Rent Calculation - Michigan Housing Directors Association

advertisement

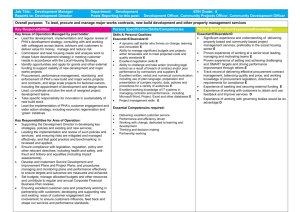

Verification and Rent Calculation Angela Foster, PH Revitalization Specialist Claunella Richardson, Financial Analyst Chandra Broadnax, Program Analyst U. S. Department of Housing and Urban Development Detroit HUD Field Office, Office of Public Housing Willie C.H. Garrett, Public Housing Hub Director Training Outline Lesson 1: Eligibility For Admission Notification Letter Interview Process Required forms and documents Lesson 2: Verification Process Document Verification What is and is not Income? Methods of Income Verification How to access and use EIV Lesson 3: Rent Calculation How to calculate deductions How to calculate Rent Benefits Reduce rent underpayments and overpayments by residents. Maximize HUD’s limited housing resources. The Dollar Impact of Rent Errors Lesson 1: Eligibility For Admission Lesson 1: Objectives Tips to construct a clear and concise notification letter so the Family is not confused about what documents they must bring to the interview. Tips to construct a detailed Annual Income Checklist to reduce the risk of overlooking eligible income. Insight on how to conduct a respectful and productive interview with the Family to ensure all required documents are collected, the verification process is thoroughly explained, questions are answered and forms requiring signatures are signed. Review the purpose of HUD form 9886 and the Declaration Of Section 214 Status form to ensure the PHA has permission to use the Family’s information for verification purposes and are eligible citizens. Notification Letter The Notification Letter commences the verification Date: process. It should state the date, time, and location of the Time: interview and a list of what documents the Family should bring. A clear and concise letter Location: can reduce the time of the What to bring: verification process and expedites housing the Family. The Interview The PHA’s interview with the Family is the beginning and most important component of the verification process. It is where the PHA lays the groundwork to build trust with the Family, collect information, and explain the housing program requirements. The interview includes the review of documents and the signature and exchange of documents between the PHA and the Family. *Give the family copies of what they sign. The Interview (cont.) The PHA must conduct the interview with dignity and respect. Establish an area to conduct interviews in private. Treat the Family with excellent customer service with a Establish a partnership with the Family. The process to obtain Public Housing should not deplete the spirit of those who need our help. The PHA is not checking to see if the family is worthy, the PHA is verifying if the Family is eligible per HUD regulations. Be objective not judgmental! “Treat the Family the way you want to be treated” The Interview (cont.) During the interview, the use of interpersonal communication skills such as empathy, sympathy, effective listening and reflecting are essential. These skills help the PHA to communicate effectively with the Family. An effective interview reduces the risk of missing vital information needed to verify the Family’s eligibility for housing assistance and alleviates the burden on the Family to making unnecessary trips back and forth to the PHA. This is especially challenging for Families that have to rely on others or unreliable public transportation. The Interview (cont.) The PHA benefits from a well conducted interview. It lessens the time the PHA staff has to take to verify information and increases the time it takes the PHA to house a Family. Documentation Check List Social Security Card Birth Certificate Driver’s License or Valid Government Issued IC INS Documentation Form HUD 9886 Authorization for the Release of Information/Privacy Act Notice (cont.) Uses of Information to be Obtained: HUD is required to protect the income information it obtains in accordance with the Privacy Act of 1974, 5 U.S.C. 552a. HUD may disclose information (other than tax return information) for certain routine uses, such as to other government agencies for law enforcement purposes, to Federal agencies for employment suitability purposes and to HAs for the purpose of determining housing assistance. The HA is also required to protect the income information it obtains in accordance with any applicable State privacy law. HUD and HA employees may be subject to penalties for unauthorized disclosures or improper uses of the income information that is obtained based on the consent form. Private owners may not request or receive information authorized by this form. Form HUD 9886 Authorization for the Release of Information/Privacy Act Notice (cont.) Who Must Sign the Consent Form: Each member of your household who is 18 years of age or older must sign the consent form. Additional signatures must be obtained from new adult members joining the household or whenever members of the household become 18 years of age. Form HUD 9886 Authorization for the Release of Information/Privacy Act Notice (cont.) Failure to Sign Consent Form: Failure to sign the consent form may result in the denial of eligibility or termination of assisted housing benefits, or both. Denial of eligibility or termination of benefits is subject to the HA’s grievance procedures and Section 8 informal hearing procedures. Annual Income Checklist A detailed Annual Income Checklist reduces the risk of overlooking eligible income which could lead to under and over payments by residents. Lesson 1: Wrap-up Construct a comprehensive, clear and concise Notification Letter Conduct a respectful and thorough Interview with Family Collect required documents Review with Family and sign Form HUD 9886 Review with Family and sign Declaration of Section 214 Status Collect all Annual Income information. Lesson 2: Verification Process Lesson 2: Objectives Review the purpose of Document Verification. Review what is and is not Income. Review the Methods of Income Verification. Learn how to access and use EIV Effectively Verifying Social Security Numbers One of the most important tools for identification is an applicant’s/participant’s Social Security Number. Prior to admission each Family member who has a Social Security Number and who is at least six years of age is required to disclose and verify that Social Security Number. New Family members at least six years of age must provide this verification prior to being added to the lease. This information must be provided for children in assisted households at the first regular reexamination after turning six. When a Family is adding a new baby to the lease, the PHA can help by providing Social Security Number application forms. Children on whose behalf welfare benefits are paid have social security numbers. Verifying Social Security Numbers (cont.) The best verification of the Social Security Number is the original Social Security card. If the card is not available, the PHA may accept letters from Social Security that establish and state the number. Documentation from other governmental agencies should also be accepted that establishes and states the number. A driver’s license, military ID, passport, or other official document that establishes and states the number is also acceptable. The documents used to verify social security numbers should be copied and placed in the applicant’s file. Verifying Social Security Numbers (cont.) If applicants state that they do not have Social Security Numbers, the PHA should ask if the applicants have ever worked, had a bank account, received any government benefits or attended school in the United States. If applicants respond negatively to these questions and continue to state that they do not have a Social Security Number, they are required to sign a certification to this effect. An example of someone who might not have a social security number would be an eligible immigrant who is retired and living on a pension from their former country. The PHA may not require any individual who does not have a Social Security Number to obtain a Social Security Number. Most methods of verification require the Social Security Number, so the PHA should be familiar with how an applicant may obtain a Social Security Number locally. Verifying Social Security Numbers (cont.) If applicants indicate they have Social Security Numbers, but cannot readily verify them, the Family cannot be assisted until verification is provided. Applicants who have Social Security Numbers but refuse to provide them are not eligible for public housing. Verifying Citizenship: Declaration of Section 214 Status Section 214 of the Housing and Community Development Act of 1980, as amended, restricts HUD from making financial assistance available for noncitizens, unless they meet one of the categories of eligible immigration status specified in Section 214. Verifying Citizenship For noncitizens, the evidence consists of the signed declaration of eligible immigration status and one of the following: Verifying Citizenship Alien Registration Receipt Card Arrival-Departure Record, with one of the following annotations: a.) Admitted as Refugee Pursuant to Section 207; b.) Section 208; c.) Asylum; d.) Section 243(h); Deportation stayed by Attorney General; or - Paroled Pursuant to Section 212(d)(5) of the INA. Verifying Citizenship Unannotated Arrival-Departure Record, with one of the following: a.) Final court action granting asylum, if no appeal is taken; b.) Letter from INS asylum officer or district director granting asylum; c.) Court decision granting withholding of deportation; or - Letter from asylum officer granting withholding of deportation. Temporary Resident card, annotated: Section 245A” or “Section 210” Employment Authorization Card, annotated “Provision of Law 274a.12(11)” or “Provision of Law 274a.12” Receipt issued by the INS indicating that the application for issuance of a replacement document in one of the above-listed categories has been made and the applicant’s entitlement to the document has been verified. Verifying Citizenship Birth Certificates are acceptable forms of verification for Evidence of Citizenship. The PHA verifies citizenship status through a birth certificate, however a U.S. passport, military identification card or DD-214 form are acceptable. Copies of all documents must be retained in the resident’s file. What is Annual Income ? 24 CFR 5.609 Annual income is used both to determine income eligibility and is the first step in income-based rent calculation. What is Income and how to Verify It All Income MUST be Verified! The PHA is responsible for Verifying Income, NOT the Family! 24 CFR§ 960.259(c)(i)(ii)(iii)(iv) What is Income and how to Verify It Asset Income - Amounts derived from assets to which any member of the family has access. Any withdrawal of cash or assets from an investment. If the family has net family assets in excess of $5,000, annual income shall include the greater of the actual income derived from all net family assets or a percentage of the value of such assets based on the current national passbook savings rate, as determined by HUD. Verify the following information 3rd Party Verification Methods: Bank Statements Investment Statements IRS records Sell of Property documents (homes, stocks, boats) Property acquisition records What is Income and how to Verify It (cont.) Asset Income NOTE: The public housing program does not have a dollar limit on the amount of assets a family can possess and still be eligible for the program, but the income produced by net family assets is counted as part of Annual Income. What is Income and how to Verify It (cont.) Employment Income that includes all wages, salaries, overtime pay, commissions, fees, tips, bonuses. Verify the following information through EIV and 3rd Party Verification Methods: Anticipated pay increases Start date Year-to-date earnings Termination date Bonuses Pay frequency Severance pay Pay rate Overtime What is Income and how to Verify It (cont.) Self-Employment Income from the operation of a business or profession. Verify the following information through EIV and 3rd Party Verification Methods: Net income (gross income – expenses) Withdrawal of cash or assets except to the extent it is a reimbursement of cash or assets invested by the family Expenditures for business expansion or amortization of capital indebtedness which are not deducted from the gross income. Allowance for depreciation of assets used in business or profession based on straight line depreciation. What is Income and how to Verify It (cont.) Social security payments, TANF, Unemployment, and Pension Benefits Verify the following information through EIV and 3rd Party Verification Methods if there are discrepancies: Social Security and SSI – Verify through EIV Unemployment – Verify through EIV TANF – Verify through EIV Pensions – Verify through EIV or 3rd party verification methods What is Income and how to Verify It (cont.) Child support Verify the following information: Verify Child Support through 3rd party verification methods; information is not available in EIV. Verify if the family is actually receiving Child Support before counting the court ordered amount. Verify how much the family is receiving. To avoid overpayment by the family, do not count the court ordered amount if it is not the amount received by the family. What is Income and how to Verify It (cont.) Use 3rd Party Verification Methods to Verify Income Below Annuity payments, Insurance policies. Private Retirement funds, disability or death benefits. Periodic receipts. All regular and special pay of a member of the Armed Forces, (except for hostile fire pay, which is excluded) Regular contributions and gifts. Note: Of all the forms of income that should be included in Annual Income, contributions from sources outside the household is the most often missed. What is Not Annual Income? 24 CFR § 5.609(c) a. Income from employment of children (including foster children) under the age of 18 years. b. Payments received for the care of foster children or foster adults (usually persons with disabilities, unrelated to the tenant family, who are unable to live alone). c. Lump-sum additions to family assets, such as inheritances, insurance payments (including payments under health and accident insurance and worker’s compensation), capital gains and settlement for personal or property losses. What is Not Annual Income? (24 CFR § 5.609(c) d. Amounts received by the family that is specifically for, or in reimbursement of, the cost of medical expenses for any family member. e. Income of a live-in aide. f. The full amount of student financial assistance paid directly to the student or to the educational institution What is Not Annual Income? (24 CFR § 5.609(c) g. The special pay to a family member serving in the Armed Forces who is exposed to hostile fire. h. Amounts received under training programs funded by HUD. Amounts received under a resident service stipend. A resident service stipend is a modest amount (not to exceed $200 per month) received by a resident for performing a service for the PHA or owner, on a part-time basis, that enhances the quality of life in the development. Such services may include, but are not limited to, fire patrol, hall monitoring, lawn maintenance, resident initiatives coordination, and serving as a member of the PHA’s governing Board. No resident may receive more than one such stipend during the same period of time. What is Not Annual Income? (24 CFR § 5.609(c) Incremental earnings and benefits resulting to any family member from participation in qualifying State or local employment training programs (including training programs not affiliated with a local government) and training of a family member as resident management staff. Amounts excluded by this provision must be received under employment training programs with clearly defined goals and objectives, and are excluded only for the period during which the family member participates in the employment-training program. What is Not Annual Income? (24 CFR § 5.609(c) i. Temporary, nonrecurring, or sporadic income (including gifts); The key element that causes the exclusion of this income is that it is neither reliable nor periodic. j. Reparation payments paid by a foreign government pursuant to claims filed under the laws of that government by persons who were persecuted during the Nazi era. k. Earnings in excess of $480 for each full-time student 18 years of age or older (excluding the head of household and spouse); What is Not Annual Income? (24 CFR § 5.609(c) m. Adoption assistance payments in excess of $480 per adopted child. n. Deferred periodic amounts from Supplemental Security Income and Social Security benefits that are received in a lump sum amount or in prospective monthly amounts; a lump sum payment covering the period from application to determination of eligibility. o. Amounts received by the family in the form of refunds or rebates under State or local law for property taxes paid on the dwelling unit; This exclusion would apply to State homestead exemptions, for example. What is Not Annual Income? (24 CFR § 5.609(c) p. Amounts paid by a State agency to a family with a member who has a developmental disability and is living at home to offset the cost of services and equipment needed to keep the developmentally disabled family member at home; the State funds alluded to in this paragraph are paid to prevent the institutionalization of a family member. q. Amounts specifically excluded by any other Federal statute from consideration as income for purposes of determining eligibility or benefits under a category of assistance programs that includes assistance under any program to which the exclusions set forth in the above list of excluded income apply. What is Not Annual Income? (24 CFR § 5.609(c) The following list of benefits is excluded income: The value of the allotment provided to an eligible household for coupons under the Food Stamp Act of 1977 [7 USC 2017 (h)]. Amounts of scholarships funded under Title IV of the Higher Education Act of 1965 including awards under the Federal work-study program or under the Bureau of Indian Affairs student assistance programs [20 USC 1087 (uu)]. Examples of Title IV programs include but are not limited to: Basic Educational Opportunity Grants (Pell Grants). Supplemental Opportunity Grants. State Student Incentive Grants. College Work Study. Byrd Scholarships. Methods of Income Verification 1. Written Third Party Verification: Independent verification of income and/or expenses by contacting the individual income/expense source(s) supplied by the family. The verification documents must be supplied directly to the independent source by the PHA and be returned directly to the PHA from the independent source. 2. Oral Third Party Verification: Independent verification of income and/or expenses by contacting the individual income/expense source(s) supplied by the family, via telephone or in-person visit. PHA staff should document in the tenant file, the date and time of the telephone call, the name of the person contacted and telephone number, along with the confirmed verified information. This verification method is commonly used in the event that the independent source does not respond to the PHA’s faxed, mailed, or e-mailed request for information in a reasonable time frame, i.e., ten (10) business days. Methods of Income Verification 3. Document Review: The PHA reviews original documents provided by the tenant in support of their declaration of income during the income reexamination. This verification method can only be used as the sole source of income verification when third party verification cannot be obtained. When the PHA resorts to reviewing tenant-provided documents, the PHA must document in the tenant file why third party verification was not available. Methods of Income Verification Acceptable Participant-Provided Documents Housing program participants have an obligation to the PHA to provide any letter or other notice, including any letter or notice from HUD that provides information concerning the amount or verification of family income, per section 3(f) of the U.S. Housing Act of 1937, as amended. In support of the tenant’s declaration of income, the PHA may review original (authentic) documents provided by the participant. All documents should be dated within the last 60 days of the interview. The PHA should make a photocopy of the original document(s) and maintain the copy in the participant case file. The PHA should also document in the tenant file, the receipt, copy, and review of the original (authentic) document. Methods of Income Verification Summary of some acceptable participant-provided documents Consecutive and original pay stubs Social Security Administration award letter Bank statements Pension benefit statements Temporary Assistance to Needy Families (TANF) award letter Other official and authentic documents from a Federal, State, or local agency. Methods of Income Verification 4. Tenant Certification: The tenant submits an affidavit or notarized statement of reported income and/or expenses. This verification method should be used as a last resort when all other verification methods are not possible. When the PHA relies on tenant certification, the PHA must document in the tenant file why third party verification was not available. Methods of Income Verification at a Glance Verification Type Oral 3rd Party Verification Level of Importance Mandatory and highest level of third party verification High (Mandatory if EIV income verification is not available or if EIV data differs substantially from tenant-reported information Medium (Mandatory if Written 3rd party verification is not available Document Review Medium-Low (Use on provisional basis) Resident Declaration (Signed affidavit) Low ( Use as a last resort) EIV Written 3rd Party HOW TO ACCESS AND USE EIV AT A GLANCE How does data get into EIV? PHAs must review EIV and maintain the data it provides A PHA submits a 50058 in PIC – EIV receives the tenant data If a record has a fatal error, it will not make it to EIV. EIV Verification & Income REPORTS If your PHA fails to report adverse information in EIV, an unqualified applicant could receive assistance. If the weekly summarization fails, updated data can be delayed in EIV. NDNH (National Database of New Hires) SSA Matching Process and Verification begins (for Action Type1) and occurs at each subsequent 50058 submission How to Access and Use EIV at a glance How do I access EIV? Valid and Active User ID User must view Security Awareness Training • Must be assigned for the PHA you represent PHA Coordinator must assign EIV role and notify the Field Office Coordinator Must access Secure Systems every 60 days • Field Office Coordinator completes the overall assignments Maintain and utilize your User ID • Requires annual recertification and access of reports monthly/quarterly intervals How to Access and Use EIV at a glance Per PIH 2010 - 19 The New HUD Regulation 24 CFR 5.233. ◦ Effective January 31, 2010, all PHAs are required to use the EIV system in its entirety. This means that PHAs must use all features of the EIV system How to Access and Use EIV at a glance Per PIH 2010 - 19 Verify tenant employment and income information during mandatory reexaminations of family composition and income in accordance with 24 CFR §5.236, and HUD administrative guidance; and Reduce administrative and subsidy payment errors in accordance with HUD administrative guidance. What is the frequency required? If a user at your PHA has not used the EIV system within the last 6 months as required , you will receive a notice of NONCOMPLIANCE. What is mandated use? Accessing detail income reports for all families subject to an annual/interim & accessing the reports How to comply with 24 CFR 5.233? How to Access and Use EIV at a glance EIV REPORTS YOU MUST USE: Monthly 1. Deceased Tenants Report 2. Identity Verification Report 3. Immigration Report Quarterly 1. Existing Tenant Search 2. Multiple Subsidy Report 3. New Hires Report - (only those PHAs with an interim increase reexamination policy) How to Access and Use EIV at a glance What if the tenant does not provide the PHA with requested information? ◦ If you fail to receive verification through the allowable means: The PHA may determine that the tenant is not in compliance with program requirements and terminate tenancy or assistance, or both, if the tenant fails to provide the requested information in a timely manner (as prescribed by the PHA). A PHAs ACOP or EIV Policy should account for allowable timely response thresholds How to Access and Use EIV at a glance What if an EIV report reveals an income source that was not reported by the tenant or a *substantial difference in the reported income information? ◦ The PHA is required to determine the retroactive rent as far back as the existence of complete file documentation (form HUD-50058 and supporting documentation) to support such retroactive rent determinations *Substantial Difference is defined as >=$2,400 annually Side Note:The tenant must be provided an opportunity to contest the PHA’s determination of tenant rent underpayment. Helpful EIV Tips Maintain accurate files and utilize the guidance HUD provides You must maintain copied EIV information under lock and key Run reports/print reports regularly Report technical issues to EIV Coordinator & issues and Keep track of open tickets Be proactive. If you are having issues with EIV or with a particular tenant’s data, contact EIV Coordinator immediately Review EIV Roundtable Notes & Always join in on EIV Roundtable conference calls Lesson 2: Wrap-up Verify Documents to determine family eligibility. Know what is and is not income per: (24 CFR § 5.609) and 24 CFR § 5.609(c) respectively. The use of EIV is mandatory. Income Verification should take no longer than 10 days by following the Methods of Income Verification. Lesson 2: Wrap-up • Follow instruction provided when you receive notices from EIV regarding resolving Debts Owed, Multiple Subsidy, & Deceased Tenants cases • Run reports/print reports regularly • Report technical issues to EIV Coordinator & issues and Keep track of open tickets • Review EIV Roundtable Notes & Always join in on EIV Roundtable conference calls Lesson 3: Rent Calculation Lesson 3: Objectives Learn how calculate deductions to ensure the accuracy of adjusted annual income. Learn how to calculate rent to reduce the risk of overpayments and underpayments by residents. DEDUCTIONS Adjusted Income is: Annual Income, minus $480 per Dependent Deduction, minus $400 Elderly/Disabled Deduction, minus Unreimbursed medical expenses for elderly/disabled family beyond 3% threshold, minus Unreimbursed reasonable attendant care and auxiliary apparatus expenses for family member with disabilities to the extent necessary to allow family member to be employed, not to exceed earned income, beyond 3% threshold, minus Reasonable childcare expenses which enable family member to work or pursue education, minus PH Permissible Deductions, minus EID Dependent Deduction The Dependent deduction is Statutory per (24 CFR § 5.611). The amount is $480, and is deducted from Annual Income. This $480 annual deduction is available for a member of the family (except live-in aides, foster children and foster adults who may be household members but are not family members) other than the family head or spouse, who is under 18 years of age, is a person with a disability, or is a full-time student. NOTE: There is no maximum age limit for who may qualify as a full-time student. Dependent Deduction How is it calculated? Number of dependents X $480 Verification Minor family member—documentation demonstrating family member is a minor Disabled family member—documentation demonstrating family member is disabled Full-time student—current enrollment status letter Elderly and Disabled Family Deduction The Elderly and Disabled Family Deduction is Statutory per (24 CFR § 5.611). This $400 annual deduction is available to families whose head of household, their spouse, or a sole member who is at least 62 years of age (elderly families), or a person with a disability (disabled families). This may also include two or more such persons living together, or two or more such persons living with a live-in aide. Each Elderly or Disabled Family is limited to one $400 deduction regardless of the number of elderly or disabled household members. Elderly and Disabled Family Deduction How is it calculated? Eligible Family X $400 Verification EIV Disability verification form completed by medical professional Birth Certificate Child Care Deduction The Child Care Deduction is Statutory per (24 CFR § 5.611). Childcare expenses are defined as the unreimbursed amounts anticipated to be paid by the family for the care of children less than 13 years of age during the period for which annual income is computed (24 CFR § 5.603). Such amounts are deductible from annual income only when the care is necessary to enable a family member to actively seek employment, be gainfully employed, or to further his or her education. Family may not be denied solely because a family member could take care of the children. Child Care Deduction (cont.) The amount deducted must reflect reasonable charges for childcare. In the case of childcare necessary to permit employment, the amount deducted may not exceed the amount of employment income that is included in annual income. The PHA is charged with determining what is a reasonable amount, especially when the care is provided to further a family member’s education. Unlike the employment related portion of the deduction, childcare costs for education purposes are not “capped” by the amount earned. Surveying the cost of childcare in the community is a good method to determine when the PHA should cap the deduction. Child Care Deduction (cont.) Verification Actively seeking employment—verify with W-2/Welfare to Work program; resident provided statement Employed—Wage income Pursue education—enrollment verification Disability Expense Deduction This deduction covers unreimbursed costs for attendant care or auxiliary apparatus for a disabled family member. The deduction must be applied as follows: The reasonable attendant and auxiliary apparatus expenses must enable an adult member of the family to be employed (including the person with disabilities). The deduction may not exceed the earned income received by adult family members who are able to work because of the care or auxiliary apparatus. Calculating Medical/Disability Expense Deduction The 3% threshold amount must only be counted once in considering medical/disability expense deductions *Disability assistance deductions must be calculated “before” medical deductions since it is limited by the amount a person works Unreimbursed Medical Expense Deductions This deduction is granted only to elderly or disabled families. A range of unreimbursed medical expenses and services can be claimed, including, but not limited to the following, to the extent that the total medical expenses exceed 3 percent of annual income (the PHA must put definition in its ACOP. Use of IRS Medical Expenses, found in IRS publication 502, as guidance is acceptable): The 3 Percent “Deductible” for Disability and Medical Deductions When only one deduction is present, the 3% is applied to that deduction. Example: Medical only – Elderly family with no dependents. Annual Income = $15,500; 3% of A.I. = $ 465 Anticipated medical costs = $400 $400 is less than $465, so this family receives no medical deduction. Note: The family would receive the $400 deduction for being an elderly household. The 3 Percent “Deductible” for Disability and Medical Deductions Example: Attendant care/apparatus only – Single person with a disability, no dependents. This family receives a deduction of $1,935 for the assistive animal ($2,400 - $465). In addition the family will also receive the $400 deduction for being a household headed by a person with a disability. Annual Income = $15,500 3 Percent of A.I. =$465 Assistive animal care costs =$2,400 $2,400 is greater than 3% of Annual Income, subtract $465 Deduction = $1,935 The 3 Percent “Deductible” for Disability and Medical Deductions Example: The 3 Percent “Deductible” with Both Unreimbursed Medical and Disability Expense Deductions Families with a head or spouse who is elderly or a person with a disability may (potentially) receive both the unreimbursed medical and disability expense deductions. Families with a member, other than the head or spouse, who is a person with a disability may only qualify for the disability expense deduction. The 3 Percent “Deductible” for Disability and Medical Deductions Example (cont.): Head of household is a senior with a disability who works part time. Annual Income = $15,500 Income from employment =$ 6,600 Anticipated medical costs =$400 Assistive animal care costs =$3,000 Total Medical and Disability costs=$3,400 Total allowed deduction =$2,935 ($3,400 -$465) Permissive Deductions Permissive Deductions (see 24 CFR § 5.611) are defined as additional, optional deductions that may be applied to annual income. If the PHA opts to use permissive deductions, it must have a written policy guiding their administration, and the deductions must be applied consistently. Permissive Deductions (cont.) PHAs considering the use of permissive deductions should apply the following considerations when developing a new deduction: Permissive deductions must be included in the PHA’s ACOP and granted to all families that qualify for them. Permissive deductions should “fill in” or complement existing income exclusions and deductions. Permissive (and mandatory) deductions can be thought of in two ways: 1. deductions based on need or family circumstance and 2. deductions designed to encourage self-sufficiency or other economic purpose. Asset Income If the family has an asset which they can access, the annual dollar amount is counted whether they receive the interest/dividends or not Asset income is based on what the family receives on the investment, not on what they put in If the cash value of the investments is greater than $5,000, either the actual income derived or 2% (passbook rate) will be counted, whichever is greater PHAs must determine the cash value of assets in some cases since this may affect their rent calculation. The cash value is equal to the market value minus the expense to convert the asset to cash: Cash Value=Market Value- Expenses Business Income The net income from the operation of a business or profession. Expenditures for business expansion or amortization of capital indebtedness shall not be used as deductions in determining net income. An allowance for depreciation of assets used in a business or profession may be deducted, based on straight-line decline, as provided in Internal Revenue Service regulations. Any withdrawal of cash or assets from the operation of a business or profession will be included in income, except to the extent the withdrawal is reimbursement of cash or assets invested in the operation by the family. Welfare Income / TANF (24 CFR § 5.609) Welfare assistance (TANF). If the welfare assistance payment includes an amount specifically designated for shelter and utilities that is subject to adjustment by the welfare assistance agency in accordance with the actual cost of shelter and utilities, the amount of welfare assistance income to be included as income shall consist of: - the amount of the allowance or grant exclusive of the amount specifically designated for shelter or utilities, plus - the maximum amount that the welfare assistance agency could in fact allow the family for shelter and utilities. If the family’s welfare assistance is radically reduced from the standard of need by applying a percentage, the amount calculated shall be the amount resulting from one application of the percentage. Note – Food Stamps are excluded from Annual Income. Welfare Income / TANF How is it calculated? Monthly Cash Assistance Amount x 12 minus the amount of Food Stamps Example: The family receives $700 per month cash assistance and $400 per month food stamps. $700 x12 =$8400 – annual cash assistance amount $400 x 12 = $4800 – annual food stamps amount 8400 + 4800 – (4800 food stamp exclusion) = $8400 $8400 = Annual Welfare/TANF Income Wages Calculation How is it calculated? 1. Average the number of hours worker per year Example: 40 hr. work week = 2080 per year 40 hrs. x 52 weeks (the number of weeks in a year = 2080 hrs. yr.) Example: 32 hr. work week = 1664 per year 32 hrs. x 52 weeks (the number of weeks in a year = 1664 hrs. yr.) 2. Hourly rate x hrs. per year $7.00 x 2080 = $14560 = Annual employment income based on 40 per yr. Social Security, Social Security Supplemental Income Calculation How is it calculated? Monthly Amount x 12 Family receives SS benefits $500 per mo. Family receives SSI benefits $250 per mo. Family receives State of Michigan SSI quarterly (receives 4 times per year) $69 $500 x 12 = $6,000 $250 x 12 = $3,000 $69 x 4 = $276 Total Annual Income = $9,276 Lesson 3: Wrap-up Calculate ALL verified Deductions before rent is calculated to obtain Adjusted Annual Income. QA/QC deduction calculations before rent is calculated. Calculate Rent using all verified income and verified Deductions QA/QC Rent calculations and provide family with a rent choice: Flat Rent or 30% of Monthly Adjusted Income. Summary of Training Construct a comprehensive notification letter in lay terms that tells the family the date and time of the Interview and what documents they must bring. Conduct a respectful and thorough Interview to ensure no information is missed and trust is built with the family. The PHA is responsible for Verifying Income, NOT the Family! 24 CFR§ 960.259(c)(i)(ii)(iii)(iv) Summary of Training (cont.) Take no longer than 10 days to Verify Income by using the “MANDATORY” EIV system and the Methods of Verification Hierarchy Chart. Calculate Deductions and QA/QC the process. Calculate Rent, QA/QC the process and provide the family with a rent choice and give them a copy of the signed choice form. Resources HUD’s Public Housing Occupancy Guidebook Code of Federal Regulation (CFR) ACOP – Admission and Continued Occupancy Policy 24 CFR § 5.609 – States what is Annual Income 24 CFR § 5.609(c) – States what is NOT Annual Income 24 CFR § Part 960 – Admission to, and Occupancy of Public Housing 24 CFR § Part 966 – Public Housing Leasing and Grievance Procedures Electronic Code of Federal Regulation for HUD http://www.ecfr.gov/cgibin/textidx?SID=be81e73214ab2ae15d297c24bde62391&tpl=/ecfrbrowse/ Title24/24tab_02.tpl Helpful Hint: Using HUD’s Public Housing Occupancy Guidebook is a Safety Net because all of its content is per HUD’s Regulations