Non Linear Modelling

Non Linear Modelling

An example

Background

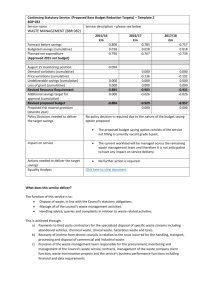

Ace Snackfoods, Inc. has developed a new snack product called Krunchy Bits. Before deciding whether or not to “go national” with the new product, the marketing manager for

Krunchy Bits has decided to commission a year-long test market using IRI’s BehaviorScan service, with a view to getting a clearer picture of the product’s potential.

The product has now been under test for 24 weeks. On hand is a dataset documenting the number of households that have made a trial purchase by the end of each week.

(The total size of the panel is 1499 households.)

The marketing manager for Krunchy Bits would like a forecast of the product’s year-end performance in the test market. First, she wants a forecast of the percentage of households that will have made a trial purchase by week 52.

Data

Approaches to Forecasting Trial

• French curve

• “Curve fitting”—specify a flexible functional form

• fit it to the data, and project into the future.

• Inspect the data (see Non Linear

Modelling .xls)

Proposed Model for this example

Y = p

0

(1 – e

– bx )

Decreasing returns and saturation.

Here: p

0

= saturation proportion b = decreasing returns parameter

Widely used in marketing.

Data

Week

8

9

10

11

12

13

14

6

7

4

5

1

2

3

20

21

22

23

24

15

16

17

18

19

# HHs

75

81

90

94

96

65

67

68

72

96

96

97

97

101

32

40

47

50

8

14

16

Propn. of Households

0.005

0.009

0.011

0.021

0.027

52

57

60

0.031

0.033

0.035

0.038

0.040

0.064

0.064

0.065

0.065

0.067

0.043

0.045

0.045

0.048

0.050

0.054

0.060

0.063

0.064

8.00%

7.00%

6.00%

5.00%

4.00%

3.00%

2.00%

1.00%

0.00%

0

Cumulative Trial vs Week

5 10

Week

15 20 25

Modelled data

Week

9

10

11

12

13

14

15

7

8

5

6

3

4

1

2

16

17

18

19

20

21

22

23

24

# HHs

96

96

97

97

101

81

90

94

96

67

68

72

75

40

47

50

52

8

14

16

32

Propn. of Households Modelled Proportion diff

0.005

0.009

0.005

0.010

9.08E-10 p0

1.12E-06 LS

0.011

0.021

0.027

0.031

0.015

0.020

0.024

0.028

1.98E-05

3.25E-06

8.94E-06

1.42E-05

57

60

65

0.033

0.035

0.038

0.040

0.043

0.031

0.035

0.038

0.041

0.044

4.49E-06

9.82E-10

2.49E-08

7.23E-07

1.13E-07

0.045

0.045

0.048

0.050

0.054

0.060

0.063

0.064

0.046

0.049

0.051

0.053

0.055

0.057

0.059

0.061

2.72E-06

1.2E-05

9.74E-06

1.09E-05

1.81E-06

7.5E-06

1.3E-05

1.06E-05

0.064

0.064

0.065

0.065

0.067

0.062

2.8E-06

0.064

3.58E-08

0.065

2.86E-07

0.067

3.38E-06

0.068

1.56E-07 beta

0.0862 0.064285

0.000128

How well does the model do?

"R^2" 0.985

Cumulative Trial vs Week

8.00%

7.00%

6.00%

5.00%

4.00%

3.00%

2.00%

1.00%

0.00%

0

Propn. of Households

Modelled Proportion

5 20 25 10

Week

15

How well does the model do – forecasting?

Cumulative Trial vs Week forecast region-->

Propn. of Households

Modelled Proportion

10.00%

9.00%

8.00%

7.00%

6.00%

5.00%

4.00%

3.00%

2.00%

1.00%

0.00%

0 10 20

Week

30 40 50

Doing the same thing in R

NLeg.df=read.csv(file.choose(),header=T) attach(NLeg.df) fit.nls<- nls( propHH ~ p0*(1-exp(beta*Week )), data = NLeg.df, start = list( p0=.05,beta=.1), trace = TRUE )

Doing the same thing in R

> fit.nls<- nls( propHH ~ p0*(1-exp(-beta*Week )),

+ data = NLeg.df,

+ start = list( p0=.05,beta=.1),

+ trace = TRUE )

0.00450657 : 0.05 0.10

0.003392708 : 0.08067993 0.04530598

0.0002417058 : 0.07951665 0.06836061

0.0001274101 : 0.08637640 0.06347303

0.0001261767 : 0.08661768 0.06369747

0.0001261767 : 0.08661641 0.06369891

>

> summary(fit.nls)

Formula: propHH ~ p0 * (1 - exp(-beta * Week))

Parameters:

Estimate Std. Error t value Pr(>|t|) p0 0.086616 0.004462 19.41 2.49e-15 *** beta 0.063699 0.005721 11.13 1.65e-10 ***

---

Signif. codes: 0 `***' 0.001 `**' 0.01 `*' 0.05 `.' 0.1 ` ' 1

Residual standard error: 0.002395 on 22 degrees of freedom

Correlation of Parameter Estimates: p0 beta -0.9798

Different types of Models

&

Their Interpretations

A Simple Model

Y (Sales Level) a

(sales level when advertising = 0)

1

} b (slope of the salesline)

X (Advertising)

Y

Y

P1: Through Origin

Phenomena

P2: Linear

Y

X

P3: Decreasing Returns

(concave)

—

Q

Y

X

P4: Saturation

X X

Y

Y

Phenomena

P5: Increasing Returns

(convex)

P6: S-shape

Y

X

P7: Threshold

X

P8: Super-saturation

Y

X X

Aggregate Response Models:

Linear Model

Y = a + bX

• Linear/through origin

• Saturation and threshold (in ranges)

Aggregate Response Models:

Fractional Root Model

Y = a + bX c c can be interpreted as elasticity when a = 0.

Linear, increasing or decreasing returns (depends on c ).

Aggregate Response Models:

Exponential Model

Y = ae bx ; x > 0

Increasing or decreasing returns

(depends on b ).

Aggregate Response Models:

Adbudg Function

Y = b + ( a – b )

X c d + X c

S-shaped and concave; saturation effect.

Widely used. Amenable to judgmental calibration.

Aggregate Response Models:

Multiple Instruments

• Additive model for handling multiple marketing instruments

Y = af ( X

1

) + bg ( X

2

)

Easy to estimate using linear regression.

Aggregate Response Models:

Multiple Instruments cont’d

• Multiplicative model for handling multiple marketing instruments

Y = aX b

X c

1 2 b and c are elasticities.

Widely used in marketing.

Can be estimated by linear regression.