Giraffe Racks

advertisement

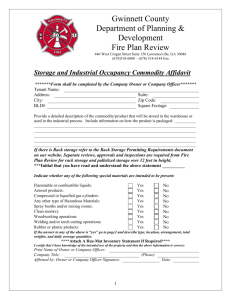

Business Plan Presentation Tyler Hutchens Dave Ryan Gary Tobin Carrie Xing Agenda The Problem Giraffe Rack Solution Marketing Strategy Operations Strategy Financial Plan Questions Bicycle Rack Market trends SUV Sales are increasing as a percentage of total vehicle sales. Sales of racks to SUV owners are increasing by 15% annually. People Want Roof Racks “Most people would rather use a roof rack, but can’t because of the vehicle size” Bobby Noyes, founder, Rocky Mounts, Inc. Roof Racks can be tough to use “I get hurt far more often loading and unloading my bike than riding it.” Pam Simich, Director, VeloNews Magazine. “I’ve seen people use ladders…” Margaret Principe, Counselor, Englewood High School. “I constantly struggle to get my bike on and off of my car.” Christy McDevitt, Physician, Kaiser Permanente. Our Solution Get the rack to the bike, not the bike to the rack! Giraffe Rack Rack Design Giraffe Rack Rack Design Giraffe Rack Rack Design Giraffe Rack Rack Design Giraffe Rack Rack Design Giraffe Rack Rack Design Giraffe Rack Rack Design Giraffe Rack Rack Design Giraffe Rack Rack Design Giraffe Rack Rack Design Giraffe Rack Rack Design Giraffe Rack Rack Design Giraffe Rack Rack Design Giraffe Rack Rack Design Giraffe Rack Rack Design Giraffe Rack Rack Design Giraffe Rack Rack Design Giraffe Rack Rack Design Giraffe Rack Rack Design Giraffe Rack Rack Design Innovative Design Yakima and Thule complementary No need to design to vehicle types Easy to use Marketing Strategy Market Size 2005 SUV rack market = $215M Total Market Potential = $630M Focused Strategy Roof rack accessory Compatible product SUVs Customer Survey Findings Bike enthusiasts SUV owners Women Vertically Challenged Already own/shopping for roof rack Pricing Strategy MSRP = $150.00 Retail discount = 45% 65% surveyed will pay $150 Retailer Specialty Stores Good discount for merchant – 45% Can sell to existing rack customers Additional installation revenue opportunity Rollout Year One - Colorado Great Market! Most SUVs per capita High concentration of bicyclists Wealthiest counties in Rockies Sales, Sales, Sales Ongoing Rollout Year Two Colorado mountain towns California, Portland, Seattle National Rollout in Year Three 180 stores by Year Five Brand Image Targeted Advertising Print ads, point-of-purchase displays Guerilla Marketing Demo units Events Giraffe Rack Advertising Brand Image Targeted Advertising Print ads, point-of-purchase displays Guerilla Marketing Demo units Events Talented Management Dave Ryan – President 10 years experience in early-stage companies Experienced Sales and Marketing Management Tyler Hutchens – Vice President 7 years experience in Marketing, Promotion, Operations, Finance Experience with early-stage companies Operations Strategy Operations Plan Major Features: Complements Sales and Marketing Low fixed costs Outsource Scope of Operation Outsource design Contract out to manufacturers for tooling and production Minimal assembly and packaging Key Success Factors Strong supplier relationships Strong retailer relationships Management involvement Development Timeline Concept R&D (30 days) Product Development (55 days) Product Release to Manufacturing (50 days) Manufacturing Ramp-up (85 days) Total Duration 220 Days (Dec ’01 – Oct ’02) Financial Plan Giraffe Rack Gross Margin Selling price of $82.50 Cost of goods sold $41.80 Our Gross Margin is 49.3% Outdoor Products average = 38.8% Higher for Marketing Costs Giraffe Rack Revenue 30 retail outlets in Year 1 Average 100 units per location Year 1 Revenues = $247,500 Year 1 Operating Expenses = $182,675 Year 1 Earnings = ($180,776) Revenue Growth $2,500,000 $2,000,000 $1,500,000 $1,000,000 $500,000 $0 Annual Revenue 1 2 3 $247,500 $544,500 $998,250 4 5 $1,536,150 $2,168,100 Giraffe Rack Cash Flow $500,000 $400,000 $300,000 $200,000 $100,000 $0 ($100,000) ($200,000) 1 2 Cash Flow ($158,861) ($130,126) 3 4 5 ($5,539) $183,873 $454,338 Giraffe Rack Cash Flow Highly seasonal sales 75% coming between April and September Cash need early, excess later Giraffe Rack Funding Owners will contribute $60,000 Raising $200,000 in debt Repaid $500,000 at the end of Year 5 Offers a 20.1% compounded return Interest expensed and accrued each year Giraffe Rack Cash Flow (b) $400,000 $350,000 $300,000 $250,000 $200,000 $150,000 $100,000 $50,000 $0 1 Cash Flow $101,139 2 3 4 5 $127,099 $225,506 $391,768 $57,262 Giraffe Rack Growth $150,000 $100,000 $50,000 $0 ($50,000) ($100,000) ($150,000) ($200,000) Earnings Net Margin 1 2 3 4 5 ($180,776) ($19,546) $76,601 $119,771 $119,675 7.67% 7.80% 5.52% Giraffe Rack Exit Acquisition by a larger company Licensing agreement with a larger marketing/manufacturing organization Manufacturing and distribution turned over Marketing and royalties negotiated Wrap Up Market need Strategy Investment Questions? Cost of Goods Sold Component Pivot Plate Outer Bars Inner Bar Mount Bar Piston/spring assembly Handle Assembly Bushings Hardware Packaging Labor Total Quant Cost Total 4 2 1 1 1 1 8 12 1 0.5 $1.50 $1.75 $2.75 $2.00 $12.00 $5.50 $0.25 $0.15 $0.25 $12.00 $6.00 $3.50 $2.75 $2.00 $12.00 $5.50 $2.00 $1.80 $0.25 $6.00 $41.80 Giraffe Rack Growth Units per outlet Outlets Selling Price Revenue Year 1 100 30 $82.50 $247,500 Year 2 110 60 $82.50 $544,500 Assumptions Yr.1 Locations Yr. 1 Units Per Location Sales growth/yr Year 3 Year 4 Year 5 121 133 146 100 140 180 $82.50 $82.50 $82.50 $998,250 $1,536,150 $2,168,100 30 100 10% Giraffe Rack Growth Revenue Gross Profit Operating Expenses EBIT Net Earnings % of Revenue Year 1 $247,500 $122,100 $182,675 ($140,575) ($180,776) Year 2 $544,500 $268,620 $239,885 $28,735 ($19,546) Year 3 Year 4 $998,250 $1,536,150 $492,470 $757,834 $357,883 $568,422 $134,587 $189,412 $76,601 $119,771 7.67% 7.80% Year 5 $2,168,100 $1,069,596 $789,131 $280,465 $119,675 5.52% Giraffe Rack Cash Flow EBIT Investing Activities Net Cash Build (Burn) Beginning Cash Balance Ending Cash Balance Year 1 ($148,861) ($10,000) ($158,861) ($158,861) Year 2 $28,735 $28,735 ($158,861) ($130,126) Year 3 $134,587 ($10,000) $124,587 ($130,126) ($5,539) Year 4 $189,412 $189,412 ($5,539) $183,873 Year 5 $280,465 ($10,000) $270,465 $183,873 $454,338 Giraffe Rack Cash Flow (b) Cash Flow From Ops Investing Activities Net Cash Build (Burn) Increase (Dec) in Debt Beginning Cash Balance Ending Cash Balance Year 1 ($148,861) ($10,000) ($158,861) $200,000 $260,000 $101,139 Year 2 $25,960 $25,960 $101,139 $127,099 Year 3 $108,407 ($10,000) $98,407 $127,099 $225,506 Year 4 $166,262 $166,262 $225,506 $391,768 Year 5 ($124,506) ($10,000) ($134,506) ($200,000) $391,768 $57,262 Giraffe Rack Repayment Year 1 Beginning Debt Balance Interest Rate Interest Expense New Debt Year 4 Year 5 $200,000 $240,225 $288,540 $346,573 20.1% $69,704 $416,277 20.1% $83,724 $240,225 $288,540 $346,573 $416,277 $500,000 20.1% $40,225 Year 2 20.1% $48,315 Year 3 20.1% $58,033