Fidget

The FidgeT

T h e F i d g e T

S a s k a t o o n , S a s k a t c h e w a n

3 0 6 - 2 9 1 - 1 5 0 6

1 2 / 3 / 2 0 1 0

By: Taylor Petrucha

A thorough and detailed business plan for the entrance of a new product – into a competitive market

Table of Contents

Executive Summary ...................................................................................................................................... 4

Main Report

1.0 Introduction ..................................................................................................................................... 5

1.1 Mission Statement ........................................................................................................................... 5

1.2 Goals and Objectives ........................................................................................................................ 6

1.3 Industry Context .............................................................................................................................. 6

2.0 Operations Plan ............................................................................................................................... 7

2.1 The Reel Power Unit ........................................................................................................................ 7

2.2 Deliveries and Suppliers ................................................................................................................... 8

2.3 Capital Budget and Operating Expenses ..................................................................................... 9-10

2.4 Cost of Goods Sold ......................................................................................................................... 10

2.5 Cash Conversion Cycle ................................................................................................................... 10

3.0 Human Resource Plan ................................................................................................................... 11

3.1 Compensation Structure ................................................................................................................ 11

3.2 Organizational Structure ........................................................................................................... 11-12

3.3 Timely Responsibilities ................................................................................................................... 12

4.0 Marketing Plan .............................................................................................................................. 13

4.1 Product ........................................................................................................................................... 13

4.2 Place ............................................................................................................................................... 13

4.2.1 Target Market ..................................................................................................................... 13-14

4.3 Pricing ............................................................................................................................................ 14

4.3.1 Direct Personal Sales Pricing ................................................................................................. 14

4.3.2 Retail Pricing ......................................................................................................................... 14

4.4 Promotion ...................................................................................................................................... 15

4.3.1 Direct Sales and Price Discounts ...................................................................................... 15-16

4.5 Sales and Profit Goals .................................................................................................................... 16

5.0 Financial Plan ................................................................................................................................. 16

5.1 Capital/Initial Investments ........................................................................................................ 16-17

5.2 Retained Earnings and Dividend Policy .......................................................................................... 17

5.3 Projected Income Statement Summary ......................................................................................... 17

5.4 Economic Forecast ......................................................................................................................... 18

5.5 Ratio Analysis ............................................................................................................................ 18-19

5.6 Financial Analysis ........................................................................................................................... 19

5.7 Risk Analysis ................................................................................................................................... 20

2 | P a g e

6.0 Conclusion ..................................................................................................................................... 20

Tables

Table 2.3 Operating Expenses ................................................................................................................ 10

Table 2.4 Cost of Goods Sold .................................................................................................................. 10

Table 2.5 Cash Conversion Cycle ............................................................................................................. 10

Table 3.1 Retained Earnings Account ..................................................................................................... 11

Table 3.2 Organizational Structure ......................................................................................................... 12

Table 3.3 Timely Responsibilities ....................................................................................................... 12-13

Table 4.3 Pricing, Revenues, Margins ..................................................................................................... 15

Table 4.5 Net Income Break Even Analysis ............................................................................................. 16

Table 5.1 Debt Amortization Schedule ................................................................................................... 17

Table 5.3 Income Statement Summary ................................................................................................... 18

Table 5.5 Ratio Analysis .......................................................................................................................... 19

Table 5.6 Financial Performance ............................................................................................................. 19

Table 5.7 Scenario Models ...................................................................................................................... 20

Diagrams

Diagram 2.1 The FidgeT Unit ................................................................................................................... 8

Diagram 2.2 Supply Chain ....................................................................................................................... 9

Appendix

A Financial Report

B Product Design

C Works Cited

21

22-23

24

3 | P a g e

Executive Summary

The FidgeT is a compact device designed to provide tactile stimulation from being manipulated by hand.

It is designed to fit comfortably in the palm of a hand. With six sides, two mechanical components, five textures, and a significant weight for its size; The FidgeT can stimulate the hand in a variety of ways.

In the current market there exist a number of competitors who have developed small handheld items for playing with, however, they have failed to is target the specific audience of people with attention disorders. The FidgeT is going to capture this audience by communicating the benefit that can be obtained by the use of The FidgeT. No other product on the market conveys how fidgeting is an acceptable coping mechanism for learning in a class room and this is where The FidgeT is going to gain its competitive advantage by being the first item on the market to not only provide a means, but communicate how fidgeting is a good thing.

With a rising number of people developing attention disorders at a young age, The North American class room is finding as high as two out of every ten students struggling with attention disorders. At a selling price of $10.99 The FidgeT provides a new strategy to assist students in classrooms who are struggling to pay attention.

Vast numbers of people of all ages struggle with attention disorders in North America; The FidgeT is a new product that belongs in the hands of people with attention disorders. The target market is approximately 4.25 million Americans under the age of 20 with attention disorders. The potential for this market is not limited to the target audience and may expand into different age groups. Between 30-

70% of attention deficit individuals continue to struggle past the age of 20. It is projected that the market will continue to grow along with the rising prevalence rate of children being diagnosed with ADD and ADHD.

The marketing and distribution of The FidgeT will be performed through various online distributors that provide teachers tools designed to assist learning in the classroom. Two of the potential partners are

Smile Makers a company by Staples, and Trainers Warehouse. These two partners are expected to assist in realizing 1500unit sales in the first year and establishing a presence with the target market. The first year projected growth rates in unit sales are conservative and opening more distribution networks will enhance the market penetration and assist in exceeding the projected growth goals.

Requiring very low investment cost and maintaining healthy profit margins ranging from 65-75%, The

FidgeT can generate positive cash flows in its first year of operations with respect to the base case.

Financed with only a $10,000 bank loan the company is projected to convert 100% debt to 100% equity in five years.

Pursuing the following business plan, The FidgeT will reach a large target market with great potential for growth and provide great insights into other products that can be developed to benefit this group.

4 | P a g e

1.0 Introduction

Fidget: to move about restlessly, nervously, or impatiently. Every type of person fidgets but some people live their lives in this state. A person with Attention Deficit Disorder(ADD) or Attention Deficit

Hyperactivity Disorder(ADHD) could be said to be in a constant state of needing to fidget. These disorders are becoming increasingly common in North American youth. and with many of the children dealing with these challenges they will continue on into their adulthood with some degree of this disorder persisting.

This Business plan will communicate why a product that promotes fidgeting is needed, and who is going to benefit from the development of a product of this nature. The FidgeT offers people living with attention disorders a means to achieve a level of stimulation that will assist in paying attention in classrooms. Classrooms from kindergarten to grade 12 have students struggling with concentration and it is not uncommon for the average classroom to have multiple children living with a true attention disorder. The opportunity to assist learning in a classroom and reduce the struggles of these children opens a large business opportunity for The FidgeT.

Many products exist that are solely created for the enjoyment of manipulating them in your hand, however, not one of these products has focused on getting in the hands of this specific target market.

There is a need for a product of this nature to communicate potential benefits to this group and the business plan for The Fidget Intends to accomplish exactly that. The strength of the fidget is its minimal risk and potential for significant returns over the first five years.

The industry in which The FidgeT will compete in contains a number of alternative products and services but defining and targeting a specific market is how it will achieve its initial penetration.

1.1 Mission Statement

"Providing people of all ages a unique strategy to cope with attention disorders by fidgeting."

5 | P a g e

1.2 Goals and Objectives

Short term goals include:

Year 1

Test the level of interest in the product with the target market.

Sell 1500 units in the first year

1200 of which will be sold through distribution partners

300 will be sold personally

Develop relations with more distribution partners

Generate 20% of sales outside of distribution contracts

Year 2-5

Reduce debt financing to $0 and begin paying dividends

Meet or exceed projected unit sales growth goals.

pay dividends when retained earnings exceed $10,000

1.3 Industry Context

With the current business strategy for the The FidgeT, the initial intent is for it to fall in the industry of school classroom equipment and supplies (except stationary). The item could then be further classified to be found in the category of therapy equipment. the NAICS code for this industry is 417930 (Statistics

Canada, 2007). The size of the target markets in this industry includes students under the age of 20 with attention disorders which totals approximately 4.25 million people in the United States (Faraone, 2003).

There are a medley of products on the market currently that are designed to provide tactile stimulation while being held in a hand. What these products have failed to do is focus on a specific target market and portray the benefit that can be obtained while manipulating them. A person with ADD or ADHD needs excess stimulation to function in comparison to an individual without a this type of disorder. The

FidgeT has been developed to provide this type of stimulation in a classroom setting without interfering with the learning environment.

Research has indicated that physical stimulation can be used to assist kids in the classroom who are struggling with attention. Some strategies have shown that carrying weighted items to the bathroom and back provides a lasting degree of stimulation for these children when they return to the classroom.

Incorporating this strategy with the use of The FidgeT for constant minor stimulation could increase the length of time these children operate efficiently in the classroom.

6 | P a g e

2.0 Operations Plan

This section will outline what The FidgeT is as a product, and what has been planned for the operation of the business. It will cover the unit itself, its design and features, who will manufacture the product, the organizational structure, and capital budget/operating expenses.

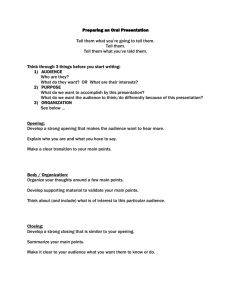

2.1 The FidgeT Unit

The FidgeT will be made of a strong and durable casing that will enclose its mechanical components. The metal, plastic, and silicone products included in the design will be nontoxic in the event of accidental ingestion of any small fragments that may break off. The shape of the product resembles a wedge prism.

The front of the product is concave and has a smooth steel plate for rubbing, while the back is ridged and bumpy to contrast the metal plate. There is a sliding segment on the bottom end of the wedge which is meant to return to its starting position by a recoiling spring when pushed left or right. The right side contains a sliding steel ball encased in the frame that will move along a channel embedded in the frame. The left side of the product has a medical grade silicone insert that is soft and squishes when pressed with a finger. Two brief drawings for The Fidget are shown in Diagram 2.1, more elaborate drawings can be found in Appendix B. The size of a child's hand is taken into consideration and the product is intended to fit comfortably in the hand of a 10 year old. The fidget stands 55mm tall, the base is 43mm wide and tapers to a width of 20mm at the top, it has a depth of 11mm.

Silence is an important element taken into consideration with the design, the two mechanical components are meant to not make noise when moved. In the sliding ball channel there are rubber pads on each end to cushion the ball so it does not impact the frame directly. the sliding segment on the bottom will also have similar cushioning pads at the extreme ranges of the component to prevent snapping noises.

7 | P a g e

Diagram 2.1 Front and Back view

Front view Back View

2.2 Deliveries and Suppliers (and supply limitations)

Diagram 2.2 Shows the supply chain line that is involved for the ordering, receiving, and delivering of goods

The FidgeT unit is planned to be made by a manufacturer in China who does injection moulding and parts assembly. It is possible to make this product for a unit production cost of $2.00cnd. The shipping to Saskatoon (if order 1000 units or more per order) works out to roughly $0.25 per unit. The first shipment will take 50 days due to the lag in production for time spent on the creation of moulds needed to construct the product. Successive orders will take roughly 30 days from date of order to be delivered.

There is a minimum order of 100 units and they are capable of producing up to 5000 units per 30 days. If more volume is needed there are similar manufacturers in China capable of producing this product at even greater volumes, though they have greater minimum order requirements.

The product will not require sales packaging because it will not be sold on a store shelf, It will be sold online and delivered directly to the consumer. Any packaging of the product will be included in the arrangements with selected distribution partners, these expenses are included in the contract for selling the product through their business. The partners will be sold each unit for 60% of its suggested retail price.

8 | P a g e

The delivery of the units will be in orders of 100 to the online stores located in the United States. The expense of shipping these orders will average to about $0.25/unit. These orders will be shipped via courier and take 10 days to reach their destination.

Diagram 2.4 – Supply Chain

2.3 Capital Budget and Operating Expenses

Since the manufacturing of The FidgeT, is being outsourced there is a very low capital cost that the business needs to incur. Two elements of this business plan have been factored in as being capital investment. The moulds required to manufacture the product are quoted to cost approximately $5000 and make up the majority of the capital budget. Also included in the capital budget are the product development costs including the necessary drafting, and focus groups to be held estimated to cost $500.

The details of the capital budget can be found in Schedule 5 of the financial model attached in Appendix

A.

The necessary operating expenses to pursue this business plan are minimal as the operation will be conducted from Taylor Petrucha's home. The majority of the expenses need to set this business plan in motion are incurred in setting up the manufacturing relationship, and shipping the product to the sales partners. There will not be any wage expenses incurred by this company because it will pay out profit to

Taylor Petrucha in the form of Dividends. In order to achieve this pay out strategy the company will incorporate the year it has a retained earnings account exceeding $10,000 and then pay dividends equal

9 | P a g e

to 3/4 of the retained earnings account to Taylor Petrucha. Table 2.3 Shows the Operating Expenses in detail for the first 5 years. Refer to Appendix A for greater detail on the effects of the operating expense on the bottom line

Table 2.3 – Operating Expenses

Marketing Expense

Insurance

Shipping Expense

Interest Expense

Total Operating Expenses

2.4 Cost of Goods Sold

3,000 3,300 3,630 3,993 4,392

2,000 2,040 2,081 2,122 2,165

600 900 1,260 1,701 2,126

700 578 448 309 160

6,300 6,818 7,419 8,125 8,843

The cost of goods sold is the expense of the inventory. The product is being produced by an external company so the COGS is an account of annual inventory purchases for The FidgeT. Table 2.4 details the gross profit margins for the two methods of selling and the COGS schedule. Refer to Appendix A –

Schedule 3 for greater detail on the COGS.

Table 2.4 – Cost of Goods Sold

Gross Profit Margin

Direct Sales

Retail Sales

Beg Inv

Purchases

End Inv

Cost of Goods Sold

2.5 Cash Conversion Cycle

77%

62%

77%

62%

77%

62%

77%

62%

77%

62%

- 411 629 898 1,236

3,750 5,738 8,193 11,282 13,234

411 629 898 1,236 1,450

3,339 5,520 7,924 10,943 13,020

From the time of order to arrival of the product there is a 30 day waiting period, and it will take an additional 10 days to ship the product to the sales partner making the # of day inventory equal to 40.

Table 2.5 details the average cash conversion for the first 5 years.

Table 2.5 – Cash Conversion Cycle

# Days Inventory

# Days Acc Receivable

# Days Acc Payable

Cash Conversion Cycle

40 40 40 40 40

30 30 30 30 30

14 14 14 14 14

56 56 56 56 56

10 | P a g e

3.0 The Human Resources Plan

The Fidget is a small business that will be solely owned by Taylor Petrucha. The HR plan will outline the method chosen to compensate the owner, the planed organisational structure, and outline the duties

Taylor Petrucha will perform to ensure goals are reached.

3.1 Compensation Structure

Operations for this business will be completed by Taylor Petrucha and he will be the sole person requiring compensation for his work. With the base case in mind the company plans to pay out a dividend after the third year of operations. Cash will be extracted from the business in the form of dividends when the retained earnings account exceeds $10,000. If the beginning retained earnings account exceeds $10,000 at the start of the year, dividends will be equal to 3/4 of that account balance.

Table 3.1 show the retained earnings account. refer to Appendix A for greater financial detail on how this transaction effects the business.

Table 3.1 – Retained Earnings Account

Beg RE

Net Income

Dividends

End RE

3.2 Organizational Structure

- 863 4,093 11,154 14,638

863 3,230 7,061 11,849 13,157

- - - (8,366) (10,978)

863 4,093 11,154 14,638 16,817

During the start up phase of this business the organizational structure will be a Sole Proprietorship. The sole proprietor will be the product creator Taylor Petrucha. The motivation for starting in this format is to allow the company to make immediate changes to its structure whenever needed. It also allows the owner to make every decision in the best interest of the company with no time delays in regard to consulting with partners or a board of directors. As outlined in section 3.1, the business intends to change from a sole proprietorship to corporation after it has a significant retained earnings account. The decision to Incorporate is motivated by the expenses saved by not having to pay the employee benefits that go along with paying wages. Figure 3.1 is a representation of the flow of the organization.

The President/Manager will oversee the operations of all departments. The outsourcing of manufacturing and selling the product makes the main duties of the business focused around setting up and maintaining relationships with these two parties. With these duties in mind sales volumes can grow well beyond projected numbers and still be managed by one person. If at any point the product growth

11 | P a g e

becomes too great for one person to manage a partnership will be formed with Susanne Petrucha who is an experienced business professional and any further recruitment will be discussed between Taylor and Susanne Petrucha.

Table 3.2 – Organizational Structure

President/Manager

Sales Marketing Finance/Accounting

Potential

Departments

Ordering/Purchasing Packaging/Shipping

3.3 Timely Responsibilities

The operation of The FidgeT does not necessarily have specific day-to-day or week-to-week responsibilities, therefore, important timelines have been developed outlining actions to take place during business quarters in Table 3.3. The timeline will include overlap of all responsibilities.

Table 3.3 – Timely Responsibilities

Responsibilities

Time Frame

January - March

April -June

-Further develop retail sales distribution contracts

-Explore various manufacturing opportunities

-Gather feedback on product

-Implement design changes based on feedback

-Process orders and design delivery schedule for retailers

-Initiate manufacturing product

-Begin deliveries of product to all retailers for sales

12 | P a g e

July - September

October - December

4.0 The Marketing Plan

-Develop method to identify which partners are reaching target market

-Ensure adequate supplies reach partners

-Contact distributors for feedback and input

-Make any necessary changes to current contracts

-Review financials and adapt to any obstacles

The FidgeT marketing plan design and implementation is the greatest contributor to the success of this business plan. This section will cover the elements required to achieve sales goals and business objectives. The FidgeT marketing plan is designed for a base case scenario and does not represent the possible investigation of opportunities with groups outside of the target market.

4.1 Product

The FidgeT offers people who need to fidget a way to keep a hand their hands busy without distracting the people around them. This product has a number of ways to entertain the sense of touch with different textures, movements, and shapes that all result in silent fidgeting. The product is intended to meet the needs of people living with attention disorders but can be enjoyed by all people who feel the need to have an object in their hands to play with. By providing a coping mechanism for people with attention disorders The FidgeT has the ultimate goal of becoming a learning aid for teachers with students who are struggling to pay attention.

4.2 Place

The FidgeT will be based out of Saskatoon where ordering and shipping of product will occur. This product will be sold in the United States online though websites that provide teaching supplies and teaching aid equipment, the two initial partners include two businesses called Trainers Warehouse and

Smile Makers, A Company by Staples. Direct sales will also be generated by Taylor Petrucha who will contact potential customers in the target market.

4.2.1 Target Market

According to a recent US census bureau there are 85 million people under the age of 20 years old in the

United States (US Census Bureau 2009). If one takes into account the current estimate of 1 in 20 children having an attention disorder this means that there are approximately 4.25 million individuals to whom this marketing strategy would apply (Faraone 2003). The key age group for the current marketing

13 | P a g e

strategy is from 5 years of age to 18 years of age, as this is the elementary and secondary school age group. An alternate group that can easily be expanded into from the current plan is the university student population as many of these individuals also have attention disorders and could benefit from the use of the product. Another factor in the university population's use of the product would be the self-directed nature of their studies, which would make them more likely to be attracted to the benefits that the product could provide to their concentration and attention. Currently the focus of this business plan is to reach the students in classrooms at the elementary and secondary education level. The investigation into university student population is reserved for business activities that extend beyond the first five years of operation.

4.3 Price

The pricing Strategy for The FidgeT will involve the two different methods of distribution. Taylor

Petrucha will generate sales at a unit selling price of $10.99. The other method of distribution will rely on external online companies that provide teaching supplies; they will buy the product for 60% of the suggested retail price of $10.99.

4.3.1 Direct Personal Sales Pricing

It is projected in the financial plan that 20% of sales will be generated by personal sales. When generating personal sales, Taylor Petrucha will continue to look for new distribution opportunities that will assist in reaching the target market. The unit selling price will remain flexible depending on the business opportunity pertaining to each sale. If selling a large number of units to one buyer is reliant on costs, prices may be dropped down to the distributer’s price of 60% of selling price to capture the sale.

This decision will rely on Taylor Petrucha's judgment. Sales generated at 10.99/unit will equate to a gross profit margin of 77%. With the above strategy in place the lowest gross profit margins/unit will drop to is 62%.

4.3.2 Retail Pricing

It is estimated that 80% of sales will be achieved by this method of distribution. Multiple relationships will be formed with different distributers and it is intended that all partners will be focused on providing teaching supplies. Distributers in this industry typically buy products of this nature for around 50% of the unit selling price. It is estimated that distributors will be sold this product for 60% of its selling price of

$10.99. The industry is flexible in the nature of these types of contracts and it is entirely possible to sell this type of product for more than 50% of the unit price. With contracts for 60% of the unit selling price gross profit margins will be 62%.

Table 4.3 details the pricing, revenues, and gross margins of sales for both direct and retail sales.

14 | P a g e

Table 4.3 – Pricing, Revenues, Margins

Year

Units Sold

Direct Sales

Retail

Average Selling Price/Unit

Direct Sales

Retail Sales

Revenues

Direct Sales

Retail Sales

Total Revenues

Gross Profit Margin

Direct Sales

Retail Sales

COGS

Gross Profit

4.4 Promotions

20%

80%

1 2 3 4 5

1,500 2,250 3,150 4,253 5,316

300

1,200

450

1,800

630

2,520

851

3,402

1,063

4,253

10.99

6.59

3,297

11.21

6.73

5,044

11.43

6.86

7,203

11.66

7.00

9,919

11.90

7.14

7,588

7,913 12,107 17,288 23,806 30,352

11,210 17,151 24,492 33,725 37,941

77%

62%

3,339

77%

62%

5,520

77%

62%

77%

62%

77%

62%

7,924 10,943 13,020

7,871 11,631 16,568 22,781 24,921

The Fidget will be promoted in partnership with companies currently involved with the target market.

Aside from Taylor Petrucha promoting the product, strategies will be developed with partner companies. Direct sales and price discounts will be the main method of securing sales.

4.4.1 Direct Sales and Discounts

The selling of products through secondary business will provide the means to advertize the product to the specific target group. Partnering with companies with access to the market reduces marketing costs directly but the cost of advertising through these companies arises in the discounts they require when purchasing The FidgeT. The FidgeT will be sold for 60% of the sale price to distributing companies. Sales to these companies will eliminate the costs of developing promotional campaigns and a website and allow the resources the company has to be used for developing more of these relationships.

Direct selling will be done by Taylor Petrucha who will communicate the product benefits to all groups who show interest in the product. These sales will range from $10.99 to $6.60 per unit based on the nature of the sale. If it is an individual consumer the FidgeT will be sold for 10.99; if it is a multi unit

15 | P a g e

purchase or sales contract the price will go as low as $6.60, as this selling price still generates profits that will assist the bottom line.

4.5 Sales and Profit Goals

The objectives for The FidgeT are to sell 1500 units in its first year. This volume accounts for far less than

1% of the target market (discussed in Section 4.2.1) and leaves a large opportunity for growth. Sales of approximately 1500 units per year minimum through year 5 provide the means to break even; any sales growth beyond an annual volume of 1500 will increase profitability significantly. The projected growth in sales is to follow the achievement of the quarterly goals and open greater means of distributing the product. With the base case outlined in the financial plan it is the goal to achieve a net profit margin of

29% by year 3 (see Appendix A – Schedule 10). See table 4.5 for a detailed net income break even analysis.

Table 4.5 Net Income Break Even Analysis

Year

Units Sold

Direct Sales

Retail

Net Income

1

1,308

262

1,046

0

2

1,470

294

1,176

0

3

1,455

291

1,164

0

4

1,446

289

1,157

0

5

1,693

339

1,335

0

5.0 Financial Plan

Financing this business will be done through a small bank loan. The base case of 1500 units of sales in the first year followed by conservative growth rates will lead to profits being removed after the third year of operation.

5.1 Capital/Initial Investments

The financial plan set out for The FidgeT is a base case scenario and is projected over 5 years. The complete financial report can be found in Appendix A. The initial investment needed for operations is

$10,000, and this will be debt financed through a bank. Taylor Petrucha will use his personal assets as collateral to secure the bank loan. This capital structure leaves the full ownership to one person and

16 | P a g e

provides a means to achieve the planned organizational structure (expressed in Table 3.2) . The bank loan is amortized over five years. See Table 5.1 for the detailed schedule of repayment.

This initial investment will cover the costs of the primary start up expenses. These include product development, manufacturing moulds, and marketing expenses. It will cover the costs required to last up to the point where the first revenues are generated.

Table 5.1 – Debt Amortization Schedule

Year

Beginning Balance

Addition

Payment

Interest

Principal Reduction

Ending Balance

5.2

1 2 3 4 5

- 8,261

10,000 -

6,400

-

4,410

-

2,279

-

2,439

700

2,439

578

2,439

448

2,439

309

2,439

160

1,739 1,861 1,991 2,130 2,279

8,261 6,400 4,410 2,279 0

Retained Earnings and Dividends Policy

The FidgeT will pay dividends in any year that the Beginning Retained Earnings account is greater than

$10,000. The Dividends paid will be equal to 75% of the Beginning Retained Earnings Account in any year a $10,000 balance is achieved; the remaining 25% balance in the account will be used to finance any expansion efforts.

5.3 Projected Income Statement Summary

The revenues for The FidgeT are derived from projections of first year sales reaching 1500 units followed by subsequent growth each year (Appendix A – Schedule 2). 80% of revenues will be generated through distribution partnerships with businesses who have access to the target market. The remaining 20% of revenues will be achieved by Taylor Petrucha who will generate direct sales to customers in the target market. These estimates are a conservative projection of the revenues, and expenses which are foreseen as a minimum standard that this business can achieve. Table 5.3 expresses the projected income statement summary.

17 | P a g e

Year

Table 5.3 – Income Statement Summary

Revenues

Cost Of Goods Sold

Gross Profit

Total Operating Expenses

Income Taxes

Net Income

Cash Balance end yr

5.4 Economic Forecast

1 2 3 4 5

11,210 17,151 24,492 33,725 37,941

3,339 5,520 7,924 10,943 13,020

7,871 11,631 16,568 22,781 24,921

6,850 7,808 8,211 8,759 9,350

158 593 1,295 2,174 2,413

863 3,230 7,061 11,849 13,157

3,243 5,054 10,249 11,395 11,341

All expenses, wages, selling price, etc will grow at the rate of inflation estimated at 2%. This estimate is based on historical inflation rates in Canada. The business is a new start-up and carries with it a high level risk, however, the financing strategy will make it possible to secure a loan that will retain an interest rate of 7% for the life of the loan.

5.5 Ratio Analysis

The ratios that are defined in this section are the key indicators that will be responsible for the success of this business. Table 5.5 details the different ratios to year 5 and they demonstrate positive results for the projected financial plan.

The Debt Ratio demonstrates that by year 5 all long term debt will be paid off and the business will become internally financed by equity. This is a primary goal of the business because it will be solely owned by Taylor Petrucha who will use his personal assets as collateral to secure the long term debt.

The Gross Profit Margin will be reduced by using the two different sales channels. 80% of sales are to be generated by partners who will buy the product at a reduced price. Because the gross profit margin from these sales is equal to 0.62, as unit sales increase this lower profit margin pulls the total ratio down. the lowest the profit margin will fall is 0.62 which would occur if all sales were generated by external business.

The Net Profit Margin increases as debt decreases. After the prototyping is complete the fixed costs are reduced significantly which also contributes to this ratio rising over the five years.

18 | P a g e

Return on assets is a strong ratio for this business and represents the small investment needed to generate great returns. The ratio is low in year one as a result of the business being financed initially with debt. The initial debt is used to purchase the assets required to start the business and most cost incurred are due to operations. The main assets the business acquires over the years to increase this ratio are Cash and Accounts Receivable

Table 5.5 – Ratio Analysis

Year

Operating Ratio

Debt Ratio

Profitability Ratios

Gross Profit Margin

Net Profit Margin

Return on Assets

5.6 Financial Analysis

1 2 3 4 5

0.87 0.58 0.27 0.13 -

0.70 0.68 0.68 0.68 0.66

0.08

0.09

0.19

.029

0.29

0.43

0.35

0.66

0.35

0.73

After constructing the financial plan for The FidgeT it can be concluded that the business plan is economically feasible and has potential to be very financially successful if sales projections exceed expectation. The variables that were used to asses these finding were: Income, Cash Flows, and the

Dividend Policy.

In the first year of operations there is a positive Net Income that continues to grow each year reaching

$13,157 by year 5. The cash flows remain positive in all years and continue to expand significantly with unit sales growth rates while financing operations, paying off debt, and making dividend payments. It is important to note that dividends are paid at the start of the year and after year five concludes and year six begins there will be an additional dividend payment that will be equal to $12,613. This business, with the given financial situation can prove to be successful. Table 5.6 shows details over 5 years.

Table 5.6 Financial Performance

Net Income

Net Cash Flow

863

3,243

3,230

5,054

7,061

10,249

11,849

11,395

14,638

11.341

Dividends 0 0 0 8,366 10,978

19 | P a g e

5.7 Risk Analysis

The FidgeT's critical variable that has the largest impact on performance is the unit sales. Though the base case right now leaves it flexibility to maintain a successful financial sheet, Table 5.7 shows the Base,

Worst and Best case scenarios for The FidgeT. The table represents the financials for year one. If the best case were realised the total dividends paid out by year five would equal $195,186. One area of concern is the break even being less than 200 units from the base case, however, if sales were to reach even 1% of the target market unit sales would equal 42,500.

Table 5.7 – Scenario Models

Base Case

Worst Case (NI Break Even)

Best Case

Units Sold

1,500

1,308

8,000

Dividends

0

0

20,614

Cash Flow

3,243

2,596

25,501

Net Income

863

0

27,486

6.0 Conclusion

The FidgeT is a small device designed to be manipulated in a hand. It is an outlet for people living with attention disorders who require excess stimulation to function effectively in a classroom setting and is intended but not limited to people ages 5-18. Products of this nature have existed in the marketplace for a number of years and The FidgeT will penetrate this competitive market with a strategic marketing plan. Low start-up costs and high profit margins make for a profitable opportunity where large incomes rely heavily on exceeding projected unit sales and growth rates. One year of operations will paint a clear picture of this plan's feasibility as a business opportunity with minimal financial risk.

20 | P a g e

Appendix A – Financial Summary

See file: The FidgeT Financials

21 | P a g e

Appendix B – Product Design

22 | P a g e

23 | P a g e

Appendix C

Works Cited

Faraone et al. "The Worldwide Prevalence of ADHD: Is It An American Condition?". World Psychiatry.

2003 June; 2(2): 104-113.

Hild, Tiffany A. (1997). Fidget to focus: A coping strategy for an adult with AD/HD. Psy.D. dissertation,

California School of Professional Psychology - San Diego, United States -- California. Retrieved

September 18, 2010, from Dissertations & Theses: Full Text.(Publication No. AAT 9731902).

Statistics Canada. (2007). NAICS 2007. Retrieved November 2010, from North American Industry

Classification System: http://stds.statcan.gc.ca/naics-scian/2007/es-re-eng.asp?criteria=417930

U.S. Census Bureau. Accessed on October 28, 2010. http://factfinder.census.gov/servlet/STTable?_bm=y&-geo_id=01000US&qr_name=ACS_2009_1YR_G00_S0101&-ds_name=ACS_2009_1YR_G00_&-_lang=en&-redoLog=false&state=st&-CONTEXT=st

24 | P a g e