Accounting 1 Chapter 1 to 4 Review

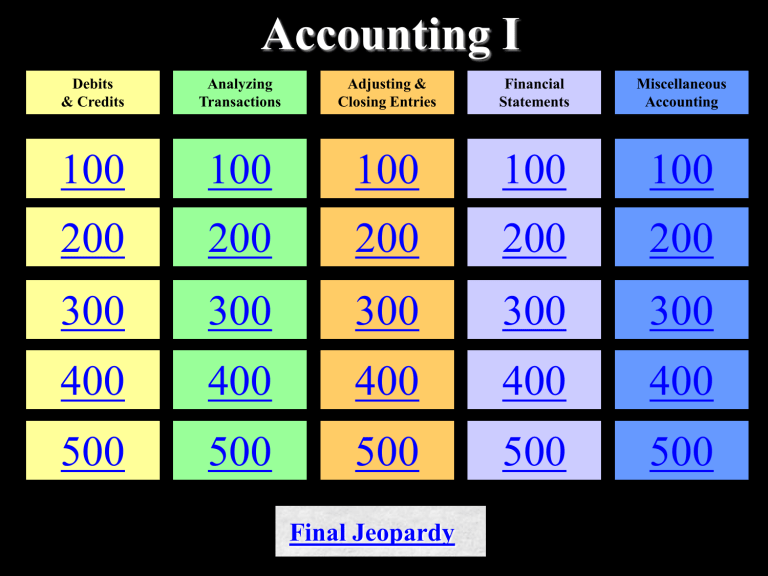

Debits

& Credits

Accounting I

Analyzing

Transactions

Adjusting &

Closing Entries

Financial

Statements

Answer

Miscellaneous

Accounting

Debits & Credits -100

• An account type that measures resources of the business and is increases on the debit side.

• What is an Asset?

Answer Question

Debits & Credits -200

• Accumulated Depreciation, Wages

Payable, and Fees Earned

• What are accounts that increase on the credit side?

Answer Question

Debits & Credits -300

• The investment of an owner into the company is recorded as a ______ to capital stock.

• What is a credit?

Answer Question

Debits & Credits -400

• Paying a utility bill for $400 would require the journal entry to debit the utilities expense account and credit the

_________ account.

• What is cash?

Answer Question

Debits & Credits -500

• Accumulated Depreciation is a contra asset account. To decrease this account would be represented by a __________.

• What is a debit?

Answer Question

Analyzing Transactions -100

• Mr. Smith invests $10,000 cash and

$35,000 in equipment to XYZ

Incorporated. This transaction would debit the _________ & ________ accounts.

• What is cash & equipment?

Answer Question

Analyzing Transactions -200

• Recording a customer purchase on account would require this journal entry.

• What is a debit to accounts receivable and a credit to revenue ?

Answer Question

Analyzing Transactions -300

• An entry to record the purchase of supplies on account would include a debit to _______ and a credit to ________.

• What is a debit to supplies and a credit to accounts payable?

Answer Question

Analyzing Transactions -400

• The entry to record a customer payment for services in advance.

• What is a debit to cash and a credit to unearned fees?

Answer Question

Analyzing Transactions -500

• The journal entry to record depreciation of an asset.

• What is a debit to depreciation expense and a credit accumulated depreciation?

Answer Question

Adjusting & Closing Entries-100

• The temporary account used at the end of a financial period to zero out revenue and expenses.

• What is income summary?

Answer Question

Adjusting & Closing Entries-200

• An inventory of supplies reveals that of the starting balance of $1010, $527 remain. The journal entry to record this is ________________.

• What is debit to supplies expense for

$483 and a credit to supplies for the same amount.

Answer Question

Adjusting & Closing Entries-300

• The company prepays for rent six months in advance. The payment of

$1200 was made at the beginning of this month. The entry at the end of the month will be ______________.

• What is a debit to rent expense for $200 and a credit to prepaid rent for the same amount.

Answer Question

Adjusting & Closing Entries-400

• The computer equipment in the office depreciates at a rate of $1050 per year.

The end of year adjusting entry is

_________________.

• What is a debit to depreciation expense and a credit to accumulated depreciation

– computer equipment .

Answer Question

Adjusting & Closing Entries-500

• The order in which accounts are closed at the end of a financial period.

• What is revenue, expenses, income summary, dividends?

Answer Question

Financial Statements -100

• The accounting equation in report format.

• What is the balance sheet?

Answer Question

Financial Statements -200

• The bottom line of this statement is net income.

• What is the income statement?

Answer Question

Financial Statements -300

• The fourth financial statement that measures cash inflows and outflows.

• What is the statement of cash flows?

Answer Question

Financial Statements -400

• A starting point for calculating financial statements that checks to make sure debits equal credits.

• What is a trial balance?

Answer Question

Financial Statements -500

• The order in which statements are prepared.

• What is income statement, statement of retained earnings, and balance sheet?

Answer Question

Misc. Accounting-100

• The third step in the closing process.

• What is transferring net income or loss to owner’s capital or closing the income summary account?

Answer Question

Misc. Accounting -200

• Warren, Reeve, & Duchac

• Who are the authors of the text for

Accounting I?

Answer Question

Misc. Accounting -300

• Left side

• What is debit?

Answer Question

Misc. Accounting - 400

• This term means not paid.

• What is accrued?

Answer Question

Misc. Accounting - 500

• The accounting equation.

• What is assets = liabilities + owner’s equity?

Answer Question

FINAL JEOPARDY

• True or False:

The accounting equation can be stated as

Owners Equity = Assets - Liabilities

• True

Answer Question