Foundations 30- Chapter 1 Student Notes

advertisement

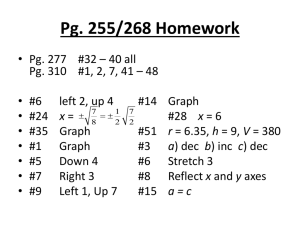

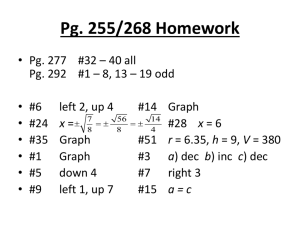

Chapter 1: Investing Money Define: a) Termb) Interestc) Principal- Ex: Jade has a goal of saving $1625 to pay for her portion of a summer vacation. She has $300 in a savings account that earns 0.20% interest each month. At the end of each month, she makes a deposit of $100. a) Predict how long it will take Jade to save $1625. Explain your reasoning. b) How much interest will she earn during the first month? (I=Prt) c) At the end of the first month, how much money will Jade have in her account? d) Complete the table below: How long will it take Jade to reach her goal? ____________ Month 1 Balance at Start Interest Earned Of Month ($) $300 Deposits ($) $100 Balance at End Of Month FM 30.1- Demonstrate understanding of financial decision making including analysis of renting, leasing, and buying credit compound interest investment portfolios. 1.1-Simple Interest Define: a) Fixed interest Rateb) Simple interestc) Maturityd) Future Value- Formulas: a) I=Prt (Interest=Principal X rate X term) b) A=P+Prt or A=P(1+rt) (Future Value) Ex: Ray bought his grandson (David) a $600 Canada Savings Bond (CSB) with a term of 10 years. The interest earned was determined using a FIXED INTEREST RATE of 5% per year on the original investment and was paid at the end of each year until David’s 10 th birthday. a) Complete the chart below for the first 3 years. Year 0 1 2 3 Value of Investment at Start of Year ($) Simple Interest Earned Each Year ($) Accumulated Interest ($) Value of Investment at End of Year ($) $600 $600 b) Is the simple interest constant or variable? Explain. c) Notice: Number of Years x Interest Earned Each Year= Accumulated Interest d) Find the value of the investment after 10 years. A=P+Prt or A=P(1+rt) e) Graph the investment over 10 years using Time (domain) and the Value of Investment (Range). (Use Graph Paper) FM 30.1- Demonstrate understanding of financial decision making including analysis of renting, leasing, and buying credit compound interest investment portfolios. f) Describe your graph. What does the shape tell you about the growth of your investment? g) What does the y-intercept and slope tell you about the investment? Your Turn: Kelsey invested in a $2000 guaranteed investment certificate (GIC) at 1.4% simple interest, paid annually, with a term of 5 years. How much interest will she accumulate over the term of the investment? What is the future value of the investment at maturity? Ex: Brent invested $12 000 in a savings account at a simple interest rate of 6% paid semiannually. Determine the value of her money after each half year until she plans to withdraw the investment in 3years. I=Prt I=12000(0.06)(0.5)=$360 for Year 0.5 Year 0 0.5 1 1.5 2 2.5 3 Value of Investment ($) $12000 $12000 + $360 = $12360 $12000+ $720= $12720 FM 30.1- Demonstrate understanding of financial decision making including analysis of renting, leasing, and buying credit compound interest investment portfolios. Define: a)Rate of Return- Rate of Return = ratio of money earned to the amount invested Ex: Carmela invested her summer earnings of $10000 at 4% simple interest, paid annually. She intends to use the money in a few years to take a holiday to Boston. a) How long will it take for the future investment to grow to $12000? b) What is Carmela’s rate of return? Ex: Jose invested $22000 in a simple interest Canada Savings Bong (CSB) that paid interest annually. a) If the future vale of CSB is $27500 at the end of 5 years, what is the interest rate? Note: See Key Ideas on P.13 FM 30.1- Demonstrate understanding of financial decision making including analysis of renting, leasing, and buying credit compound interest investment portfolios. 1.2-Exploring Compound Interest Define: a)Compound InterestEx: Chloe invests $4000 at 3.5% interest, compounded annually for 4 years. a) Determine the future value of the investment. Year 1 2 3 4 Balance ($) $4000 P(1+rt)= Year End Value 4000(1+0.035)= b) How much would Chloe have for an investment if she had received simple interest rather than compound interest with the same terms? A=P+Prt Note: See Key Ideas on P.19 FM 30.1- Demonstrate understanding of financial decision making including analysis of renting, leasing, and buying credit compound interest investment portfolios. 1.3-Compound Interest: Future Value Definition: a) Compounding PeriodFormulas: a) A=P (1+i)n b) i= interest rate/terms per year c) n= number of years x periods per year Ex: Gavin has invested a $12000 inheritance in an account that earns 12.4% compounded semiannually. The interest rate is fixed for 10 years. a) What is the future value of the investment after 5 years? b) What is the future value of the investment after 10 years? c) Compare the Principal and the future values after 5 years and 10 years. What do you notice? d) Calculate the interest had it been calculated using simple interest. FM 30.1- Demonstrate understanding of financial decision making including analysis of renting, leasing, and buying credit compound interest investment portfolios. Ex: Both Reina, age 45, and her son Walker, age 20, plan to invest $1500 in an account with an annual interest rate of 8% compounded monthly. If both hold their investment until age 65, what will be the difference in the future value of their investments? Define: a) Rule of 72 Ex: Ciara invested $6000 by purchasing Canada Savings Bonds that earn 8%, compounded annually. a) Estimate the doubling time using the “Rule of 72”. b) Determine the actual doubling time. c) Estimate the future value of an investment after 18 and 27 years. How close are your estimates? Note: The Rule of 72 is less accurate when used for multiple doubling. FM 30.1- Demonstrate understanding of financial decision making including analysis of renting, leasing, and buying credit compound interest investment portfolios. 1.4- Compound Interest: Present Value Definition: a) Present Value- Forumlas a) Present Value: P= A _ (1+i)n b) To Compare Investments A_ = (1+i)n P Example: Jarome is 18 years old. He wants to invest some money so that he can buy a home in Wapella, Saskatchewan, when he turns 30. He estimates that he will need about $160 000 to buy a home. a) How much does he need to invest now at 6.3% compounded annually. b) What is the ratio of future value to present value? c) How would the ratio change if the interest rate changed to 6% compounded semiannually? FM 30.1- Demonstrate understanding of financial decision making including analysis of renting, leasing, and buying credit compound interest investment portfolios. Ex: Ashley has invested $13 500 in a Registered Education Savings Plan (RESP). She wants the investment to grow to at least $45 000 by the time her newborn enters university (18 years). a) What interest rate, compounded annually will result in a future value of $45 000? Round to two decimal places. b) Suppose Ashley wants her investment to grow to at least $55 000 at the interest rate from part a). How long will this take? FM 30.1- Demonstrate understanding of financial decision making including analysis of renting, leasing, and buying credit compound interest investment portfolios. 1.5- Investments Involving Regular Payments Ex: a) Chelsea deposits $600 into her savings account every 6 months from her earnings. The account earns 4.2%, compounded semi-annually. How much money will she have at the end of 5 years? How much interest has she earned? a) Using a Spreadsheet (Teacher Note: Excel File Saved) Year 0.5 1 1.5 2 2.5 3 3.5 4 4.5 5 Principal rate Terms per Year i= Years Number of Compounding Future Value Periods Deposit ($) ($) 9 $600 $723.41 8 $600 $708.53 7 $600 $693.96 6 $600 $679.68 5 $600 $665.70 4 $600 $652.01 3 $600 $638.60 2 $600 $625.46 1 $600 $612.60 0 $600 $600.00 Totals $6,000 $6,599.95 Interest Earned $599.95 $600 0.042 2 0.021 5 FM 30.1- Demonstrate understanding of financial decision making including analysis of renting, leasing, and buying credit compound interest investment portfolios. Ex: b) How much would Chelsea have at the end of 5 years if she deposits $100 monthly at an interest rate of 4.2% compounded monthly? Compare your answer to a). Use http://www.interestcalc.org/ to make your calculations. b) What can you conclude about making monthly payments rather than semi-annually payments when investing equivalent amounts of money? FM 30.1- Demonstrate understanding of financial decision making including analysis of renting, leasing, and buying credit compound interest investment portfolios. NOTE: TECHNOLOGY (APP or GRAPHING CALCULATOR) needed for next examples. Ex: Melky made a $250 payment at the end of each year into an investment that earned 5% compounded annually. Casey made a single investment at 5%, compounded annually. At the end of 5 years, their future values were equal. a) What was their future value? b) What principal amount did Casey invest 5 years ago? c) Who earned more interest? Why? Ex: Jasmine deposits $650 into an investment account quarterly. Interest is compounded quarterly, the term is 3 years and the future value is $ 9562.72. What annual rate of interest does Jasmine’s investment earn? FM 30.1- Demonstrate understanding of financial decision making including analysis of renting, leasing, and buying credit compound interest investment portfolios. Note: Use Technology to Assist Ex: Jarrett wants to have a retirement fund of $500 000 in 20 years so that he can retire. Jarrett has found a trust account that earns a fixed rate of 10.8% compounded annually? a) What regular payments does Jarrett need to make at the end of each year to reach his goal? b) How much interest will he earn over 20 years? FM 30.1- Demonstrate understanding of financial decision making including analysis of renting, leasing, and buying credit compound interest investment portfolios. 1.6- Solving Investment Portfolio Problems Definitions: a) Portfolio- Ex: Nessah started to build the following portfolio for her retirement: She bought a $1000 Canada Savings Bond at the end of each year for 5 years. The first three CSBs earned a fixed rate of 5.2% interest, compounded annually. The next two CSBs earned a fixed rate of 5.6% interest, compounded annually. Two years ago, she bought a $10 000 GIC earning 7% interest, compounded monthly over a term of 2 years. a) What was the value of Nessah’s portfolio after 5 years? What is the rate of return? b) Nessah redeemed her portfolio since interest rates increases. She invested all of her money into a savings account that earned 8.1%, compounded semi-annually. About how long will it take to double her money in the savings account? FM 30.1- Demonstrate understanding of financial decision making including analysis of renting, leasing, and buying credit compound interest investment portfolios. FM 30.1- Demonstrate understanding of financial decision making including analysis of renting, leasing, and buying credit compound interest investment portfolios.

![Practice Quiz Compound Interest [with answers]](http://s3.studylib.net/store/data/008331665_1-e5f9ad7c540d78db3115f167e25be91a-300x300.png)