Chapter 6 Strategy Analysis & Choice

advertisement

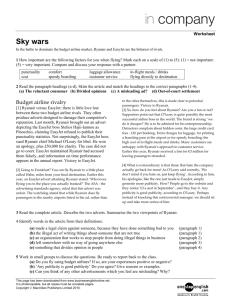

Chapter 6 Strategy Analysis & Choice Strategy Analysis & Choice Nature of Strategy Analysis & Choice -- Establishing long-term objectives -- Generating alternative strategies -- Selecting best alternative to achieve mission & objectives Comprehensive Strategy-Formulation Framework Stage 1: The Input Stage Stage 2: The Matching Stage Stage 3: The Decision Stage Strategy-Formulation Analytical Framework Internal Factor Evaluation Matrix (IFE) Stage 1: The Input Stage External Factor Evaluation Matrix (EFE) Stage 1: The Input Stage Basic input information comes from the internal /external evaluation (matrices) Requires strategists to quantify subjectivity early in the process: the assigned weights… Good intuitive judgment always needed Strategy-Formulation Analytical Framework Stage 2: The Matching Stage SWOT Matrix BCG Matrix Stage 2: The Matching Stage: SWOT analysis Match between organization’s internal strengths and weaknesses and the opportunities & risks created by its external factors E.g. internal: strong R and D function External changing demographics (e.g. population getting older) Strategy: Develop new products for older adults (related to long term objectives financial or strategic) Stage 2: The Matching Stage: SWOT Matrix Four Types of Strategies Strengths-Opportunities (SO): Use a firm’s internal strengths to take advantage of external opportunities Weaknesses-Opportunities (WO): Improving internal weaknesses by taking advantage of external opportunities Strengths-Threats (ST): Use a firm’s strengths to avoid or reduce the impact of external threats. Weaknesses-Threats (WT): Defensive tactics aimed at reducing internal weaknesses and avoiding external threats Matching Key Factors to Formulate Alternative Strategies Key Internal Factor Key External Factor Excess working capacity (strength) 20% annual growth in the cell phone industry (opportunity) Insufficient capacity (weakness) Strong R&D (strength) Poor employee morale (weakness) + Resultant Strategy = Acquire Cellfone, Inc. Exit of two major foreign + competitors from the = industry (opportunity) Pursue horizontal integration by buying competitor's facilities Decreasing numbers of young adults (threat) Develop new products for older adults + + Strong union activity (threat) = = Develop a new employee benefits package Which types of strategies, e.g. intensive diversification…, are referred to above 9 Ryanair : Matching Key Factors to Formulate Alternative Strategies Key Internal Factor Key External Factor S1: Own 42 bases in Europe (strength) + 02: lower interest rates on borrowing money (opportunity) + Cheaper holiday’s being offered by resorts (opportunity) + Risk of increasing oil prices(threat) W7: charge for items free on other airlines (weakness) S7: profits increase by 200%(strength) W2: Poor customer service (weakness) T2: increase in + competitors customers services (threat) Resultant Strategy = Invest money (e.g. 100 million) in terminal space at new airports now currently served. = Increase amount spent on advertising to attract customers only concerned about price. = Hedge (invest) money to protect against rising oil prices = Spend money annually to increase customer services. The above is based on the internal and external evaluation of Ryanair: 10 Limitations with SWOT Matrix • Does not show how to achieve a competitive advantage • Provides a static assessment in time • May lead the firm to overemphasize a single internal or external factor in formulating strategies Boston Consulting Group (BCG) Matrix Enhances multi-divisional firm in formulating strategies Divisions may compete in different industries Focus on market-share position & industry growth rate BCG Matrix Relative Market Share Position Industry Sales Growth Rate High 1.0 Medium .50 High +20 Low 0.0 Stars II Question Marks (problem child) I Cash Cows III Dogs IV Medium 0 Low -20 Ratio of a division’s own market share in an industry to the market share held by the largest rival firm in that industry 13 BCG Matrix Quadrant 1: Question Marks or Problem child Low relative market share – compete in highgrowth industry Cash needs are high Case generation is low Decision to strengthen (intensive strategies) or divest (a defensive strategy) BCG Matrix Stars High relative market share and high growth rate Best long-run opportunities for growth & profitability Substantial investment to maintain or strengthen dominant position Integration strategies, intensive strategies BCG Matrix Cash Cows High relative market share, competes in lowgrowth industry Generate cash in excess of their needs Milked for other purposes Maintain strong position as long as possible Product development, Related diversification If weakens—retrenchment or divestiture BCG Matrix Dogs Low relative market share & compete in slow or no market growth Weak internal & external position Liquidation, divestiture, retrenchment Strategy-Formulation Analytical Framework Stage 3: The Decision Stage Quantitative Strategic Planning Matrix (QSPM) Technique designed to determine the relative attractiveness of feasible alternative actions Steps to Develop a QSPM 1. Make a list of the firm’s key external opportunities/threats and internal strengths/weaknesses in the left column 2. Assign weights to each key external and internal factor 3. Examine the Stage 2 (matching) matrices, and identify alternative strategies that the organization should consider implementing 4. Determine the Attractiveness Scores (A.S) 5. Compare the Total Attractiveness Scores 6. Compute the Sum Total Attractiveness Score QSPM : information from IFE and EFE Key External Factors Economy Political/Legal/Governmental Social/Cultural/Demographic/ Environmental Technological Competitive Weight Strategic Alternatives Strategy 1 Strategy 2 Strategy 3 Key Internal Factors Management Marketing Finance/Accounting Production/Operations Research and Development Computer Information Systems Sum total A.S. AS 1 to 4 and blank if factor does not effect strategy: TAS = Weight x AS 20 Ryanair: Sample QSPM matrix Increase terminal space at airports Increase advertising Opportunities 1. Local competitors’ going bankrupt allows Ryanair to capture their customers and possibly buy equipment they are forced to sell. Weight AS TAS AS TAS 0.08 4 0.32 3 0.24 2. Lower interest rate on borrowing money. 3. Down cycle of economy has increased potential profit because people are most cost sensitive. 4. Potential increase in investors due to high dividend payout $500 million dividend. 5. The economy is recovering. 6. Cheaper vacation prices are being offered by resorts. 0.05 3 0.15 2 0.10 0.06 2 0.12 3 0.18 0.05 0 0.00 0 0.00 0.05 2 0.10 3 0.15 0.05 2 0.10 3 0.15 0.07 0 0.00 0 0.00 0.09 4 0.36 3 0.27 7. European countries lowering or doing away with tourist taxes will attract more vacationers. 8. Passengers expected to grow to 73.5 million by the beginning of 2012. Ryanair: Sample QSPM matrix 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Threats Regulatory rules in Europe can change that would restrain the way Ryanair does business. Increase in competitor customer service could attract customers to their airlines. Cost increase at Dublin airport will lower passenger traffic through Dublin airport. Weather threats operating in Europe during winter. Fluctuations of foreign currency and longevity of the Euro. Heavily unionized labor force. Risk of oil rising back over $100 a barrel. Weaking of the global economy. Internet has led to more competitive pricing and more price sensitivity to industry. Continued threat to industry’s human relations concerning displeasure over carbon dioxide emissions. Weight AS TAS AS TAS 0.08 0 0.00 0 0.00 0.05 3 0.15 4 0.20 0.03 0 0.00 0 0.00 0.04 0.06 0.07 0.07 0.04 0 0 0 0 2 0.00 0.00 0.00 0.00 0.08 0 0 0 0 3 0.00 0.00 0.00 0.00 0.12 0.04 2 0.08 4 0.16 0.02 0 0.00 0 0.00 Ryanair: Sample QSPM matrix Increase terminal space at airports 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Weight Strengths Owning 42 bases allows Ryanair to operate at a lower cost then 0.06 competitors. 92% of bookings being done over the internet lower cost by 0.04 lower workers needed and telephone usage. Ryanair being the second largest airlines in Europe is a well 0.07 known company among European flyers. 90% of Ryanair’s flights arrive on time. 0.04 Ryanair has created a niche in the market by offering many direct 0.04 flights. 284 new routes will allow Ryanair to capture new passenger 0.05 business. Profits increased by 204% due to an increase in planes, routes 0.10 and passengers. The down turn in the economic cycle and low fares has lead to 0.05 an increase in traffic growth by 14%. Ryanair forecast generating over $1 billion in surplus cash. 0.10 Have 51 new planes. 0.05 Increase advertising AS TAS AS TAS 4 0.24 2 0.12 2 0.08 4 0.16 4 0.28 3 0.21 1 0.04 3 0.12 4 0.16 2 0.08 4 0.20 3 0.15 4 0.40 2 0.20 4 0.20 3 0.15 3 4 0.30 0.20 2 2 0.20 0.10 Ryanair: Sample QSPM matrix 1. 2. 3. 4. 5. 6. 7. 8. Weaknesses Low customer loyalty because of a no refund policy and relax attitude on canceling of flights. Poor customer service leaves an opening for competitors to capture our customers. Ryanair advertisements may be viewed as poor do to the use of vulgar, explicit, and sexual material. Ryanair’s lack of major city destinations. Low market growth opportunities. Staff cost increased by 8%. Ryanair charges customers for many ancillaries items that are free on most other airlines. Maintenance cost increased by 29%. TOTALS Weight AS TAS AS TAS 0.05 0 0.00 0 0.00 0.06 0 0.00 0 0.00 0.02 2 0.04 4 0.08 0.05 0.05 0.04 4 3 0 0.20 0.15 0.00 2 2 0 0.10 0.10 0.00 0.06 0 0.00 0 0.00 0.07 0 0.00 0 0.00 3.95 Recommendations: Invest $100 million in terminal space annually at new airports not currently serviced. What is this type of “generic” strategy; does it correspond to the proposed strategies of the grand strategy and BCG matrix 3.34 QSPM Limitations Requires intuitive judgments & educated assumptions Only as good as the prerequisite inputs Advantages Sets of strategies considered simultaneously or sequentially Integration of pertinent external & internal factors in the decision making process Example of a QSPM for Dell Questions • Explain, using suitable examples, how you would use a SWOT analysis in strategic formulation. (10 marks). • What are the main limitation associated with using this analysis (2 marks) • Describe, the relationship between the quadrants of the BCG matrix and the growth of an industry and the organisations market share. (8 marks) • Explain, using an example, the types of strategies a firm could adopt in any three of these quadrants. (10 marks) • How would you choose the most appropriate strategy given you have performed an internal and external evaluation. (10 marks)