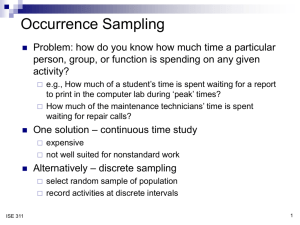

ISE

advertisement

CHAPTER 8 SECURITIES EXCHANGES IN TURKEY SECURITIES EXCHANGES THERE ARE 6 GROUPS OF EXCHANGES: – – – – – – COMMODITIES SECURITIES GOLD AND PRECIOUS METALS FOREIGN EXCHANGE INDEXES FUTURES AND OPTIONS IN TURKEY; – – – ISTANBUL STOCK EXCHANGE (ISE) ISTANBUL GOLD EXCHANGE (IGE) TURKISH DERIVATIVES EXCHANGE SECURITIES EXCHANGES; – STOCK EXCHANGE MARKET – ORGANIZED STOCK EXCHANGE OTC MARKET BONDS AND BILLS MARKET ORGANIZED BONDS AND BILLS MARKET OTC MARKET STOCK EXCHANGES Stock exchanges provide liquidity for C.S. Provide institutionalization of the firm by creating social responsibility. Increase the credibility of the issuing firms in the mms. Provide globalizatıon of the firm by selling their stocks ın foreıgn markets or selling them to foreign investors in domestic markets. Provide reputation to the firms. STOCK EXCHANGES NYSE WITH 2600 FIRMS TRADED CONTROLLING APP. 80% OF THE VALUE OF ALL ORG. TRANSACTIONS IN USA. IN TURKEY ISE WAS ESTABLISHED IN 1986 WITH A FEW FIRMS NOW ABOUT 321 FIRMS ARE TRADED ON ISE. ISE ISE WAS ESTABLISHED AS A PRIVATELY BUDGETED, SELF-REGULATED, SEMIPUBLIC LEGAL ENTITY. IT IS GOVERNED BY THE EXECUTIVE COUNCIL COMPOSED OF 5 MEMBERS ELECTED BY GENERAL ASSEMBLY. ISE ONE OF THEM IS THE CHAIRMAN AND CHIEF EXECUTIVE OFFICER APPOINTED BY THE TURKISH GOVERNMENT FOR A TERM OF 5 YEARS. FOUR OTHER MEMBERS OF THE COUNCIL REPRESENT 3 TYPES OF EXCHANGE MEMBERS ISE EXCHANGE MEMBERS: BANKS AND BROKERAGE HOUSES ARE AUTORIZED BY THE CMB. – – – INVESTMENT AND DEVELOPMENT BANKS COMMERCIAL BANKS BROKERAGE HOUSES ISE THE MEMBERS ARE AUTORIZED TO TRADE FOR EACH MARKET; – – – – – STOCK MARKET (EXCEPT COM. BANKS) BONDS AND BILLS MARKET REAL ESTATE CERTIFICATES MARKET REPO-REVERSE REPO MARKET INTERNATIONAL MARKET ISE ISE MEMBERS TRADE THROUGH THEIR REPRESENTATIVES. THERE ARE TRADING PROGRAMS TO BE A REPRESENTATIVE. ISE SECURITIES TRADED IN ISE; – – – – – – – EQUITIES BONDS AND BILLS REVENUE SHARING CERTIFICATES PRIVATE SECTOR BONDS FOREIGN SECURITIES REAL ESTATE CERTIFICATES INTERNATIONAL SECURITIES ISE STOCK MARKET FULL-COMPUTERIZED SYSTEM HAS BEEN INITIATED AT THE END OF YEAR 1994. STOCK TRADING ACTIVITIES ARE CARRIED OUT IN TWO SEPERATE TWOHOUR SESSIONS. THERE ARE NO FIXED COMMISSIONS BTW 0.2%-1%. ISE STOCK MARKET cont. THE PRICES ARE DETERMINED ON A “MULTIPLE PRICE-CONTINUOUS AUCTION” METHOD. – – WHEN EACH BIDDER PAY WHATEVER THEY BID: MULTIPLE PRICE AUCTION. WHEN THE PRICES VARY WITH THE PATTERN OF THE ORDERS: CONTINUOUS AUCTION. STOCK MARKETS IN ISE 1. NATIONAL MARKET: – – ALL COMPANIES ARE INCLUDED EXCEPTS INV. TRUSTS 100 COMPANIES SELECTED AMONG THE LISTED COMPANIES ARE INCLUDED IN ISE NATIONAL 100 INDEX. STOCK MARKETS IN ISE cont 2. SECONDARY NATIONAL MARKET ESTABLISHED WITH THE AIM OF TRADING SMALL AND MEDIUM SIZE COMPANIES STOCKS. – CONSISTS OF COMPANIES THAT ARE; DELISTED TEMPORARILY OR PERMANANTLY FROM ISE NATIONAL MRK. LACK OF NECESSARY QUALIFICATIONS FOR TRADING IN THE ISE NATIONAL MRK. STOCK MARKETS IN ISE cont. 3. NEW ECONOMY MARKET – – ESTABLISHED TO EMPOWER YOUNG COMPANIES TO OFFER THEIR STOCKS TO PUBLIC. ALLOWS TRADING OF SUCH STOCKS IN AN ORGANIZED MARKET. STOCK MARKETS IN ISE cont. FOR THESE 3 MARKETS; – – – – SETTLEMENT OF SECURITIES TRADED IN THESE MARKETS IS REALIZED BY THE SETTLEMENT AND CUSTODY BANK. SETTLEMENT PERIOD IS T+2 DAYS MULTILATERAL NETTING SYSTEM PAYMENTS CLEARED BY SAME DAY FUNDS. STOCK MARKETS IN ISE cont. – – DELIVERY VERSUS PAYMENT (DVP) ORDERS ARE ENTERED INTO THE ELECTRONIC SYSTEM OF ISE BY DISKETTES BTW 9.30-9.45 AM AND 2.00-2.10 PM, THROUGH KEYBOARDS 9.30-12.00 AM AND 2.00-4.30 PM. STOCK MARKETS IN ISE cont. 4. WATCH LIST COMPANIES – IT WAS ESTABLISHED WITH AN AIM OF SPECIAL SURVEILLANCE AND INVESTIGATION DUE TO EXTRAORDINARY SITUATIONS: DISCLOSURE OF INCOMPLETE, INCONSISTENT OR UNTIMELY INF. TO THE PUBLIC. FAILURE TO COMPLY WITH EXISTING RULES AND REGULATIONS LEADING TO DELISTING OF STOCKS STOCK MARKETS IN ISE cont. DISMISSAL FROM THE REALTED MRK. TEMPORARILY OR PERMANENTLY IN ORDER TO PROTECT INVESTORS’ RIGHTS AND PUBLIC INTEREST. Trading Hours: 2.00-3.00 PM STOCK MARKETS IN ISE cont. 5. WHOLESALE MARKET – – PROVIDING TRADING OF STOCKS IN LARGE QUANTITIES. PERMITS THE SALE OF STOCKS THAT ARE TRADED ON ISE NATIONAL AND REGIONAL MRKS AS WELL AS THOSE WHICH ARE NOT TRADED ON ISE, THROUGH CAPITAL INCREASES OR SALE OF STOCKS OF EXISTING SHAREHOLDERS TO PREDETERMINED OR UNIDENTIFIED BUYERS. STOCK MARKETS IN ISE cont. BLOCK SALE OF STOCK WITHIN THE FRAMEWORK OF PRIVATIZATION SETTLEMENT IS REALIZED BY THE ISE SETTLEMENT AND CUSTODY BANK T+2 DVP 11.00-12.00 AM. ISE INDICES ISE NATIONAL -ALL SHARES INDEX ISE NATIONAL 30 ISE NATIONAL 100 SECTORIAL INDICES ISE SECONDARY NATIONAL AND NEW COMPANIES MARKET INDEX ISE INVESTMENT TRUST INDEX ISE BONDS AND BILLS MARKET IT IS THE ORG. MRK IN THE STRUCTURE OF ISE. PARTICIPANTS; – – – – MEMBER BANKS BROKERAGE HOUSES CMB OF TURKEY CENTRAL BANK ISE BONDS AND BILLS MARKET cont. FIXED-INCOME SECURITIES OF THIS MRK: – – – – – GOVERNMENT BONDS TREASURY BILLS REVENUE SHARING CERTIFICATES BONDS ISSUED BY PRIVATIATION ADMINISTRATION CORPORATE BONDS LISTED ON ISE ISE BONDS AND BILLS MARKET cont. THE MRK OPERATES ON A MULTIPLE PRICE-CONTINUES TRADIND SYSTEM. BONDS AND BILLS MRK CONSISTS OF; – – OUTRIGHT PURCHASES AND SALES MARKET REPO-REVERSE REPO MARKET ISE BONDS AND BILLS MARKET cont. ALL THE SECURITIES EXCEPT GOVERNMENT AND PRIVATIZATION ADM. ARE REQUIRED TO FULLFILL THE LISTING REQUIREMENTS. CLEARING AND SETTLEMENT OPERATIONS ARE HANDLED BY THE ISE SETTLEMENT AND CUSTODY BANK WHICH EMPLOY DVP. OUTRIGHT PURCHASES AND SALES AND REPOREVERSE REPO TRANSACTIONS TAKE PLACE BTW 9.30 AM-5.00 PM. ISE INTERNATIONAL MARKET OPERATIONS IN THIS MARKET ARE TAXFREE. FOREIGN CAPITAL FLOWS TO ISE. THERE ARE TWO INT. MARKETS; – – ISE INT. DEPOSITORY RECEIPTS MRK ISE INT. BONDS AND BILLS MRK.