Upward Obligations

advertisement

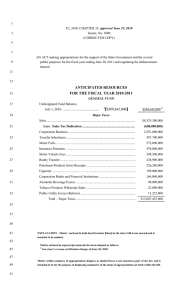

Tips on Base Level Fiscal Law Keith M. Dunn Counsel to the Navy Surgeon General Navy Bureau of Medicine and Surgery keith.dunn@med.navy.mil 202.762.3299 www.twitter.com/TheFiscalLawyer 1 The Power of the Purse • “No money shall be drawn from the Treasury, but in Consequence of Appropriations made by law . . . “ – Constitution, Article I, section 9, clause 7 what does it mean? “The established rule is that the expenditure of public funds is proper only when established by Congress, not that public funds may be expended unless prohibited by Congress.” United States v. MacCollom, 426 US 317 (1976) Sources of Law • US CODE • AUTHORIZATION ACTS – AUTHORIZE PROJECTS - 10 USC 2802 – AUTHORIZE APPROPRIATIONS - 10 USC 114 – ENACT PERMANENT LEGISLATION • APPROPRIATION ACTS – 31 USC 1301(d) – GENERALLY TEMPORARY • OTHER PUBLIC LAWS • OPINIONS 4 THE BOX DOES NOT CHANGE! PURPOSE – Funds may be obligated and expended only for specified purposes; TIME – Funds are available for obligation only for specified time limits AMOUNT – Agencies may not spend more than is appropriated 5 Banking and Laundering Funds If it sounds too good to be true, it is. Sending money to GSA does not change the character of your money! (Neither does MIPRing it somewhere!) You cannot extend the life of money by offloading it somewhere! 6 Interagency Agreements B-308944, July 17, 2007 • A MIPR lacking specificity as to the goods or services ordered does not serve properly to obligate DOD funds • Funds must be used within a reasonable time of receipt in order to meet the bona fide needs rule. 7 Natural Resources Conservation Service – Obligating Orders with GSA’s AutoChoice Summer Program B-317249, July 1, 2009 • Current fiscal year funds are not available for obligation for orders placed this fiscal year that cannot be finalized until the next fiscal year. • Not a valid obligation to the current fiscal year because, until finalized, the order is tentative and incomplete. 8 Speaking of GSA . . . Chemical Safety and Hazard Investigation Board – Interagency Agreement with the General Services Administration, B318425, December 8, 2009 • FY appropriations are not available to fund severable services that will be performed in a future fiscal year • Proposed IA that does not specify a period of performance or the services to be provided (exposing the agency to an unknown liability) violates the Antideficiency Act. 9 Funding of Severable Services Contracts Severable Services Contracts, B-317636, April 21, 2009 • 10 USC 2410a authorizes agencies to enter into severable services contracts that begin in one fiscal year and end no more than 12 months later funded with the appropriation current at the time of contract award – a statutory exception to the bona fide needs rule – only applies to contracts funded with time limited appropriations • An agency using a multiple year appropriation would not violate the bona fide needs rule if it enters into a severable services contract for more than one year so long as the period of performance does not exceed the period of availability of the appropriation • Bona fide needs rule not an issue with no-year funds 10 Nonseverable Services Contracts • A nonseverable services contract that is not separated for performance by fiscal years may not be funded on an incremental basis without statutory authority. • Failure to obligate the estimated cost of a nonseverable cost reimbursement contract at time of award violates the bona fide needs rule. Financial Crimes Enforcement Network – Obligations under a Cost-Reimbursement, Nonseverable Services Contract, B-317139, June 1, 2009 11 Recurring Purpose Issues Plus ca change plus c'est la meme 12 Food “[F]ree food . . . Normally cannot be justified as a ‘necessary expense’ under an appropriation since such expenses are considered personal expenses that government employees are expected to bear from their own salaries.” 72 Comp. Gen. 178 Forest Service--Light Refreshments for National Trails Day, B-310023, April 17, 2008 13 The Food Exceptions • • • • • • • Emergencies Training Meetings Conferences Awards Ceremonies Cultural Awareness Ceremonies Travel • • • DoD DGC(Fiscal) memo dtd 1 Sept 05 FMB memo dtd 12 May 06 http://www.gao.gov/special.pubs/appforum2005/approfunds/index. html 14 U.S. Army Garrison Ansbach, B-317423, March 9, 2009 • Food may be provided for civilian employees, military members, and nonfederal participants such as contractors and host nation first responders at annual antiterrorism training exercises where necessary to achieve the objectives of the training exercise • That it would be an “embarrassment” not to provide food to host nation first responders is not sufficient justification for using appropriated funds to buy food for nonfederal personnel 15 Department of the Navy – Lunch for Volunteer Focus Group B-318499, November 19, 2009 • • • • In general, appropriated funds are not available for personal expenses, such as lunch Whether to provide food for focus group participation must be decided on a case-by-case basis Here, no specific statutory objective identified, so appropriated funds not available Contrast with Veterans Benefits Administration – Refreshments for Focus Groups, B-304718, Nov. 9, 2005 16 Bottled Water The Rule: personal expense! Appropriated funds may be used only upon a showing of necessity; i.e., there is no potable water available. 2 Comp. Gen 776 (1923) and many other cases! B-318588, Sept. 29, 2009 B-310502, 4 Feb 2008 17 Kitchen Appliances • Use of Appropriated Funds to Purchase Kitchen Appliances, B302993, 25 June 2004 – appropriated funds may be used to purchase major kitchen appliances that would be placed in common areas for the use of personnel at the site 18 Clothing “ . . . every employee of the Government is required to present himself for duty properly attired according to the requirements of his position.” 63 Comp. Gen. 245, 246 (1984) See also B-288828, 3 Oct 02; B-289683, 7 Oct 02 19 The Clothing Exceptions • Official Civilian DOD Uniforms: 10 U.S.C. § 1593 • Administrative Expenses Act: 5 U.S.C. § 7903 • Special/unusual clothing • Item must be for the benefit of the Government, essential to the safe and successful accomplishment of the work, and not solely for the protection/comfort of employee • Must involve hazardous duty • OSHA Compliance: 29 U.S.C. § 668 20 Not Exceptions! • Raincoats and umbrellas for employees who must frequently go out into the rain • Running shoes for couriers • Cold weather/foul weather gear 21 the “strolling through the mall” test Clothing items that are specifically required safety equipment under NAVOSH Instructions Jackets with cool Command Logos given to all employees to increase esprit d’ corps Foul weather gear and work overalls demanded by the local Labor Union “Organizational Clothing” “GOOD” “BAD” “MAYBE” Astronaut's Suit Grateful Dead® T-Shirts 22 Other Personal Expenses • Questions to ask: – Is there a reasonable relationship between the proposed expenditure and the purpose for which the funds were appropriated? – What is the benefit to the agency? – What is the benefit to the individual? – Is there a more cost effective way to achieve the agency mission or program goals? • Examples: – – – – Registered traveler programs Health promotion items Recruiting items Gifts and other giveaway items 23 The Ever Popular Trinkets • Legitimate only: – As part of an approved Awards program – Items of no intrinsic value designed solely to assist in achieving internal agency management objectives – In rare cases, ok where there is a direct connection between the expenditure and the execution of the agency’s mission; benefit to the government must outweigh the personal nature of the item • (Rule of thumb: with the exception of a legitimate award, if it’s something actually you’d want, you can’t have it.) 24 Giveaway Items Held Proper • Caps and other items distributed to a local residents in furtherance of threatened eider conservation plan – US Fish and Wildlife Service, B318386, 12 August 2009 • Gift cards for respondents to the Converter Box Coupon Program Survey - National Telecommunications and Information Administration, B310981, 25 Jan 2008 • Lava rocks distributed by National Park Service at Capulin Mountain National Monument, B-193769, 24 Jan 1979 25 Examples of Improper Giveaway Items • T-shirts with the CFC logo given to employees who contributed a certain amount • Ice scrapers imprinted with the logo “Don’t Drink and Drive” • Novelty plastic garbage cans containing candy in the shape of solid waste, given by EPA to attendees at an exposition • Decorative ashtrays given to conference attendees 26 Commander’s Coins Three sources of funding - O&M – for awards pursuant to a properly established awards program; or pursuant to 10 USC § 2261 authority for recognition items - ORF – IAW SECNAVINST 7042.7K (for the Navy) or other relevant Instruction - OWN – for all others Caveats - Be wary of bona fide need - Personalization increases risk of obsolete stock upon departure 27 Recognition Items for Recruitment/Retention 10 USC 2261 • Allows appropriated funds to be used to procure items of nominal or modest value for recruitment/retention – to members of the armed forces, their families, and other individuals recognized as providing support that substantially facilitates service in the armed forces – “nominal or modest value” defined as a commemorative coin, medal, trophy, badge, flag, poster, painting, or similar item valued less than $50 • B-307892, October 11, 2006 • OASN(FM&C) memos dated November 9, 2006 and December 14, 2006 28 Traditional Ceremonies (i.e., Retirement, Change of Command) – Traditional ceremonies are considered official events – Authorized to use appropriated funds, government personnel, and other resources Includes cost of printing/addressing/sending reasonable number of invitations, as appropriate Does not include cost of food, beverages, or other entertainment – Presentation of award during a traditional ceremony does not permit use of appropriated funds to purchase food at follow-on reception or ceremony 29 Commuting Expenses • National Indian Gaming Commission – Reimbursing Bicyclists as Part of the Agency’s Transportation Fringe Benefit Program, B-318325, Aug. 12, 2009 – Agency may use its authority under 5 USC 7905 to provide a $20 reimbursement to employees who commute to work by bicycle • Army – Mass Transit Benefits, Aberdeen Proving Ground, B316381, July 18, 2008 – A certifying officer does not have a responsibility to question the wisdom of a payment where there is clear agency policy 30 Use of Government Resources • B-277678, 4 January 1999 • Joint Ethic Regulation, DoD 5500.7-R 3-201 31 Social Networking • Has been embraced by DoD • Can be a valuable tool – information dissemination – freeing workforce from answering repetitive questions – sharing best practices – information management – electronic learning 32 however • Use caution with social networking, user generated content, and wikis • Do not combine personal and professional information. • When in doubt, talk to your lawyer! 33 remember . . . • “What happens in Vegas . . .” stays on YouTube, Facebook, Twitter • Ten seconds to post – it’s out there forever • Most Commands require users to sign statements regarding permissible use, etc. • IT Departments can detect spikes in online use; also can monitor content • Use Facebook, Twitter, etc. for personal use on personal time 34 Use of Official Government Vehicles • 31 USC 1344 • 31 USC 1349 – penalty for violating 1344 is a suspension of at least one month 35 For the Vast Majority of Us . . . •Official Purpose •TAD Status 36 Domicile to Duty Transportation Only as authorized by 31 U.S.C. § 1344, e.g. Secretaries and Chiefs of Staff, certain others as justified by command & control or security issues 37 Ground Travel and Transportation Ground Transportation of Spouses • Spouses may ride in government vehicles to official events with their sponsors • Spouses may not ride by themselves in government vehicles to official events unless – the sponsor is authorized domicile-to-duty transportation and – it is impractical or impossible for the sponsor to accompany the spouse Duty-to-Duty Transportation 38 Air Travel and Transportation Funded Travel of Spouses & Family Members “Rare Exception” authorized only if • The family member actually participates in an “unquestionably official” function or capacity, or • Such travel is in the best interests of the United States because of a diplomatic or public relations benefit to the United States DoDD 4500.56, DoD 4515.13-R 39 Air Travel and Transportation Unofficial travel of Spouses and Family Members of Senior Official on MilAir – also a rare exception: Spouse/family member may accompany General Officer, SES and equivalents on official business if 1. 2. 3. 4. Travel is reimbursed at full coach fare MilAir already scheduled for official trip Spouse/family member cannot displace official travelers Larger aircraft not required to accommodate spouse/family member travel 40