Cost Management Systems and Activity

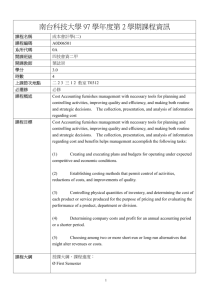

advertisement

Chapter 14 Cost Management Systems and Activity-Based Costing ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4-1 Learning Objective 1 Describe the purposes of cost management systems. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4-2 Cost Management System A cost-management system (CMS) is a collection of tools and techniques that identifies how management’s decisions affect costs. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4-3 What is Cost Accounting? Cost accounting is that part of the accounting system that measures costs for the purposes of management decision making and financial reporting. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4-4 Learning Objective 2 Explain the relationships among cost, cost objective, cost accumulation, and cost allocation. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4-5 Cost Accounting System Cost Accumulation Collecting costs by some “natural” classification such as materials or labor Cost Allocation Tracing costs to one or more cost objectives ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4-6 Cost Accounting System Cost Accumulation Cost Allocation to Cost Objects: 1. Departments 2. Activities RAW MATERIAL COSTS (METALS MACHINING DEPARTMENT FINISHING DEPARTMENT ACTIVITY ACTIVITY ACTIVITY ACTIVITY CABINETS 3. Products CABINETS DESKS DESKS TABLES ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton TABLES 4-7 Cost A cost may be defined as a sacrifice or giving up of resources for a particular purpose. Costs are frequently measured by the monetary units that must be paid for goods and services. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4-8 Cost Objective What is a cost object or cost objective? It is anything for which a separate measurement of costs is desired. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4-9 Learning Objective 3 Distinguish among direct, indirect, and unallocated costs. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 10 Direct Costs What are direct costs? Direct costs can be identified specifically and exclusively with a given cost objective in an economically feasible way. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 11 Indirect Costs What are indirect costs? Indirect costs cannot be identified specifically and exclusively with a given cost objective in an economically feasible way. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 12 What Distinguishes Direct and Indirect Costs? Managers prefer to classify costs as direct rather than indirect whenever it is “economically feasible” or “cost effective.” Other factors also influence whether a cost is considered direct or indirect. The key is the particular cost objective. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 13 Categories of Manufacturing Costs Any raw material, labor, or other input used by any organization could, in theory, be identified as a direct or indirect cost depending on the cost objective. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 14 Categories of Manufacturing Costs 1 2 3 All costs which are eventually allocated to products are classified as either… direct materials, direct labor, or indirect manufacturing. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 15 Direct Material Costs... – include the acquisition costs of all materials that are physically identified as a part of the manufactured goods and that may be traced to the manufactured goods in an economically feasible way. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 16 Direct Labor Costs... – include the wages of all labor that can be traced specifically and exclusively to the manufactured goods in an economically feasible way. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 17 Indirect Manufacturing Costs... – or factory overhead, include all costs associated with the manufacturing process that cannot be traced to the manufactured goods in an economically feasible way. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 18 Product Costs... are costs identified with goods produced or purchased for resale. Product costs are initially identified as part of the inventory on hand. These costs, inventoriable costs, become expenses (in the form of cost of goods sold) only when the inventory is sold. – ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 19 Period Costs... – are costs that are deducted as expenses during the current period without going through an inventory stage. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 20 Period or Product Costs In merchandising accounting, insurance, depreciation, and wages are period costs (expenses of the current period). In manufacturing accounting, many of these items are related to production activities and thus, as indirect manufacturing, are product costs. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 21 Period Costs – Merchandising and Manufacturing In both merchandising and manufacturing accounting, selling and general administrative costs are period costs. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 22 Learning Objective 4 Explain how the financial statements of merchandisers and manufacturers differ because of the types of goods they sell. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 23 Financial Statement Presentation – Merchandising Companies Income Statement Sales Balance Sheet – Merchandise Inventory Expiration Cost of Goods Sold (an expense) Equals Gross Margin – Period Costs Selling and Administrative Expenses Equals Operating Income ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 24 Financial Statement Presentation – Manufacturing Companies Income Statement Sales Balance Sheet Direct Material Inventory – Expiration Cost of Goods Sold (an expense) Equals Gross Margin – Work-inProcess Inventory Finished Goods Inventory Period Costs Selling and Administrative Expenses Equals Operating Income ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 25 Costs and Income Statements On income statements, the detailed reporting of selling and administrative expenses is typically the same for manufacturing and merchandising organizations, but the cost of goods sold is different. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 26 Cost of Goods Sold for a Manufacturer 1 2 3 The manufacturer’s cost of goods produced and then sold is usually composed of the three major categories of cost: Direct materials Direct labor Indirect manufacturing ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 27 Cost of Goods Sold for a Retailer or Wholesaler The merchandiser’s cost of goods sold is usually composed of the purchase cost of items, including freight-in, that are acquired and then resold. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 28 Learning Objective 5 Understand the main differences between traditional and activity-based costing systems and why ABC systems provide value to managers. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 29 Traditional Cost System Direct Material Resource Direct Labor Resource Direct Trace Direct Trace Products All Indirect Resources All Unallocated Value Chain Costs Cost Driver Unallocated ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 30 Two-Stage Activity-Based Cost System Direct Material Resource Direct Labor Resource Direct Trace Direct Trace Other Direct Resources Indirect Resource A % % Indirect Resource Z % All Unallocated Value Chain Costs % Activity Activity 1 10 Cost Cost Driver Driver Products ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton Unallocated 4 - 31 Activity-Based Costing Understanding the relationships among activities, resources, costs, and cost drivers is the key to understanding ABC and how ABC facilitates managers’ understanding of operations. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 32 Activity-Based Costing Example of Activities and Cost Drivers: Activities: Cost Drivers: Account billing No. of lines Bill verification No. of accounts Account iniquity No. of labor hours Correspondence No. of letters ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 33 Learning Objective 6 Identify the steps involved in the design and implementation of an activity-based costing system. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 34 Designing and Implementing an Activity-Based Costing System Step 1 Step 2 Determine cost of activities, resources, and related cost drivers. Develop a process-based map representing the flow of activities, resources, and their interrelationships. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 35 Designing and Implementing an Activity-Based Costing System Step 3 Collect relevant data concerning costs and the physical flow of the cost-driver units among resources and activities. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 36 Designing and Implementing an Activity-Based Costing System Step 4 Calculate and interpret the new activity-based information. Using an activity-based costing system to improve the operations of an organization is activity-based management (ABM). ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 37 Activity-Based Management Activity-based management aims to improve the value received by customers and to improve profits by identifying opportunities for improvements in strategy and operations. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 38 Activity-Based Management A value-added cost is the cost of an activity that cannot be eliminated without affecting a product’s value to the customer. In contrast, non-value-added costs are costs that can be eliminated without affecting a product’s value to the customer. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 39 Learning Objective 7 Use activity-based cost information to improve the operations of an organization. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 40 Using ABC Information Activity-based management… provides costs of value-added and non-value-added activities. improves managers’ understanding of operations. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 41 Learning Objective 8 Understand cost accounting’s role in a company’s improvement efforts across the value chain. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 42 Cost Accounting and the Value Chain A good cost accounting system is critical to all value-chain functions from research and development through customer service. ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 43 End of Chapter 4 ©2002 Prentice Hall Business Publishing, Introduction to Management Accounting 12/e, Horngren/Sundem/Stratton 4 - 44