T8 Audit Sampling

advertisement

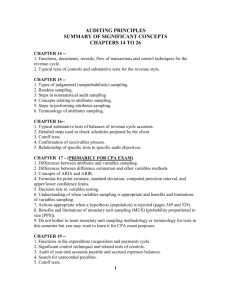

Chartered Accountants of Audit Conference in 2007 Fundamentals Auditing ASA 530 – Audit Sampling and Other Means of Testing Michael Cain, FCA Audit & Accounting Technical Director Nexia International – Australia and New Zealand charteredaccountants.com.au charteredaccountants.com.au/training Sampling Experiment Choose a Numbe r from 1 to 10 16 14 12 10 8 6 4 2 0 1 2 3 4 5 6 7 8 9 10 Sampling Experiment Select an Invoice for Testing 12 10 8 6 4 2 0 1 2 3 4 5 6 7 8 Sampling Experiment – Same Birthday? 30 25 20 15 10 5 0 1 2 3 4 5 6 Various means of gathering audit evidence > 100% examination: this is not a sampling method. > Selecting specific items: e.g. high value or high risk — this is not a sampling method. Items selected will not necessarily be representative of the population. > Audit sampling. Sampling ASA 530: Sampling > ASAs do not prescribe any particular way of determining the sample size or selecting the sample. > AARF Audit Guide No 1 (available at Institute library) outlines methods for determining the sample size. Stratification > Stratification: occurs when the auditor divides the population into a series of sub-populations, each of which has an identifying characteristic, such as dollar value. > Can assist with audit efficiency as it allows the auditor to reduce the sample size by reducing variability, without increasing the sampling risk. > Can direct auditor’s attention to areas of audit interest, especially risky or material items. Definition and features > Audit sampling: the application of an audit procedure to less than 100% of the items within a population to obtain audit evidence about particular characteristics of the population (ASA 530.06. > Audit sampling is important because it provides information on: • How many items to examine • Which items to select • How sample results are evaluated and extrapolated to the population in order to tell us something about the population (e.g. level of misstatement). Definition and features > ASA 530: Sampling > Key issue is to select a sample that is representative of the population. > Remember: > % coverage is no guarantee of a representative sample. > The number of items in the population has little effect on the sample size, unless the population is small. Sampling risk defined > Sampling risk: the probability that the auditor has reached an incorrect conclusion because audit sampling was used rather than 100% examination (i.e. correctly chosen sample was not representative of the population). Non-sampling risk defined > Non-sampling risk: arises from factors, other than sample size, that cause an auditor to reach an incorrect conclusion, such as the possiblility that: • The auditor will fail to recognise misstatements included in examined items. • The auditor will therefore apply a procedure that is not effective in achieving a specific objective. Characteristic of interest > When sampling, the auditor identifies a particular characteristic of the population to focus upon. > For tests of control, the characteristic of interest is the rate of deviation from an internal control policy or procedure. > For substantive tests, the characteristic of interest is monetary misstatement in the balance. Statistical sampling defined > Statistical sampling: any approach to sampling that has the following characteristics: • Random sample selection. • Use of probability theory to evaluate sample results, including measurement of sampling risk. > Major advantage of statistical sampling over non-statistical sampling methods is defensibility, thorough quantification of sampling risk. > Refer ASA 530.13 Non-statistical sampling > Non-statistical sampling: sampling approaches that do not have all the characteristics of statistical sampling. > Major advantage of non-statistical sampling is greater application of audit experience. > The basic principles and essential procedures identified in ASA 530 apply equally to both statistical and non-statistical sampling. Plan the sample 1. State the objectives of the audit test 2. Decide whether audit sampling applies 3. Define attributes and deviation conditions 4. Define the population 5. Define the sampling unit 6. Specify the tolerable deviation/misstatement rate 7. Specify allowable risk of overreliance/incorrect acceptance 8. Estimate population deviation/misstatement in the population 9. Determine initial sample size Select the sample and perform the audit procedures 10. Select the sample 11. Perform the audit procedure Evaluate the results 12. Generalise from the sample to the population 13. Analyse the exceptions 14. Decide the acceptability of the population Planning and designing the sample > Auditor must consider: • Objectives of the audit test (usually related to an audit assertion of interest). • Population from which to sample. • Possible use of stratification. • Definition of the sampling unit. Planning and designing sample for tests of controls > Auditor should consider: • Audit objectives (assertions of audit interest). • Tolerable error — maximum error rate that would till support control risk assessment. • Allowable risk of over-reliance — allowable risk of assessing control risk too low. • Expected error — amount of error the auditor expects to find in the population. Defining the audit objective and population > Once the audit objective is specified, such as reliance on controls or misstatement of account balance, the auditor must consider what conditions would constitute an error. > The auditor must ensure that the population from which the sample is to be selected is complete and appropriate to the audit objective. Defining the sampling unit > Sampling unit is commonly the: • Transactions or balances making up the account balance; or • Individual dollars that make up an account balance or class of transactions, commonly referred to as Probability Proportionate to Size Sampling (PPS) or Dollar Unit Sampling (DUS). Determining sample size > Sample size is affected by the degree of sampling risk the auditor is willing to accept. > Auditor's major consideration in determining sample size is whether, given expected results from examining sample, sampling risk will be reduced to an acceptably low level. Sampling for tests of controls, attribute sampling > Audit sampling is useful for tests of controls, especially involving inspection of source documentation for specific attributes such as evidence of authorisation (attribute sampling). > Involves examination of documents for particular attributes related to controls (e.g. authorisation). > Results of attribute sampling can be used to support or refute an initial assessment of control risk. Factors that influence sample size for tests of controls Determining the sample size – test of controls Judgemental considering statistical sample sizes Terminology > Risk of overreliance > Tolerable (error) rate > Expected population deviation rate Sample size estimation for attribute sampling Reliability factors for assessing required confidence level Determining the sample size – test of controls Example using Table 2 > 5% risk of overreliance. > No errors are expected (= 0 deviation rate) > 10% tolerable error rate. = Sample size of 29 items Sample size estimation for attribute samples (alternative method) > An alternative method is to determine sample size by reference to: • Appendix, Table 3, for where allowable risk of over-reliance (ARO) is 10% (90% confidence). This ARO is common in practice. • Appendix, Table 2, for where allowable risk of over-reliance is 5% (95% confidence). Sampling for substantive tests > The following matters should be considered: • Relationship of sample to relevant audit objective (assertion of audit interest) • Preliminary judgments about materiality levels • Auditor's allowable risk of incorrect acceptance • Characteristics of the population • Use of other substantive procedures directed at same financial report assertion. Factors that influence sample size for substantive testing Determining the sample size – substantive tests Judgemental considering statistical sample sizes Terminology > Risk of incorrect acceptance > Tolerable error as a % of population > Expected error as a % of tolerable error Determining the sample size – substantive tests Example using Table 1 > Acceptable risk of incorrect acceptance is low. > Few errors are expected. > Tolerable error = 10% of population. = sample size of 23-30 items Determining the sample size – substantive tests Judgemental using approximation of a statistical technique Terminology > Audit assurance (substantial, moderate, little). > Expected error (little/no, or some). > Individually significant items. > Tolerable error. Determining the sample size – substantive tests Example: > Recorded amount is $500,000. > No individually significant amounts. > Tolerable error = $50,000. > High degree of assurance required. > Few errors expected. Determining the sample size – substantive tests Formula: = Population recorded amount/tolerable error x assurance (reliability) factor = sample size. = 500,000/50,000 x 3.0 = 30 items Selecting the sample > To draw conclusions about population or strata, the sample needs to be typical of characteristics of population or strata. > Sample needs to be selected without bias so that all sampling units in the population or strata have a chance of selection. > Common sampling techniques are: • Random selection — random number generation • Systematic selection • Haphazard selection — select without conscious bias Steps in systematic selection For example, suppose the sample size is 20 and the number of items in the population is 10,000: > Step 1: Calculate the sample interval: No. of items in population 10 000 500 Sample size 20 > Step 2: Give every item in population chance of selection by choosing a random number (random start) within range of 1 and sampling interval (in this example, 500), e.g. 217. > Step 3: Continue to add sampling interval to random start, and identify items to be sampled, e.g. item nos. 217, 717, 1217. . . 9217, 9717. Performing the audit procedures > To ensure conclusions arising from tests on audit samples are appropriate, auditor must perform testing on each item selected. > If selected item is not appropriate for application of testing procedure, a replacement item can be selected. > If auditor is unable to perform test on a selected item (e.g. loss of documentation), it is considered to be an error. Analyse the exceptions Tests of control > Determine whether exceptions are errors. > Determine the no. of errors/error rate. > Compare to tolerable error. Evaluation of attribute sample results > Approach in practice is to use sample deviation rate (SDR) as best estimate of population deviation rate. > For example, auditor selects 25 items, finds one error => SDR rate is 4%. > Auditor compares with tolerable deviation rate (TDR). If SDR <= TDR, sample results support auditor’s planned reliance on IC. > If SDR > TDR, sample results do not support auditor’s planned reliance on IC, auditor will revisit audit plan and reduce reliance on IC and increase substantive testing. Analyse the misstatements Substantive tests > Determine any differences. > Calculate projected error compare to tolerable error. Evaluating sample results > To evaluate sample results, auditor determines the level of error found in sample and directly projects this error to relevant population. For example: sample 20%, find misstatement of $10,000. Therefore projected error = $50,000 ($10,000/20%). > Projected error is then compared with tolerable error for the audit procedure to determine if characteristic of interest can be accepted or rejected. > Auditor should consider both the nature and cause of any errors identified. Decide the acceptability Financial report overall > Summary of audit differences (mandatory requirement). Dollar-unit sampling > Sample unit is individual dollar units, not physical units (transactions or balances). A population with $1,000,000 that contains 1,000 physical units or accounts is viewed as a population with 1,000,000 sample units. > Individual dollar selected is attached to that physical unit or account in which it is contained, which will then be tested. Advantages of dollar-unit sampling (DUS) > Directs auditor’s attention to material items. For example, under traditional sampling, debtor A (owing $10,000) and debtor B (owing $1,000) have equal chance of selection. Under DUS, debtor A is ten times more likely to be selected and tested. > Directs auditor’s attention towards overstatement errors. > However, a disadvantage is that it directs auditor’s attention away from understatement errors. Illustration of DUS with systematic selection Determination of sample size for substantive tests n = R reliabilit y factor = TE BV tolerable error book value For convenience, this is usually presented as: n = BV xR TE E.g. account balance $1,000,000. Tolerable error $50,000. Expected error is zero and risk of incorrect acceptance is 5% Reliability factor = 3 Sample Size 1 000 000 x 3 60 50 000 Illustration of DUS with systematic selection Evaluation of sample results for substantive testing Take Away > Mandatory requirement to consider > Defensible > Focus on key areas > Reduction in audit work? = < $$$ > Questions??