Rural Telecom Revenues

advertisement

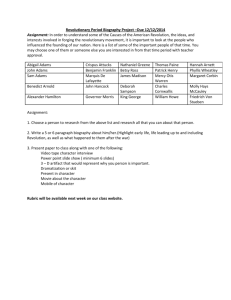

Rural Telecom Revenues FCC Reform Spring 2012 Presented to ABC Communications MOSS ADAMS LLP | 1 © Moss Adams LLP | April 2012 V2 THE BASICS MOSS ADAMS LLP | 2 ACCESS • What other carriers pay to use our network • Most companies pool access with NECA using cost studies © Moss Adams LLP | April 2012 V2 MOSS ADAMS LLP | 3 RATE OF RETURN REGULATION • Expenses & Operating Taxes, plus • Profit (Return on Rate Base), equals • Revenue Requirement Rates = Revenue Requirement / Demand © Moss Adams LLP | April 2012 V2 MOSS ADAMS LLP | 4 COMPETITION • When there is no monopoly, companies compete to: o Maximize revenues o Minimize costs © Moss Adams LLP | April 2012 V2 MOSS ADAMS LLP | 5 KEY ELEMENTS OF FCC REFORM INTENDED PURPOSE OF REFORM MOSS ADAMS LLP | 6 I. LOCAL VOICE SERVICE RATES Key elements Purpose Minimum customer monthly rate (if HCLS recipient) Rural companies must charge end users a minimum rate for local service, reasonably comparable to urban rates, to justify cost recovery through USF. 3-year phase-in with benchmarks ($10, $14, national average) ARC charge if local service rates are <$30/month © Moss Adams LLP | April 2012 V2 MOSS ADAMS LLP | 7 II. CARRIER ACCESS RATES Key elements Purpose All terminating switched access transitions to $0.000 over 9 years Switched access rates are problematic. Originating interstate rates frozen at 12-29-11 The number of minutes is declining due to wireless calls, VoIP traffic that is not measured and problems billing carriers that terminate traffic. Differences between state and interstate rates don’t make sense. Switching costs are lower in an IP environment - Reform to provide an orderly transition away from carriers paying for switching. © Moss Adams LLP | April 2012 V2 MOSS ADAMS LLP | 8 UNIVERSAL SERVICE FUNDING III. FEDERAL SUPPORT FOR LOOP COSTS ASSIGNED TO INTRASTATE AND LOCAL (HCLS) Key elements Purpose Revised corporate operations expense limitation calculation (more support if < 3,500) (less support if > 3,500) Current mechanism allows carriers to spend whatever they deem appropriate and receive support. Reform sets limits to provide incentive to companies to limit spending. Regression based limitations on capital expenditures and operating expenses © Moss Adams LLP | April 2012 V2 MOSS ADAMS LLP | 9 UNIVERSAL SERVICE FUNDING IV. SUPPORT FOR HIGH LOOP COST GROWTH (SNA) Key elements Purpose Phased out depending on qualification factor (plant versus lines) Original intent was to support significant cost growth in an environment where access lines were flat or growing. With access line losses, many carriers are growing cost per line only as a result of line loss. No longer consistent with original intent. © Moss Adams LLP | April 2012 V2 MOSS ADAMS LLP | 10 UNIVERSAL SERVICE FUNDING V. SUPPORT FOR LOOP COSTS ASSIGNED TO INTERSTATE (ICLS) Key elements Purpose New limitation on corporate operations Current mechanism allows carriers to expense spend whatever they deem appropriate and receive support. Regression based limitations on capital expenditures and operating expenses Reform sets limits to provide incentive to companies to limit spending. © Moss Adams LLP | April 2012 V2 MOSS ADAMS LLP | 11 UNIVERSAL SERVICE FUNDING VI. SUPPORT FOR LOCAL SWITCHING COSTS (LSS) Key elements Purpose Eliminated and cost recovery shifted to CAF Local switching costs are declining and can be absorbed by the end user. Cost recovery is locked in at a 5% annual reduction to provide stability during the transition period. © Moss Adams LLP | April 2012 V2 MOSS ADAMS LLP | 12 UNIVERSAL SERVICE FUNDING VII. OTHER SUPPORT LIMITATIONS Key elements Purpose Identical support for cellular & wireline competitors (CLEC) Difficult to justify supporting more than one carrier via identical support. Providing support equal to the incumbent means other carriers not required to cost justify support. 5-year phase out of identical support Mobility Fund created for wireless providers for underserved areas Total support limited to $250 per line per month © Moss Adams LLP | April 2012 V2 Overall $250/line/month cap on support forces use of an alternate provider (i.e. satellite) when traditional wireline service is extremely costly – applies to very few companies/end users. MOSS ADAMS LLP | 13 HOW THE CONNECT AMERICA FUND (CAF) WORKS MOSS ADAMS LLP | 14 PURPOSE OF THE CAF Designed to compensate companies for intercarrier switching costs with 2011 as a baseline, revenues are then reduced 5% per year. © Moss Adams LLP | April 2012 V2 MOSS ADAMS LLP | 15 SWITCHED ACCESS REVENUE BASELINE • Baseline Equals 1. 2011 IS Switched Access Revenue Requirement, plus 2. 2011 ST Terminating Switched Access Revenue, plus 3. 2011 Net Reciprocal Compensation • The baseline includes intercarrier and support revenues © Moss Adams LLP | April 2012 V2 MOSS ADAMS LLP | 16 ANNUAL CAF CALCULATION • Annual CAF revenue equals o Prior year switched access revenue baseline less 5% o Less actual revenues earned in the current year for: © Moss Adams LLP | April 2012 V2 All interstate switched access State terminating switched access Net reciprocal compensation ARC revenues MOSS ADAMS LLP | 17 ACCESS RECOVERY CHARGE (ARC) ARC customer charges phase-in to $3/line/month • Residential = $0.50 increments for 6 years • Single Line Bus = $0.50 increments for 6 years • Multi-Line Bus = $1.00 increments for 3 years ARC revenues reduce CAF revenues © Moss Adams LLP | April 2012 V2 MOSS ADAMS LLP | 18 REFORM YET TO COME? MOSS ADAMS LLP | 19 REFORM YET TO COME I. ORIGINATING SWITCHED ACCESS • The FCC is phasing out terminating, and will likely also eliminate originating in favor of end users and USF paying all switching costs (bill and keep). When this will happen, the specifics of transition and the means for providing USF to offset lost revenues are currently being reviewed. © Moss Adams LLP | April 2012 V2 MOSS ADAMS LLP | 20 REFORM YET TO COME II. BROADBAND SUPPORT • Existing USF mechanisms cover portions of loop related broadband costs, but not all. The FCC is yet to establish the means for rural companies to recover costs for broadband connections from the customer premises to the connection with the backbone provider. © Moss Adams LLP | April 2012 V2 MOSS ADAMS LLP | 21 REFORM YET TO COME III. USF CONTRIBUTIONS • USF is funded through charges to consumers based on a percentage of purchased telephone services. This system is out dated and the contribution base is declining, which results in an increasing contribution factor (FUSC). Reform is expected to implement a line/connection based contribution, which would expand the base to include more carriers and services. © Moss Adams LLP | April 2012 V2 MOSS ADAMS LLP | 22 MOSS ADAMS LLP | 23 Impact of Reform REVENUES BEFORE Revenue ($) END USER Local Voice Service Subscriber Line Charge (SLC) Miscellaneous Revenue ($) Variance ($) Local Voice Service Subscriber Line Charge (SLC) Miscellaneous Access Recovery Charge (ARC) ACCESS CUSTOMERS Switched Access Special Access DSL UNIVERSAL SERVICE FUNDING (USF) High Cost Loop Support (HCLS) Interstate Common Line Support (ICLS) Local Switching Support (LSS) Wireless (Identical Support) CLEC (Identical Support) Safety Net Additive (SNA) NON-REGULATED Internet Access Cellular Video (Cable TV, IPTV) Premises equipment Long distance service CLEC customers Other TOTAL REVENUES AFTER Switched Access Special Access DSL High Cost Loop Support (HCLS) Interstate Common Line Support (ICLS) ICC Connect America Fund (ICC CAF) Mobility Fund - Internet Access Cellular Video (Cable TV, IPTV) Premises equipment Long distance service CLEC customers Other TOTAL - MOSS ADAMS LLP | 24 The material appearing in this presentation is for informational purposes only and is not legal or accounting advice. Communication of this information is not intended to create, and receipt does not constitute, a legal relationship, including, but not limited to, an accountant-client relationship. Although these materials may have been prepared by professionals, they should not be used as a substitute for professional services. If legal, accounting, or other professional advice is required, the services of a professional should be sought. MOSS ADAMS LLP | 25