Comparative Economic Systems and Decision Making

advertisement

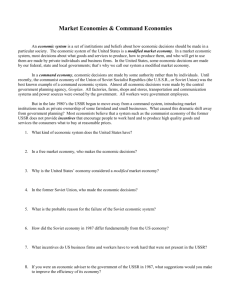

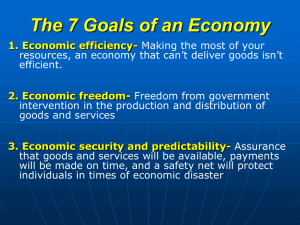

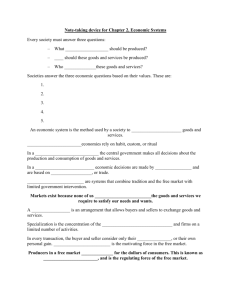

Economic Systems and Decision Making Review! What 3 questions must every economy try to answer? What goods and services should be produced? How should these goods and services be produced? Who consumes these goods and services? All economic systems try to answer these Q’s Cuba: Cosmetic surgery NOT available—government refuses to allow resources to be used on this service You don’t have to live like a refugee! 4 Types of Economic Systems Traditional economies rely on habit, custom, or ritual to decide what to produce, how to produce it, and to whom to distribute it In a centrally planned economy/command economy the central government makes all decisions about the production and consumption of goods and services In a market economy economic decisions are made by individuals and are based on exchange, or trade. AKA “Laissez-faire economy” (“allow them to do” or more simply, leave it alone) Mixed economies are systems that combine tradition and the free market with limited government intervention. Traditional Economy In a traditional economy, roles and economic decisions are defined by custom Traditional economies rely on habit, custom, or ritual to decide what to produce, how to produce it, and to whom to distribute it Examples: Canadians living in Nunavut Advantages: Everyone knows which role to play, little certainty about what, how, or for whom to produce Disadvantages: Discourages new ideas, new ways of thinking. LOW Standard of living Command Economy In a centrally planned economy/command economy the central government makes all decisions about the production and consumption of goods and services Found in North Korea, Cuba, China, Vietnam Ex: Cosmetic surgery is illegal in Cuba Advantages: Can drastically change direction quickly, little uncertainty Disadvantages:Consumer needs are not met, hard work is not rewarded, decision making is delayed, has little flexibility, individual initiative is not rewarded, NO INCENTIVES!!!!!! Problems of a Centrally Planned Economy Centrally planned economies face problems of poorquality goods, shortages, and diminishing production. The Former Soviet Union Soviet Agriculture – In the Soviet Union, the government created large state-owned farms and collectives for most of the country’s agricultural production. Soviet Industry – Soviet planners favored heavy-industry production (such as steel and machinery), over the production of consumer goods. Soviet Consumers – Consumer goods in the Soviet Union were scarce and usually of poor quality. The USSR Under Lenin & Stalin Lenin took large estates from the rich and gave them to the peasants, while outlawing private property Factories were turned over to workers Workers lacked skill, so New Economic Policy was instituted (Capitalism) Stalin’s 5-Year Plans were industrialization at any cost Stalin instituted collectivization, particularly on farms The USSR after Stalin The Communist Party and Gosplan, the central planning authority, ran just about everything without any local input The agricultural sector was a problem—Khrushchev’s “Virgin Lands” failed and the USSR imported grain from the U.S. Finally, the people demanded better consumer goods, and more of them Gorbachev’s “perestroika” and “glasnost” provided opportunities to criticize and reform the economic Transition in Russia 1. Communism in Russia--The Soviet government reorganized farmland into state farms and collective farms. Much of the economy was focused on the growth of heavy industry. 2. Glasnost and Perestroika--In the late 1980s, Soviet Premier Mikhail Gorbachev introduced new reforms. Glasnost was a policy of "openness" encouraging open speech. Perestroika called for a gradual change from a centrally planned economy to free enterprise. 3. Collapse of Communism--In 1991, Russians voted in their first democratic election. Soon after, the Soviet republics declared themselves independent nations. By the end of 1991, the Soviet Union ceased to exist. 4. Transition to a Free Market--Since 1991, the Russian government has moved Russia towards free enterprise. However, extensive corruption and government mismanagement have hindered Russia's progress. Socialism and Communism Socialism is a social and political philosophy based on the belief that democratic means should be used to distribute wealth evenly throughout a society. EX: Sweden Benefits: Better distribution of benefits Disadvantages: Lower efficiency, high taxes, entrenched special interests Communism is a political system characterized by a centrally planned economy with all economic and political power resting in the hands of the government. EX: Cuba, China (neither a great example) Advantage: Economy can shift quickly, lack of uncertainty. Disadvantage: Poorly meets consumers’ needs Free Market Capitalism Producers and consumers determine how/what/for whom to produce. Each consumer’s dollar is an “economic vote.” Examples: United States, Canada, Western Europe, Japan, South Korea, Singapore Advantages: Can adjust to change, gives a high degree of individual freedom, small degree of government involvement, consumers have a say in the economy, leads to a wide variety of goods and services (think of how many brands of dog food there are), and leads to high levels of consumer satisfaction (more tattoos than pocket squares right now) Disadvantages: More uncertain for individuals. Unemployment and inflation do happen regularly. Price Theory (Important Component of Free Market) Output in a free market is decentralized. You will work for wages. These wages represent income--the amount of money a household earns in a year. Wealth is the accumulation of of past income or inheritances. Wage rates determine the rewards for working in different jobs and professions. The basic coordinating mechanism in the economy is price. Individuals will pursue their own self-interest, motivated by profit, and produce what people want. Others will acquire skills and buy, save, or invest the income they earn. Price is the determinant. The Continuum Parts of the US economy are almost completely unregulated (Internet), but the Constitution permits Congress to regulate any interstate commerce—which since the 1930s has meant practically everything During World War II, the government limited production of goods such as washing machines, refrigerators, and automobiles so the resources used to produce those goods could be funneled to different industries (food, armaments, etc). Western Democracies vary widely in their level of capitalism. Sweden is Socialist, Singapore is almost unbridled capitalism An economic system that permits the conduct of business with minimal government intervention is called free enterprise. The degree of government involvement in the economy varies among nations. Continuum of Mixed Economies Centrally planned Free market Iran North Korea Cuba South Africa China Russia France Botswana Greece United Kingdom Canada Peru Source: 1999 Index of Economic Freedom, Bryan T. Johnson, Kim R. Holmes, and Melanie Kirkpatrick Hong Kong Singapore United States Making the Transition Privatization in Eastern Europe and Russia has been difficult. No Civil Society exists, and distributing government owned property evenly is difficult In addition, there is little understanding by the populace of free market economy values Eastern Germany has probably done the best, with Poland a close second. Critical Thinking Question In the 1990s, many Eastern European countries moved from command to market economies. 1) HST link: What political developments made this possible? 2) What problems did people in these countries face as the made the change? Section 1 Review 1. In a socialist country, – (a) central planning is unnecessary. – (b) the government often owns major industries, such as utilities. – (c) an authoritarian government controls the economy. – (d) economic equality is not important. 2. Which of the following is an advantage of a centrally planned economy? – (a) The system’s bureaucracies are small and flexible. – (b) The system can work quickly to accomplish specific goals. – (c) Innovation is well rewarded. – (d) Consumers’ needs are well met. Did You Know? The Fair Labor Standards Act of 1938 set the nation’s minimum wage at 25¢. Debate has raged for years about what an acceptable minimum wage should be—should it be a “living wage?” The answer to questions like this depends on a society’s economic goals. Economic Goals Economic Freedom—Little government intervention in the production and distribution of goods and services, allows people to make their own economic decisions Economic Stability—avoiding wide swings in prices, wages, unemployment, etc. Economic Equity—fair distribution of wealth (has not been achieved in US) Economic Equality—everyone has equal opportunity to participate in free market, buying and selling Economic Security and Predictability--Assurance that goods and services will be available, payments will be made on time, and a safety net will protect individuals in times of economic disaster (Welfare, FDIC) More Economic Goals Economic Growth and Innovation--Innovation leads to economic growth, and economic growth leads to a higher standard of living. Economic Efficiency-Making the most of resources Other goals: Environmental Protection, Using Economics to reach political/military goals (US selling grain to USSR in 1970s to coerce USSR into behaving better) Full Employment—providing as many jobs as possible. (See next slide) Unemployment It’s impossible for every member of the workforce to be employed. Bad times often coincide with market failure-- a situation in which the market, on its own, does not distribute resources efficiently Rate is higher among non-whites and males Frictional and structural unemployment: Frictional: between jobs Structural: you don’t have necessary skills Full employment: ~4.5% unemployment During World War II, 1% unemployment-overemployment Group Activity In groups of 4, take on the role I assign you and decide what the US’s economic goals should be. Roles: CEO of large company, middle-aged Single mother on welfare Teenagers College Student Environmental activist Elderly couple YUPpy couple We will discuss these with 15 mins left Key Concept: Which economic goals conflict? Competition and Free Enterprise Capitalism is a market economy in which private citizens own the factors of production. In a free enterprise system, there is limited government interference and businesses are free to compete, within reason (NO monopolies though) During voluntary exchanges, buyers and sellers are free to decide whether or not to complete transactions. To complete a transaction, both must usually agree that the good or service obtained is of more value than the money or product given up Private property rights give people the motivation to succeed because they can keep rewards they earn The profit motive encourages entrepreneurship Competition helps lower prices and improve allocative efficiency Economic systems have 2 parts: Public sector Government spending/investments A public good is a shared good or service for which it would be impractical to make consumers pay individually and to exclude nonpayers. EX: Government buys F-22 fighters Quasi-Public goods are either contestable or price-excludable EX: Government funds Amtrak; you may decide not to ride EX: Mackinac Bridge toll Private Sector Consumer spending EX: You buy any product or service The Free-Rider Problem A free rider is someone who would not choose to pay for a certain good or service, but who would get the benefits of it anyway if it is provided as a public good. EX: You don’t want money spent on a new highway, but when it’s built, you use it during your commute to work Answer: Fee-based system The Role of Economic Participants in Capitalism Entrepreneurs use land, capital, & labor to make profits The consumer has much power in a free market economy. Consumers influence producers through their buying decisions. Consumers influence the government’s economic policies through voting and other techniques. People in 2001 wanted a tax cut, less spending, elected George W. Bush Both consumers and producers are dependent upon each other. EX: Consumer desires size 16.5- 38 dress shirts. Entrepreneur may decide tall people don’t represent much of a market, so the entrepreneur won’t make tall dress shirts. If entrepreneurs want to sell product, however, they must offer clothing that fits. But what is the role of government??????????????? The Role of Government What is government’s role in a capitalistic society? Answer: Depends on your political orientation Liberals: Favor big, all-powerful government, protect environment and less pro-business Conservatives: “the government that governs least governs best,” preserve initiative, reward success, sink or swim on your own DO NOT confuse with “economic liberal”: favors free trade, government noninterference, laissez-faire Laissez faire is the doctrine that government generally should not interfere. Americans have traditionally favored economic freedom over economic regulation Governments create laws protecting property rights and enforcing contracts. They also encourage innovation through patent and copyright laws. Patent=allows you to exclusively produce an invention. Copyright=intellectual and artistic work protection Japan’s “Role of Government” Japan is an advanced Western Capitalistic society But its government is much more active in the economy that many capitalist governments Japan’s early success was due to management style and willingness to embrace technology The government enacted Protective Tariffs to help these industries develop, but it never got rid of them. Japan’s economy is closed by non-tariff barriers as well. Protectionism in Japan, however, is hurting consumers and the Japanese economy A 1990s banking crisis has still not been dealt with. The Japanese economy has been sick since 1990-91. Policy and Technology Review 1. Policymakers encourage all of the following EXCEPT – (a) stable productivity. – (b) high employment. – (c) stable prices. – (d) steady growth. 2. The government encourages advances in technology and improvements in productivity by – (a) maintaining steady price controls. – (b) funding research and development projects at many levels. – (c) hiring more workers to reduce unemployment. – (d) regulating banks and other financial institutions. Government’s Role in a Mixed Economy Market economies, with all their advantages, have certain drawbacks. In a mixed economy, the government purchases goods and services in the product market, and purchases land, labor, and capital from households in the factor market. Product market Factor market Protecting Health, Safety, and Well-Being Many federal agencies regulate industries whose goods and services affect the wellbeing of the public. Consumers are also aided by public disclosure laws, which require companies to give consumers full information about their products. Major Federal Regulatory Agencies Agency and Date Created 1906 Food and Drug Administration (FDA) Role Sets and enforces standards for food, drugs, and cosmetic products 1914 Federal Trade Commission (FTC) Enacts and enforces antitrust laws to protect consumers 1934 Federal Communications Commission (FCC) Regulates interstate and international communications by radio, television, wire, and satellite, and cable 1958 Federal Aviation Administration (FAA) Regulates civil aviation, air-traffic and piloting standards, and air commerce 1964 Equal Employment Opportunity Commission (EEOC) Promotes equal job opportunity through enforcement of civil rights laws, education, and other programs 1970 Environmental Protection Agency (EPA) Enacts policies to protect human health and the natural environment 1970 Occupational Safety and Health Administration (OSHA) Enacts policies to save lives, prevent injuries, and protect the health of workers 1972 Consumer Product Safety Commission (CPSC) Enacts policies for reducing risks of harm from consumer products 1974 Nuclear Regulatory Commission Regulates civilian use of nuclear products Fiscal Redistribution • • • • • • • Def’n: “Robin hood”: Taking money from the wealthier members of society and giving it to less well-off members in a variety of different ways The poverty threshold is an income level below that which is needed to support families or households. The poverty threshold is determined by the federal government and is adjusted periodically. Currently $20,000 for a family of 4. US poverty is RELATIVE poverty, much of the world is ABSOLUTE. # OF POOR IN WORLD HAS ACTUALLY DECLINED SINCE 1980 Welfare is a general term that refers to government aid to the poor. Welfare is funded by taxing the non-poor. Cash redistribution is usually in the form of transfer payments Redistribution Programs 1. Temporary Assistance for Needy Families (TANF) This program allows individual states to decide how to best use federally provided funds. 2. Social Security Social Security provides direct cash transfers of retirement income to the nation's elderly and living expenses to the disabled. 3. Unemployment Insurance Unemployment compensation provides money to eligible workers who have lost their jobs. 4. Workers' Compensation Worker's compensation provides a cash transfer of state funds to employees injured while on the job. Other Redistribution Programs Besides cash transfers, other redistribution programs include: • In-kind benefits In-kind benefits are goods and services provided by the government for free or at greatly reduced prices. (Free school lunches) • Medical benefits Health insurance is provided by the government for the elderly and disabled (Medicare) and for poor people who are unemployed or are not covered by their employer’s insurance (Medicaid). • Education benefits Federal, state, and local governments all provide educational opportunities for the poor. Government Involvement Quiz 1. Welfare includes all of the following EXCEPT – (a) Temporary Assistance to Needy Families. – (b) Occupational Safety and Health Administration. – (c) Social Security. – (d) Medicaid. 2. Education programs make the economy more productive by – (a) adding to human capital and labor productivity. – (b) reducing taxes. – (c) providing more jobs in manufacturing. – (d) reducing injuries on the job. Fiscal and Monetary Policy Government can affect the performance of the economy and the allocation of resources. It can: Impose TAXES (luxury tax on yachts, gas guzzler tax on Vipers, “Sin tax” on cigarettes Outlaw certain products Spend more or less (change FISCAL POLICY) Alter the amount of money in the economy (MONETARY POLICY) A business cycle is a period of macroeconomic growth followed by a period of contraction. Government can adjust interest rates to stave off recession or inflation We will revisit all of these concepts later Externalities An externality is an economic side effect of a good or service that generates benefits or costs to someone other than the person deciding how much to produce or consume. Often the result of incomplete property rights (Who owns the air?) Property rights must be 1) Clearly defined 2) Well-enforced 3) Transferable EX: Chemical company produces DDT, dumps waste into river. But externalities can be positive EX: “Anchor stores” in malls generate traffic. As a result, they often pay zero rent! EX: Bees benefit more than beekeepers—beekeepers and orchard owners can work together. Symbiotic relationship is necessary. The goal: Marginal social benefits = Marginal social cost Save the Whales Activity Externalities: An Example The building of a new dam/creation of a lake generates: · · · · · Positive Externalities a possible source of hydroelectric power swimming boating fishing lakefront views · · · · Negative Externalities loss of wildlife habitat due to flooding disruption of fish migration along the river overcrowding due to tourism noise from racing boats and other watercraft Critical Thinking Question What would be some positive externalities and negative externalities of a city deciding to permit Dow Chemical to build a brand new manufacturing facility? Positive: Jobs, tax revenue for the city, property values might increase (due to need for housing workers—shortage) Negative: Pollution, health problems, property values may decrease Government tries to encourage positive externalities (subsidies for ethanol) and limit negative externalities (taxation) to avoid an underallocation or overallocation of resources Think about this… The market system we have in the United States is so efficient that… We make things like Beanie Babies—that we don’t even use! 98% of the poor own a color TV In a capitalistic system, the only way I can become wealthy is by improving everyone else’s standard of living.