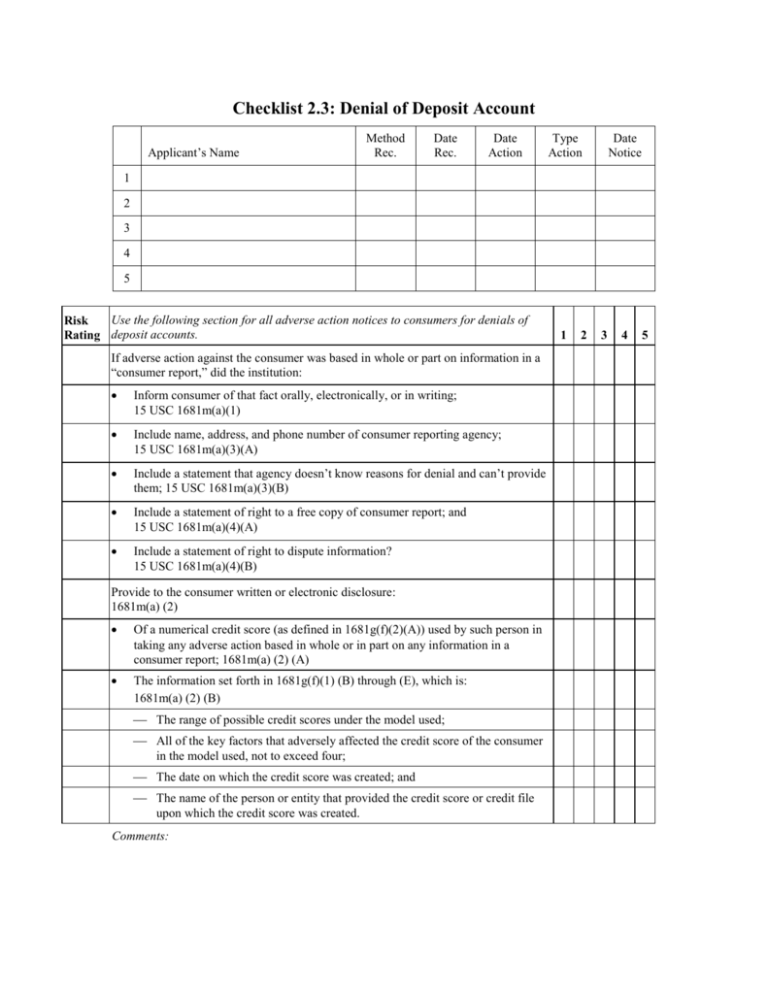

Checklist 2.3: Denial of Deposit Account Applicant's Name Method

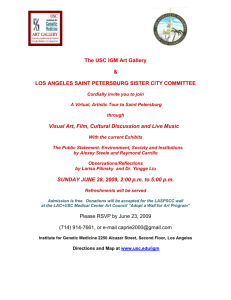

advertisement

Checklist 2.3: Denial of Deposit Account Applicant’s Name Method Rec. Date Rec. Date Action Type Action Date Notice 1 2 3 4 5 Use the following section for all adverse action notices to consumers for denials of Risk Rating deposit accounts. If adverse action against the consumer was based in whole or part on information in a “consumer report,” did the institution: Inform consumer of that fact orally, electronically, or in writing; 15 USC 1681m(a)(1) Include name, address, and phone number of consumer reporting agency; 15 USC 1681m(a)(3)(A) Include a statement that agency doesn’t know reasons for denial and can’t provide them; 15 USC 1681m(a)(3)(B) Include a statement of right to a free copy of consumer report; and 15 USC 1681m(a)(4)(A) Include a statement of right to dispute information? 15 USC 1681m(a)(4)(B) Provide to the consumer written or electronic disclosure: 1681m(a) (2) Of a numerical credit score (as defined in 1681g(f)(2)(A)) used by such person in taking any adverse action based in whole or in part on any information in a consumer report; 1681m(a) (2) (A) The information set forth in 1681g(f)(1) (B) through (E), which is: 1681m(a) (2) (B) The range of possible credit scores under the model used; All of the key factors that adversely affected the credit score of the consumer in the model used, not to exceed four; The date on which the credit score was created; and The name of the person or entity that provided the credit score or credit file upon which the credit score was created. Comments: 1 2 3 4 5