Libor Market Models

Calibration of Libor Market

Model

-

Comparison Between the Separated and the Approximate Approach –

MSc Student: Mihaela Tuca

Coordinator: Professor MOISĂ ALTĂR

Dissertation paper outline

The aims of this paper

Evolution of Interest Rate Models

The LIBOR Market Model

Calibrating the LIBOR Market Model

– short description

The separated approach with Optimization

Approximate Solutions for Calibration

Data

Results

The separated approach with Optimization

Approximate Solutions for Calibration

Concluding remarks

References

1

The aims of this paper

Compare 2 methods of calibration for the Libor Market Model using data on EUR swaptions and historical EUR yield curves.

1 st method of calibration proposed by Dariusz Gatarek is the separated approach, which gives good results but is computationally intensive.

2 nd method of calibration – proposed by Ricardo Rebonato and Peter

Jackel

• uses an approximation for the instantaneous volatility and correlation functions of

European swaptions in a forward rate based Brace-Gatarek-Musiela framework which enables us to calculate prices for swaptions without the need for Monte Carlo simulations.

• The method generates appropriate results in a fraction of a second.

• using an approximation for the volatility and correlation function can lead to an accurate calibration by optimizing the parameters of the two volatility and correlation functions.

2

Evolution of Interest Rate Models

The early days - Black and Scholes (1973), Black (1976) and Merton

(1973)

The first yield curve models – Vasicek (1977) and Cox, Ingersoll and

Ross (CIR)

The Second-Generation Yield-Curve Models – Black, Derman and

Toy (1990), Hull and White (1990), extended Vasicek and extended CIR models.

The Modern Pricing Approach – Heath-Jarrow-Morton (HJM).

3

The LIBOR Market Model

The LIBOR Market Model (LMM) = interest rate model based on evolving LIBOR market forward rates.

In contrast to models that evolve the instantaneous short rate (Hull-White model) or instantaneous forward rates (HJM model), which are not directly observable in the market, the objects modeled using LMM are marketobservable quantities (LIBOR forward rates).

The forward rate dynamics :

time-dependent instantaneous volatility for the forward rate resetting at time ti , σ i

( t ) and its implied “average” volatility given by the Black formula :

4

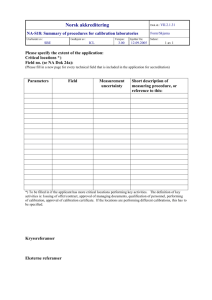

Calibrating LIBOR Market Model

computation of the parameters of the LIBOR market model, σ i

, i =

1 …….N, so as to match as closely as possible model derived prices/values to market observed prices/values of actively traded securities

insures that the time-0 delta and hedging costs predicted by the model are the same as the ones provided in the market

The meaning of the word ‘calibration’ has a much wider scope

the trader needs to recalibrate the model day after day to the future market prices

Procedure of recalibrating every day the model to the current market prices is essential.

The practical success of a hedging strategy largely depends on the ability to choose, for a given model, a calibration, such that the parameters of the model have to be adjusted as little as possible throughout the life of the deal.

5

The Separated Approach With Optimization

Initial data for the calibration:

Matrix of Swaption Volatilities :

SWPT

Vector of dates and discount factors obtained for the current yield curve

Define the variance-covariance matrix of the forward of LIBOR Rates.

φ k,l i

=

Φ i = φ k,l i

0

Ti inst

(t,T l-1

,T l

) *

inst

(t,T k-1

,T k

) dt for i<k and i<l

φ k,l i = φ k,l

* Λ i

reducing the variance-covariance matrix by removing eigenvectors associated with negative eigenvalues Principal Component Analysis

Optimization algorithm . The target function is:

RMSE =

i,j=1

10 (

i,j

THEO -

i,j

MKT ) 2

Minimize that and obtain the specification of parameters

i calibration used in the

6

Approximate Solutions for Calibration I

The instantaneous volatility function

inst could function of: be a deterministic

Calendar time:

inst

(t)

Maturity:

inst

(T)

realization of the forward rate itself at time

τ : inst

(τ ,T, f

τ

)

The full history of the yield curve

inst

(F t

)

The Functional form:

Conditions for the volatility functions:

Term-structure of volatilities -time homogenous

flexible functional form

parameters - transparent econometric interpretation

In order to preserve the time-homogenous character it is important to assure that the k i are as close as possible to 1.

a + d Short maturities implied volatilities.

a+d>0

d Very-long maturities implied volatilies.

d>0 c>0

7

Approximate Solutions for Calibration II

The correlation function:

Is time-homogenous

It only depends on the relative distance in years between the two forward rates in question (T i

-T j

)

ρ ij

= ρ (|T i

-T j

|) = e - β |Ti-Tj |

The swap rate depends on the forward rates of that part of the yield curve in a linear way with the weights:

Eq.1

comes from Ito’s lema

Instantaneous volatility of a swap rate is a stochastic quantity, depending on :

- coefficients w

- the realization of the forward rate

in order to obtain the total Black volatility of a given European swaption to expiry, one first has to integrate its swap-rate instantaneous volatility:

8

Approximate Solutions for Calibration III

Eq 1 becomes: where

Because:

1.

Parallel movements in the forward curve

, the coefficients

ζ are only very mildly dependent on the path realizations.

2.

Higher principal components shock the forward curve the expectation of the future swap rate instantaneous volatility is very close to the value obtainable by using today’s values for the coefficients ζ and the forward rates f.

9

Calibration in practice

1. The Separated Approach With Optimization

2. Approximate Solutions for Calibration

Data I

Daily yield curves for a trading period 20-Jun-2007 – 20-Jun-2008 across 40 maturities between 1 month and 50 years.

LIBOR cash deposit rates 1M, 2M, 3M (1month, 2 months, 3 months)

Future contracts for intermediate maturities: H, M, U, Z (March, June,

September, December)

Equilibrium (par) swap rates for expiries between two years and the end of the LIBOR curve: 2S

50S (2 years

– 50 years)

0.055

0.05

0.045

0.04

0.035

0.03

300

200

100

0 0

10

20

30

40

1

0.5

0

-0.5

40

30

20

10

0 0

10

20

30

40

11

Data II

The market volatility matrix - Black implied volatilities of ATM European swaptions.

1

0.8

0.6

0.4

0.2

0

30

30

20

20

10

10

0 0

I reduced the data to a 10 maturities yield curve (from 1 year to 10 years) and a (10,10) matrix for swaption quoted Black volatilities.

12

Results - The Separated approach I

Input the initial data for the calibration:

Matrix of market swaption volatilities

Dates and discount factors obtained for the current yield curve

Define the variance-covariance matrix of the forward of LIBOR Rates

φ k,l i

=

0

Ti inst

(t,T l-1

,T l

) *

inst

(t,T k-1

,T k

) dt for i<k and i<l

Reduce variance-covariance matrix remove eigenvectors associated with negative eigenvalues

Optimization algorithm.

RSME = theoretical volatililities - market swaption volatilities.

Minimize that function + obtain the specification of parameters

i

φ k,l i = φ k,l

* Λ i

13

Results - The Separated approach II

Two negative eigenvalues explanatory power is very low.

I eliminated the negative eigenvalues by using PCA

(principal component analysis)

The eigenvectors generate small differences between theoretical and market swaption volatilities.

Value of the eigenvalue with the explanatory power

L (vector of eigenvalues) Explanatory power Cumulative explanatory power

-0.077352

-0.043544311

-0.043544311

-0.037983

-0.02138204

-0.06492635

0.0076164

0.060573

0.084643

0.004287554

0.034098789

0.047648685

-0.060638796

-0.026540007

0.021108678

0.11274

0.24182

0.28975

0.46193

0.63266

0.063465529

0.136129449

0.163111025

0.260037534

0.356147785

0.084574206

0.220703656

0.38381468

0.643852215

1

1

0.8

0.6

0.4

0.2

0

-0.2

-0.4

-0.6

-0.8

- 1

1 2 3 4 5 6 7 8 9 10 e7 e8 e9 e10

14

Results - The Separated approach III

Algebraic difference between theoretical and market swaption volatilities

The biggest differences are denoted for 4 to 5 year length underlying swaps.

The other differences for the volatilities in other maturities are not significant.

The RSME for 100 iterations is 0.47053.

0.2

0.1

0

-0.1

-0.2

-0.3

10

10

5

8

6

4

2

0 0

Parameters obtained for Λ i through optimization with 100/1000 iterations

18

16

14

12

10

8

6

4

2

0

Lambda 100 iterations

Lambda 1000 iterations

1 2 3 4 5 6

Lambda

7 8 9 10

15

Results - The Separated approach IV

If we increase the number of iterations in the optimization function (1000),

RSME = 0.013019

results obtained are much more accurate.

Theoretical vols 100 iterations

RSME

100

= 0.47053

Theoretical vols 1000 iterations

RSME

1000

= 0.013019

0.5

0.4

0.3

0.2

0.1

0

10

0.5

0.4

0.3

0.2

0.1

0

10

10

8

5

5

6

4

2 0 0

0 0

Theoretical volatilities computed from optimization - 100/1000 iterations

2

4

6

8

10

16

Results - The Separated approach V

RSME

100

= 0.47053

RSME

1000

= 0.013019

0.2

0.1

0

-0.1

-0.2

-0.3

10

8

0.1

0

-0.1

-0.2

10

-0.3

10

5

6

4

5

8

0 0

2

4

6

2

0 0

Algebraic difference between theoretical and market swaption volatilities - 100/1000 iterations

17

10

Results - Approximate Solutions I

Volatility function with a =5%, b = 0.5, c = 1.5, and d = 15%. K=1

Correlation function

ρ ij

= ρ (|T i

-T j

|) = e - β |Ti-Tj |

β= 0.1;

Calculation of the required approximate implied volatility for the chosen European swaption

With this implied volatility the corresponding approximate Black price was obtained

RSME = theoretical volatilities – market volatilities was computed

18

0.8

0.6

0.4

0.2

0

10

Results - Approximate Solutions II

The biggest differences are denoted for swaptions with long implied volatilities.

Swaptions starting in 4 years as well as long end starting swaptions have theoretical implied Black volatilities higher than the market quoted swaptions.

we can conclude that that the very-long maturities implied volatilities might not be accurately specified

“d”.

Black volatility Rebonato Market Black volatility

0.4

0.3

0.2

0.1

0

10

5

0 0

2

4

6

8

10

5

0 0

2

4

6

8

10

19

Results - Approximate Solutions III

RSME = 0.34032.

The error is comparable with the one obtained from the previous calibration, however theoretical Black volatilities are concentrated long-end starting swaptions

1

0.5

0

10

2.5

2

1.5

5

4

2

0

0

Theoretical swaption prices

6

8

10

20

Results - Approximate Solutions IV

Impact of a change in parameters on a swaption price and on the theoretically quantified

Black volatility The exercise was done for the swaption with the underlying swap starting one year from today and maturing one year after (1,2 swaption).

2.5

2

1.5

1

0.5

0

-0.5

pa ra m

1 pa ra m

2 pa ra m

3 pa ra m

4 pa ra m

5 pa ra m

6 pa ra m

7 pa ra m

8 pa ra m

9 pa ra m

10 pa ra m

11 pa ra m

12 pa ra m

13 c d a b

0.7

0.6

0.5

0.4

0.3

0.2

0.1

0

-0.1

-0.2

1 2 3 4 5 6

A

Black v olatility p arameter c hange

7 8 9 10 11 12 13

Theoretical Black volatility for the 1.2 swaption is almost the same as the one quoted in the market. Parameter “a” has the greatest impact on the quantified volatility

This method of calibration gives better results if we optimize the parameters used as inputs for the instanataneous volatility and correlation function {a, b, c, d, β} .

21

Concluding remarks

The calibration using the separated approach with optimization

minimizes the root mean squared error for the differences between theoretical and market swaption volatilities.

the Lambda parameters are computed, in order to minimize the error.

the method is accurate and provides good results for the error but is computationally intensive.

If we increase the number of iterations in order to obtain a smaller error, even if the results do improve significantly, the computation also becomes quite lengthy.

The calibration using the approximate solutions proposed by Rebonato&Jackel

The error between theoretical and market prices for swaptions is similar to the error obtained from the first calibration technique (with 100 iterations).

this error can be further minimized by optimizing the input parameters of the instantaneous volatility and correlation function - one can first optimize iteratively over the parameters so as to find the set of {a, b, c, d, β} that best accounts for the swaption matrix.

Improvements on calibration results:

· 1 st calibration method - increase the number of iteration with the disadvantage of a long lasting computation

· 2 nd calibration method – optimize the value of the input parameters {a, b, c, d, β} of the instantaneous volatility and correlation functions

22

References

[1] Alexander C. (2002), “Common Correlation Structures for Calibrating the LIBOR Model”, ISMA Centre Finance

Discussion Paper No. 2002-18

[2] Brace A., Gatarek D. and Musiela M.

(1997), “The market model of interest rate dynamics”, Mathematical

Finance, 127

–155

[3] De Jong F., Driessen J., Pelsser A. (2001), “Libor Market Models versus Swap Market Models for Pricing Interest

Rate Derivatives -An Empirical

Analysis”, European Finance Review,201-237

[4] Gatarek D.,Bachert P. and Maksymiuk R (2006 ),”The LIBOR Market Model in Practice”, John Wiley and Sons,

Ltd, 1-21, 27-37, 63-167

[5] Jackel P. (2002), “Monte Carlo Methods in Finance”, John Wiley and Sons

[6] Jackel P. and Rebonato R.( 2001)

“Linking Caplet and Swaption Volatilities in a BGM/J Framework: Approximate

Solutions”, Journal of Computational Finance

[7] Kajsajuntti L.(2004),

“Pricing of Interest Rate Derivatives with the LIBOR Market Model”, Royal Institute of

Technology Stockholm

[8] Rebonato R.(2002),

“Modern Pricing of Interest-rate Derivatives. The LIBOR Market Model and Beyond”,

Princeton University Press, Princeton and Oxford, 3-57, 135-209, 276-331

[9] Rebonato R.(1999

)“On the simultaneous calibration of multi-factor log-normal interest-rate models to Black volatilities and to the correlation matrix”, Journal of Computational Finance

[10] Vojteky M.(2004),

“Calibration of Interest Rate Models - Transition Market Case” , CERGE-EI Working Paper

No. 23

23

![[These nine clues] are noteworthy not so much because they foretell](http://s3.studylib.net/store/data/007474937_1-e53aa8c533cc905a5dc2eeb5aef2d7bb-300x300.png)