What are goals?

advertisement

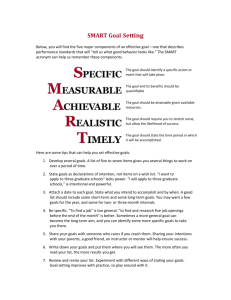

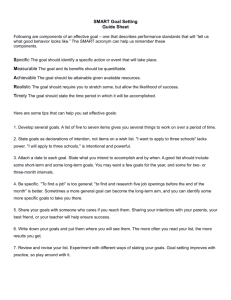

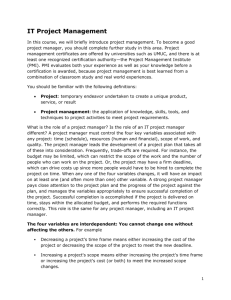

OPENING We all want something that costs more than the money we have. Think of something you want. • What would you do to get it? • Ask parents? • Borrow from a friend? • Do you really need it or just want it? GOALS & FINANCIAL PLANNING 1.3 OBJECTIVES By the end of this lesson, you will be able to: • Define: Opportunity Cost, Trade-Offs, Delayed Gratification, and Satellite Decisions • Compare and contrast short-term, intermediate and long-term goals • Analyze the five steps in the financial planning process • Create SMART goals GOALS • What are goals? • Why do people set goals? • What are some of your goals? Take two minutes to make a list of all of your goals. They can be academic, personal, financial, occupational, anything. TIMING OF GOALS Short-Term Intermediate Long-Term 3 months or sooner between 3 months & a year more than a year Now, go through your list of goals, and write a “S,” “I,” or “L” next to each of your goals to categorize them. You should have at least 5 goals for each category. SINCE REACHING YOUR GOALS TAKES TIME… OPPORTUNITY COST • “what you give up to get something else” • “the value of the next-best alternative” • Hard to measure: so usually described: – “High opportunity cost” – “Low opportunity cost” OPPORTUNITY COST EXAMPLES WHAT WOULD THE OPPORTUNITY COST BE FOR THIS WOMAN TO OPEN UP A NEWSPAPER STAND IN NY? HIGH OR LOW WHAT WOULD THE OPPORTUNITY COST BE FOR THIS BASKETBALL MAN TO PLAY AFTER HIGHSCHOOL INSTEAD OF ATTENDING COLLEGE ? HIGH OR LOW What is the opportunity cost of achieving each of your goals? Why? TRADE-OFFS • “giving up one want to satisfy another” • How do trade-offs relate to opportunity cost? • Why do we have to make trade-offs? SATELLITE DECISIONS • “when a major decision leads to several smaller ones” • What are some examples of satellite decisions? • ex. Car – (what kind, down payment, color, where and when to buy, insurance, etc.) DELAYED GRATIFICATION • Take a guess… what do you think it means? • What are some examples of delaying gratification? – saving money over time to make a major purchase – waiting to buy a new product until the price goes down – waiting to see the latest movie until the crowds get smaller and the lines shorter MAKING FINANCIAL GOALS Be “SMART” USING WHAT WE’VE LEARNED…. • Let’s make some financial goals! • What are some things that you need money for in your future? • Be sure to consider short-term, intermediate, and long-term goals! SMART Goals • Specific • Measurable • Attainable • Realistic • Time-limited SMART Goals Examples • Specific • Measurable • Attainable • Realistic • Time-limited • “Pay for lodging, transportation, meals for a 5-day trip to Washington, How can we make all of D.C.” the financial goals • “$300 through fundraising, $50we from birthday save $25 a week.” listed money, earlier, SMART? • “If I stick to my plan, I’ll have the money when I need it.” Go ahead and edit your while I work toward this goal.” goals to make them • “I need to have all the money by 6 SMART. months from now.” • “I still have enough money to live on The Decision- Making Process Identify Your Goal Set Goals Establish Criteria Examine Your Options The Financial Planning Process Weigh Pros and Cons Analyze Information Create a Plan Implement the Plan Make a Decision Evaluate Results Monitor & Modify the Plan LET’S PUT SOME NUMBERS TO THIS… • You all did a spending log for HW….take it out. • See your final total for the week. If it’s positive, good job. If it’s negative, you need to decide what you’re going to cut to make it positive. Go ahead and do this now. • Next, you are going to calculate how many weeks it will take for you to reach each of your goals at the same rate. List 3 of each short, intermediate, and long-term goals in a new Google Doc, with how many weeks it will take you to reach each. QUIZ REMINDER! Know these terms: • financial goals • opportunity cost • financial planning • satellite decisions • goals • scarcity • barter • incentive • short-term goal • cash flow • inflation • store of value • currency • intermediate goal • supply • decision • liquidity • trade-off • delayed gratification • long-term goal • unit of measure • demand • medium of exchange • values • economist • money • wants • economy • needs