Share consolidation benefits

advertisement

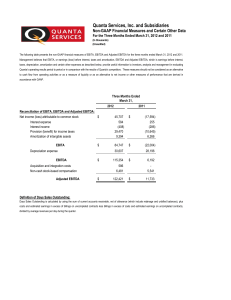

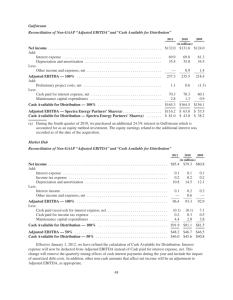

Q1 2012 TELUS investor conference call May 9, 2012 Robert McFarlane EVP & Chief Financial Officer Joe Natale EVP & Chief Commercial Officer Darren Entwistle President & Chief Executive Officer TELUS Forward Looking Statement Today's presentation and answers to questions contain statements about expected future events and financial and operating performance of TELUS that are forwardlooking. By their nature, forward-looking statements require the Company to make assumptions and predictions and are subject to inherent risks and uncertainties. There is significant risk that the forward-looking statements will not prove to be accurate. Readers are cautioned not to place undue reliance on forward-looking statements as a number of factors could cause actual future performance and events to differ materially from that expressed in the forward-looking statements. Accordingly our comments are subject to the disclaimer and qualified by the assumptions (including assumptions for 2012 annual targets), qualifications and risk factors (including TELUS proposed share consolidation and foreign ownership levels, the ability over time to sustain dividend growth of circa 10% per annum with semi-annual dividend increases to 2013, and CEO three year goals for EPS and free cash flow growth excluding spectrum costs to 2013) referred to in the Management’s discussion and analysis in the 2011 annual report, and in the 2012 first quarter report. Except as required by law, TELUS disclaims any intention or obligation to update or revise forward-looking statements, and reserves the right to change, at any time at its sole discretion, its current practice of updating annual targets and guidance. 2 Agenda Share conversion proposal update Wireless and wireline segment review Consolidated financial review Updates Spectrum auction and foreign direct investment policies Operational highlights Questions and Answers 3 Mason Capital Despite Mason having one twentieth of the economic interest of our employees, they hold four times the voting power Executive Director of CCGG condemns ‘empty voting’ and fully supports one share – one vote Leading independent proxy advisors, ISS and Glass Lewis supported the proposal four times 4 Share consolidation benefits Enhances TELUS’ leading good corporate governance practices Enhances marketability of TELUS shares Enhances liquidity of common shares Listing on New York Stock Exchange One share – one vote 5 Significant share value appreciation since announcement Feb. 21 – May 8 Common Shares: 4.0% Non-Voting: 5.9% Toronto Stock Exchange Index: (7.3)% MSCI Global Telecom Index: (0.7)% Since announcement, TELUS’ market value has increased circa $1 billion 6 Our commitment to our shareholders TELUS Board and Management fundamentally agree this is the right proposal and in the best interest of our company and long-term shareholders We will pursue other actions to convert our share structure to a single class Conversion on one-to-one basis is the right model TELUS continues to build upon our company’s operational and financial momentum 7 Q1 2012 wireless financial results ($M) Q1-11 Q1-12 Revenue (external) 1,308 1,383 5.7% 551 622 13% 41.8% 44.7% 2.9 pts EBITDA margins2 (total revenue) Capex EBITDA less capex 76 151 99% 475 471 EBITDA1 change (0.8)% 1 EBITDA 2 before restructuring costs in Q1-12 and Q1-11 were $626 and $551 million, respectively. Margins on network revenue in Q1-12 and Q1-11 were 48.3% and 45.8%, respectively. Record EBITDA with growth of 13% and margin improvement Cash flow strong while continuing LTE investments 8 Wireless subscriber results Total net adds Postpaid net adds Wireless subscribers 63K 52K 16% 7.4M total 32K 22K Q1-11 Q1-12 1.2M prepaid Q1-11 Q1-12 6.2M postpaid 84% Postpaid net adds growth of 21% y/y Smartphones now 56% of postpaid base, up from 38% in prior year 9 Marketing and retention Q1-11 Q1-12 388 363 (6.4)% 1.70% 1.55% (0.15) pts $348 $362 4.0% COA expense $135M $131M (3.0)% Retention expense $148M $139M (5.8)% Lifetime revenue $3,405 $3,798 12% Gross adds (000s) Churn1 COA per gross add 1 change Q1-12 and Q1-11 churn of 1.52% and 1.62% when normalized for loss of Government of Canada contract. Industry leading churn combined with lower acquisition and retention expenses 10 Blended ARPU analysis Data Voice % of ARPU $57.89 $58.87 17.71 22.83 31% 39% 40.18 36.04 69% 61% Q1-11 Q1-12 Q1-11 Q1-12 ARPU increase of 1.7% led by data Sixth consecutive quarter of ARPU growth 11 Wireless data revenue $498M $366M $254M Q1-10 Q1-11 Q1-12 Industry leading data revenue growth of 36% Q1 data increased to 39% of network revenue 12 Q1 2012 wireline financial results ($M) Q1-11 Q1-12 Revenue (external) 1,223 1,248 2.0% 435 387 (11)% 34.4% 30.0% (4.4) pts Capex 333 290 (13)% EBITDA less capex 102 97 (4.9)% EBITDA1 EBITDA margins (total revenue) change 1 Q1-12 adjusted EBITDA of $388M excludes a $1M equity loss for residential component of TELUS Garden real estate joint venture and Q1-11 adjusted EBITDA of $419M excludes a $16M non-cash gain on Transactel. Wireline revenue growth reflects strong TV and HSIA subscriber growth Cash flow stable as lower EBITDA offset by reduced capex 13 Adjusted wireline EBITDA 435 387 (11)% 419 388 (7.4)% 33.6% 30.1% (3.5) pts 98 14% (16) Equity loss for residential component real estate J.V. Adjusted EBITDA1 Adjusted EBITDA margin Adjusted EBITDA less capex 1 Adjusted change Gain on Transactel acquisition Q1-12 EBITDA Q1-11 ($M) 1 86 EBITDA before restructuring costs in Q1-12 and Q1-11 were $397 and $423 million, respectively, down 6.5%. Adjusted wireline EBITDA lower by 7.4% 14 TELUS TV customer growth TELUS TV net additions* TELUS TV subscribers* 553K 358K 44K 44K Q1-11 Q1-12 Q1-11 Q1-12 Momentum continues with TV net adds of 44K Total subscribers up 54% surpassing 550,000 15 * Includes both IP TV and TELUS Satellite TV subscribers TELUS high-speed Internet customer growth High-speed net additions 16K 16K Q1-11 Q1-12 High-speed subscribers 1.18M 1.26M Q1-11 Q1-12 Stable growth in HSIA despite competitive environment Total subscriber base up 6.3% 16 TELUS network access line losses Residential Q1-11 Q1-12 Business 2K Q1-12 Q1-11 -10K -33K -47K Residential line losses impacted from price-based competition Business line losses reflects competition, and wholesale adds in Q1/11 17 Q1 2012 consolidated financial results ($M, except EPS) Q1-11 Q1-12 change Revenue (external) 2,531 2,631 4.0% EBITDA1 986 1,009 2.3% EPS (basic) 1.01 1.07 5.9% Capex 409 441 7.8% EBITDA less capex 577 568 (1.6)% Free cash flow 162 358 121% 1 Q1-12 adjusted EBITDA of $1,010M excludes a $1M equity loss for residential component of TELUS Garden real estate joint venture and Q1-11 adjusted EBITDA of $970M excludes a $16M non-cash gain on Transactel. FCF growth driven by lower discretionary defined benefit pension contributions, increased EBITDA and lower financing costs 18 EPS continuity analysis ($) 1.01 0.13 0.04 -0.06 0.97 Excl. Trans. gain Q1-11 reported 1.07 Higher Normalized EBITDA1 Lower Financing costs2 Higher Dep & Amort - 0.02 Higher Pension - 0.02 Higher Restructure & other 1.04 Excl. Tax Adj. Q1-12 reported EPS growth reflects EBITDA growth and lower financing costs partly offset by higher D&A, pension and restructuring costs 1 2 Normalized EBITDA excludes $0.04 combined for restructuring and pension costs. Financing costs excludes $0.02 of interest on income tax refunds in Q1/12. 19 Industry Canada sets spectrum auction and telecom foreign ownership policies Spectrum cap of 10 MHz for prime 700 MHz auction and 40 MHz for 2.5 GHz auction 700 MHz prime spectrum divided into 4 paired blocks of 10 MHz 2.5 GHz spectrum cap means TELUS should be eligible to obtain up to 40 MHz of spectrum Auctions delayed to H1 2013 for 700 MHz and H1 2014 for 2.5 GHz Foreign ownership restrictions to be lifted for carriers with less than 10% national market share TELUS encourages government to continue to work towards full liberalization to ensure level playing field Policy announcement on spectrum auctions consistent with TELUS’ proposed recommendations to Government 20 2012 guidance confirmed 2012 guidance Revenue (external) EBITDA EPS (basic) Capex y/y change $10.7 to 11.0B 3 to 6% $3.8 to 4.0B 1 to 6% $3.75 to 4.15 0 to 10% Approx $1.85B 2012 consolidated and segmented guidance confirmed 21 Q1 2012 summary Strong consolidated revenue growth driven by data Record consolidated EBITDA Great wireless metrics across the board (e.g. EBITDA, ARPU, churn, lifetime revenue, postpaid net adds, COA/COR) Continued Optik TV and high-speed Internet subscriber growth Strong FCF growth aided by lower discretionary defined benefit pension contributions, higher EBITDA, and lower financing costs Better than expected beginning to 2012 with strong free cash flow generation supporting an even stronger balance sheet 22 Strong smartphone adoption, ARPU growth continue Postpaid subscribers (millions) Wireless Data ARPU Smartphone % of postpaid 5.4 5.8 $22.83 6.2 $17.71 $13.14 56% 38% 22% Q1-10 Q1-11 Q1-12 Q1-10 Q1-11 Q1-12 1Q 2012 Smartphone base up 63% to 3.5 million year over year Data ARPU expansion driven by 36% growth in data revenue 23 Future friendly home – continued strength in Optik High-speed Internet TELUS TV Residential NALs 60K 16K 60K 16K 50K 38K 44K 44K -50K -43K -33K -47K -30K Q1-10 Q1-11 32K 3K 29K -39K Q1-12 TV and High-Speed Internet loading exceeding residential NAL losses for seventh consecutive quarter 24 Continued new innovations for Optik TV Twitter app for Optik TV Tweet what watching Optik TV, follow what others saying about favourite shows through ‘TV Tweets’ Optik TV for Xbox 360 TELUS Optik TV first in world to offer customers gesture & voice control ability with Kinect Optik on the go View select TV On Demand content on your mobile device, anywhere in Canada 25 Appendix – free cash flow C$ millions 2011 Q1 2012 Q1 Adjusted EBITDA1 Capex 970 (409) 1,010 (441) (9) (1) (235) (116) Interest expense paid, net (61) (55) Income taxes received (paid), net (66) (48) (5) 7 (23) 162 17 54 2 358 (169) (60) (168) (188) (32) (15) (62) (164) 61 170 (39) 6 22 Net Employee Defined Benefit Plans Expense (Recovery) Employer Contributions to Employee Defined Benefit Plans Share-based compensation Restructuring payments (net of expense) Free Cash Flow Common and Non-voting shares issued Dividends reinvested (DRIP) Dividends Acquisitions Real estate joint venture Working Capital and Other Funds Available for debt redemption Net Issuance (Repayment) of debt Increase in cash 1 - Q1-12 and Q1-11 adjusted EBITDA excludes a $1 million equity loss for residential component of TELUS Garden real estate joint venture and a $16 million non-cash gain on Transactel, respectively. Appendix – definitions EBITDA: Earnings before interest, taxes, depreciation and amortization Capital intensity: capital expenditures divided by total revenue Cash flow: EBITDA less capex Free cash flow: EBITDA, adding Restructuring costs, net employee defined benefit plans expense, cash interest received and excess of share-based compensation expense over share-based compensation payments, subtracting the non-cash gain on Transactel, cash interest paid, cash taxes, capital expenditures, restructuring payments and employer contributions to employee defined benefit plans. Cost of retention (COR): total costs to retain existing subscribers, often presented as a percentage of network revenue