(Indicators - Combining Them to Create a Trading Strategy (Class 3)).

advertisement

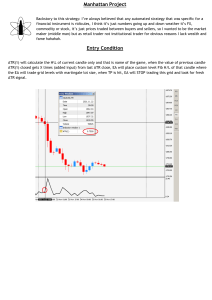

Combining Indicators to Create a Trading Strategy, Class 3 Written by James Goulding www.jamesgoulding.com 0 Contents Introduction ..................................................................................................................................... 1 1 Introduction In the first class we categorized a few indicators by Trend and Direction. In the second class we covered two topics. The first topic looked at what indicators a trader shouldn’t combine on a chart. The second topic covered how to combine some indicators to create half of a trading system. We answered the first two questions in the group of four questions that we use to build a system. 2 The four questions: 1. Why are we getting in the market? 2. Where are we getting in the market? 3. Where’s are profit target? 4. Where’s are stop? We answered the first two questions: 1. Why are we getting in the market? a. We were waiting for a reason to get in. That reason came in the form of a trading signal. The trading signal was produced by a 5 minute chart with the backing of a 30 minute chart. b. There were actually 3 signals that can be written in the form of an IF, THEN statements off of the 5-min chart. To keep it simple, let’s just write down what occurred on the 5-min chart and leave the 30-min chart out of the equation for now. 3 4 5 6 Let’s answer questions #3 and #4. We are short at 110.13 There are several ways to get out of the trade. What you’ll see below is simply using the Average True Range / Historical Volatility as a guide to get out. It looks more complicated than it is. That’s because we have to define everything for the computer. Imagine walking out of a building and hailing a cab, getting in and giving the driver directions to your destination. Try breaking that down into IF THEN statements. Let’s introduce a new indicator Average True Range / Historical Volatility ATR at 12:30 was .03. When using this indicator simply multiply by 3. • The ATR = Average True Range. In Telerate this indicator is listed under Historical Volatility (HV). • When charting fixed income instruments simply multiply ATR/HV by 3 to get the approximate average range. Then, add a tic for bonds, add a 1/2 tic for the 10s and 5s. Always use a minimum of 1 1/2 tic stops in ZN, and ZF now matter what the ATR/HV. Read on. 7 8 9 Thank you, Jim Goulding www.jamesgoulding.com