value of business or shareholder capital gains, with the objective of bringing in the highest possible return. It is a long term goal. It considers both time of returns and risk. 2.3. Agency Theory It is important to be careful because sometimes ownership-management controversy may appear. The desires or goals of the principal and manager may be in conflict, and the principal may be unable to verify (because it difficult and/or expensive to do so) what the manager is actually doing. The principal and manager may have different attitudes towards risk. Because of different risk tolerances, the principal and manager may each be inclined to take different actions. An agency theory is founded to prevent it. Agency theory is concerned with resolving problems that can exist in agency relationships; between shareholders and board of directors for example. 3.1. Definition of Corporate Governance It is a set of rules with which organizations are directed and controlled. Companies are owned by the shareholders but run by the board directors. Corporate governance ensures that the company is run in the interests of the shareholders. 3.2. Historical of Corporate Governance It emerged in the 1990’s. The reasons of this emergence are financial crisis and especially corporate scandals. Enron is a company of US energy sector and it was causing the biggest financial scandal of the last 20 years. For a time, Enron was considered by the press and financial analysts as a new model of management. In fact, the company artificially inflated its profits and masked its deficits. It ends with a bankruptcy. Its goal was to inflate the market value. 3.2. Historical of Corporate Governance This case led to new laws and accounting rules, such as SarbanesOxley Act and the new accounting rules IAS and IFRS. Sarbanes- Oxley Act of 2002 introduced the regulation of financial practice and corporate governance. It imposed new penalties for violations of securities law. It established the Public Company Accounting Oversight Board (PCAOB). It is a non-profit corporation. Its goal is to adopt auditing, quality control, ethics and disclosure standards. 3.3. Principles of Corporate Governance Corporate governance primary pillars are fairness, accountability, responsibility and transparency. Fairness: The company applies the principle of equal treatment to all rights owners. Accountability: The board of directors should give an explanation or reason for each action and conduct. Responsibility: The company should develop codes of ethical conduct for their directors. Transparency: The company should deliver as many information as possible to the public and shareholders. Stockholders Board of Directors President (CEO) Vice- President Manufacturing Vice- President Finance (CFO) Treasurer •Capital Budgeting •Cash Management •Credit Management •Dividend Disbursement •Fin Analysis/Planning •Pension Management •Insurance/Risk Management •Tax Analysis/Planning Vice- President Marketing Controller •Cost Accounting •Cost Management •Data Processing •General Ledger •Government Reporting •Internal Control •Preparing Fin Statements •Preparing Budgets •Preparing Forecasts Charreaux, G. (2006). Théorie Financiere et Stratégie Financiere . Lavoisier , 109-137. Cohen, E. (1991). Gestion Financiere de l'Entreprise et Développement Financier . Vanves: UREF. Gitman, L. J. (1991). Principles of Managerial Finance. New York : Harper Collins . Joumard, R. (2009). Le Concept de Gouvernance. Bron: INRETS. Paramasivan, C., & Subramanian, T. (2008). Financial Management . New Age. The 107th United States Congress (2002, July 30). Sarbanes-Oxley Act. Public Law 107–204, 116 stat. 745 . United States. Van Horne, J. C. (1974). Financial Management and Policy . London : Prentice Hall. Van Horne, J. C., & Wachowicz, J. M. (2008). Fundamentals of Financial Management . London : Prentice Hall.