Belgrade Stock Exchange - Web Design John Cabot University

advertisement

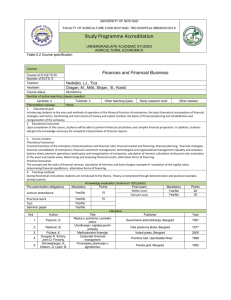

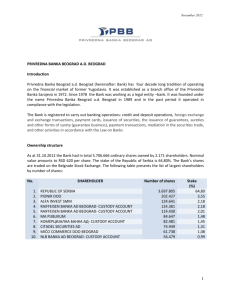

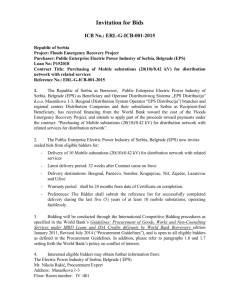

MARINA JANKOVIC JOHN CABOT UNIVERSITY BELGRADE STOCK EXCHANGE TABLE OF CONTENT Belex Market Making Economy of Serbia Belgrade Stock Exchange- Belex Overview Belgrade Stock Exchange is a joint stock company with the rights, obligations and responsibilities stipulated by Law on Capital Market (Official Gazette No. 31/11). Belgrade Stock Exchange performs activities of the market operator in accordance with the Law on Capital Market and manages or carries on business in connection with the operation of regulated markets and multilateral trading facility (MTP). Stock Exchange may also perform services related to the promotion and improvement of the capital market development, sales and licensing of the market data, investor education, and other activities related to the tasks that are in relation to the regulated market or MTP. Stock exchange activities are more closely regulated by Exchange Articles of Association. Stock Exchange can not trade with financial instruments, and can only invest in financial instruments issued by the Republic of Serbia, the National Bank of Serbia, local governments, or by the relevant institutions. Stock Exchange, nor any of the members of its organs, the Director of the Exchange or the Exchange staff must not give advice on buying and selling financial instruments or choice of an investment company. Shareholders In accordance with the Law on Capital Market, Exchange shareholders may be domestic and foreign entities, with an obligation of respecting specific rules on obtaining or reduction of qualified participation in the Exchange's capital. The Law in this regard prescribed obligation to obtain the prior approval of the Securities Exchange for the acquisition of shares in which the percentage of voting shares or equity reaches or exceeds 10%, 20%, 33% or 50%. This obligation applies to individuals and legal entities, and closely related persons, with the exception of the Republic of Serbia. Also, the Law stipulates that a natural or legal person who makes a decision that directly or indirectly reduce the percentage of qualified participation in the Exchange's capital below 10%, 20%, 33% or 50% of the total capital, is obliged to inform the Commission with a prior notice and state the amount of the intended reduction in participation. Shareholdeing structure of the Belgrade Stock Exchange consists, in addition to the Republic of Serbia, of investment companies, banks, insurance companies, other legal entities and individuals. The share capital of the Exchange consists of 4,160 ordinary shares with voting rights. Belgrade Stock Exchange is organized as a joint stock company that doesn't have the status of a public company, and shares of the Belgrade Stock Exchange can be transacted, respecting pre-emptive rights of shareholders of the Exchange. Exchange Articles of Association shall regulate the procedure for the secondary transacions of the Exchange shares, according to the aforementioned restriction Market Making Who do we work with The activities of a market maker are regulated by the Belgrade Stock Exchange rules. A MARKET MAKER may be any member of the Belgrade Stock Exchange who fulfilled the legally prescribed requirements and who concluded a contract on market making with the Exchange obliging him to continuously and for his own account place buy and sell orders for particular securities, under the contract terms and in compliance with the Exchange Rules of Business Operation. One security may simultaneously have several market makers. A market maker on financial markets is commonly called a specialist or a liquidity provider. By simultaneous and continuous placement of buy and sell orders, and in line with the liquidity level of the given security, market makers increase the turnover, liquidity of the security and market depth and reduce the price range for particular securities. A market maker makes profit through the difference between buy and sell price, i.e. spread. The members of the Belgrade Stock Exchange who choose to perform market making operations pay a discounted fee to the Exchange for transactions carried out in the capacity of a market maker, and there are also some forms of market maker protection aimed at preventing too many trade executions (20% of average daily turnover in previous six months). In such situations, a market maker may withdraw from the market without fulfilling the required time period within one trading session. Member Activity 1. ABC broker a.d., Beograd Broker 2. Alpha bank Srbija a.d. , Beograd BrokerDealer 3. Athena Capital a.d. , Beograd BrokerDealer 4. Banca Intesa a.d. , Beograd BrokerDealer 5. Banka Poštanska štedionica a.d. , Beograd BrokerDealer 6. Belgrade Independent broker a.d. , Beograd BrokerDealer 7. Capital broker a.d., Niš BrokerDealer Citadel securities a.d. , Beograd BrokerDealer 9. Convest a.d. , Novi Sad Broker 8. 10. Čačanska banka a.d. , Čačak BrokerDealer 11. Delta broker a.d. , Beograd BrokerDealer 12. Dil broker a.d. , Beograd BrokerDealer 13. Dunav Stockbroker a.d. , Beograd BrokerDealer 14. Energo broker a.d. , Beograd BrokerDealer 15. Erste bank a.d., Novi Sad BrokerDealer 16. Euro fineks broker a.d. , Beograd Broker 17. Eurobank a.d., Beograd BrokerDealer 18. Fimaks broker a.d. , Beograd Broker 19. Galenika broker a.d. , Beograd BrokerDealer 20. Ilirika investments a.d. , Beograd Broker 21. InterCapital Securities a.d. , Beograd BrokerDealer 22. Intercity broker a.d. , Beograd BrokerDealer 23. Invest broker a.d. , Beograd BrokerDealer 24. Jorgić broker a.d. , Beograd BrokerDealer Market Maker TIGR TIGR FIXAPI ECONOMY OF SERBIA Serbia's economy is based mostly on various services (63.8% of GDP), industry (23.5% of GDP), and agriculture (12.7% of GDP). In the late 1980s, at the beginning of the process of economic transition from a planned economy to a market economy, Serbia's economy had a favorable position, but it was gravely impacted by economic sanctions from 1992–1995, as well as excessive damage to infrastructure and industry during the 1999 NATO bombing. After the ousting of former Yugoslav President Slobodan Milošević in October 2000, the country went through an economic liberalization process, and experienced fast economic growth. GDP per capita (nominal) went from $1,160 in 2000 to $6,485 in 2008. Furthermore, it has been made a candidate for the European Union in March 2012. The European Union is Serbia's most important trading partner. Estimated GDP (nominal) of Serbia for 2013 is $53.1 billion, which is $7,136 per capita. Estimated GDP (PPP) of Serbia for 2013 is Intl. $96.8 billion, which is Intl. $13,004 per capita. In 2011 the economy grew at 3.7% (Q1 2011) 2.5% (Q2 2011) 0.5% (Q3 2011) 0.8% (Q4 2011),resulting in nearly 2% GDP growth for 2011. Serbia entered a second recession in 2012, causing GDP to decline 1.6% for that year. However, during the first quarter of 2013 growth in industrial production and exports resulted in a 2.0% increase in GDP. At present, main economic problems are high unemployment rate (22.4%, November 2012) and a large trade deficit ($7.2 billion, 2009). Trading Methods Block trading Fluctuation zone Single price method Continuous trading method