Exercises 14-3, 14-4, and 14-13, located in WileyPLUS

o Problem 14-6A, located in WileyPLUS

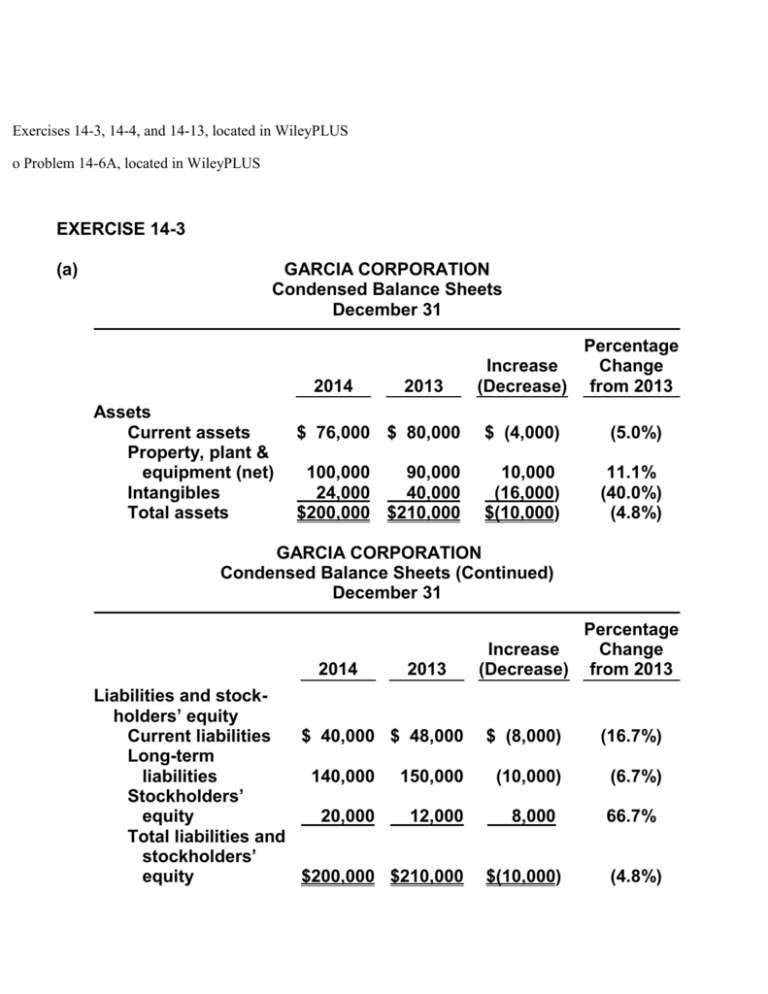

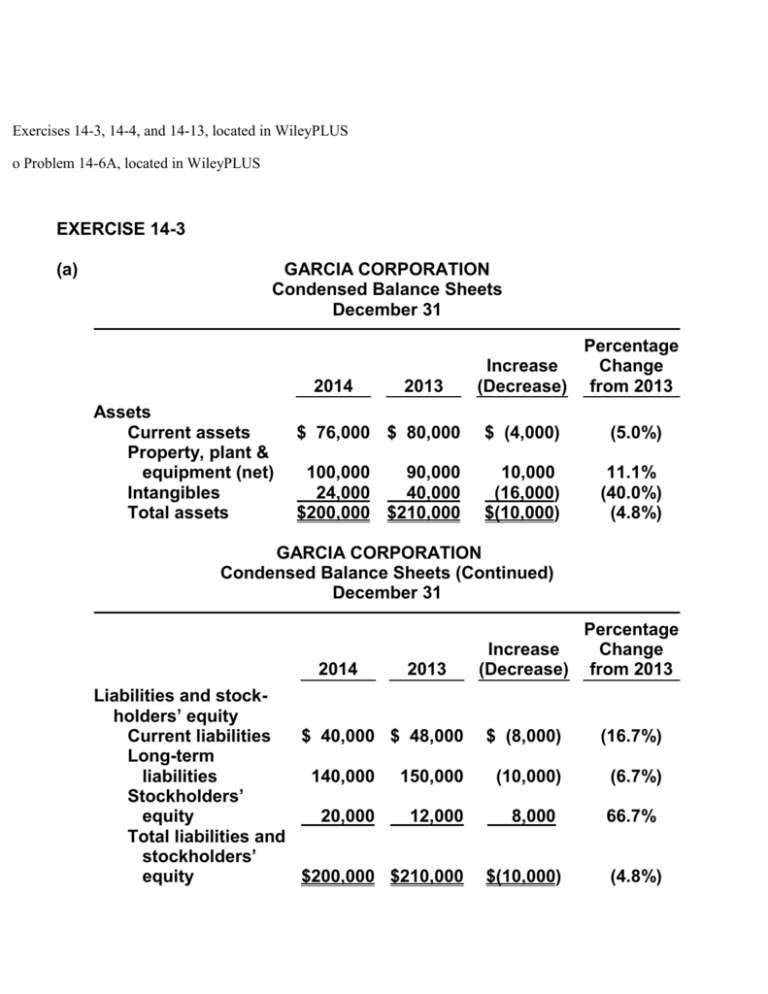

EXERCISE 14-3

(a)

GARCIA CORPORATION

Condensed Balance Sheets

December 31

2014

Assets

Current assets

Property, plant &

equipment (net)

Intangibles

Total assets

2013

Percentage

Increase

Change

(Decrease) from 2013

$ 76,000 $ 80,000

$ (4,000)

(5.0%)

100,000

90,000

24,000

40,000

$200,000 $210,000

(10,000)

(16,000)

$(10,000)

(11.1%)

(40.0%)

(4.8%)

GARCIA CORPORATION

Condensed Balance Sheets (Continued)

December 31

2014

2013

Liabilities and stockholders’ equity

Current liabilities

$ 40,000 $ 48,000

Long-term

liabilities

140,000 150,000

Stockholders’

equity

20,000

12,000

Total liabilities and

stockholders’

equity

$200,000 $210,000

Percentage

Increase

Change

(Decrease) from 2013

$ (8,000)

(16.7%)

(10,000)

(6.7%)

8,000)

(66.7%)

$(10,000)

(4.8%)

(b)

GARCIA CORPORATION

Condensed Balance Sheet

December 31, 2014

Amount

Percent

Assets

Current assets

Property, plant, and equipment (net)

Intangibles

Total assets

$ 76,000

100,000

24,000

$200,000

38%

50%

12%

100%

Liabilities and stockholders’ equity

Current liabilities

Long-term liabilities

Stockholders’ equity

Total liabilities and stockholders’ equity

$ 40,000

140,000

20,000

$200,000

20%

70%

10%

100%

quest2096801ent

quest2096801

asnmt967525

take-question

a

Exercise 14-3

Your answer is correct.

The comparative condensed balance sheets of Garcia Corporation are presented below.

GARCIA CORPORATION

Comparative Condensed Balance Sheets

December 31

2014

2013

$ 76,000

$ 80,000

100,000

90,000

24,000

40,000

$200,000

$210,000

Assets

Current assets

Property, plant, and equipment (net)

Intangibles

Total assets

Liabilities and stockholders’ equity

Current liabilities

$ 40,000

$ 48,000

Long-term liabilities

140,000

150,000

Stockholders’ equity

20,000

12,000

Total liabilities and stockholders’ equity

$200,000

$210,000

(a) Prepare a horizontal analysis of the balance sheet data for Garcia Corporation using 2013 as a base. (If amount

and percentage are a decrease show the numbers as negative, e.g. -55,000, -20% or (55,000). (20%).

Round percentages to 1 decimal place, e.g. 12.3%.)

GARCIA CORPORATION

Condensed Balance Sheets

December 31

2014

2013

Percentage

Change from

2013

Increase

(Decrease)

Assets

$

Current Assets

$76,000

$80,000

(4000)

Property, Plant & Equipment (net)

100,000

90,000

10000

24,000

40,000

(16000)

Intangibles

Total assets

(5.0)

%

11.1

%

(40.0)

%

$

$200,000

$210,000

Current Liabilities

$40,000

$48,000

(8000)

Long-term Liabilities

140,000

150,000

(10000)

Stockholders' Equity

20,000

12,000

$200,000

$210,000

(4.8)

(10000)

%

Liabilities and Stockholders' Equity

Total liabilities and stockholders' equity

$

(16.7)

%

%

66.7

8000

%

$

(10000)

(4.8)

%

(b) Prepare a vertical analysis of the balance sheet data for Garcia Corporation in columnar form for 2014. (Round

percentages to 0 decimal places, e.g. 12%.)

GARCIA CORPORATION

Condensed Balance Sheet

December 31, 2014

Amount

Percent

Assets

Current Assets

$76,000

38

Property, Plant, and Equipment (net)

100,000

50

24,000

12

Intangibles

%

%

%

Total assets

$200,000

100

%

Liabilities and Stockholders' Equity

Current Liabilities

$40,000

20

Long-term Liabilities

140,000

70

Stockholders' Equity

20,000

10

Total liabilities and stockholders' equity

$200,000

%

%

%

100

%

Click here if you would like to Show Work for this question

Question Attempts: 2 of 3 used

EXERCISE 14-4

(a)

HENDI CORPORATION

Condensed Income Statements

For the Years Ended December 31

Net sales

Cost of goods sold

Gross profit

Operating expenses

Net income

2014

2013

$600,000

468,000

132,000

60,000

$ 72,000

$500,000

400,000

100,000

54,000

$ 46,000

Increase or (Decrease)

During 2013

Amount

Percentage

$100,000

68,000

32,000

6,000

$ 26,000

20.0%

17.0%

32.0%

11.1%

56.5%

(b)

HENDI CORPORATION

Condensed Income Statements

For the Years Ended December 31

2014

Net sales

Cost of goods sold

Gross profit

Operating expenses

Net income

quest2096802ent

quest2096802

Amount

Percent

2013

Amount

Percent

$600,000

468,000

132,000

60,000

$ 72,000

100.0%

78.0%

22.0%

10.0%

12.0%

$500,000

400,000

100,000

54,000

$ 46,000

asnmt967525

100.0%

80.0%

20.0%

10.8%

9.2%

take-question

a

Exercise 14-4

Your answer is correct.

The comparative condensed income statements of Hendi Corporation are shown below.

HENDI CORPORATION

Comparative Condensed Income Statements

For the Years Ended December 31

2014

Net sales

2013

$600,000

$500,000

Cost of goods sold

468,000

400,000

Gross profit

132,000

100,000

60,000

54,000

$ 72,000

$ 46,000

Operating expenses

Net income

(a) Prepare a horizontal analysis of the income statement data for Hendi Corporation using 2013 as a

base. (Show the amounts of increase or decrease.) (If amount and percentage are a decrease

show the numbers as negative, e.g. -55,000, -20% or (55,000). (20%). Round percentages

to 1 decimal place, e.g. 12.3%.)

HENDI CORPORATION

Condensed Income Statements

For the Years Ended December 31

Increase or (Decrease)

During 2013

Net sales

Cost of goods sold

2014

2013

$600,000

$500,000

468,000

400,000

Amount

$

Percentage

100000

20.0

68000

17.0

%

%

Gross profit

Operating expenses

Net income

132,000

100,000

60,000

54,000

$72,000

$46,000

$

32000

32.0

6000

11.1

26000

56.5

%

%

%

(b) Prepare a vertical analysis of the income statement data for Hendi Corporation in columnar form

for both years. (Round percentages to 1 decimal place, e.g. 12.3%.)

HENDI CORPORATION

Condensed Income Statements

For the Years Ended December 31

2014

Amount

Net sales

Percent

$600,000

100.0

Cost of goods sold

468,000

78.0

Gross profit

132,000

22.0

60,000

10.0

$ 72,000

12.0

Operating expenses

Net income

2013

Amount

%

%

%

%

%

Percent

$500,000

100.0

400,000

80.0

100,000

20.0

54,000

10.8

$ 46,000

9.2

%

%

%

%

%

Click here if you would like to Show Work for this question

Question Attempts: 1 of 3 used

EXERCISE 14-13

(a)

MAULDER CORPORATION

Partial Income Statement

For the Year Ended December 31, 2014

Income from continuing operations ......................................

Discontinued operations

Gain on discontinued division, net of $10,500

income taxes ..............................................................

Income before extraordinary item..........................................

Extraordinary item

Extraordinary loss, net of $21,000 income tax saving ......

Net income...............................................................................

quest2096813ent

quest2096813

asnmt967525

take-question

$290,000

24,500

314,500

(49,000)

$265,500

a

Exercise 14-13

Your answer is correct.

Maulder Corporation has income from continuing operations of $290,000 for the year ended December 31, 2014. It

also has the following items (before considering income taxes).

1.

An extraordinary loss of $70,000.

2.

A gain of $35,000 on the discontinuance of a division.

3.

A correction of an error in last year’s financial statements that resulted in a $25,000 understatement of 2013 net

income.

Assume all items are subject to income taxes at a 30% tax rate.

Prepare an income statement, beginning with income from continuing operations.

MAULDER CORPORATION

Partial Income Statement

For the Year Ended December 31, 2014

Income From Continuing Operations

EAT_1326366279

Discontinued Operations

EAT_1326366279

Gain on Discontinued Division

EAT_1326366279

Income Before Extraordinary Item

EAT_1326366279

Extraordinary Item

EAT_1326366279

Extraordinary Loss

Net Income / (Loss)

$

24500

314500

EAT_1326366279

EAT_1326366279

Click here if you would like to Show Work for this question

290000

49000

$

265500

Question Attempts: 1 of 3 used

PROBLEM 14-6

(a) Current ratio =

$204,000

= 1.5:1.

$134,000

(b) Acid-test ratio =

$21,000 + $18,000 + $85,000

= 0.93:1.

$134,000

$500,000

($85,000 + $75,000)

2

= 6.3 times.

(c) Accounts receivable turnover =

(d) Inventory turnover =

(e) Profit margin ratio =

$315,000

= 4.5 times.

$80,000 + $60,000

2

$36,700

= 7.3%.

$500,000

(f)

Asset turnover =

$500,000

= 0.8 times.

$627,000 + $551,000

2

(g) Return on assets =

$36,700

= 6.2%.

$627,000 + $551,000

2

$36,700

$373,000 + $350,000

2

= 10.2%.

(h) Return on common stockholders’ equity =

(i)

Earnings per share =

$36,700

= $1.22.

30,000 (1)

(1) $150,000 ÷ $5.00

(j)

Price-earnings ratio =

(k) Payout ratio =

$19.50

= 16.0 times.

$1.22

$13,700 (2)

= 37.3%.

$36,700

(2) $200,000 + $36,700 – $223,000

(l)

Debt to total assets =

$254,000

= 40.5%.

$627,000

(m) Times interest earned =

$64,200 (3)

= 8.6 times.

$7,500

(3) $36,700 + $20,000 + $7,500

quest2096823ent

quest2096823

asnmt967525

take-question

a

Problem 14-6A

Your answer is correct.

The comparative statements of Beulah Company are presented below.

BEULAH COMPANY

Income Statement

For the Years Ended December 31

2014

Net sales (all on account)

2013

$500,000

$420,000

Cost of goods sold

315,000

254,000

Selling and administrative

120,800

114,800

Expenses

Interest expense

Income tax expense

Total expenses

Net income

7,500

6,500

20,000

15,000

463,300

390,300

$ 36,700

$ 29,700

BEULAH COMPANY

Balance Sheets

December 31

Assets

2014

2013

Current assets

Cash

$ 21,000

$ 18,000

Short-term investments

18,000

15,000

Accounts receivable (net)

85,000

75,000

Inventory

80,000

60,000

204,000

168,000

Total current assets

Plant assets (net)

Total assets

423,000

383,000

$627,000

$551,000

$122,000

$110,000

12,000

11,000

134,000

121,000

Liabilities and Stockholders’ Equity

Current liabilities

Accounts payable

Income taxes payable

Total current liabilities

Long-term liabilities

Bonds payable

120,000

80,000

254,000

201,000

Common stock ($5 par)

150,000

150,000

Retained earnings

223,000

200,000

373,000

350,000

$627,000

$551,000

Total liabilities

Stockholders’ equity

Total stockholders’ equity

Total liabilities and stockholders’ equity

Additional data:

The common stock recently sold at $19.50 per share.

Compute the following ratios for 2014. (Round Earnings per share and Acid-test ratio to 2 decimal places, e.g.

1.65, and all others to 1 decimal place, e.g. 6.8 or 6.8% .)

(a)

Current ratio

1.5

:1

(b)

Acid-test ratio

0.93

:1

(c)

Accounts receivable turnover

6.3

times

(d)

Inventory turnover

4.5

times

(e)

Profit margin

7.3

%

(f)

Asset turnover

0.8

times

(g)

Return on assets

6.2

%

(h)

Return on common stockholders’ equity

10.2

%

(i)

Earnings per share

(j)

Price-earnings ratio

16.0

times

(k)

Payout ratio

37.3

%

(l)

Debt to total assets

40.5

%

8.6

times

(m) Times interest earned

$

1.22

Click here if you would like to Show Work for this question

Question Attempts: 1 of 3 used

Copyright © 2000-2012 by John Wiley & Sons, Inc. or related companies. All rights reserved.