Business Plan - Back The Brook

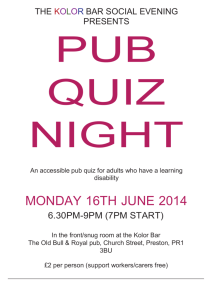

advertisement

The Brook Inn Business Plan April 2014 Back the Brook Ltd. Registered in England 8758434 Registered Address: Huntley House, The Street, Copdock, Ipswich, IP8 3HT Executive Summary 1. Punch Taverns have put The Brook up for sale following the decision of Gary and Anne to give up the tenancy. A new tenant has been installed on a temporary basis. There is the opportunity for the village to buy the pub and ensure it is maintained as a public house. 2. The loss of the pub, one of the few remaining focal points in the village, would reduce the attractiveness of the Washbrook and Copdock villages. 3. Following the well-attended meeting on the 8th May 2013, a small committee was formed to explore the viability of the village buying the pub. 4. The committee has considered the options with a view to meeting the objectives: 1. Financial viability and 2. Retaining The Brook as a village pub. 5. The estimates produced based on the historical turnover previous to the present temporary landlord and on discussions with others show that the business is profitable. 6. The structure which would best meet the objectives is to set up a Limited Liability Company. It would appoint the manager and deal with the Breweries. 7. To achieve the purchase of the pub and upgrade the facilities the company would issue shares at a price of £250 per share to locals and friends of The Brook. No one person would be allowed to buy more than 30% of the shares sold in order to avoid loss of control and conform with the Enterprise Investment Scheme (EIS). 8. The total sum to be achieved by the share offer is £400,000 with a maximum 1,600 shares. This would cover the purchase of the freehold of building, the upgrade of facilities and the initial working capital required to run the business. 9. The financial structure suggested would comply with the EIS. This scheme enables personal tax relief of 30% on the investment made provided the asset is held for a period of 3 years, as well as Capital Gains and Inheritance tax benefits. 10. The following pages set out the proposal in more detail and the steps taken so far, including agreeing a purchase price for The Brook Inn, subject to contract. The Contents 1. The opportunity 2. The local market 3. The Brook Inn property 4. Ownership 5. Management 6. Financial estimates 7. Development 8. Risks Attachments 1. Turnover history 2. Professional Advisors 3. EIS Provisional Clearance 1. The Opportunity The financial difficulties experienced by groups like Punch Taverns have led to a number of pubs being put up for sale. Many have been bought by their local communities, including the Sorrell Horse at Shottisham and the Black Buoy at Wivenhoe. A question mark hangs over the future of The Brook Inn after Punch put it up for sale at the start of 2013. The pub is profitable but, with landlords Ann and Gary moving on to fresh challenges, Punch Taverns have installed a temporary manager for the ‘foreseeable future’. However with their bankers requiring loan repayments, Punch have stressed that the pub would remain for sale. Except for the petrol station on London Road, there are no longer any shops or communitybased businesses left in Copdock and Washbrook. To lose the Brook Inn would leave a gap in community life and reduce the amenities in the village. The Brook Inn already enjoys a good reputation for food; boosted by its popularity among coeliacs on account of the high proportion of Gluten Free dishes. It has 450 members in its Discount Club, with members from inside and outside the village. The pub is located in the heart of the village and within walking distance of many residents and it adjoins a public footpath. It is proposed that the pub should be bought by a newly-formed company – Brook Inn Ltd which will be funded by a share issue to local people and others. This will enable it to be run on a commercial basis to ensure financial viability whilst being under community control. Proposed Mission: to continue The Brook Inn as a traditional English pub to welcome visitors who want to enjoy a village pub with good food To operate the pub in a way which meets the aspirations of the village To maintain and improve the property and provide a financial return to investors. Proposed Values: The company would be part of the Copdock and Washbrook community and would be accountable to the community through its directors and shareholders. It aims to be an active centre for the community. The company will be run in a way which listens to the wishes and concerns of local people irrespective of whether they are shareholders. Major decisions on investment and development will be widely consulted on. 2. The Local Market Since 2005 the number of pubs in the UK has dropped from 59,000 to 55,000 and it is expected that this decline will continue to around 50,000 in 2015. However, when one looks at just the UK independent pub market there are 22,000 pubs and this is not forecast to decline much over the next five years. The average turnover for these pubs is £260,000. The large pub operating companies in particular have been finding life difficult. Punch Taverns which owns The Brook Inn is experiencing commercial difficulties; it has almost £2bn of debt . This debt burden is forcing it to sell off a large number of its pubs. Going to the pub is not the national pastime it used to be. Price competition from supermarkets, tax rises and the smoking ban has helped drive sales away from pubs notably amongst younger drinkers. But it’s not all gloom and doom, and countryside pubs are different from city centre pubs. A recent review of the industry identified five positive themes: • There is a sense of cautious optimism amongst the surviving pubs; closure rate is slowing, the weak have gone and there are even a few new openings • Those that have made it through the recession and credit crunch may be well placed for the recovery and growth • Pub food has really come in to its own and there is significant potential for growth • Customers are looking for a wider mix of products with a revival of cask ales, greater attention to wines, interest in premium soft drinks, popularity of speciality coffees; all of this creates less dependency on lager and the potential for a higher margin • Customers are starting to take notice of the loss of pubs, are recognising the sense of community, and are prepared to act on it. Food is central to ensuring profitability due to its higher margins. It is this which places The Brook Inn in a strong position with its strong reputation, especially its coeliac menu. Another recent market research report identified four strengths for pubs: • Eating out remains a top consumer spending priority • Pubs continue to be a favourite eating out venue thanks to their value-‐for-‐ money positioning and relaxed, casual atmosphere • Although traditional fare is rarely out of favour, the recession boosted popularity of traditional British food as consumers looked for “guarantees” that they will enjoy their meal. This is an area for which pubs are renowned, with increasing evidence of titles such as “pub classics” making an appearance on menus again • Growth opportunities still exist in, for example, breakfast/café culture sector or takeaways. The community population is around the 1,300 mark. In addition it is close to local villages, namely, Capel St Mary(3,500), Bentley (800), Belstead (190) and Chattisham (140), as well as Burstall, Sproughton, Bramford and Hintlesham, and, of course, Ipswich. The nearby area is not well served with good quality pub restaurants such as the Crown at Stoke by Nayland or the Tuddenham Fountain found in other parts of Suffolk. 3. The Brook Inn Property The Brook Inn is a detached two-storey, Victorian brick-built property under pitched slate roof with single storey side and rear extensions and on the market for £325,000, excluding VAT. The details are shown on the estate agent’s website http://everardcole.co.uk/wpcontent/uploads/Washbrook-Brook-Inn-Details.pdf The ground floor is accessed via central lobby in a largely open plan bar area with wooden bar servery, tiled floor, open fireplace and space for 40+ covers. To the rear is a dedicated restaurant with space for 50+ covers. Serving this area is a well-equipped kitchen and washing-up area. There is also a large prep area, office, ground floor cellar and spirit store, which is accessed from the front, Back lane. The first floor flat includes a double bedroom, kitchen (formerly a bedroom), lounge and bathroom. Externally the property provides a large 40 space tarmac car park, fenced trade garden with space for 10 picnic tables, service yard, garage (currently used for storage) and private garden. The ground floor footprint of the main pub building, as measured from digital mapping, is approximately 290m² (3,120 sq ft), with a site area of 0.48 acres, or 1,975m² (also approximate). The current 2011 Rateable Value for the public house is £9,000; there is a 90% reduction on the amount charged as it is a small local business. The residential element is Band A with a charge of £994.61 per annum. The committee has agreed a price of £290,000 with Punch Taverns, subject to contract. A survey has been carried out in March 2014 by James Aldridge, Chartered Surveyors. They asses that “the main structure of the building is sound” but there is a need for some maintenance. The report sets out the maintenance work required. Lawyer Toby Kramers at Ellisons solicitors in Colchester has agreed to act for us in any future purchase. John Phillips & Co Ltd accountants have agreed to act on our behalf on future financialrelated matters while a business account has been opened with Barclays Bank in Ipswich 4. Ownership The company will be owned by a broad range of investors with, ideally, a large number living locally. The pub will be run to make a profit. Profits will initially be used to improve the operation of the business. Subsequently investors will be rewarded via dividends. The company will hold an AGM for all shareholders and will hold further meetings during the year to report on progress and discuss plans. Funding The intention is to raise the £400,000 required to purchase the property and enable enhancements to take place and to also provide working capital. Every effort will be made to sell the 1600 shares at £250 per share. In order to avoid too much influence to fall into individual hands no shareholder (including close family) will be able to buy more than 30% of the company. Should the company be unable to raise the full amount efforts will be made to find other options including obtaining community grants/ loans for the shortfall before looking for bank loan finance. Assets: The Company will own the freehold of the pub and adjoining car park (see Land Registry map attached). The purchase price includes the furniture and fittings. Trading stock will be purchased separately. Over time a growing reputation and improving profitability will further enhance the value. Tax Benefits: The company is expected to qualify for the Enterprise Investment Scheme (EIS) which provides for tax relief of 30% of the amount invested. This means that if a taxpayer invests £1000 they will be able to claim £300 back from the taxman. There are also significant capital gains and inheritance tax benefits. You should consult. Potential investors should go to the HMRC website, http://www.hmrc.gov.uk/eis/ for further information as well as consulting a tax advisor on these aspects. The EIS scheme requires that approval is sought by the company from HMRC after four months of operation. The company, Back The Brook Ltd, has been formed and provisional clearance has been received from HMRC, the letter is shown in Attachment 3. 5. Management The committee believes the best option is for the company to appoint a professional manager to run the pub. Clearly the shareholders need to ensure that the operation is well run. It is proposed that the shareholders will elect a Board of Directors comprised of up to seven directors. Any shareholder will be eligible to become a board member. The directors will retire on a three-year cycle agreed at the first General Meeting. A retiring Director may seek re-election. These aspects will be set out in the Memorandum and Articles of the Company. The Chairman of the Board will be elected by the directors. The role of the Board will be to oversee the operation of the business. The Board will appoint the manager who will have full operational responsibility for the pub and the delivery of the annual financial targets set by the Board. While it is the responsibility of the Board to establish the strategy for the business, as a community venture, the Board will work in a way which is consultative with both shareholders and the wider community. Various options will be considered to enhance the value of the pub to the village. Examples might be: Making the pub available for community activities on a Monday evening Offering to act as a cost price off-licence to shareholders and discount card holders. The committee is anxious the local community contribute with ideas and, where practical, with support with the refurbishment. 6. Financial Estimates Based on the information available, the pub has been making profits annually up to May 2013. None of the figures we have been given have been officially audited but have been reviewed by an independent accountant. Quite separately Punch Taverns have indicated that the pub is profitable and appointed a temporary tenant, Mr Alan Tolfrey. The pub has a turnover (excluding VAT) of about £230,000 which varies over the year as shown in Attachment 1. Based on the information we had relating to 2013, we estimate the current profit position under Punch Tavern’s ownership is made up as follows: £ £ Turnover 230,000 Cost of Sales 92,000 Gross Profit 138,000 Overheads Staff Costs 62,000 Rent & Rates 30,000 Utilities 7,000 Insurance 3,250 Repairs & Renewals 4,000 Marketing 3,000 Accountancy 5,000 Bank Charges 3,000 Other Charges 15,000 132,250 NET PROFIT 5,750 For the next four years an increase in turnover is anticipated, together with an associated increase in costs. The turnover increase will be the result of the recovery from the recession, an upgrade to the facilities and an increase in local support . On the basis of an increase in turnover of 5% on wet sales & 10% on dry sales the projected profits would be as shown on the next page. Projected 4 year results £000s Turnover Cost of Sales Gross Profit Staff Costs Overheads Profit before Tax Taxation 20% Retained Profit 2013/14 2014/15 2015/16 2016/17 233 254 272 286 88 95 102 107 145 159 170 179 ----------------------------------------------85 87 90 93 53 48 47 48 7 24 33 38 1.4 4.8 6.6 7.6 5.6 19.2 26.4 30.4 A key assumption is the level of gross profit. Over the last four years the margin on wet sales has been 35% and 70% on dry sales; overall the gross profit has been between 56 and 60%. With a free house not buying through a pub company the margin on wet sales is expected to rise to 50% and a figure of 62.5% overall has been used for the above projection. The gross profit improvement is partly offset by increases in staff costs for a manager but there is a reduction in overheads due to no payments for rent. By 2014/15 the increase in turnover and Gross Profits will give a major increase in net profits. Dividend policy The company will pay dividends to shareholders from profits after payment of all costs and repayment of any debts due. It is currently proposed that a policy will be put in place to pay around half of the profits after taxation in dividends and retain half in the company. Dividends will be proposed by the Board at the Annual General Meeting of the shareholders who will be asked to approve them. The target for dividends is 5% but based on the 50% of above projected profit figures the possible dividends for 2014/15 to 2016/17 are 2.4%, 3.3% & 3.8% respectively. 7. Developments Today anyone walking into the Brook Inn will enjoy the pleasant atmosphere and good food but most will probably think it needs a facelift. With that in mind, the committee would like to see a redesign both inside the pub and outside. Among the things that would be investigated are: 1. 2. 3. 4. Redecoration Fresh furnishings and redesign of the restaurant Upgrade and redesign of the kitchen area A conservatory erected at the rear of pub in the garden area which will increase the dining space and therefore potential revenue streams 5. Rejigging the rear area to make more space and more child-friendly for families 6. Create more of a ‘café-culture’ during the day to attract non-pub regulars eg toddler groups, ramblers, tourists 7. Review the cellar to offer more ‘guest’ ales which would be available more cheaply when Brook Inn becomes a free house Some of the above could be achieved at low cost with local help. Other things, such as the conservatory idea, will require considerable investment and will depend on the success of the share offering and subsequent performance of the pub. 8. Risks All investments carry an element of risk. This document has not been prepared by a qualified financial adviser and the figures have not been audited. Anyone considering investment may wish to discuss the risks with their own advisers. The following risks have been identified: 1. The property could have structural faults or other defects. A professional surveyor’s report has been obtained. This advises that property is sound but maintenance has been neglected. The full report may be obtained by email from info@backthebrook.co.uk 2. The title to the property. Prior to proceeding, this will be checked and searches carried out by our solicitors 3. Failure to raise sufficient funds. Pledges have been obtained which are sufficient for the purchase of The Brook. However, if for any reason, the purchase does not take place, the funds raised will be returned less the surveyor’s fee and solicitors charges. 4. A loss of key staff. An incentive scheme will be in place and be reviewed 5. The market risk. A large turnover decline could cause losses. Efforts will be made with the community to address the issues. In the worst case scenario where there is a catastrophic decline in the business over an extended period exceeding 12 months the property value for an alternative use is likely to be at least at the same level as the price today. _____________