Simulation Methods (cont.)

advertisement

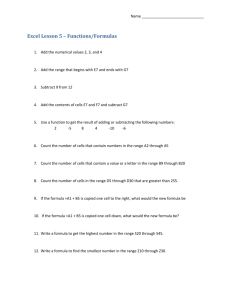

Simulation Methods (cont.) Su, chapters 8-9 Numerical Simulation II • Simulation in Chapter 8, section IV of Su • Taken from “Forecasting and Analysis with an Econometric Model,” Daniel B. Suits, American Economic Review, March 1962, pp. 104-132 • Four equation econometric model. – Parameters come from empirical estimates Model YC+I+G C = a1 + b1(Y - T) I = a2 + b2Y-1 + g2R T = a3 + b3Y • Exogenous: • Endogenous: • Parameters Structural Model YC+I+G C = a1 + b1(Y - T) I = a2 + b2Y-1 + g2R T = a3 + b3Y • Exogenous: G, R • Endogenous: Y, C, I, T • Parameters: a1 a2 a3 b1 b2 b3 g2 Parameterized Model YC+I+G C = 16 + 0.7(Y - T) I = 6 + 0.1Y-1 - 0.3R T = 0.0 + 0.2Y Obtained by statistical techniques - data were obtained and these parameters were estimated Reduced Form Equations • The “solution” to this model is called reduced form equations • Shown in equations (8.4a)-(8.4d) • The numbers are reduced form parameters • Note that an explicit reduced form equation for Y has been solved for • First-order linear difference equations • Endogenous on RHS, Exogenous on LHS Reduced Form Equations - General Form Y C I T = = = = a10 a20 a30 a40 + + + + a11Y-1 a21Y-1 a31Y-1 a41Y-1 + + + + a12R a22R a32R a42R + + + + a13G a23G a33G a43G Reduced Form Equations Y C I T = 50 + 0.2273Y-1 = 44 + 0.1273Y-1 = 6 + 0.1Y-1 = 10 + 0.0455Y-1 - 0.6818R + 2.2727G - 0.3818R + 1.2727G 0.3R - 0.1364R + 0.4545G Reduced Form Parameters Y • The reduced form parameters are functions of the structural parameters • Can be solved to get: a10= (a1+ a2- b1 a3) / (1- b1+ b1 b3 ) a11= (b2) / (1- b1+ b1 b3 ) a12= (g2) / (1- b1+ b1 b3 ) a13= 1 / (1- b1+ b1 b3 ) Spread Sheet Set-up • Top 7 rows will be used for parameter calculations • Top two rows: Structural Parameters • Row three: Combinations • Rows 4-7: Reduced Form parameters Spread Sheet Set-up - Example alpha1= 16 alpha2= 6 alpha3= 0 gamma3= -0.3 beta1= 0.7 beta2= 0.1 beta3= 0.2 Z1= a10= a11= a12= a13= a20= a21= a22= a23= a30= a31= a32= a33= a40= a41= a42= a43= Time Saving Hint: Y • Use Z1 = (1- b1+ b1 b3 ), then a10= a11= a12= a13= (a1+ a2- b1 a3) / Z1 (b2) / Z1 (g2) / Z1 1 / Z1 • Saves coding steps Reduced Form Parameters T • Want to find these next. Substitute • T = a3+ b3(a10+a11Y-1+a12R+a13G) a40= a3+ b3 a10 a41= b3a11 a42= b3a12 a43= b3a13 Can use a’s from row 4! Reduced Form Parameters I • These are easy a30= a31= a32= a33= a2 b2 g2 0 Reduced Form Parameters C • Substitute • C = a1+ b1(Y-T) • C = a1+ b1[a10+a11Y-1+a12R+a13G a3 - b3(a10+a11Y-1+a12R+a13G)] a20= a21= a22= a23= a1- b3 a3 + (1- b3) b1 a10 (1- b3) b1 a11 (1- b3) b1 a12 (1- b3) b1 a13 Time Saving Hint: C • Write a formula for (1- b3) b1 in row 3 • Use this and a’s from row 4 Multipliers • In a dynamic model, can distinguish between two types of multipliers: – Short-term or Impact multipliers – Long-Term Multipliers Baseline Solution • • • • “Most likely and reasonable time path” A basis for comparison In this case, Y-1 = 100 G=20 R=10 In this case, simply means no change in fiscal policy Spreadsheet - Time Paths • Put Time and variables in columns • Use a’s in formulas to calculate Y,C,I,T alpha1= beta1= Z1= a10= a20= a30= a40= Time 0 1 16 alpha2= 6 alpha3= 0 gamma2= -0.3 0.7 beta2= 0.1 beta3= 0.2 0.44 (1-beta3)beta1 0.56 50 a11= 0.2273 a12= -0.6818 a13= 2.2727 44 a21= 0.1273 a22= -0.3818 a23= 1.2727 6 a31= 0.1 a32= -0.3 a33= 0 10 a41= 0.045455 a42= -0.13636 a43= 0.454545 G R Y C I T C+I+G 20 10 100.0000 20 10 111.3636 78.3636 13.0000 22.2727 111.3636 Time Table 8.1 Spreadsheet t-1 0 t 1 t+1 2 t+2 3 t+3 4 Reduced Form Equation: Y • Y = a10 + a11Y-1 + a12R + a13G • $B$4 + $D$4*D9 + $F$4*C10 + $H$4*B10 • Use absolute cell references for a’s Time Path of Yt - Baseline 120 115 110 105 100 1 2 3 4 5 6 7 8 9 10 11 12 Additional Policy Simulations • Once-for-All Change: G=21 in t+1 only • Sustained Change: G=21 in t+1 and all subsequent periods Time Path of Yt - Case 2 & 3 120 115 Series1 110 Series2 Series3 105 100 1 2 3 4 5 6 7 Short and Long Run Multipliers • • • • • What is the Short-Run multiplier on G in What is the Short-Run multiplier on G in What is the Long-Run multiplier on G in What is the Long-Run multiplier on G in Why the difference? 2? 3? 2? 3? Summary: Chapter 8 Simulations • What have we learned about macroeconomic models? – Relationship between structural parameters and reduced form parameters – How to perform “policy simulations” • Relationship to Forecasting?