Table Summarizing CG DPO1 Prior Actions and Status of

advertisement

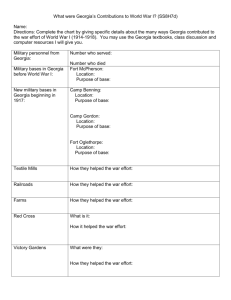

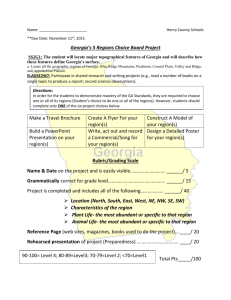

DRAFT PROGRAM INFORMATION DOCUMENT (PID) CONCEPT STAGE May 11, 2012 Report No.: AB7024 Operation Name Region Country Sector Operation ID Lending Instrument Borrower(s) Implementing Agency Date PID Prepared Estimated Date of Appraisal Estimated Date of Board Approval Corporate Review Decision I. Georgia Competitiveness and Growth DPO I EUROPE AND CENTRAL ASIA Georgia General industry and trade sector (50%);General public administration sector (50%) P129597 Development Policy Lending GEORGIA IBRD May 11, 2012 June 6, 2012 July 26, 2012 May 23, 2012 Key development issues and rationale for Bank involvement COUNTRY CONTEXT AND OUTLOOK 1. Georgia has been implementing far-reaching reforms since 2004 with impressive results; however the crisis and conflict of 2008 represented a set-back. During the first decade of transition, Georgia was one of the poorest performing economies in the region mainly due to conflict and governance issues. In 2003, real GDP was 40 percent of the 1989 level. Starting 2004, significant reforms undertaken to strengthen public finances, improve the business environment and social services, fight the then all-pervasive corruption, liberalize trade, and upgrade infrastructure, resulted in growth of more than 9 percent over the 2004-2008 period. A key driver of this growth was substantial inflows of foreign direct investment (FDI), stimulated by stronger investor confidence resulting from improvements to the business environment: Georgia’s Doing Business rank improved from 112th in 2005 to 15th in 2008. Effective public debt management also led to steady improvement in debt indicators, with external public debt declining from 46 percent to 17.5 percent of GDP between 2003 and 2007. While these efforts were successful in pulling Georgia out of “fragile” status, the country then experienced a sharp downturn in economic growth as a result of the double shocks from the August 2008 conflict and the subsequent global economic crisis. These shocks had three severe consequences: a sharp deterioration in investor and consumer confidence, contraction in foreign direct investment, exports, and remittances, and a cutback in bank lending. The closing to Georgia of the Russian market in 2007 was a significant aspect of these adverse economic outcomes. As a result, the economy contracted by 3.8 percent in 2009. 2. The authorities responded swiftly to the crisis with a countercyclical fiscal stimulus that ultimately led to economic recovery by 2010. Public expenditures were reprioritized and increased from 34 percent of GDP in 2007 to 38.4 percent in 2009. Expenditures on transport infrastructure, as well as on education, health, and social protection were scaled up significantly, with the fiscal space for these increases coming in part from a marked reduction of defense expenditures and tightening of public sector administration. At the same time, revenue collection suffered: tax revenues fell to 24.5 percent in 2009 from 25.8 percent of GDP in 2007. As a result, the overall deficit widened from 4.7 percent of GDP in 2007 to 9.2 percent in 2009. The higher fiscal deficits have been financed primarily through increased donor support. The economy responded strongly to higher public investment spending to grow by 6.3 percent in 2010. The recovery was led by manufacturing, construction and services. The country also benefited from a pickup in exports, tourism, and bank lending, as well as from strong support from the international community. FDI inflows started to recover, but remained weak. Investment rates also recovered in 2010. 3. Addressing the significant challenge of high unemployment will entail modernization of the country’s economic structure. High growth during 2004-2008 was not accompanied by large decreases in unemployment, which hovered in the 13 percent range. This sluggish employment response was due to three main reasons: (1) a sharp decline in public sector employment following an efficiency enhancing reorganization; (2) low employment base in fast growing sectors and slower increase in number of jobs in these sectors compared to losses in shrinking sectors; and (3) growth occurred on the back of more effective capacity utilization. Looking forward, several factors may affect job creation. For one, formal employment is currently only about 20 percent of the labor force with selfemployment accounting for about 64 percent (mainly in rural areas and agriculture). It is also expected that agricultural productivity increases will entail shedding workers to non-farm jobs that the economy may not be able to generate quickly enough despite reforms. Capacity utilization in agriculture remains low, suggesting scope for growth through better land use. Additionally, employment increases may lag behind growth in unpredictable ways, given that high economic growth has not generated high job growth in the past. Boosting employment creation through facilitation of investment, skills formation, and high growth is therefore now considered an urgent priority by the Government. 4. Narrowing the current account deficit via higher domestic saving that will address the savings-investment imbalance is another priority. The low saving rate and high import demand have led to persistent current account deficits. The saving rate in the early 2000s amounted to about 25 percent of GDP before sharp increases in consumption, driven by the credit boom and then by the need to smooth consumption after the crisis, led to a dramatic decline. As the factors driving the boom recede in importance, household savings are also expected to recover, which should ease pressure on the current account. While currently viewed as sustainable, in the event of a shock external vulnerabilities may emerge. This has led to the Government’s prioritization of FDI, and trade and trade facilitation as a means to ensure financing of the current account while improving the trade balance. 5. After continued declines during the economic boom period of 2004—2007, poverty increased in 2010 in lagged response to the double shocks of the conflict and the crisis. Growth during 2004-07 was associated with improvements in several indicators of wellbeing of the poor. Preliminary estimates suggest that the overall poverty headcount continued to decline in 2008 and 2009, even in the face of the economic downturn. 1 Poverty fell from 20.1 percent in 2007 to 17.7 percent in 2008 and further to 17.4 percent in 2009. In 2008-09, social expenditures were scaled up to mitigate the impact of the crisis and to support economic recovery. The pension benefit was raised from GEL 38 per month in 2007 to GEL 70 in 2009 and coverage and benefits were also raised for the targeted social assistance (TSA) and medical insurance programs (MIP). It is likely that the fiscal stimulus put in place at the time contributed to the reduction in poverty, especially in rural areas. Poverty increased considerably in 2010, amounting to 21.0 percent and surpassing the poverty level in 2007, in a lagged response to the economic downturn. Female-headed households were affected in particular as the increase in their poverty rate was twice as high as the increase for male-headed households. 6. Consumption inequality followed a similar pattern. The Gini coefficient declined from 38.9 in 2007 to 38.7 and 38.6 in 2008 and 2009. In 2010, consumption inequality rose relatively sharply, reaching 39.4. Growth incidence curves show the distributional effects in more detail. Between 2008 and 2009, the change in consumption was relatively evenly distributed across the welfare distribution. In 2010, however, only the better-off benefited from the recovery after the twin crisis. People at the lower end of the welfare distribution continued to experience negative consumption growth. 7. Evidence on the impact of the crisis suggests that greater hardship resulted mainly from higher unemployment, and also through household debt. Unemployment is estimated to have increased from 13.3 percent in 2007 to 16.3 percent in 2010. In the precrisis years, the unemployment rate among men has often been slightly higher than among women. In 2008, it was about 0.7 ppt. By 2009 this gap widened considerably and reached 3.4 ppt in 2010.2 Youth unemployment is particularly high - at approximately 36 percent in persons between 15 and 24 years of age in 2010 - with women having significantly higher youth unemployment rates than men. In a 2009 UNICEF survey, job loss was cited most commonly as being responsible for a general perception of greater hardship. The increase in poverty rates in 2010 is corroborated by subjective evidence from the Life in Transition survey 2010. According to the survey, a significant proportion of households cut expenditures on both staple foods and health expenditures. In addition, increased borrowing during the rapid growth years left Georgian households vulnerable to the financial shock in 2008. Household loans—including mortgages, credit card debt, and other consumer credit— increased significantly as credit became more widely available. A large share of the new borrowing was denominated in foreign currencies and at higher interest rates. Households were thus exposed on three fronts when the financial crisis hit, facing higher interest rates, higher foreign exchange rates, and lower incomes. A large number of households assumed new debt during the crisis. The 2009 UNICEF survey also shows that a total of 35 percent of households took out new loans during the June/July 2008 and June/July 2009 period. 8. More recently, following two years of growth, it is likely that unemployment and poverty have declined in 2011. The latest estimates suggest that the strong growth in 2010 and 2011 has led to slightly lower unemployment in 2011. The effect on poverty is more difficult to predict as several factors are at play, such as growth, inequality and types of jobs 1 These poverty headcount indicators are computed directly from the Georgia household budget survey using national poverty lines of 77.9 GEL per month in 2008 and 84.8 GEL per month in 2010, respectively. 2 Source: National Statistics Office of Georgia, http://www.geostat.ge. created. If jobs were to be created in the more productive and high value-added sectors of the economy, poverty is likely to decline as well. The most recent household survey data covering 2011 will become available in the third quarter of 2012 and will allow an updated analysis. 9. Provided the Euro zone crisis is contained, its impact on the Georgian economy is expected to be mild. Largely due to relatively weak trade and financial links, in the baseline scenario no significant impact is envisaged of the situation in Europe. However there are downside risks. The slower global and regional growth may reduce capital inflows, and impose difficult external financing conditions for the country. As estimated for downside scenario, the FDI inflows of about 4 percent will only generate the growth of about 0-2 percent in the next couple of years3. 10. Georgia’s debt burden indicators are projected to remain well below relevant prudential thresholds. External debt is projected to decline from 58.1 percent of GDP in 2011 to 41.3 percent in 2017. External public debt decreased from 33.8 percent of GDP in 2010 to 29.4 percent of GDP in 2011 due to strong GDP growth. The external debt service to export ratio was 15.8 percent in 2011 and is expected to stabilize at about 16 percent by 2030. According to the most recent debt sustainability analysis (DSA), the external debt position is not a cause for concern under the full range of standard stress scenarios, from baseline to worst case. Domestic public debt is close to $1.2 billion or 5 percent of GDP and is projected to increase to over 10 percent by 2030 as reliance on domestic savings to finance public investment increases. Although the new IMF program is intended to smooth out the spike in the repayment schedule (over 2012-2014), the authorities may prefer to rely on savings accumulated in the treasury deposit account. Georgia’s Eurobond refinancing in April and its sovereign credit ratings provide indication that it has favorable market access as well. 11. Georgia's strong growth prospects and improved public finances led to recent upgrades of Georgia’s sovereign ratings. Standard & Poor's Ratings Services raised its long-term foreign and local currency ratings on the Government of Georgia to “BB-” from “B+” in November 2011. Fitch Ratings has followed and also increased the country’s Longterm foreign and local currency Issuer Default Ratings (IDR) to 'BB-' from 'B+' in December. Moody’s assigned the country a first-time foreign and local currency sovereign credit rating of Ba3/Not-Prime with stable outlook in 2010 and maintained the assessment. RATIONALE FOR BANK SUPPORT 12. The DPO series is a central component of the Country Partnership Strategy (CPS) for Georgia covering 2010-2013. The CPS is built upon a two-pillar approach to the Bank’s engagement with Georgia, namely: (i) meeting post-conflict and vulnerability needs; and (ii) strengthening competitiveness for post-crisis recovery and growth. The CPS Progress Report (2011) proposed a rebalancing of emphasis toward the second pillar in light of the need for a medium term reform agenda to support growth in both output and employment. The CPS is also fully consistent with the Government’s reform program as highlighted both in Basic Data and Directions (2011-14) and the Ten-Point Plan of the Government of 3 Euro zone crisis impact on FSU countries: Shocks, Impacts, Vulnerabilities. March 2012, WB staff note Georgia. This DPO covers the core sectors targeted for Bank Group support in the CPS, including fiscal management, competitiveness for growth and employment generation, and social inclusiveness, which are rooted in a subset of the Government’s broader policy reform program. 13. The proposed DPO exploits complementarities with other Bank operations. In particular, the policy dialogue underlying the proposed operation was facilitated by three key projects. The Public Sector Financial Management Reform Support Project assisted the Government in addressing the capacity constraints of key public sector agencies, thereby complementing the dialogue on the new DPO series. Similarly, the health sector reforms supported in the DPO program are receiving significant support from the ongoing Health Sector Development Project as well as a grant to support the PEFA. In addition the proposed Competitiveness and Growth DPO builds on the strong reform program developed under the previous DPO series, which concluded in July 2011. 14. Important results were achieved under the support of the previous DPO series. DPO-1 (2009) balanced immediate crisis mitigating measures with structural reforms while DPO-2 (2010) facilitated an orderly transition in the focus of the authorities from immediate mitigating measures toward preparing the conditions for post-crisis growth. Specifically, the economic downturn was contained in 2009, the economy rebounded strongly in 2010, and fiscal policy moved swiftly from stimulus to adjustment during 2010. On public finances, important steps were taken toward further improving efficiency by enacting the new Budget Code and for the first time, including annexes on program and capital budgets in the 2010 Annual Budget. On the social safety net, coverage was scaled up and benefits were improved without significant loss of targeting effectiveness. On external competitiveness, significant improvements were achieved in reducing the time required for tax compliance and for trading across borders; furthermore, progress was made in identifying trade-related reforms for improved access of Georgian products to international markets. 15. The proposed Programmatic Competitiveness and Growth DPO series deepens the reform agenda supported by previous policy-based Bank lending to Georgia. The Bank concluded the Poverty Reduction Support Credit Series in 2008, which focused mainly on public sector reform, education, and health care. The programmatic development policy operation series that concluded in 2011 supported reforms in public finances, competitiveness, and social sectors. The CG DPOs will refocus support to deepen reforms in areas where the Bank has strong comparative advantage, through engagement via policy dialogue or analytical support and also where there is scope to leverage support provided by other international partners. II. Proposed Objective(s) 16. The Program Development Objectives are to support inclusive growth and job creation by: (i) Improving competitiveness through efforts to enhance market access for exports and foreign investment, facilitate trade, strengthen the investment climate in power, and modernize and build a high quality education system; (ii) Strengthening fiscal effectiveness by improving accounting controls through phased introduction of IPSAS and better coverage of the budget; and (iii) Enhancing the effectiveness of social spending by improving quality of and access to health services and further improving the efficiency of the targeted social assistance program. 17. These development objectives are also central to the 2010-2013 Country Partnership Strategy (CPS) which is built upon the twin pillars of meeting post-conflict vulnerability needs and strengthening competitiveness for post-crisis growth. 18. Selected key outcome indicators include: I.1: Promote market access with a view to enhancing exports and foreign investment Exports as a share of GDP increase to approximately 45 percent from a baseline of 37 percent of GDP; I.2: Improve customs efficiency to facilitate trade Time taken to process exports and imports falls by half I.3: Enhance climate for attracting investment in the power sector Electricity exports increase significantly I.4: Strengthen the quality of general education to support competitiveness through improved national curriculum and better human resource policies. Learning outcomes as measured by national assessments of Grade 4 in Georgian language and literature and mathematics improve II.1: Strengthening the efficiency of treasury management All central government budgetary organizations adopt modified cash-basis IPSAS starting from a baseline of zero. III.1: Improve accessibility and quality of health care Coverage of medical insurance program. III.2: Improve the efficiency of targeted programs 19. The time taken for assessing beneficiary eligibility falls by half for both TSA and MIP (1) exports to the EU and investment from the EU (2) power exports and investment in mining exploration (3) learning outcomes as measured by national assessments (4) coverage of TSA of bottom decile of population (5) coverage of medical insurance program and (6) improvement in relevant Public Expenditure and Financial Accountability (PEFA) indicators. A matrix of outcome indicators is provided in the concept note. III. Preliminary Description 20. The proposed operation (CG DPO1) is the first in a series of three programmatic development policy operations for Georgia. The CG DPO1 is in the amount of $50 million equivalent and supports measures aimed at facilitating growth in output and employment and social cohesion. The Competitiveness and Growth DPO series is a central component of the Country Partnership Strategy (CPS) for 2010-13, which is built upon the twin pillars of meeting post-conflict vulnerability needs and strengthening competitiveness. The program outlined in this document has been prepared following two years of post-crisis recovery at a time of renewed focus on the second pillar. 21. The proposed DPO series is anchored in the developmental objectives of the program of the Government described in the comprehensive “Ten Point Plan of Modernization and Employment.” In addition to the measures supported by the proposed operation, the Plan includes a wide range of policy and institutional reform efforts, several of which are under implementation. These include measures to strengthen power and infrastructure, position the country as a regional trade and logistics hub, and intensify efforts to promote investment and exports. Modernization of agriculture, tourism, and regional development are also critical components of the Government's overall reform program. Within this program, the DPO supports actions that will improve the economy’s skill base and facilitate investment in key tradables sectors, thereby helping to create opportunities to enhance productive capacity and generate employment. This focus on jobs is critical for Georgia, where high growth pre- and post-crisis, has been accompanied by the persistence of social vulnerabilities. 22. The reforms supported by the DPO series will contribute to a number of objectives. First, trade and trade facilitation, modernization of education, and deepening of investment climate reforms in the power sector will support competitiveness. This enhanced competitiveness is expected to facilitate investment and modernization of key tradables sectors, and create the pre-conditions for both improved production capacity as well as greater access to world markets. In addition, enhanced competitiveness will improve productive capacity and support job growth. Second, improvements in the efficiency of public expenditure management will continue to support fiscal adjustment and improved targeting of spending in line with growth and social priorities. Third, ensuring that the benefits of growth in the medium-term are broadly shared is an urgent priority of the Government. Brisk growth during post-crisis recovery notwithstanding, unemployment stands at close to 17 percent, and nearly half of the work force is self-employed. Poverty rates, including among vulnerable groups such as internally displaced peoples (IDPs), were exacerbated by the conflict, the mid-2011 spike in food inflation, and the global crisis of 2008-2009. While the authorities have taken measures to mitigate impacts on the poor, there is an urgent need to create jobs in order to address social vulnerabilities in a sustainable manner, while further strengthening available social safety nets. The strategy adopted by the Government – supporting a virtuous cycle of productivity improvements, investment, and exports leading to growth and ultimately higher employment – will be supported in the medium-run through expanded state health insurance and more effective management of the targeted social assistance program. 23. The Government has strong ownership of the reforms supported by the Growth and Competitiveness DPO series. The policy actions supported by the DPO program have been developed in close collaboration with the Government and focus on areas where the Bank has comparative advantage and is leveraging resources, expertise, and technical support through cooperation with international partners. The strong commitment to the program on the part of the government is expected to ensure implementation and sustainability of the DPO program. 24. Eight prior actions supported under the CG DPO1, which have been largely fulfilled. These are summarized in the Table below, which includes information on Status of Implementation and Next Steps. Table Summarizing CG DPO1 Prior Actions and Status of Implementation Proposed Policy Action for the CG DPO1 Status of Implementation Discussion on Next Steps Pillar I: Competitiveness 1. Parliament adopted DCFTA legislative package including the framework law on competition, Code on Food Safety, Veterinary and Plant Protection and Code on General Product Safety and Liability 2. The Government of Georgia issued the decree authorizing the revenue service to issue certificates of origin and import, export and transit related permits at the border crossings. 3. The Ministry of Energy and Natural Resources has issued an order with the draft amendments to electricity (capacity) market rules to prioritize new renewable power production access to the grid with remaining congested transfer capacity allocated via transparent auctions. 4. Strengthen the quality of general education to support competitiveness through improved national curriculum and better human resource policies. a) The Ministry of Education and Science approved a new national curriculum for grades I through XII and operationalizes the new National Curriculum for grades I through VI, including distribution of supporting materials. b) The Ministry of Education and Science offers teacher certification examinations to include teachers of all subjects. Parliament has approved the legislative package. The Government of Georgia has issued the relevant decree. The applications for the issuance of certificates of origin and import, export and transit related permits accepted by RS starting from January 1, 2012. To be completed. Draft amendments to power sector market rules have been provided to the Bank and are being reviewed. The amendments are expected to be submitted by appraisal. Completed. a) New national curriculum was enacted as reflected in the decree No. 36 of the Ministry of Education & Science as of November 3, 2011. The new curriculum is being implemented in primary grades in all schools from 2011-2012 academic years. b) In 2011, the number of teacher certification examinations was expanded to all subjects. c) School principal standards were adopted in 2011 on the basis of which examination content for the evaluation of school principals was developed and put in place. Pillar II: Fiscal Effectiveness 5. The Ministry of Finance prepared financial reports of 8 pilot agencies in accordance with modified cash basis accounting methods as part of the transition to adopting IPSAS. Completed. Eight pilot agencies prepared their 2011 financial reports in accordance with the new “Temporary regulation on financial reporting based on modified cash basis IPSAS.” The regulation came in to force for all public sector bodies for accounting periods starting January 1, 2012. 6. The Ministry of Finance issues regulations requiring inclusion in the annual budget execution report of information on financial flows of Legal Entities of Public Law (LEPL) Completed. 2012 budget execution report (Chapter VIII) will include consolidated report on financial flows of LEPLs covering about 90 percent of the legal entities. The report is published on the MoF website (www.mof.ge). Pillar III: Effectiveness of Social Spending 7. Improve accessibility, and quality of healthcare services a) Ministry of health ensures implementation of upgraded standards in all hospitals through issuing of permits in accordance with the decree of the Government of Georgia to ensure safety and quality of healthcare services The Government of Georgia issued a decree expanding coverage of medical insurance plan to children below 6 and pensioners. 8. Expand Medical Insurance Plan coverage to pensioners and children under 6. Completed. Verification of issuance of permits to be provided to the team. Completed. Budget appropriation for expansion done. Decree issued on May 8 2012. 25. These reforms are contributing to a number of objectives including higher investment and exports, efficiency and results orientation of public spending in the context of fiscal consolidation, and the mitigation of persistent social vulnerabilities. First, trade and trade facilitation, education, and deepening of investment climate reforms will support competitiveness, skills development and modernization of key tradables sectors, and create the pre-conditions for improved access of Georgian products to world markets. Second, improvements in the efficiency of public expenditure management will continue to support fiscal adjustment and improved targeting of spending in line with growth and social priorities. Third, ensuring that the benefits of growth in the medium-term are broadly shared is an urgent priority of the Government. Brisk growth during post-crisis recovery notwithstanding, unemployment stands at close to 17 percent. Poverty rates, including among vulnerable groups such as internally displaced peoples (IDPs), were exacerbated by the conflict, the mid-2011 spike in food inflation, and the global crisis of 2008-2009. While the authorities have taken measures to mitigate impacts on the poor, there is an urgent need to create jobs in order to address social vulnerabilities in a sustainable manner, while further strengthening available social safety nets. RISKS AND RISK MITIGATION 26. Georgia faces significant but manageable macroeconomic and regional risks. First, the underlying macroeconomic framework is vulnerable to global developments, particularly a contagion from the Euro zone crisis, which could compromise growth in exports, FDI and remittances. Second, regional tensions may have an adverse impact on investor and consumer confidence and on the post-crisis growth outlook. If these risks materialize, further external and fiscal adjustment, additional reforms and, depending on the magnitude of the shocks, additional external financing, could be needed. Third, with elections next year, fiscal consolidation may be challenged by demand to increase spending, particularly on social programs. Fourth, policies under the competitive pillar are second generation and therefore are subject to capacity and implementation risks, including: (1) commitment to all the elements needed for a good practice policy framework in all sectors; (2) weak implementation capacity at middle-levels of the civil service, which will need to design and implement the reforms; and (3) risks relating to environmental de-regulation and need to recognize the possible trade-off between sustainable and quick results growth. 27. The authorities are mitigating these risks in several ways. First, they are committed to inflation targeting and flexible exchange rates, which would support external sustainability and be the first line of defense against a Euro zone crisis. They are backed up by a relatively large fiscal cushion (savings in the treasury) and a comfortable level of international reserves. In addition, a precautionary IMF arrangement is in place that will ensure access to resources in the event of a crisis. On mitigating regional tensions, the accession of Russia to the WTO has already led to incipient exports from Georgia to Russia. In addition, Georgia has unilaterally waived visa requirements for Russian citizens, which is also a step towards further easing tensions. Domestically, political conditions remain stable, with parliamentary and presidential elections are scheduled for end-2012 and 2013, respectively, and no significant changes in the direction of economic policy are envisaged at this time. Related to capacity and implementation risks, the authorities are committed to work with all key stakeholders and have strong ownership of the policy matrix supported by the proposed operation as well as their own complementary and comprehensive reform program under the three pillars. At the same time, the team is working actively with the Government to mobilize best international practice. Risks from deregulation would be mitigated by careful analysis of the proposed legislative changes to ensure that simplification of procedures and removal of redundant administrative burdens do not compromise the environmentally sustainable development. Also, assistance from the international community to key technical staff to learn from best international practices and strengthen the institutional capacity to assess environmental risks will also support sustainable development. IV. Poverty and Social Impacts and Environment Aspects POVERTY AND SOCIAL IMPACTS 28. Translating continued strong growth into sustained reductions in unemployment and poverty is at the center of the reforms supported by the DPO. The prior actions in Pillar 1 should help strengthen competitiveness for growth through enhanced market access, improved customs efficiency, a better investment climate, and higher quality of education. In the medium term, reforms to sustain economic recovery are expected to be the driving force behind decreased unemployment and improved living standards. The prior actions in Pillar II strengthen fiscal effectiveness by increasing the efficiency of treasury management, improving quality of budget spending, and increasing coverage and transparency of budget data. The actions under Pillar II improve the overall functioning of the public sector and are expected to be distributionally neutral. The anticipated fiscal consolidation could have adverse distributional effects, and careful monitoring is needed as the consolidation moves forward. This section focuses on the prior action in Pillar III that aim to increase targeting and coverage of the basic safety net programs (TSA and health insurance). 29. The TSA program is a cost effective policy instrument, and targets the poorest and most vulnerable. The TSA program costs less than 1 percent of GDP (0.7 percent in 2009); and it has good targeting accuracy, with close to 45 percent of the transfers going to individuals in the poorest decile (the poorest 10 percent of the population). Since the program is focused on the poor, and is means-tested, it presents the government with a very costeffective policy instrument with which to combat extreme poverty and respond to crises. For instance, it only costs 1.25 Lari channeled through the TSA program to increase consumption of the average poor individual by 1 Lari. In response to the economic downturn, the TSA monthly distribution per additional family member was doubled from GEL 12 to GEL 24, resulting in a sharp rise in expenditures in 2009. At the onset of the crisis, TSA coverage was also expanded, although more modestly, from about 400,000 beneficiaries in July 2008 to about 475,000 in July 2009. According to survey data for 2009 (most recent available), the poverty headcount in 2009 without TSA would have been almost two percentage points higher (27.5 percent versus 25.7 percent), while the poverty gap would have been more than two percentage points higher (9.6 versus 7.5). 30. The expansion of the MIP program to pensioners and households with young children is expected to contribute to a reduction in poverty incidence among such households. Out-of-pocket expenditures on health in Georgia are one of the highest in Europe. Less than a quarter of Georgia's population is covered by any kind of health insurance and the health insurance market is underdeveloped. The current fully medical insurance plan program targeted to poor families covers about one-fifth of individuals in the poorest quintile (the poorest 20 percent of the population). High out-of-pocket expenditures serve both as a barrier to access health services and source of impoverishment for families, particularly in the case of a catastrophic health shock. Approximately 490,000 female and 235,000 male pensioners will become eligible after the expansion of the MIP program. Expanding coverage of this program to pensioners and children under six is expected to improve the access to health services for these vulnerable groups as well as contribute to a decrease in poverty among households that include pensioners and children under six. Given the aging pattern in the population, the large gender wage gap and the high incidence of low pay among female workers. Women are particularly vulnerable to old age poverty and will be among the main beneficiaries of the expansion of the MIP program. 31. Teacher certification is likely to lead to improved quality of teaching. The aim of the training opportunities offered in conjunction with the certification can lead to improvements in the skills of certified teachers. The majority of teachers at the primary and secondary school levels are women (86 percent in both cases). The mandatory certification of teachers (an action in the third proposed DPO in this series) is therefore likely to impact women more than men. Teacher layoffs when certifications become mandatory could disproportionately affect women. At the same time, new hires in this sector are also likely to be women. Hence, the overall effect on female employment in this sector is likely to be small. In 2011, about 24,000 teachers took the examinations, with only 15.4 percent being certified. Depending on the availability of data, the team will monitor performance on the exam by age, gender, location, subject specialization, and so on in order to gather information on which groups are likely to be the most affected as the certification process becomes mandatory. ENVIRONMENTAL ASPECTS 32. The policy actions supported by this DPO series are not likely to cause significant effects on the natural environment of Georgia. Supporting new renewable power projects is intended to stimulate growth of hydropower generation, which is a declared national target. While increased use of renewable sources of energy as opposed to the utilization of fossil fuels is a generally positive trend, massive investment in hydropower carries potentially significant environmental and social implications. National legislation of Georgia does not provide for strategic or programmatic environmental assessments, which would be highly relevant for examining cumulative impacts of numerous new hydropower generation plants. Individual projects are subject to the environmental impact assessment (EIA), but the importance of analyzing alternatives (including a no-project alternative) in the process of EIA gets undermined in cases where formal announcement/inauguration of a new project precedes completion of the EIA and public consultation on its findings. While acknowledging the existing indirect risks of supporting Georgia's accessibility to energy markets, the DPO series promote transparency of laws and regulations which follow international practices in order to attract reputable private investors in the development of Georgia's energy resources and to foster a viable hydropower sector. Further support for improving the capacity for environmental impact assessment of hydropower investments will improve substantially the sustainability footprint of the power sector. 33. The adoption of the Code on Food Safety, Veterinary and Plant Protection under CG DPO1 may help decrease future environment pollution in agriculture, as improved practices of plant and animal farming imply the application of higher standards in the use agrochemicals and pesticides. V. Tentative financing Source: BORROWER/RECIPIENT International Bank for Reconstruction and Development International Development Association (IDA) Borrower/Recipient IBRD Others (specifiy) ($m.) 0 50 Total 50 VI. Contact point World Bank Contact: Rashmi Shankar Title: Senior Economist Tel: (202) 473-4601 Fax: Email: rshankar@worldbank.org Borrower: Ministry of Finance, Government of Georgia Contact: Konstantine Kintsurashvili Title: Deputy Minister of Finance Tel: Email: VII. For more information contact: The InfoShop The World Bank 1818 H Street, NW Washington, D.C. 20433 Telephone: (202) 458-4500 Fax: (202) 522-1500 Web: http://www.worldbank.org/infoshop