Market Overview

advertisement

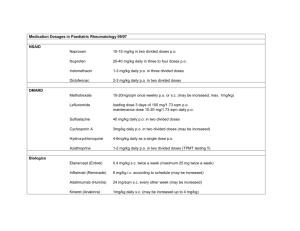

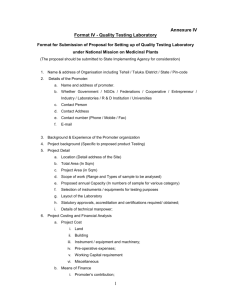

BRAZILIAN REAL ESTATE OFFICE MARKET OVERVIEW 2009 AGENDA Company Overview Brazilian Real Estate Market Evolution Brazilian Real Estate Office - Market Overview Investment Cases - Rio de Janeiro and São Paulo Real Estate Market - Challenges and Opportunities * F/X Rate: 1,85 Company Partners Bueno Netto With over 30 years of experience, Focused on urban transformation, homebuilding and development. Over 25 projects in the pipeline and a construction portfolio adding up to approximately US$1,5 billion. MaxCap/Bank of America Merrill Lynch (BAML) MaxCap is a leading Brazilian real estate investment management company, MaxCap has five partners, who together , acquiring or developing real estate investments totaling over US$3 billion. BAML’s Global Real Estate Principal Investments group has invested US$8.2 billion in real estate and real estate related assets in North and South America since 2003 * F/X Rate: 1,85 BNCORP Created in mid 2008, leveraging Bueno Netto´s track record in the sector Combining with the strategic vision and financial management of MaxCap and Bank of America/Merrill Lynch, A leading position in a segment with no dedicated players - FOCUS Five projects “under development” with potential sales value of more than US$320 million, and A development pipeline of corporate buildings, office suites and mixed-use projects of US$500 million. Company Business Sample Projects CORPORATE BUILDING Minimum of 500 sqm per floor Class A and over to 800 sqm Class AA Leased to Corporate Tenants Sold to End Users/Tenants, Individual Property Investors or Institutional Investors CONDOS OFFICE BUILDINGS Several small units per floor starting with 35,0 sqm Small companies and service providers Sold to End Users/Tenants or Individual Property Investors RETROFIT PROJECTS Acquisition of buildings in need of renovation Bring to current market standards Class AA requirements Sold to End Users/Tenants, Individual Property Investors or Institutional Investors Market Overview Brazilian Real Estate Market Evolution UNTIL 2003 LACK OF AQUISITION AND CONSTRUCTION FINANCING – NO CAPITAL MARKETS LACK OF GOVERNANCE STRATIFIED PROPERTIES BRAZILIAN PENSION FUNDS THE MAIN INSTITUTIONAL INVESTORS LOCAL PLAYERS DEVELOPERS AND CONSTRUCTION COMPANIES PROPERTY COMPANIES WEALTHY FAMILIES RIO DE JANEIRO AND SAO PAULO 2,3 MM sqm. 2003 - 2008 HIGH LIQUIDITY (FUELED BY IPOs AND FOREIGN DIRECT INVESTMENT) INVESTMENT GRADE IN 2008 STABLE POLITICAL ENVIRONMENT INTERNATIONAL INVESTORS => PENSION FUNDS , DEVELOPERS, HEDGE FUNDS LOCAL PLAYERS => REAL ESTATE FUNDS, PROPERTY COMPANIES, PRIVATE EQUITY FUNDS, WEALTHY FAMILIES, CONSTRUCTION AND DEVELOPMENT COMPANIES BUILT TO SUIT –ATYPICAL LEASE RIO DE JANEIRO AND SAO PAULO 3.2 MM sqm. Market Overview Main Office Markets Total Stock 20 MM sqm. 70% in Sao Paulo and Rio de Janeiro 18%Class A/AA – 65% in Sao Paulo BRASÍLIA (DF) BELO HORIZONTE (MG) Total stock: 1.7 million sqm. Total stock: 2.0 million sqm. Class A & AA Stock: 86 thous sqm. Class A & AA Stock: 38 thous sqm. New stock: 50 thous sqm. Net absorption: 23 thous sqm. Vacancy rate: 2.5% New stock: 97 thous sqm. Vacancy rate: 1.7% Source: Jones Lang LaSalle; Cushman & Wakefield ; BN CORP RIO DE JANEIRO (RJ) SÃO PAULO (SP) Total stock: 4.5 million sqm. Total stock: 9.6 million sqm. Class A & AA Stock: 876 thous sqm Class A & AA Stock: 2.4 million sqm. Net absorption: 36.2 thous sqm. Net absorption: 15.3 thous sqm. New stock: 25.7 thous sqm. New stock: 29.0 thous sqm Vacancy rate: 3.76% Vacancy rate: 7,44% PORTO ALEGRE (RS) CURITIBA (PR) Total stock: 800 thous sqm Total stock: 1.1 million sqm. Class A & AA Stock: 150 thous sqm Class A & AA Stock: 100 thous sqm New stock: 47 thous sqm. New stock: 39 thous sqm. Vacancy rate: 7.1% Vacancy rate: 6.7% Market Overview Corporate Office Market 2nd Quarter 2009 São Paulo Class A and AA 9,6 MM sqm Total Stock 2,4 MM sqm Class A and AA 7.4% Vacancy Rate NET ABSORTION FROM 2009 /2011 - São Paulo Thousand m² 300 30% HISTORICALLY LEASE RATES DO 250 22% 24% 25% 200 20% 18% 150 100 21% 12% 13% 11% 12% 13% 15% 12% 11% NOT DECREASE UNTIL VACANCY REACHES 16% 65% OF BRAZIL’S HIGH-END PROPERTIES ARE LOCATED IN 10% 7% 50 10% 7% SÃO PAULO 5% New Supply Net Absorption 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 0 -50 500 thous sqm. 0% Vacancy Rate Source: Jones Lang LaSalle; BN CORP Market Overview - Brazil Market Overview – São Paulo 2nd Quarter 2009 Prices – AA and A Class Buildings R$/sm/month AA Class A Class RENTAL ASKING PRICES 160 140 CLASS A – US$ 41.5/ sqf. /year 120 R$ 64.0 / m2 / Month 100 80 60 CLASS AA – US$ 54.4 / sqf. 40 /Year 20 R$ 84.0 m2 / Month 0 Primary Regions Secondary Regions Alternative Regions Source: Jones Lang LaSalle; BN CORP Market Overview - Brazil Condo/Suites Office Market São Paulo - 2nd. Semester 2009 and forecast 4,600 Units US$900 million Sales Value CONSTRUCTION FINANCING EMERGING SECURITIZATION MARKET FOR RECEIVABLES 90% 80% 5,000 4,500 4,000 3,500 3,000 2,500 2,000 1,500 1,000 500 0 SALES VALUE - 25% 4,451 4,035 80% 100% 100% USD 153 USD 255 2005 2006 2,600 USD 520 USD 565 2007 2008 60% OF BUYERS ARE INDIVIDUAL INVESTORS 1,995 1,826 1,514 CULTURAL ENVIRONMENT 60% OF SOLD UNITS - 50sqm. USD 364 1S 2009 USD 541 2S 2009/10 REDUCED DEVELOPMENT CYCLE SMOOTH APPROVAL PROCESS Potential Sales (US$ 'MM) Units Launched % Sold AND CLEAR EXIT OF PROJECT WITHIN THREE YEARS Source: BN CORP São Paulo Investment Case Alpha Tower Company Project Alpha Tower – São Paulo Assumptions Type of Project Corporate Total Private Area 6,900 SQM Number of Floors 12 Private Area per Floor 570 SQM Construction Aug/2009 until Mar/2011 Market Overview - Brazil Corporate Office Market – 1st Semester 2009 Rio de Janeiro – Class A and AA Total Stock 4,5 MM sqm. Class A and AA - 876 Thousand sqm. 3.76% Vacancy Rate SECOND PRIME MARKET IN Rio de Janeiro Thousand Sqm 160 BRAZIL 140 16% 16% 15% 120 “RETROFIT” GOVERNMENT COMPANIES 100 11% 5% 10% 11% 80 GAS COMPANIES 9% 60 9% 5% 7% 40 4% 6% 5% 3% 4% PENSION FUNDS, OIL AND SERVICING 3% 2% 20 1% 0 -20 -40 -4% New Supply Net Absorption Vacancy Rate Source: Jones Lang LaSalle; BN CORP Market Overview - Brazil Market Overview - Rio de Janeiro 2nd Quarter 2009 Prices – AA and A Class Buildings AA Class R$/sqm A Class 120 CLASS A AVERAGE 110 R$ 83 / sqm/ Month 100 US$ 53.8/sqf/Year 90 CLASS AA AVERAGE 80 R$ 84 / sqm / Month 70 US$ 54.4/sqf/Year 60 50 Centro Orla Barra Source: Jones Lang LaSalle; BN CORP Rio de Janeiro INVESTMENT CASE Rio Branco 115 Company Project Rio Branco 115 – Rio de Janeiro Assumptions Type of Project Corporate (Retrofit) Total Private Area 12,200 SQM Number of Floors 20 Private Area per Floor 610 SQM Construction Oct/2008 until Aug/2010 Market Overview Cap Rate by Sector CORPORATE BUYERS (12-14%) Cap Rate 20.0% SELLERS (11%) REALIZED RATES 11.8% UP TO MID 12% 18.0% DOWNWARD PRESSURE ON THE RATES DUE TO THE Industrial 16.0% Retail 14.0% 12.0% LOWERING INTEREST RATE – TRENDS 10% Corporate ASSET VALUE INCREASING Selic (Dec) INDUSTRIAL SUBSTANTIAL DECREASE IN CAP RATES IN THE PAST FIVE YEARS 10.0% STILL A INCIPIENT MARKET 8.0% 2005 2006 2007 2008 2009 LESS THAN 2 MILLION SQM AS PRIME STOCK CONCENTRATED IN SAO PAULO AND RIO DE JANEIRO Source: Jones Lang LaSalle; Colliers International; BN CORP Market Overview - Brazil 2008/2009Brazilian Real Estate Market Challenges and Opportunities BRIC - Real Estate Market Trend: Lease Rate US$ per m² 160 • São Paulo lease rate: +25% • Moscow: -63% 140 • Mumbai: -44% 120 Beijing 100 Mumbai • Beijing: -16% Moscow 80 São Paulo 60 Vacancy Rate Trend: Total Stock (high-end): Beijing 8,8 MM sqm Mumbai 3,8 MM sqm Moscow 1,5 MM sqm São Paulo 2,4 MM sqm 40 20 2Q/08 3Q/08 4Q/08 1Q/09 2Q/09 Source: Jones Lang LaSalle; BN CORP Market Overview Brazilian Real Estate Market Challenges and Opportunities Challenges Funding options Opportunities An emerging securitization market Brazilian Pension Funds are investing Transaction Structuring Real Estate Funds - the development phase Foreign Investors should be Familiarized with Prevalent stratified title and Pre-Sell floors the Market Dynamics. Capital needs and provide self liquidating. Local developers are becoming more institutional The world is Global, Regional and Local Local expertise with local partners Risk Adjusted Opportunity Cost of Investing in Underleveraged Market - the real estate market Brazil is not distressed and a strong bank system is present. Cap rates will go down soon; Low interest rate trend, Rise asset value, With the yield compression Sandra Ralston sandra.ralston@bncorp.com.br +55 11 4083-5301 +55 11 4083-5302 +55 11 9952-7772