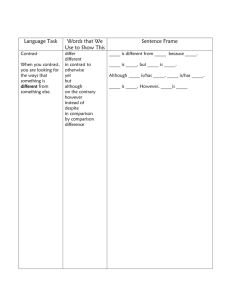

1 Budget RES.

advertisement