PPT - Office of Research

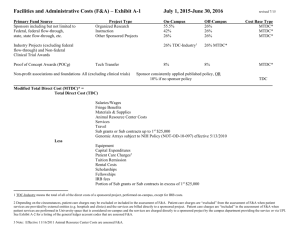

advertisement

Facilities and Administrative Costs (Indirect or Overhead) Michael J. Warnock, Ph.D. Director, Office of Sponsored Program Administration What’s in a name? Facilities and Administrative Costs F&A Costs Indirect Costs Overhead Costs Administrative Costs Direct Costs Allocable Costs Not a “tax” over and above the cost of project, but an integral part of the project cost What are F&A Costs? Costs associated with completing a project that are not directly charged to the project Includes: Space where work is done Utilities where work is done Equipment used to support work done Administration and oversight of work done Use of library facilities General supplies/materials to support work Cost recovery mechanism based on historical expenditures Why not charge F&A costs as a direct charge? Increased administrative burden (cost) to: Determine what charge at what rate for each project Accounting for actual and reconciling differences Allocations between projects (e.g., costs for a lab used in several projects would need to be allocated and records kept to differentiate between the uses by each project) Selected Items Excluded From F&A Animal care costs Service operations Certain building costs Certain utility costs Is F&A Important to Me? Where does my paycheck come from? How are my support staff paid? What was the source of funding for the building I work in? What is the source of funds for the utilities in my building? How are costs for shared purposes tied to the benefiting functions (including mine--cost and benefit)? How is research infrastructure paid for? These are real dollars Scope of F&A Rates Research Instruction On-campus Off-campus On-campus Off-campus Other Sponsored Activity (any other project sponsored by an external entity that is not research or instruction) On-campus Off-campus Determination of F&A Rate Summary of financial information—i.e., how funds were spent in base year Classification of cost to cost pools Adjustments to identify modified total direct costs (MTDC) Review and adjustments to cost classification Allocations of indirect costs Calculation of F&A rates Summary of Financial Information Functional classifications in PeopleSoft PCS (Project Classification System) codes PCS tree for Chartfields DeptID (some exceptions) is the key for PCS codes Classification of Cost to Cost Pools Based on Chartfield PCS code Depends on accurate decision making with regard to which Chartfield is used for expenditure Expenditures for multiple purposes must be split between appropriate Chartfields Summary of Financial Information Instruction (28% ) Research (16% ) Service (16% ) Departmental Administration (9% ) Student Services Administration (3% ) General Administration (6% ) Operations & Maintenance (6% ) Scholarships (1% ) Depreciation (4% ) Auxiliary (11% ) Adjustments to Identify MTDC Move certain costs out of individual Chartfields to other categories Capitalized building expenses Capital equipment costs Scholarships Unallowable costs (including A-21 Exclusions) Etc. These reclassifications are proscribed by OMB Circular A-21 A-21 Exclusions Certain costs may not normally be charged to the federal government either as direct charges or through the F&A rate (see separate handout) Under certain conditions, some of these may be chargeable as direct costs to the federal government (must be specifically approved by sponsor) There are generally no prohibitions on charging these as direct costs to non-federal projects (be careful of federal flow through—it counts as federal) Adjustments to Identify MTDC Instruction (31% ) Research (16% ) Service (16% ) Departmental Administration (10% ) Student Services Administration (3% ) General Administration (6% ) Operations & Maintenance (5% ) Scholarships (0% ) Depreciation (4% ) Auxiliary (9% ) Review and Adjustment Cleanup process Review expenditures on Chartfield to identify where expenditures may have been made from Chartfield with one PCS code that should have been another Initial identification by review of expenses, confirmation by consultation with Chartfield approver Review and Adjustment In stru c tio n (2 0 %) Re se a rc h (1 1 %) Oth e r Sp o n so re d Ac tivity (1 2 %) De p a rtme n ta l Ad min istra tio n (1 0 %) Stu d e n t Se rvic e s Ad min istra tio n (3 %) Ge n e ra l Ad min istra tio n (5 %) Op e ra tio n s & Ma in te n a n c e (8 %) Sc h o la rsh ip s (0 %) De p re c ia tio n (4 %) Oth e r In stitu tio n a l Ac tivity (2 4 %) L ib ra ry (3 %) Sp o n so re d Pro je c ts Ad min istra tio n Allocations of Indirect Costs Differing allocation methods for different classes of indirect cost pools Administrative pools Library pool Facilities pools Allocation functions of indirect pools are to direct Administrative Allocations Allocation is based on expenditures within covered direct cost pools General administration Allocated to all institutional direct functions Departmental administration Allocated among direct functions within administrative unit Student services administration Allocated entirely to instruction function Sponsored projects administration Allocated functions among sponsored project direct cost Allocation of Library Cost Based on user population Allocations differ for each population Can be based on employee/user populations or special study Ours done on employee/user FTEs Faculty Staff Students Other users Facilities Allocation Based on space allocations Space allocations can be based on salary allocation to direct costs or on space study We use a space study because it more closely ties costs to usage (especially for O&M and equipment) Calculation of F&A Rates Divide amount of indirect cost allocated to direct cost pool by MTDC amount of direct cost pool (A/B)*100% = C where A = allocated indirect cost B = MTDC of direct costs C = indirect cost rate for that indirect function Thus, if general administrative costs are $50,000 and direct instruction costs are $1,000,000, then instruction F&A rate for GA is 5% After Calculation, Then What? Administrative Cap Utility Cost Adjustment Rate Proposal Negotiation Agreement Administrative Cap Administrative indirect costs for research cost pool are capped at 26% That means any administrative (collectively) costs above 26% are unrecoverable Administrative cap does not apply to non-research cost pools (we apply it, A-21 does not) Utility Cost Adjustment A-21 recognizes that research uses a greater proportion of utilities than other direct cost functions UCA was designed to reimburse these costs UCA applies only to certain institutions UM campuses are not among those institutions OMB was supposed to have issued new rules for the UCA in July 2002--not yet done Rate Proposal Lots of data Calculated rates for each indirect cost pool supporting each direct cost pool Additional (beyond the F&A data) institutional data Lots of tables Lots of paper Negotiation Government wants to pay as little as possible University wants reimbursement (we have already spent this money) for as much of the cost as possible Research rate is the focus because that is most of what federal government funds at the negotiated rate Negotiated rate never exceeds proposed rate—the amount that it is less is largely based on strength of proposal Differentials between proposed rate (cost) and negotiated rate are 2.9% Agreement Specifies rates for each direct cost pool except OIA Specifies MTDC base components by what is excluded from the base Specifies effective dates of rates Specifies type of rate (normally “predetermined”)--we were provisional since July References requirements of A-21 A-21 Referenced in Agreement What does this mean for us? Cost Accounting Standards No special accounting practices for sponsored projects (can’t charge them costs not charged elsewhere) F&A rates apply to all projects funded from outside the institution Costs charged to a project must be during the term of the agreement and for the benefit of the project Others, but these are the big ones Where does that leave us? The F&A rate is a cost recovery process—if we do not recover F&A from projects, the difference to cover the costs is made up from elsewhere The cap on the administrative rate means any administrative costs exceeding 26% are unrecoverable Since we exceed the cap, administrative cap also means the only variables are facilities and library costs Cost Recovery Assessment 60.0% 51.0% 50.0% 47.0% 40.0% 32.0% 30.0% 26.8% 25.0% Recoverable 20.0% Unrecoverable 8.3% 10.0% 0.1% 0.0% 0.0% Instruction Research Other Sponsored Activity Other Institutional Activity Strategies for Strength Reduce non-mandatory reclassifications Have more accurate Asset Management (buildings and equipment) records Develop a higher degree of confidence in relationship between activity (and funds to support it) data and space assignment data Spend funds according to the PCS code assigned to the Chartfield Conduct a library special study All else being equal, use institutional funds for facilities and project funds for salaries Next year (FY 2005) is the next base year Space is Critical to Success The space data drive almost all the facilities costs Recoverable building depreciation is based on space allocations Recoverable equipment depreciation is based on assignment of equipment to rooms and space allocations of those rooms Recoverable O&M is based on space allocations What are MU’s F&A rates? Research-on campus 47% Research-off campus 26% Instruction-on campus 51% Instruction-off campus 26% Other Sponsored Activity-on campus 25% Other Sponsored Activity-off campus 19.5% What about state projects? Research-on campus 47 Research-off campus 26 Instruction-on campus 51 Instruction-off campus 26 Other Sponsored Activity-on campus 25 Other Sponsored Activity-off campus 19.5 36.6% 20.2% 39.7% 20.2% 19.5% 15.2% What are the components of MU’s research rate? General Administration-4.5% Departmental Administration-19.5% Sponsored Projects Administration-2.0% Building Depreciation-3% Equipment Depreciation-2.2% Operations and Maintenance-13.9% Library-1.9% What happens when F&A costs are not recovered? Costs must be picked up from another source RIF is reduced Compliance problems Reduced future rate (but with constant or increasing costs) Who is affected when F&A is not recovered? General Administration-4.5% (9.6%) Departmental Administration-19.5% (41.4%) Sponsored Projects Administration-2% (4.3%) Building Depreciation-3% (6.4%) Equipment Depreciation-2.2% (4.7%) Operations and Maintenance-13.9% (29.6%) Library-1.9% (4%) Research Rate Components De p a rtme n ta l Ad min istra tio n (4 1 .4 %) Ge n e ra l Ad min istra tio n (9 .6 %) Op e ra tio n s & Ma in te n a n c e (2 9 .6 %) Bu ild in g De p re c ia tio n (6 .4 %) Eq u ip me n t De p re c ia tio n (4 .7 %) L ib ra ry (4 %) Sp o n so re d Pro je c ts Ad min istra tio n (4 .3 %) Who pays when F&A is not recovered? General Administration 7.2% Departmental Administration 31.1% Sponsored Projects Administration 3.2% Building Depreciation 4.8% Equipment Depreciation 3.5% Operations and Maintenance 22.2% Library 3% RIF 25% How do our rates compare? University of Illinois Purdue University Indiana University University of Texas University of Minnesota University of Oklahoma University of Colorado University of Iowa University of Kentucky Iowa State University Kansas State University University of Kansas *provisional rate under negotiation 53% 52% 50.5 50%* 48.5% 48% 48% 47.5% 47% 46%* 46% 44% Questions/More Information? Mike Warnock, OSPA, 882-4329, warnockm@missouri.edu